Russia Mushroom Market Size, Share, Trends and Forecast by Mushroom Type, Form, Distribution Channel, End Use, and Region, 2025-2033

Russia Mushroom Market Overview:

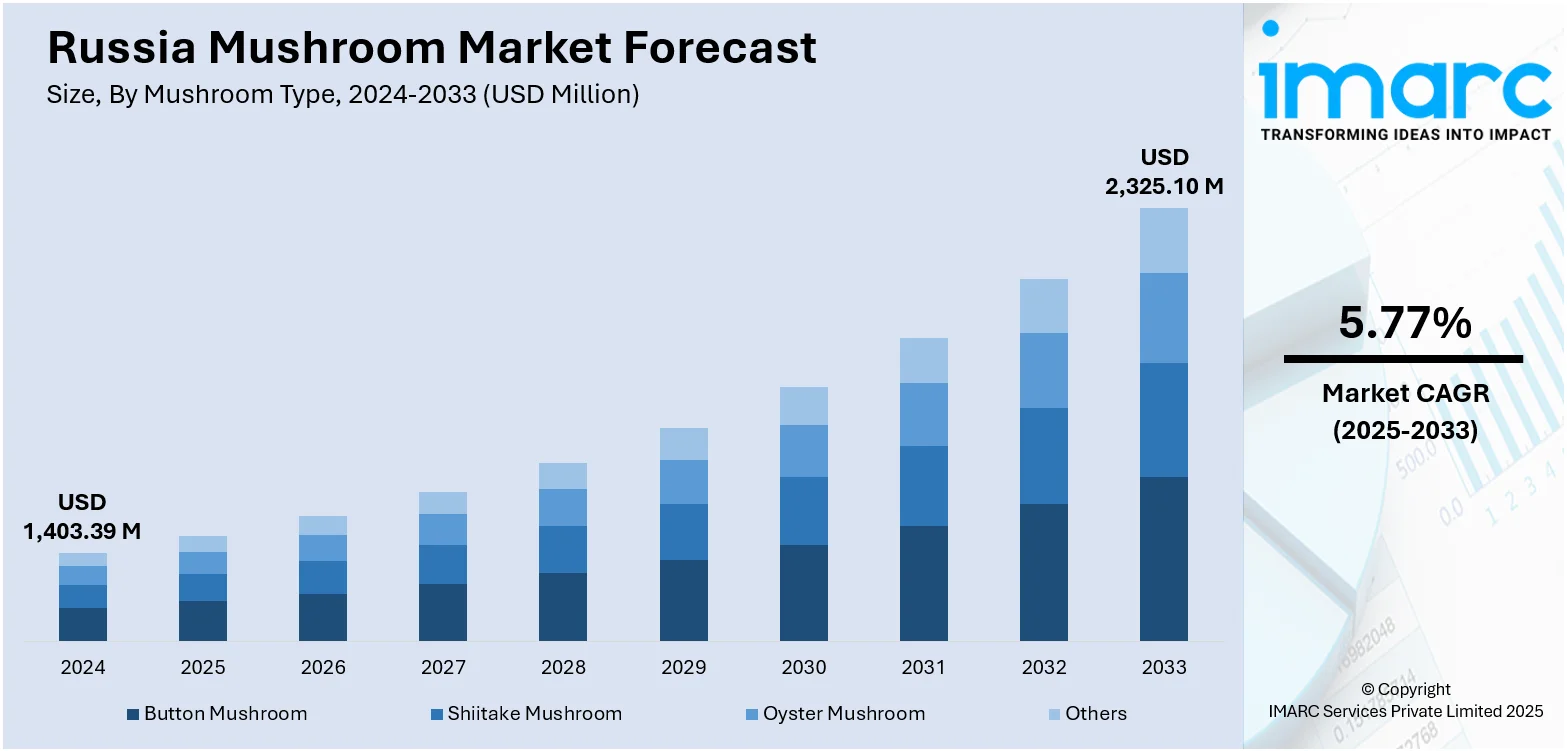

The Russia mushroom market size reached USD 1,403.39 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,325.10 Million by 2033, exhibiting a growth rate (CAGR) of 5.77% during 2025-2033. The rise of online grocery services and improvements in cold chain infrastructure are enhancing the distribution of fresh and specialty mushrooms across Russia. These factors increase accessibility, particularly in urban and remote areas, supporting the broader availability and visibility of mushrooms through efficient logistics and digital platforms, thereby influencing the Russia mushroom market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,403.39 Million |

| Market Forecast in 2033 | USD 2,325.10 Million |

| Market Growth Rate 2025-2033 | 5.77% |

Russia Mushroom Market Trends:

Rise of Online Grocery

Online grocery services are increasing the availability of fresh and specialty mushrooms throughout Russia, particularly in urban areas where retail shelf space may be restricted or variable. With urban shoppers moving to weekly food buys through delivery apps and e-commerce platforms, mushrooms are increasingly included in regular online orders. This transformation not only provides ease but is also altering the marketing and distribution of mushrooms. Subscription services and direct-to-consumer (DTC) delivery systems now enable producers to avoid wholesalers and provide fresher goods with quicker delivery times. This is especially crucial for fragile varieties that struggle to endure lengthy supply chains. Producers are utilizing digital platforms to highlight health advantages, provide recipes, and enhance brand awareness among consumers looking for clean-label or nutrient-dense foods. As reported by the IMARC Group, the Russia e-commerce sector was valued at USD 63.80 billion in 2024, highlighting the rapid pace at which the transition towards online platforms is progressing. This swift expansion provides mushroom growers a scalable path to market, which is not reliant on conventional retail positioning. With enhancements in logistics infrastructure and an increasing number of consumers accustomed to ordering perishables food products online, mushrooms, particularly pre-packed and specialty varieties, are benefiting from increased visibility and broader access. It is also motivating producers to create packaging designed for digital platforms, where visuals, ease of use, and clear communication is crucial.

To get more information on this market, Request Sample

Expansion of Cold Chain Infrastructure

The advancement of contemporary cold storage and transport systems is improving the distribution of fresh mushrooms, enabling their efficient delivery from farms to retail locations, even across greater distances. Historically, perishability posed a significant challenge, particularly for consumers in smaller towns with restricted availability of fresh fruits and vegetables. Advancements in temperature management throughout storage, transport, and retail presentation are dismantling these obstacles, guaranteeing that fresh mushrooms can be delivered to secondary and tertiary cities without deterioration. The enhanced reliability in logistics is encouraging retailers to expand their product range, as they are now able to maintain the freshness of mushrooms for extended durations. An illustration of this infrastructure expansion is the development of the Teplichnaya Street Warehouse Complex in Nizhny Novgorod, Russia, which commenced in Q1 2024 and was projected to be finalized by Q1 2025. This 51,000m² facility featured a cold storage, increasing the area's ability to manage perishable items. Investments in cold chain logistics, storage enhancement, and real-time temperature tracking systems are key to this transition, aiding in waste reduction and boosting trust among manufacturers, suppliers, and purchasers. This infrastructure growth is contributing to the Russia mushroom market growth, expanding the reach of fresh and specialty mushrooms across the country.

Russia Mushroom Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based mushroom type, form, distribution channel, and end use.

Mushroom Type Insights:

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Others

The report has provided a detailed breakup and analysis of the market based on the mushroom type. This includes button mushroom, shiitake mushroom, oyster mushroom, and others.

Form Insights:

- Fresh Mushroom

- Canned Mushroom

- Dried Mushroom

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes fresh mushroom, canned mushroom, dried mushroom, and others.

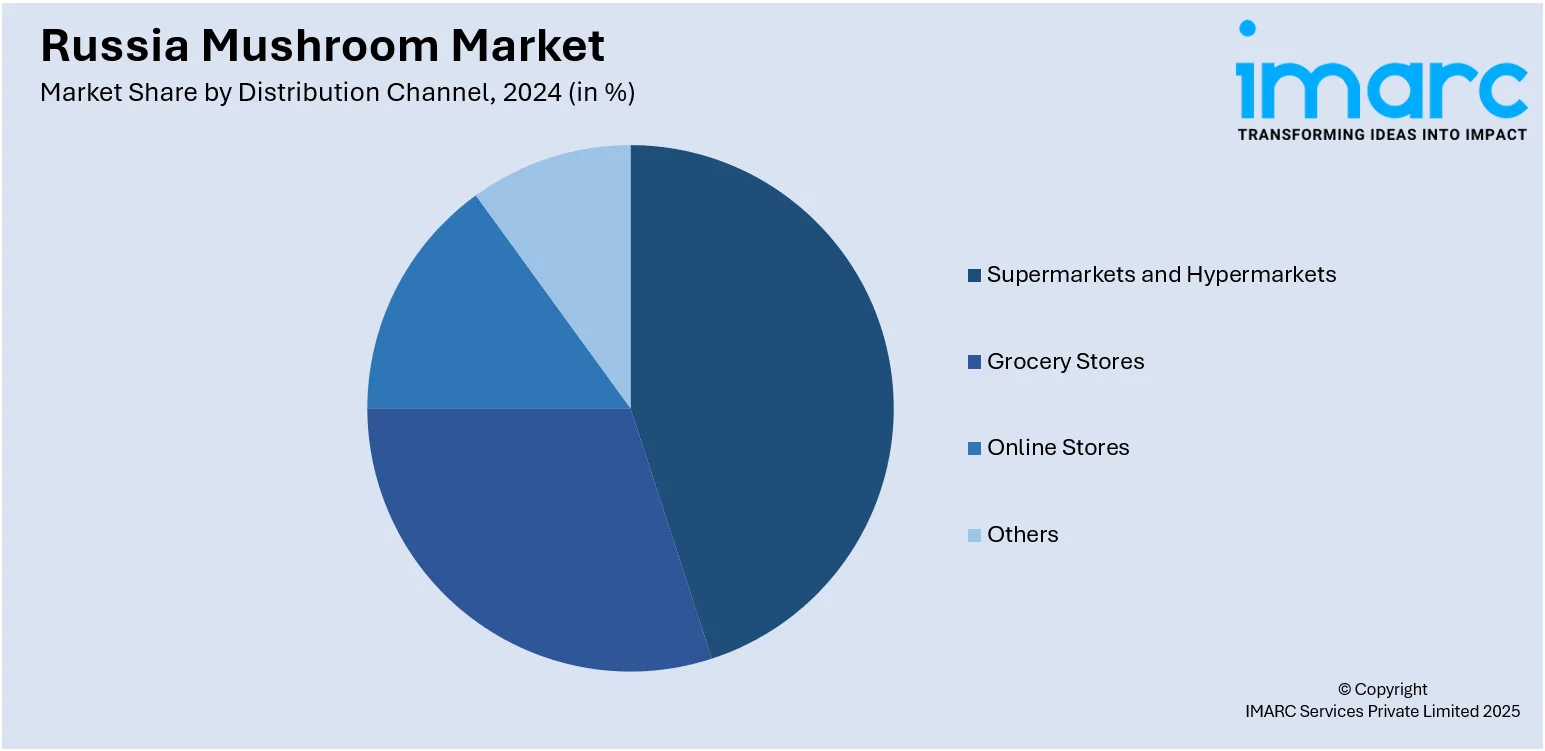

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, grocery stores, online stores, and others.

End Use Insights:

- Food Processing Industry

- Food Service Sector

- Direct Consumption

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes food processing industry, food service sector, direct consumption, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Mushroom Market News:

- In May 2025, Russian Mushroom Days 2025 will take place on May 13–14 at the Radisson Blu Olympiyskiy Hotel in Moscow, bringing together professionals from all areas of the mushroom industry. The event includes an exhibition, conference, sectional sessions, and culinary master classes.

Russia Mushroom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mushroom Types Covered | Button Mushroom, Shiitake Mushroom, Oyster Mushroom, Others |

| Forms Covered | Fresh Mushroom, Canned Mushroom, Dried Mushroom, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online Stores, Others |

| End Uses Covered | Food Processing Industry, Food Service Sector, Direct Consumption, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia mushroom market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia mushroom market on the basis of mushroom type?

- What is the breakup of the Russia mushroom market on the basis of form?

- What is the breakup of the Russia mushroom market on the basis of distribution channel?

- What is the breakup of the Russia mushroom market on the basis of end use?

- What is the breakup of the Russia mushroom market on the basis of region?

- What are the various stages in the value chain of the Russia mushroom market?

- What are the key driving factors and challenges in the Russia mushroom market?

- What is the structure of the Russia mushroom market and who are the key players?

- What is the degree of competition in the Russia mushroom market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia mushroom market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia mushroom market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia mushroom industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)