Russia Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

Russia Insurtech Market Overview:

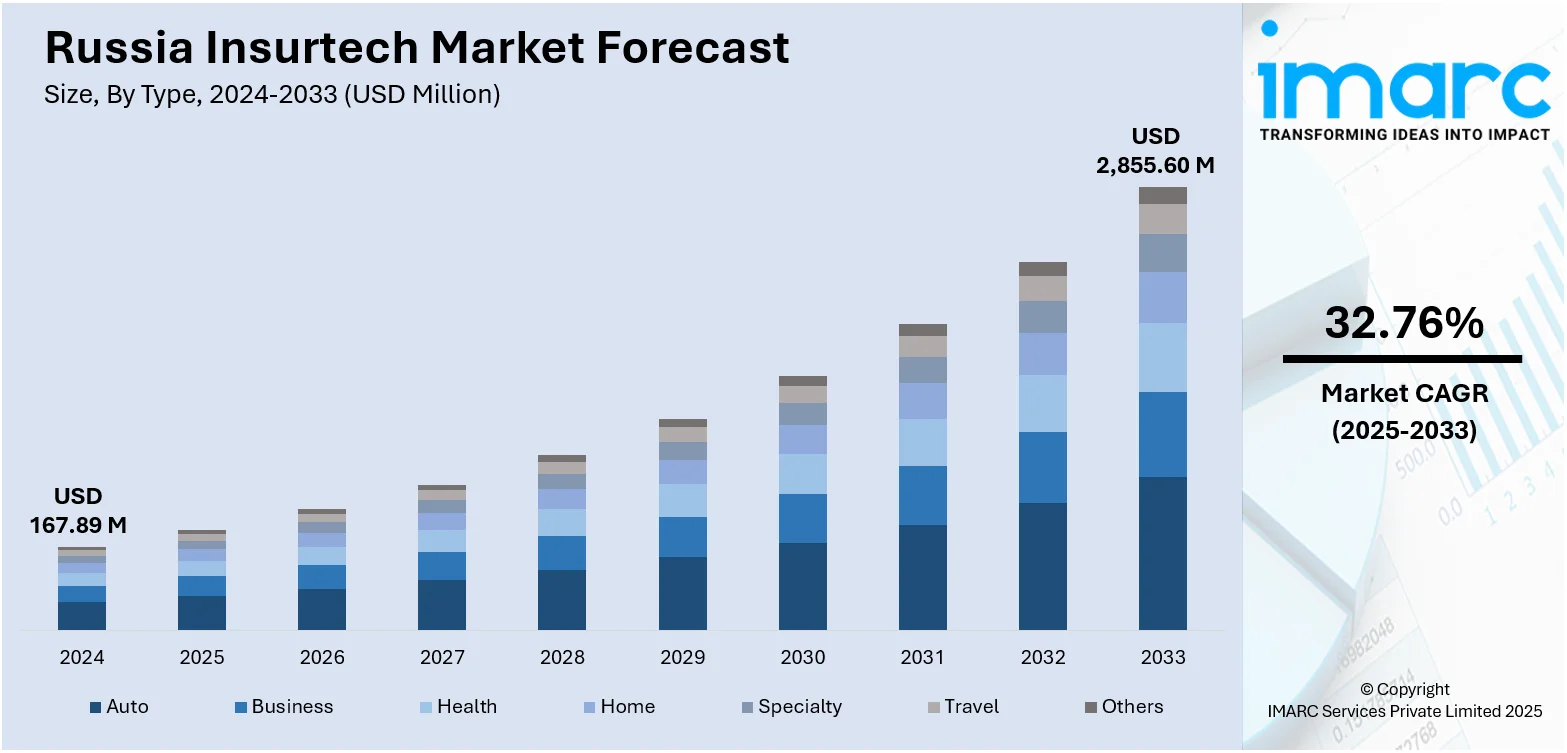

The Russia Insurtech market size reached USD 167.89 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,855.60 Million by 2033, exhibiting a growth rate (CAGR) of 32.76% during 2025-2033. The Russia market is advancing through stronger digital infrastructure, rising collaboration with e-commerce and fintech platforms, and the introduction of regulated products linked to alternative assets. These trends improve access, enhance individual experience, and align insurance offerings with shifting user and investment behavior, thereby expanding the Russia Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 167.89 Million |

| Market Forecast in 2033 | USD 2,855.60 Million |

| Market Growth Rate 2025-2033 | 32.76% |

Russia Insurtech Market Trends:

Rise of Digital Infrastructure

Russia's swift embrace of digital payment methods is transforming the purchasing and servicing of insurance products. Biometric authentication, quick response (QR)-code payments, and e-wallets are enhancing the efficiency and user-friendliness of policy issuance and claims processing. Insurtech platforms are incorporating these attributes to minimize friction throughout the user experience. The drive for this change intensified in 2025 when the Bank of Russia announced that the digital ruble would commence widespread implementation in September 2026, targeting complete adoption by 2028. Having completed more than 63,000 transfers and 17,000 smart contracts during the pilot phase, the groundwork is being set for programmable currency and automated financial services. With the rise of digital ruble usage, insurers can integrate payments and policy activities directly into digital ecosystems, enhancing the accessibility and responsiveness of insurance. This transformation reinforces the case for end-to-end digital infrastructure across the insurance sector.

To get more information on this market, Request Sample

Partnerships with E-commerce and Fintech Platforms

The increasing partnership between Insurtech firms and e-commerce or fintech platforms is a crucial factor impelling the Russia Insurtech market growth. These integrations enable users to obtain insurance when reserving services, making purchases, or utilizing familiar payment methods. By collaborating with popular platforms, insurers enhance product exposure and lower entry obstacles, particularly for younger, mobile-oriented users. The magnitude of this opportunity is underscored by the extent of Russia’s e-commerce sector, which hit USD 63.80 Billion in 2024, as per the IMARC Group. This increase in online transactions establishes a straightforward opportunity for embedded insurance to thrive. Fintech partnerships enhance adaptable payment solutions, such as mobile wallets and buy-now-pay-later (BNPL) services, rendering insurance more accessible. This convenience boosts user trust in digital insurance and encourages ongoing interaction. With the rise of online shopping in Russia, these integrated models are demonstrating their effectiveness for insurers aiming to increase access and adoption.

Integration of Alternative Assets into Regulated Insurance Products

Insurance providers in Russia are increasingly incorporating non-traditional assets, such as cryptocurrencies, into structured and regulated insurance products. This reflects a shift toward more flexible product development aimed at affluent clients seeking both capital appreciation and financial protection. As insurers explore policy models linked to emerging asset classes, they facilitate innovation within a compliant framework. This development is attracting a new segment of digitally proficient investors who are open to alternative financial instruments. It further demonstrates the sector’s willingness to move beyond conventional models to meet evolving financial expectations. The use of regulated exchanges and approved investment vehicles underscores a cautious yet deliberate effort to merge technological advancement with regulatory standards, thereby encouraging broader acceptance of Insurtech solutions designed to support product design, risk evaluation, and policy administration in these new insurance formats. For instance, in 2025, Russian insurers Renaissance Life and BCS Life Insurance launched Bitcoin-backed life insurance policies, offering capital-protected exposure to Bitcoin via BlackRock’s IBIT. These regulated ILIPs target affluent investors using Bitcoin futures on the Moscow Exchange. The move reflects growing integration of crypto into mainstream finance.

Russia Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

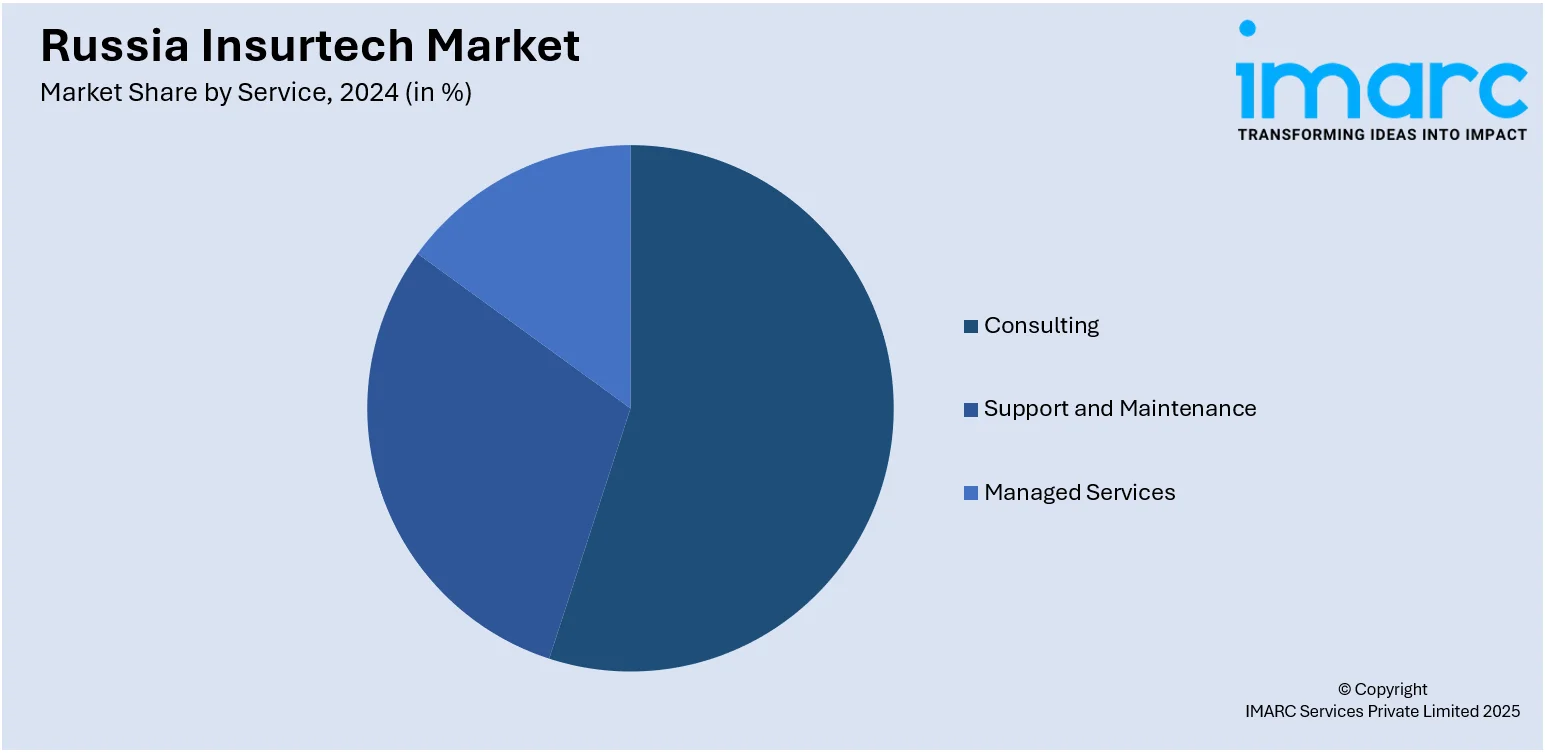

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia Insurtech market on the basis of type?

- What is the breakup of the Russia Insurtech market on the basis of service?

- What is the breakup of the Russia Insurtech market on the basis of technology?

- What is the breakup of the Russia Insurtech market on the basis of region?

- What are the various stages in the value chain of the Russia Insurtech market?

- What are the key driving factors and challenges in the Russia Insurtech market?

- What is the structure of the Russia Insurtech market and who are the key players?

- What is the degree of competition in the Russia Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)