Russia Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

Russia Luxury Fashion Market Overview:

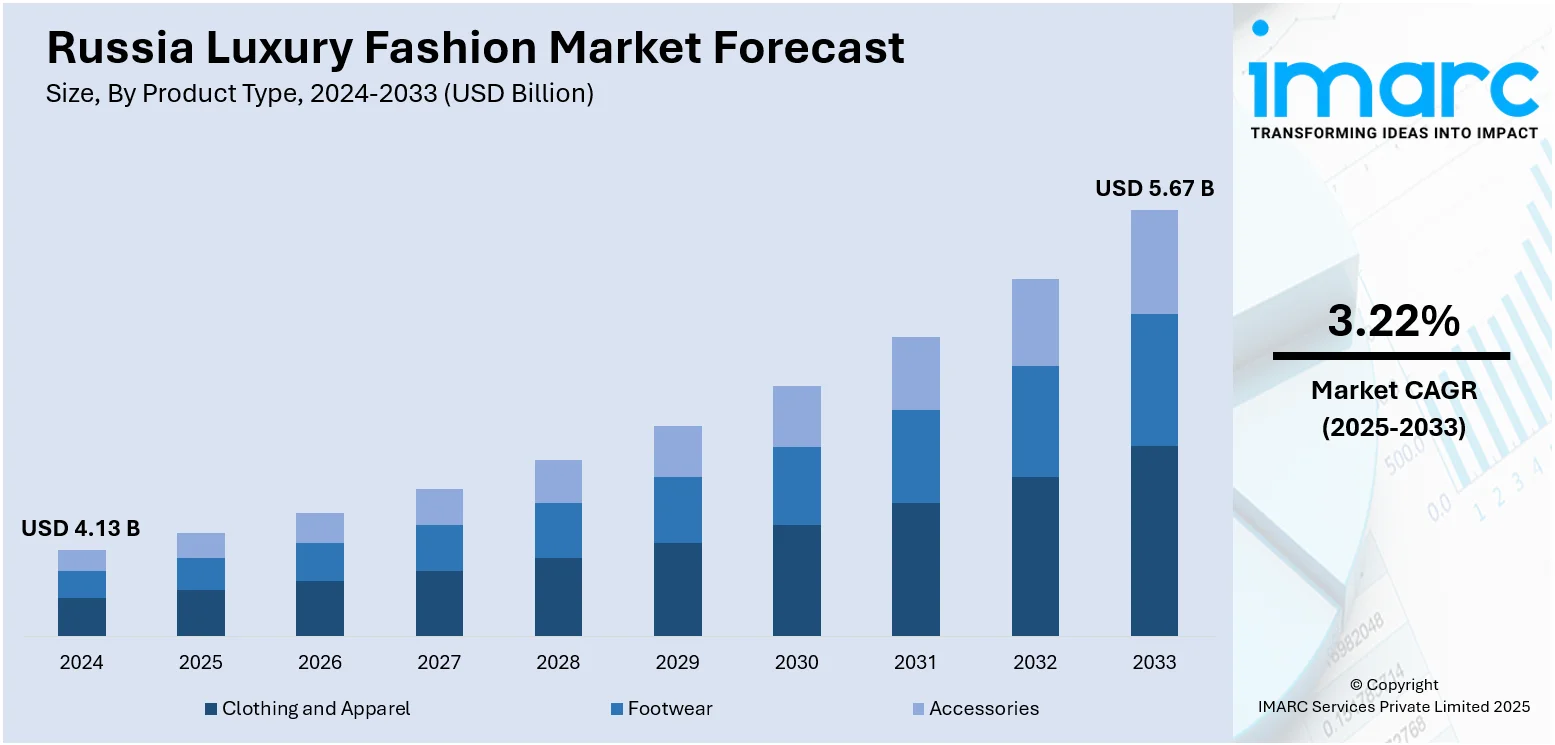

The Russia luxury fashion market size reached USD 4.13 Billion in 2024. The market is projected to reach USD 5.67 Billion by 2033, exhibiting a growth rate (CAGR) of 3.22% during 2025-2033. The market is fueled by increased disposable incomes, growing demand for high-end products, and wider interest in Western fashion. Aside from this, the luxury brands gain advantage from consumers' demand for exclusivity and prestige, with online platforms speeding up exposure to global collections. Further, support from the government of luxury manufacturing within the country and rising luxury tourism are among the key factors majorly augmenting the Russia luxury fashion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.13 Billion |

| Market Forecast in 2033 | USD 5.67 Billion |

| Market Growth Rate 2025-2033 | 3.22% |

Russia Luxury Fashion Market Trends:

Rising Disposable Income Among Affluent Demographics

Luxury fashion in Russia has become increasingly accessible to a broader segment of affluent consumers due to a steady rise in disposable income within upper-middle-class and high-net-worth households. As per industry reports, in Russia, disposable incomes saw an overall growth of 8.6% for the period spanning January to September 2024. Despite macroeconomic challenges, certain sectors, particularly energy, finance, and IT, continue to generate substantial earnings, allowing a consistent portion of the population to allocate spending toward non-essential goods. For consumers in major urban centers like Moscow, St. Petersburg, and Yekaterinburg, luxury purchases are often used to signify social standing and personal achievement. This income shift has led to increased spending on premium fashion items, including designer clothing, accessories, and high-end footwear. Additionally, consumers are showing a willingness to spend more on quality, craftsmanship, and personalization. The luxury buyer is no longer limited to older generations or international travelers; younger professionals are becoming a driving force, often making their first luxury purchases in their twenties. This evolution in consumer demographics has broadened the base for luxury fashion brands, creating a larger, more diverse market segment interested in regular engagement with premium labels.

To get more information on this market, Request Sample

Expansion of Digital Retail and E-Commerce Platforms

Digital commerce is positively impacting the Russia luxury fashion market growth, particularly since global travel restrictions and sanctions have limited access to physical flagship stores abroad. As of 2024, Russia's internet penetration reached 90.4% of the population, as per industry reports. This high level of digital access has significantly contributed to the rising trend of consumers shifting toward online shopping platforms. In addition, high-end consumers are increasingly interacting with brands over the internet, both for convenience and for access to a broader selection. Furthermore, domestic e-commerce platforms have rapidly evolved to incorporate upper-tier segments, presenting carefully selected luxury products and virtual styling services. Luxury brands that initially hesitated the adoption of e-commerce have either partnered with local platforms or built their own direct-to-consumer sites tailored to Russian users. In addition, richer digital experiences from 3D previews of products to concierge chat capabilities have changed the way luxury consumers engage with high-end products. Mobile-first luxury retail is also on the rise, fueled by better payment infrastructure and geolocated apps. This trend not only enhances conversion but also allows brands to remain top of mind and loyal while having no footprint in the retail space. Aside from this, the online platform provides smaller brands with the ability to compete for eyeballs and provides successful brands with the ability to sustain interest using focused content and special online releases.

Russia Luxury Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing and apparel (jackets and coats, skirts, shirts and T-shirts, dresses, trousers and shorts, denim, underwear and lingerie, and others), footwear, and accessories (gems and jewellery, belts, bags, and watches).

Distribution Channel Insights:

- Store-Based

- Non-Store Based

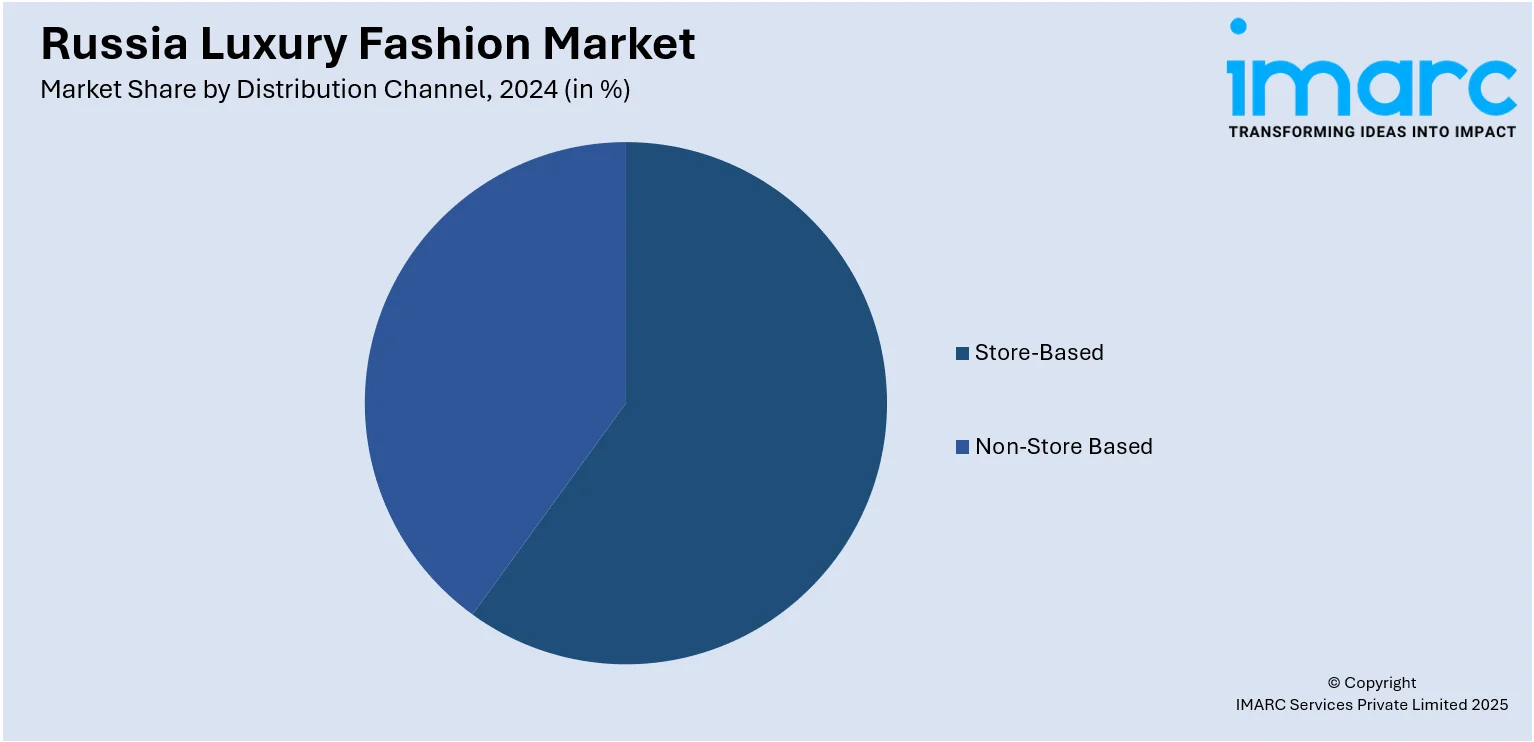

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based and non-store based.

End User Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and unisex.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia luxury fashion market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia luxury fashion market on the basis of product type?

- What is the breakup of the Russia luxury fashion market on the basis of distribution channel?

- What is the breakup of the Russia luxury fashion market on the basis of end user?

- What is the breakup of the Russia luxury fashion market on the basis of region?

- What are the various stages in the value chain of the Russia luxury fashion market?

- What are the key driving factors and challenges in the Russia luxury fashion market?

- What is the structure of the Russia luxury fashion market and who are the key players?

- What is the degree of competition in the Russia luxury fashion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia luxury fashion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia luxury fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia luxury fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)