Russia Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2025-2033

Russia Fintech Market Overview:

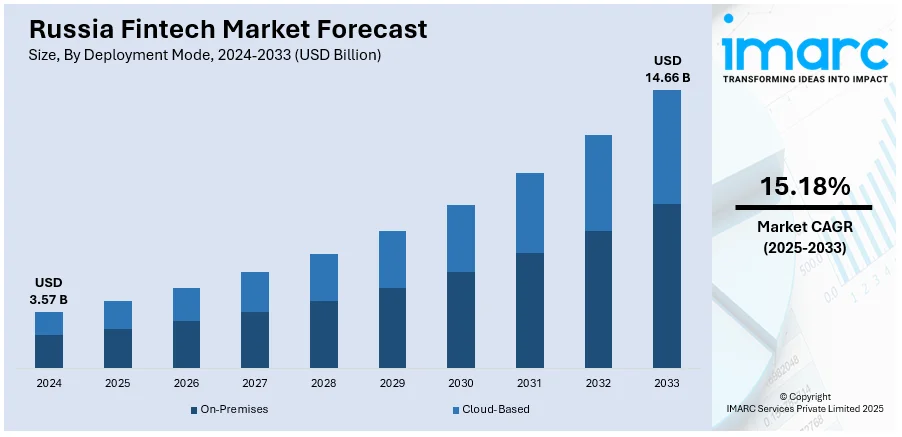

The Russia fintech market size reached USD 3.57 Billion in 2024. The market is projected to reach USD 14.66 Billion by 2033, exhibiting a growth rate (CAGR) of 15.18% during 2025-2033. The market is undergoing dynamic transformation, propelled by digital adoption, innovation in payments, and supportive government initiatives. The landscape spans a range of deployment modes, from on‑premises systems to agile cloud‑based solutions, and integrates cutting‑edge technologies like blockchain, AI, and regtech. Applications cover payments, neo banking, wealth management, and insurance, serving individuals, SMEs, and enterprises. The regulatory environment, including developments like the digital ruble and national payment systems, continues to foster growth. These combined forces shape the evolving contours of Russia fintech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.57 Billion |

| Market Forecast in 2033 | USD 14.66 Billion |

| Market Growth Rate 2025-2033 | 15.18% |

Russia Fintech Market Trends:

Growing Digital Transaction Infrastructure

In July 2025, the Bank of Russia projected that by the end of this year, cashless payments would account for of all transactions a clear sign of how widespread digital infrastructure has become. Over the past year, the number of ATMs and POS terminals jumped by around 8 percent, surpassing 5 million devices across the country, paving the way for more reliable, universal access to non‑cash payment methods. Everyday payments are shifting seamlessly to digital wallets, QR scanning, and contactless options, as users relax into the convenience these bring. For consumers, that means fewer delays at checkout and fewer bottlenecks during busy shopping periods; for businesses, it means streamlined transactions and lower failure rates at the point of sale. The infrastructure expansion creates a stable foundation for fintech offerings to flourish and fosters a cashless mindset that changes daily habits. These developments are subtle but significant drivers, showing how foundational changes in payments infrastructure are quietly powering Russia fintech market growth.

To get more information on this market, Request Sample

Expanding Financial Connectivity Across Borders

In January 2024, the Bank of Russia reported that its SPFS messaging system, developed as a domestic alternative to SWIFT, had extended connections to 20 foreign countries and 550 organizations 150 of which are outside Russia. This level of international adoption marks a key step in the evolution of financial connectivity under constrained global conditions. The SPFS system’s scaling up reflects not only strategic necessity but also the country’s growing ability to operate independently in digital finance. Meanwhile, digital identity tools are increasingly popular among users, driving a significant rise in online account openings and remote financial services. This surge underscores a shift toward self-service finance, with more users embracing mobile onboarding, digital KYC, and remote account management. These behavioral changes reinforce the digital financial ecosystem. Together, they reflect how Russia fintech market trends are now being shaped not only by domestic innovation but also by broader shifts in infrastructure and digital literacy.

Digital Ruble Pilot Accelerates Adoption

In May 2025, the Central Bank of Russia revealed that the pilot phase of the digital ruble had been a success and that arrangements were in place to announce the launch date for its large-scale rollout by the end of the year. The digital ruble is a significant step towards streamlining Russia's payment system, enabling quicker, more efficient, and secure transactions for both businesses and individuals. By incorporating blockchain technology, the digital currency hopes to lower fees compared with conventional banking systems and boost convenience in underdeveloped areas. Initial comment from pilot users points to faster and more convenient transactions, which are likely to be used once the service is widely accessible. The initiative also feeds into a cashless payments and digital wallets trend, continuing to reshape consumer behavior and attitudes. The development of digital ruble mirrors wider developments in the fintech sector and underscores Russia's resolve to build a stable, tech-oriented financial system. They all together indicate robust momentum in Russia fintech market.

Russia Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment mode, technology, application, and end user.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

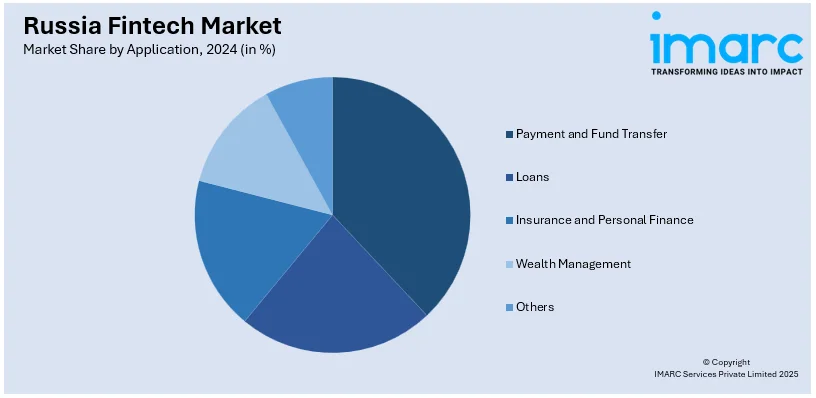

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

End User Insights:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes banking, insurance, securities, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Fintech Market News:

- June 2025: Russia's Oleg Tinkov and Michael Calvey have invested heavily in Mexican fintech firm Plata, which was set up by former Tinkoff Bank executives. Plata is a fully digital platform offering a variety of financial products like credit cards and buy-now-pay-later. The company values high compliance and customer experience as it makes its way into expanding across Latin America. These Russian high-profile investors participating highlights their confidence in the growth prospects of Plata and in the fintech potential in the region overall.

Russia Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia fintech market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia fintech market on the basis of deployment mode?

- What is the breakup of the Russia fintech market on the basis of technology?

- What is the breakup of the Russia fintech market on the basis of application?

- What is the breakup of the Russia fintech market on the basis of end user?

- What is the breakup of the Russia fintech market on the basis of region?

- What are the various stages in the value chain of the Russia fintech market?

- What are the key driving factors and challenges in the Russia fintech market?

- What is the structure of the Russia fintech market and who are the key players?

- What is the degree of competition in the Russia fintech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia fintech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)