Russia Electric Vehicle Market Size, Share, Trends and Forecast by Component, Propulsion Type, Vehicle Type, and Region, 2025-2033

Russia Electric Vehicle Market Size and Share:

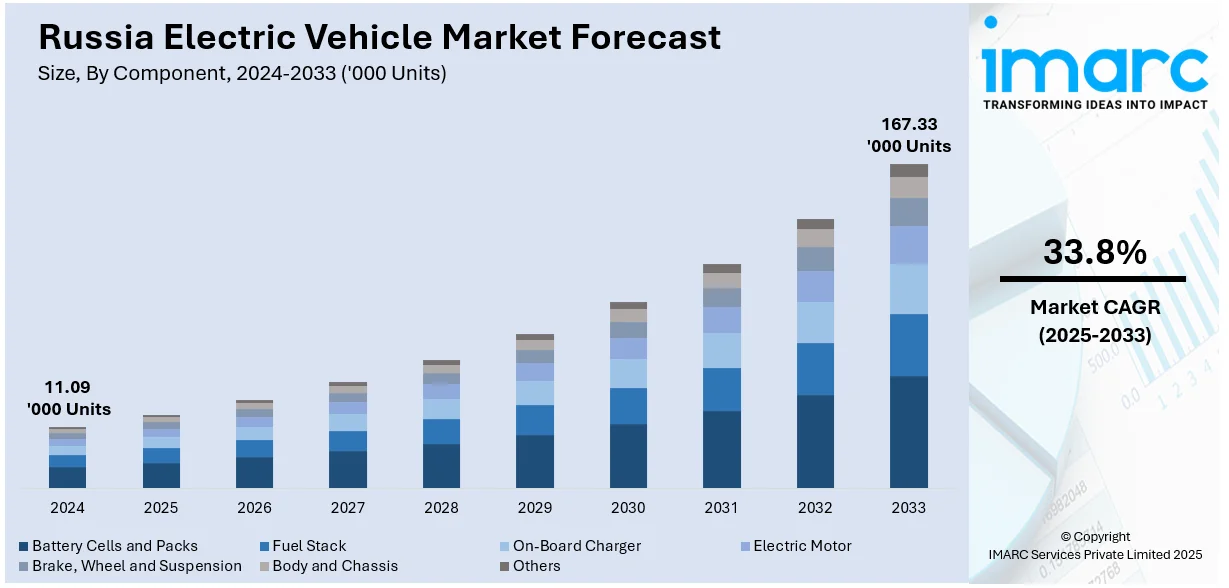

The Russia electric vehicle market size was valued at 11.09 Thousand Units in 2024. Looking forward, IMARC Group estimates the market to reach 167.33 Thousand Units by 2033, exhibiting a CAGR of 33.8% from 2025-2033. The market is primarily driven by increased government support and incentives accelerating EV adoption, a significant rise in domestic production fueled by local and international investments, continual advancements in charging infrastructure enhancing accessibility. Additionally, the implementation of stringent guidelines promoting EV adoption to align with sustainability goals is contributing to the growth of the Russia electric vehicle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 11.09 Thousand Units |

| Market Forecast in 2033 | 167.33 Thousand Units |

| Market Growth Rate 2025-2033 | 33.8% |

The Russian government is spearheading initiatives to promote the adoption of electric vehicles through a comprehensive framework of supportive policies, financial incentives, and the expansion of charging infrastructure. Various policy initiatives including subsidies for buying, exemptions, and lowering custom duties on imported cars are facilitating the switch for both manufacturers and consumers to electrical mobility. Of critical importance has been the widening out of electric vehicle charging networks across the entire country. By 2030, the state plans to install 73,000 charging points, of which 44, 000 will be slow and 29,000 will be fast chargers, greatly increasing accessibility. All this is part of an overall plan to update the transport sector, decrease its impact on the environment, and increase domestic EV manufacturing, making Russia a cutting-edge participant in the world car market.

With the withdrawal of most Western automakers, Chinese electric vehicle brands have become the leading players in Russia. Their swift entry and robust presence have offered Russian consumers a broader choice of EVs, generally perceived as technologically sophisticated and competitively priced. This transformation has deepened market competition and fueled interest in electric mobility. The popularity of Chinese EVs has also prompted local stakeholders to innovate and adapt. Their increasing dominance is not just rewriting consumer taste but also pushing the overall trend of the EV industry in Russia to new heights of affordability and performance.

Russia Electric Vehicle Market Trends:

Increase in Government Support and Incentives

The Russian market needs more government help and incentives significantly in order to hasten the uptake of electric vehicles across the country. According to industry reports, in 2021, the Russian government announced plans to invest USD 10.5 Billion in the development of hydrogen and electric vehicles by 2030. Recently, the government has introduced certain policies, for instance, granting subsidies on purchases of electric cars, tax concessions, and reductions in import customs duties on electrical cars and spare parts. Substantial financing is being placed in building full-scale charging networks, enhancing ease of use, and access by individuals. Added support comes with initiatives aimed at raising public knowledge about the ecological and economic value of electric mobility. Such support strategy goes alongside global initiatives directed toward fighting climatic change in Russia, a move aimed to reduce its fuel dependence on fossils and help realize a greener innovative automotive industry. The Russia electric vehicle market forecast indicates continued growth, driven by these supportive policies and rising Russia electric vehicle market growth.

Rise in Domestic Production

The domestic market is witnessing a significant spike in domestic output primarily because of increasing investments made by local automakers. Major players are channeling efforts toward developing and commercializing new electric models to drive the increasing consumer demand and gain a stronger grip on competitive value in the world market. All this is promoted by strategic tie-ups with international EV technology providers, which create opportunities for passing on high-value technologies and capability. Apart from this, the government is also encouraging domestic manufacturing via positive policies and monetary rewards. For example, the Government of Russia in 2021 announced subsidizing the acquisition of electric vehicles (EVs) produced locally with a view to enhance demand and expand production. The intention of the subsidy was to reduce the price of locally produced EVs. As part of this program, the government wanted to pay 25% of the cost of purchase of each electric vehicle produced in Russia, with a cap of USD 8,570. The increase in domestic production not only seeks to decrease dependence on foreign vehicles but also to develop a robust EV ecosystem in Russia, advancing economic growth and technological advancement. This expansion in local production is likely to have a positive effect on the Russia electric vehicle market share, showing a more competitive and autonomous industry.

Expansion of Charging Infrastructure

Charging infrastructure development would be a primary trend in this market, which really affects the wide adoption and applicability of electrical vehicles. Toward this demand, significant funds are being planned to develop charging stations in integrated networks across city and rural setups. Both the public and private sectors are actively participating in this venture. For instance, in December 2024, AtomEnergo LLC, a subsidiary of Rosatom's energy division JSC Rosenergoatom Concern, announced the launch of 8 new fast electric vehicle (EV) charging stations in Kaliningrad, taking the number of EV charging stations in the region to a total of 10. Fast-charging stations are placed at highways, commercial centers, and residential complexes. These expansion infrastructures are further enhanced through government incentives and regulatory support, promoting private investment and innovation in charging technologies. The increased accessibility to charging stations directly benefits the electric vehicle owners as well as pushes the overall acceptance of electric mobility for Russia's pursuit of environmental sustainability and economic diversification. This expansion of charging infrastructure is expected to significantly drive Russia electric vehicle market demand.

Russia Electric Vehicle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia electric vehicle market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on component, propulsion type, and vehicle type.

Analysis by Component:

- Battery Cells and Packs

- Fuel Stack

- On-Board Charger

- Electric Motor

- Brake, Wheel and Suspension

- Body and Chassis

- Others

Based on the Russia electric vehicle market forecast, the battery cells and packs are the core of electric vehicles, storing and supplying power to the motor. In Russia, demand is rising for advanced, durable batteries due to harsh climate conditions. Development focuses on improving energy density, range, and charging speed to meet growing consumer and regulatory expectations.

Additionally, the fuel stacks are primarily used in hydrogen-powered EVs, converting hydrogen into electricity. Though limited in Russia currently, there is growing interest in alternative propulsion systems. Investment in fuel stack research reflects an effort to diversify EV technologies and reduce long-term dependency on traditional lithium-ion battery systems.

Moreover, the on-board chargers manage power conversion from AC to DC during charging. In Russia, the development of efficient on-board chargers is vital to support expanding charging infrastructure. These components ensure faster and safer energy transfer, enabling convenient home and public charging for EV owners in both urban and rural regions.

Besides this, the electric motor converts electrical energy into mechanical motion, driving the vehicle. Russian EV makers and importers prioritize efficient and durable motors that perform well in extreme weather. As the market matures, innovations focus on improving torque delivery, energy efficiency, and compact design for various vehicle segments.

Furthermore, the brake, wheel, and suspension systems are adapted for the weight and dynamics of EVs. In Russia, manufacturers must ensure reliability over uneven terrain and icy conditions. Enhanced regenerative braking and adaptive suspension systems are being integrated to boost safety, ride quality, and energy recovery during braking.

Along with this, the body and chassis are designed to optimize aerodynamics, safety, and weight distribution. In Russia, strong materials and thermal insulation are crucial due to diverse climate conditions. Lightweight yet durable frames help maximize range and performance while accommodating the battery’s structural integration into the vehicle platform.

Apart from this, the others segment involves thermal management systems, power electronics, wiring, and infotainment. In Russia’s EV market, these components are increasingly important for enhancing comfort, energy efficiency, and vehicle control. Features like battery heating systems and intelligent power distribution are essential for vehicle functionality in cold and variable conditions.

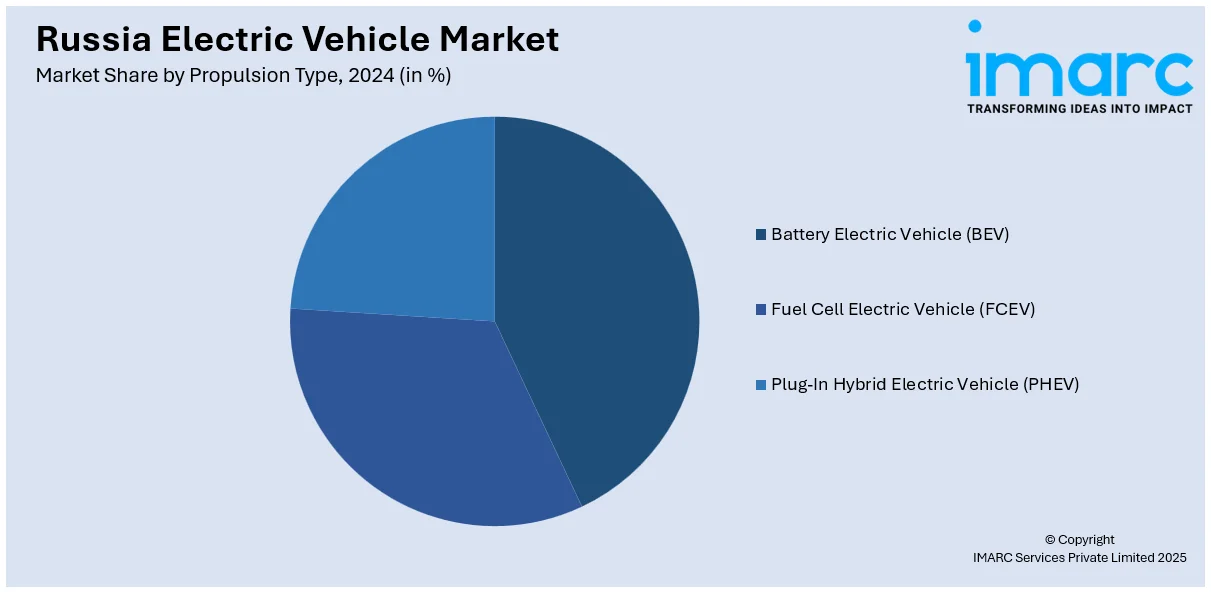

Analysis by Propulsion Type:

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

Battery Electric Vehicle (BEV) run solely on electricity stored in batteries and emit no tailpipe emissions. In Russia, BEVs are gaining popularity due to government incentives and expanding charging infrastructure. Their suitability for urban areas, lower operating costs, and simplicity in design make them the most favored propulsion type in the market.

In line with this, the fuel cell electric vehicle (FCEV) generates electricity using hydrogen fuel cells, producing only water as a byproduct. In Russia, their adoption remains limited due to high infrastructure costs and minimal hydrogen refueling stations. However, interest is growing for future applications, especially in commercial transport, as part of Russia’s broader strategy for energy diversification.

Moreover, the plug-in hybrid electric vehicle (PHEV) combines a traditional internal combustion engine with an electric motor and rechargeable battery. In Russia, they offer a transitional solution for drivers concerned about range limitations. Their dual-power system provides flexibility, especially in areas with sparse charging infrastructure, making them a practical choice during the EV adoption phase.

Analysis by Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Others

According to the Russia electric vehicle market outlook, the passenger vehicles dominate the market, driven by rising consumer demand for eco-friendly transportation. With expanding charging infrastructure and government incentives, electric cars are becoming more accessible. These vehicles offer a sustainable alternative to traditional gasoline-powered cars, with a focus on affordability, range, and efficiency.

Concurrently, the commercial electric vehicles (EVs) in Russia include delivery trucks, buses, and fleet vehicles. These vehicles are gaining traction due to their lower operating costs and environmental benefits. Government support for commercial EV adoption is encouraging businesses to transition to electric fleets, especially in urban areas with emissions regulations and rising fuel costs.

Besides this, the Others category includes electric two-wheelers, electric vans, and specialized vehicles like electric construction machinery. While less common, these types are gaining ground in Russia as niche markets evolve. Growing interest in urban mobility solutions, especially in cities, is driving innovation in smaller, more flexible electric transportation options.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District leads Russia's electric vehicle market, featuring Moscow and key industrial cities. It has a higher adoption of EVs due to advanced infrastructure, governmental support, and demand for eco-friendly transportation, with numerous charging stations and urban initiatives promoting electric mobility.

Additionally, the Volga District sees moderate EV growth, driven by regional policies, local manufacturing capabilities, and expanding charging infrastructure. It has emerging markets like Tatarstan, which is promoting EV adoption through industrial development and environmentally focused initiatives, though consumer awareness remains a challenge.

Moreover, the Urals District is evolving in electric mobility, benefiting from the region's strong industrial base and investments in EV manufacturing. However, despite regional interest, challenges like limited charging infrastructure and high vehicle costs impede widespread adoption, though local government support is growing.

Besides this, the Northwestern District, particularly St. Petersburg, is advancing EV adoption with a focus on environmental policies and innovation. The region's proximity to European markets encourages EV development, though factors like harsh climates and limited charging networks hinder more widespread consumer uptake.

Furthermore, the Siberian District faces challenges in electric vehicle adoption due to its vast geography, extreme climate, and underdeveloped charging infrastructure. However, regional initiatives and support for EV production in cities like Novosibirsk are driving gradual growth, despite slower market penetration.

Also, the other regions in Russia, like the Far East and Southern District, show limited EV adoption, often due to geography and lower disposable incomes. Despite this, some local authorities are beginning to invest in EV infrastructure and promote eco-friendly transportation solutions in select cities, though national adoption remains low.

Competitive Landscape:

The competitive landscape of the electric vehicle (EV) market in Russia is rapidly evolving, driven by a mix of foreign entrants and emerging domestic efforts. As traditional players reduce their presence due to geopolitical and economic factors, new participants are capitalizing on the market gap with diverse product offerings and aggressive strategies. The competition is shaped by factors such as affordability, energy efficiency, technological innovation, and charging infrastructure availability. Companies are focusing on localization, partnerships, and after-sales services to gain consumer trust and market share. Despite challenges like infrastructure gaps and fluctuating policies, the market remains dynamic, with increasing consumer interest and policy support fostering a competitive environment aimed at long-term growth and sustainability.

The report provides a comprehensive analysis of the competitive landscape in the Russia electric vehicle market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Kaliningrad-based Avtotor announced the release of a new range of small electric vehicles (EVs) under the Eonyx brand. Two models are included in the launch. At present, an experimental batch is being built while engineering solutions and technologies are developed in order to customize basic equipment according to the demands of the Russian market.

- March 2025: Atom announced that it will begin serial production of its electric cars from July 2025 in Moscow. Atom’s team consists of over 1,600 experts with backgrounds in significant Russian and foreign IT and automotive firms. So far, 13 working prototypes of the electric car have been developed.

- December 2024: MG reported to launch the MG HS in the Russian market in early 2025, offering both fuel and plug-in hybrid electric vehicle (PHEV) versions with two power options: 1.5T and 2.0T engines. The car was unveiled at the 2024 Goodwood Festival of Speed and is designed as an improved version of China's Roewe RX5. The PHEV model will feature a 1.5T engine combined with an electric motor for enhanced performance and range.

- December 2024: The MG4 EV, a pure electric compact crossover, officially entered the Russian market with a selling price of 5,300,000 rubles. The car, launched in the all-wheel-drive XPower version, offers advanced features like a dual-motor system, 320 kW power, and a 0-100 km/h acceleration in 3.8 seconds. The MG4 EV is designed with a modern aesthetic and high-tech interior, including a 10.25-inch floating central control screen.

- October 2024: Belarusian company BKM Holding launched nine electric buses and three charging stations in Sochi, Russia. The new fleet, which began operations on October 1, includes BKM Holding's E321 electric buses, designed for urban transport with features like non-cash payment and climate control. This move supports Sochi's shift toward sustainable public transportation.

- August 2024: LUKOIL announced the launch of its specialized transmission fluid, LUKOIL E-FLUID 301, for electric vehicles. The fluid, designed for cars with direct motor-to-transmission contact, is already available at authorized service stations and will soon be sold in retail. This move highlights LUKOIL's capability in creating advanced products for the growing electric vehicle market.

Russia Electric Vehicle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Battery Cells and Packs, Fuel Stack, On-Board Charger, Electric Motor, Brake, Wheel and Suspension, Body and Chassis, Others |

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-In Hybrid Electric Vehicle (PHEV) |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia electric vehicle market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia electric vehicle market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia electric vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia electric vehicle market was valued at 11.09 Thousand Units in 2024.

The Russia electric vehicle market is projected to exhibit a CAGR of 33.8% during 2025-2033, reaching a value of 167.33 Thousand Units by 2033.

The Russia electric vehicle (EV) market is propelled by several key factors. Government incentives, such as subsidies and tax benefits, encourage both consumers and manufacturers to embrace electric mobility. The expansion of charging infrastructure across urban areas enhances the practicality of EV ownership. Growing environmental awareness among consumers, coupled with concerns over air pollution and fuel efficiency, drives demand for cleaner transportation options.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)