Russia Furniture Market Size, Share, Trends and Forecast by Product, Material, End Use, and Region, 2025-2033

Russia Furniture Market Size and Share:

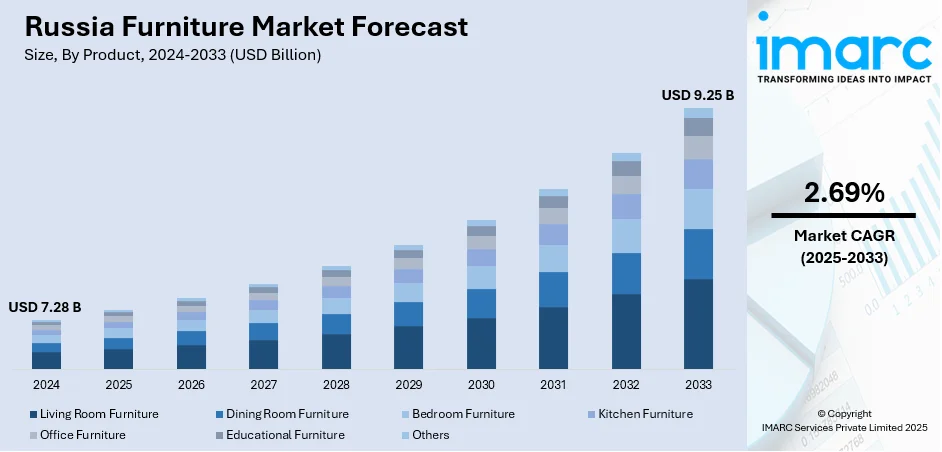

The Russia furniture market size was valued at USD 7.28 Billion in 2024. Looking forward, the market is expected to reach USD 9.25 Billion by 2033, exhibiting a CAGR of 2.69% during 2025-2033. Central District currently dominates the market, holding a significant market share of 35.0% in 2024. The growing urbanization, increasing disposable incomes, rising demand for home renovation and interior design, expansion of the e-commerce sector, government support for housing projects, and the emerging trend toward sustainable and eco-friendly furniture options are key factors driving the Russia furniture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.28 Billion |

| Market Forecast in 2033 | USD 9.25 Billion |

| Market Growth Rate (2025-2033) | 2.69% |

A major catalyst of the market is the country’s urbanization trend, with a rising number of people relocating to cities like Moscow and St. Petersburg. This shift is driving demand for modern, space-saving furniture designed for compact apartments. Government support for residential construction is also fueling furniture purchases. For instance, in April 2024, Via videoconference, Vladimir Putin participated in a ceremony marking the inauguration of new housing and social infrastructure projects in the recently integrated regions of the Russian Federation. Moreover, the demand for ergonomic office furniture is rising due to flexible work arrangements and increased corporate activity. Domestic production is expanding to reduce reliance on imports, supported by local manufacturing initiatives.

To get more information on this market, Request Sample

The Russia furniture market growth is also driven by improved disposable incomes and a growing middle class, which are encouraging consumers to invest in stylish, functional, and often customizable furniture pieces. Online shopping is playing a pivotal role, with e-commerce platforms making furniture more accessible. Digital tools such as virtual room planners and AR-based visualization features are enhancing the buying experience. Sustainability is another important driver, as Russian consumers, especially younger demographics, are prioritizing eco-friendly materials, local sourcing, and sustainable manufacturing practices. In parallel, modern design preferences are evolving, with a tilt towards Scandinavian minimalism, smart furniture, and multifunctional solutions.

Russia Furniture Market Trends:

Urbanization and housing development

One of the primary trends driving the Russian furniture market is urbanization. According to estimates, 75.04% of the population of Russia lives in urban areas, equating to 108,062,384 individuals. As people move to more cities, demand for housing is on the rise, and with it, the need for furniture. Typically, modern, functional furniture as well as space-saving furniture is preferred by people living in smaller apartments and in other small spaces typical in cities. Modular and multifunctional furniture is preferred as it can maximize the utility of limited space. Support by the Russian government for housing development projects, such as affordable housing initiatives, further boosts demand. The construction of new apartment buildings generates a constant demand for a variety of furniture kinds, from more specialized and customized pieces to more fundamental necessities, which is aiding in market expansion. The Russia furniture market forecast indicates steady growth driven by these trends and evolving user preferences.

E-commerce and digital transformation

The rapid growth of online furniture shopping has been influenced by the benefits of convenience, such as home delivery, and extensive choices, beyond what can be found in traditional brick-and-mortar establishments. Overall, the e-commerce market in Russia reached USD 63.80 Billion in 2024 and is forecasted to grow at a CAGR of 8.88% from 2025-2033, as per a report by the IMARC Group. E-commerce facilitates easy comparison of prices, reviews from other clients, and a vast number of choices, making the entire purchasing process much more transparent and efficient. According to the Russia furniture market trends, digital transformation in the industry has seen the integration of advanced technologies, such as AR and VR, which enable users to see how furniture will look in their homes before buying. Through improved shopping experience and reduced uncertainty levels in furniture purchases online, these technological innovations are enhancing individual confidence and driving growth in the market.

Sustainability and eco-friendly furniture

Growing environmental consciousness among people propels the need for sustainable, eco-friendly furniture in Russia. People are searching for products of environmentally responsible materials and processes- recycled materials, certified wood, and other forms of sustainable resources. Additionally, manufacturers are going greener and sourcing materials with lower environmental impacts. For instance, in 2012, IKEA Russia launched the “Yes! – To people and the planet!” sustainable development initiative, aimed at reducing the harmful environmental impact of the company’s furniture production practices in the country. Through this initiative, IKEA Russia promoted deliberate and responsible forest usage, along with furniture and waste recycling. Additionally, minimalism is an increasing trend; the market is experiencing a surge due to consumers who are demanding furniture that not only is functional but also leaves the smallest possible ecological footprint, further propelling the market. The shift towards sustainability is further backed by government regulations and initiatives for the industry to encourage the production of more eco-friendly products and practices. As a result, furniture brands prioritizing sustainability appeal to the environmentally conscious individuals, thus strengthening the Russia furniture industry.

Russia Furniture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia furniture market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, material, and end use.

Analysis by Product:

- Living Room Furniture

- Dining Room Furniture

- Bedroom Furniture

- Kitchen Furniture

- Office Furniture

- Educational Furniture

- Others

Living room furniture stand as the largest component in 2024, holding 37.5% of the market due to its central role in both functionality and home aesthetics. As the primary gathering space for families and guests, the living room is often prioritized in home furnishing budgets. Consumers in Russia increasingly seek stylish, comfortable, and multifunctional pieces like sofas, entertainment units, and coffee tables that reflect modern interior trends. Urbanization and smaller apartment layouts also drive demand for compact and modular living room solutions. Additionally, the rise of online furniture shopping has made it easier for consumers to browse and purchase a variety of designs and styles. According to the Russia furniture market forecast, these factors collectively contribute to the dominance of living room furniture in Russia’s overall furniture market.

Analysis by Material:

- Metal

- Wood

- Plastic

- Glass

- Others

Wood leads the market with 55.2% of market share in 2024 due to its long-standing cultural preference, aesthetic appeal, and availability. Russia is rich in forest resources, making wood a widely accessible and cost-effective material for domestic furniture manufacturing. Consumers favor wooden furniture for its durability, natural look, and ability to complement both traditional and modern interior styles. Additionally, wood offers versatility in design, from carved classics to minimalist Scandinavian forms, which appeals to a broad customer base. The emphasis on sustainable and eco-friendly living has further boosted demand for solid wood and certified materials, creating a positive impact on the Russia furniture market outlook. As domestic manufacturers prioritize local sourcing and environmentally responsible production, wood continues to dominate the market across residential, commercial, and institutional segments.

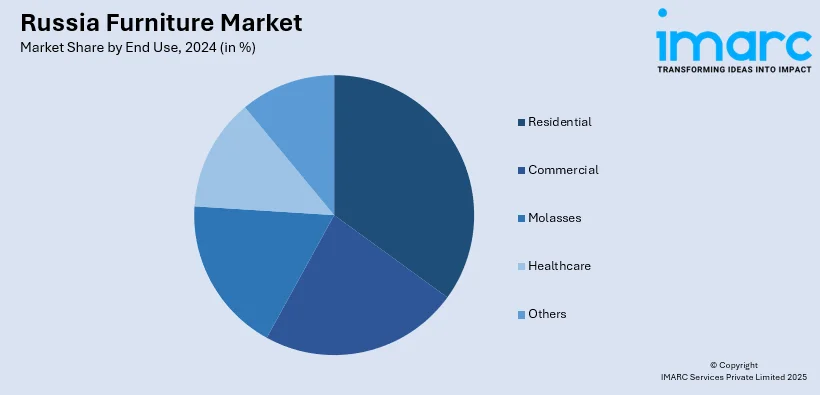

Analysis by End Use:

- Residential

- Commercial

- Molasses

- Healthcare

- Others

Residential leads the market with 63.4% of market share in 2024 due to growing urbanization, rising disposable incomes, and expanding housing development across the country. As more people move to cities and invest in homeownership or rental properties, demand for home furniture, particularly for living rooms, bedrooms, and kitchens, continues to surge. Government-backed housing projects in both urban centers and newly integrated regions further fuel this trend. Additionally, consumers are increasingly focused on home aesthetics and functionality, driving purchases of modular, space-saving, and customizable furniture. The shift toward remote work has also led to greater investment in home office setups. These factors make the residential segment the most dominant and consistent source of demand within the Russian furniture industry.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

In 2024, the Central District accounted for the largest market share of 35.0%. The Russia furniture market demand in the Central District is driven by several strong factors. As the country’s most urbanized and economically developed region, it includes Moscow and other major cities with high population density and strong infrastructure. This leads to increased demand for modern, space-saving, and stylish furniture suited to compact urban homes. The region also hosts a significant concentration of furniture manufacturers and suppliers, making it a production and distribution hub. Higher disposable incomes in cities like Moscow fuel demand for premium and customized furniture. Additionally, the Central District leads in e-commerce adoption, with consumers embracing online furniture shopping supported by virtual showrooms and AR tools.

Competitive Landscape:

The competitive landscape of the Russia furniture market is characterized by a mix of established domestic manufacturers, regional players, and a limited presence of international brands. Key local companies such as Shatura, Stolplit, and Lazurit dominate the market through extensive retail networks and competitive pricing. These firms focus on modular, ready-to-assemble, and customized solutions to cater to evolving consumer preferences. The market is increasingly influenced by e-commerce platforms like Wildberries and Ozon, enabling smaller brands to gain visibility. Government support for local production and import substitution policies have further strengthened domestic players. Additionally, sustainability, design innovation, and digital engagement are becoming major differentiators, with companies investing in eco-friendly materials and virtual shopping tools to enhance customer experience and retain market share.

The report provides a comprehensive analysis of the competitive landscape in the Russia furniture market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: President Vladimir Putin commissioned a full-cycle timber processing project in the Kaluga Region via video conference for the production of particleboards and laminated particleboards. The goal of the launch is to enhance the effectiveness of deep timber processing support, thereby fulfilling local demand and providing high-value items, including furniture.

- March 2025: The MosBuild 2025 Exhibition announced official dates. The exhibition will be held from April 1, 2025, till April 4, 2025, in Moscow, showcasing various eco-friendly and specialized offerings for diverse interior industries, including furniture, bathroom and kitchen, and flooring.

- December 2024: The 5th Moscow Interior and Design Week, united over 1,100 companies, including 45 international participants, and attracted 180,000 visitors. Notable features included the "Made in Moscow" initiative showcasing Russian-style furnishings, an innovation area with state-of-the-art design technologies, and workshops led by industry professionals.

- February 2024: CHOOO.SPACE, led by Vladimir Chuvashev, unveiled its bespoke furniture collection, showcasing unique designs inspired by "Russian Fantasticism" and Soviet Suprematism. Crafted with brass, stone, and glass, the pieces emphasize artistry and craftsmanship, redefining Russian collectible furniture. The collection aims to elevate interior design with meaningful, sculptural creations.

- July 2023: A new store named Гуд Лакк (“Good Luck”) opened in Russia, closely mimicking IKEA. With blue-and-yellow branding, similar furniture designs, and the return of IKEA’s iconic plush sharks, Good Luck offers nearly identical items, including pre-arranged rooms. However, local touches, like Soviet-era dictionaries and Russian penmanship books, set it apart.

Russia Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Living Room Furniture, Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, Office Furniture, Educational Furniture, Others |

| Materials Covered | Metal, Wood, Plastic, Glass, Others |

| End Uses Covered | Residential, Commercial, Molasses, Healthcare, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The furniture market in Russia was valued at USD 7.28 Billion in 2024.

The Russia furniture market is projected to exhibit a CAGR of 2.69% during 2025-2033, reaching a value of USD 9.25 Billion by 2033.

Key factors driving the Russia furniture market include rapid urbanization, rising disposable incomes, growing demand for modern and space-saving furniture, expansion of e-commerce platforms, and increased government investment in housing. Additionally, consumer preference for locally made, sustainable, and customizable furniture is further fueling market growth.

Central District currently dominates the furniture market due to high urbanization, affluent consumers, and a strong manufacturing base. Demand for compact, modern furniture is rising due to dense housing. Additionally, advanced e-commerce adoption and a focus on design innovation boost market growth in this region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)