Russia Fruits and Vegetables Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Russia Fruits and Vegetables Market Size and Share:

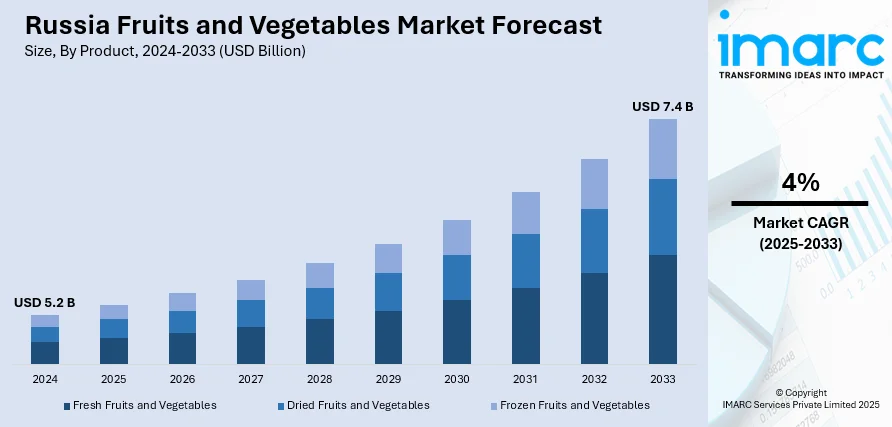

The Russia fruits and vegetables market size was valued at USD 5.2 Billion in 2024. The market is projected to reach USD 7.4 Billion by 2033, exhibiting a CAGR of 4% from 2025-2033. Central district region is currently dominating the market as it is experiencing high momentum based on changing consumer tastes towards healthy eating and enhanced supply chain networks. Increasing preference for fresh, locally grown produce is driving urban and regional demand. In addition, government support and improving health awareness are driving amplified fruits and vegetables consumption. A growing distribution network and retail innovations are also boosting market accessibility, which is favorably impacting the industry and reinforcing the Russia fruits and vegetables market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.2 Billion |

|

Market Forecast in 2033

|

USD 7.4 Billion |

| Market Growth Rate (2025-2033) | 4% |

Urbanization in the Russia fruits and vegetables market is strongly driving demand trends, particularly in urban areas. As increasing numbers of consumers relocate to urban areas, eating habits are moving toward convenient, health-oriented foods like fresh fruits and vegetables. Urban dwellers are becoming highly sensitive to the health advantages of eating fruits and vegetables, which are packed with vital nutrients and provide protection against chronic illnesses. This phenomenon is underpinned by increasing fitness and wellness culture in Russian cities, where the consumers are embracing nutrient-rich diets emphasizing fresh, seasonal produce. Furthermore, urban cities provide improved exposure to variety in product offering through new retail formats like supermarkets, organics, and online channels, which make easy and frequent buying of fresh produce and fruits and vegetables easier. According to the reports, in May 2024, Uzbekistan exported 26% more fruit and vegetables to Russia year-on-year at 156,000 tons, with strong growth in shipments of cabbage, persimmon, carrots, and cauliflower. Furthermore, ease of availability, coupled with changing health priorities and hectic lifestyles, is playing a crucial role in fueling regular consumption and defining the Russian produce market dynamics.

To get more information on this market, Request Sample

Growing focus on local agricultural growth is another key driver that is driving the Russia fruits and vegetables market trends. As a reaction to foreign trade restrictions and import substitution policies, the Russian government has stepped up investment in the domestic agri-food industry, promoting self-reliance in vegetable and fruit production. As per the sources, In May 2024, Russia announced to increase imports of tropical fruits from India, after phytosanitary clearance and successful shipments of bananas and grapes earlier during the year. Moreover, government-backed subsidies, grants, and participation in advanced agricultural technologies have given local producers the capability to expand production and improve yield quality. This strategic emphasis has led to increased accessibility of locally produced fruits and vegetables, which is highly appealing to consumers looking for fresher, cheaper alternatives. In addition, nationwide campaigns supporting "grown in Russia" produce have enhanced consumers' confidence in locally produced fruits and vegetables. Enhanced infrastructure in the form of cold storage facilities and logistics networks has also been instrumental in limiting post-harvest losses and facilitating better distribution to more regions. Consequently, the expansion of local production not only decreases reliance on imports but also guarantees round-the-year availability and price stability in the Russian fresh market.

Russia Fruits and Vegetables Market Trends:

Growing Health Consciousness

Growing health consciousness among Russian consumers is becoming a key driver of the market growth. Consumers have witnessed a significant change in food attitudes towards healthier food consumption propelled by an increasing recognition of the nutritional value linked to fresh produce. The President of Russia estimates that about 11 Million individuals in the nation are suffering from restraints on health, highlighting the case for dietary intervention with utmost urgency. Fruits and vegetables are rich in vitamins, minerals, and antioxidants, which assist in keeping chronic diseases at bay and ensuring well-being. This consciousness is further promoted by the increased prevalence of lifestyle diseases like obesity, diabetes, and cardiovascular disease (CVD) and has led people to take a second thought while choosing food. Additionally, health awareness programs and initiatives aimed at making the general public aware of the importance of healthy eating are driving this trend. This shift in consumption behavior strongly supports the Russia fruits and vegetables market forecast, reflecting sustained demand growth for fresh, health-oriented produce.

Increasing Disposable Incomes

Boost in disposable incomes of Russian consumers is playing a central part in the growth of the fruits and vegetables market. In recent releases, real disposable incomes increased by 9.4% year-over-year during Q3 2024, indicating a rise in purchasing power. Increased economic growth and enhanced living standards have led to amplified disposable incomes, allowing consumers to spend on healthier and premium foods. This movement can be observed most prominently in urban areas, where a growing middle class is highly attracted to varied and high-quality fruits and vegetables. With higher incomes comes a willingness to pay for fresh and healthy food products, including exotic and organic produce that were until now considered to be luxuries. In addition, increased disposable incomes are leading consumers to try international foods that promote the consumption of fresh produce, thereby accelerating demand for a wide range of fruits and vegetables.

Government Support

Government support is also a key driver of the Russia fruits and vegetables market growth. Despite recognizing the pivotal role of agriculture towards national food security and economic stability, the Russian government has been trying to support local farmers and promote the agricultural sector. Official reports indicate that the Russian government has pledged to spend USD 2.8 Billion in 2025, USD 2.87 Billion in 2026, and USD 2.9 Billion in 2027 towards funding the agricultural sector. Some of these initiatives involve subsidies, grants, and inexpensive loans to farmers to adopt improved modern agricultural methods and technology. The government is also making investments in the development of infrastructure like irrigation systems, storage facilities, and transportation networks to increase efficiency and productivity along the agricultural supply chain. Further, policies of protection trade, such as tariffs and foreign produce import limitations, serve to protect local farmers during international competition and ensure the consumption of locally produced fruits and vegetables.

Russia Fruits and Vegetables Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia fruits and vegetables market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product and distribution channel.

Analysis by Product:

- Fresh Fruits and Vegetables

- Dried Fruits and Vegetables

- Frozen Fruits and Vegetables

In 2024, fresh vegetables and fruits had 61.2% market share of the Russia vegetables and fruits market, leading overall product share. The high consumer demand for unprocessed, natural vegetables and fruits is backed by increasing knowledge of the diet benefits of fresh produce. Fresh foods are becoming top priority in home diets because they are linked to immunity support, disease prevention, and general health. The success of farmer markets and the direct-to-consumer retailing model has also driven this segment's dominance. Urban and semi-urban consumers actively demand seasonal, locally produced produce, further driving market share. Also, Russia's farm policy has further focused on fresh produce production through subsidies and support of logistics for perishable items. With the growth in cold chain infrastructure and availability of fresh items throughout the year, the fresh fruits and vegetables segment is likely to continue to be the dominant segment, fueling continuous Russia fruits and vegetables market growth.

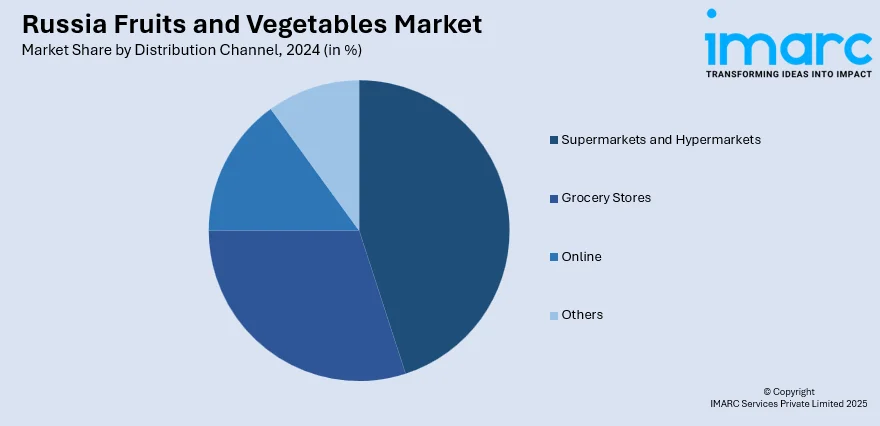

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Grocery Stores

- Online

- Others

Hypermarkets and supermarkets are the most powerful distribution channel available in the market of fruits and vegetables in Russia, having a dominant presence in urban as well as semi-urban areas. These store formats provide consumers with the benefit of convenience, guaranteed availability of products, and extensive variety at one place. Growth in disposable incomes and desire for organized retail environments have driven consumers faster from open markets to modern grocery stores. Food retailers are stressing hygiene, standard packaging, and labeling—qualities that resonate with quality-aware Russian shoppers. Organized retailers are also establishing long-term procurement links with local manufacturers, which assures fresher stocks and reduced logistics costs. Promotional schemes, loyalty cards, and bundling are also supporting retention of customers in this channel. With ongoing urbanization and infrastructure growth, supermarkets and hypermarkets are expected to play a growing central role in influencing consumer shopping behavior and servicing the overall fruits and vegetables supply chain in Russia during the forecast period.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

Central district is a key player in the Russia fruits and vegetables market outlook based on its favorable climatic conditions, agricultural infrastructure, and immense consumer base, particularly in and around Moscow. It enjoys well-developed transportation and storage networks that enable the efficient distribution of perishable produce. Furthermore, its close proximity to dense urban areas generates high demand for fresh produce and vegetables, boosted by the increasing health consciousness of consumers in urban areas. Farm areas within the Central District are also given special government assistance in the form of modernization grants, which has helped it implement advanced farming methods, like greenhouse farming. This has resulted in enhanced yield quality and quantity, further establishing the district's strategic significance within the national supply chain. The mix of manufacturing power and consumption intensity positions the Central District as a key node in Russia's fruits and vegetables market, playing a major role in the overall structure of the market and future growth.

Competitive Landscape:

As per Russia fruits and vegetables market analysis competitive landscape involves a large concentration of domestic producers, agricultural cooperatives, and retail distribution partners with diverse offerings. Local farm businesses lead the supply side, receiving government support through subsidies and incentives as well as policies for decreasing import reliance and increasing domestic agricultural production. Vertical integration is becoming more prevalent, with some producers handling everything from planting to packaging and distribution. Players from the local region tend to specialize in a particular crop as per their climatic regions, adding diversity to the product. From the retail side, big supermarket chains and hypermarkets are increasing their fresh produce area, making direct purchase deals with farmers for quality and continuity. Infrastructure development in the cold chain has made wider geographic coverage for perishables possible, making the competition among suppliers fiercer. Also, specialty players with organic and exotic fruits and vegetables are making inroads in urban areas. Competitive forces in the market are tilting toward innovation, logistics efficiency, and direct-to-consumer models.

The report provides a comprehensive analysis of the competitive landscape in the Russia fruits and vegetables market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Salix Fruits started its 2025 citrus season with increased focus on Europe and Russia due to tight local supply and weather-related setbacks in Turkey and Spain. Southern Hemisphere exporters like Argentina, Peru, and Chile redirected citrus shipments to Russia, leveraging improved yields and market opportunities amid shifting global trade dynamics.

- April 2025: Magnit acquired a controlling stake in premium supermarket chain Azbuka Vkusa for up to $490 million, expanding its retail footprint in Moscow and St. Petersburg. The deal included kitchen factories and distribution centers, boosting Magnit’s capacity to meet rising urban demand for fresh produce, including fruits and vegetables.

- February 2025: Russia’s Stavropol Krai announced plans to develop a cutting-edge greenhouse complex focused on cultivating bananas and other tropical fruits a notable advancement for agriculture in Southern Russia. Governor Vladimir Vladimirov recently met with an Azerbaijani investor to finalize the project, which will span 15 hectares in the city of Nevinnomyssk.

Russia Fruits and Vegetables Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Fresh Fruits and Vegetables, Dried Fruits and Vegetables, Frozen Fruits and Vegetables |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia fruits and vegetables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia fruits and vegetables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia fruits and vegetables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fruits and vegetables market in Russia was valued at USD 5.2 Billion in 2024.

The Russia fruits and vegetables market is projected to exhibit a CAGR of 4% during 2025-2033, reaching a value of USD 7.4 Billion by 2033.

The Russia fruits and vegetables market is being led mainly by increasing health awareness, a growing trend toward natural and nutrient-dense foods, and rising disposable incomes. Local farming is being supported by government subsidies and better cold chain logistics as well. Urbanization and changing dietary preferences towards fresh fruits and vegetables are also driving market growth throughout the nation.

In 2024, fresh fruits and vegetables were the leading product category with a 61.2% market share, fueled by consumers' appetite for unprocessed, nutrition-rich foods. Regionally, the Central District accounts for the majority, attributable to superior distribution infrastructure, suitable climate for crops, and high-density urban population. The region's robust retailing infrastructure and agricultural production make it a growth driver.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)