Russia Palm Oil Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

Russia Palm Oil Market Overview:

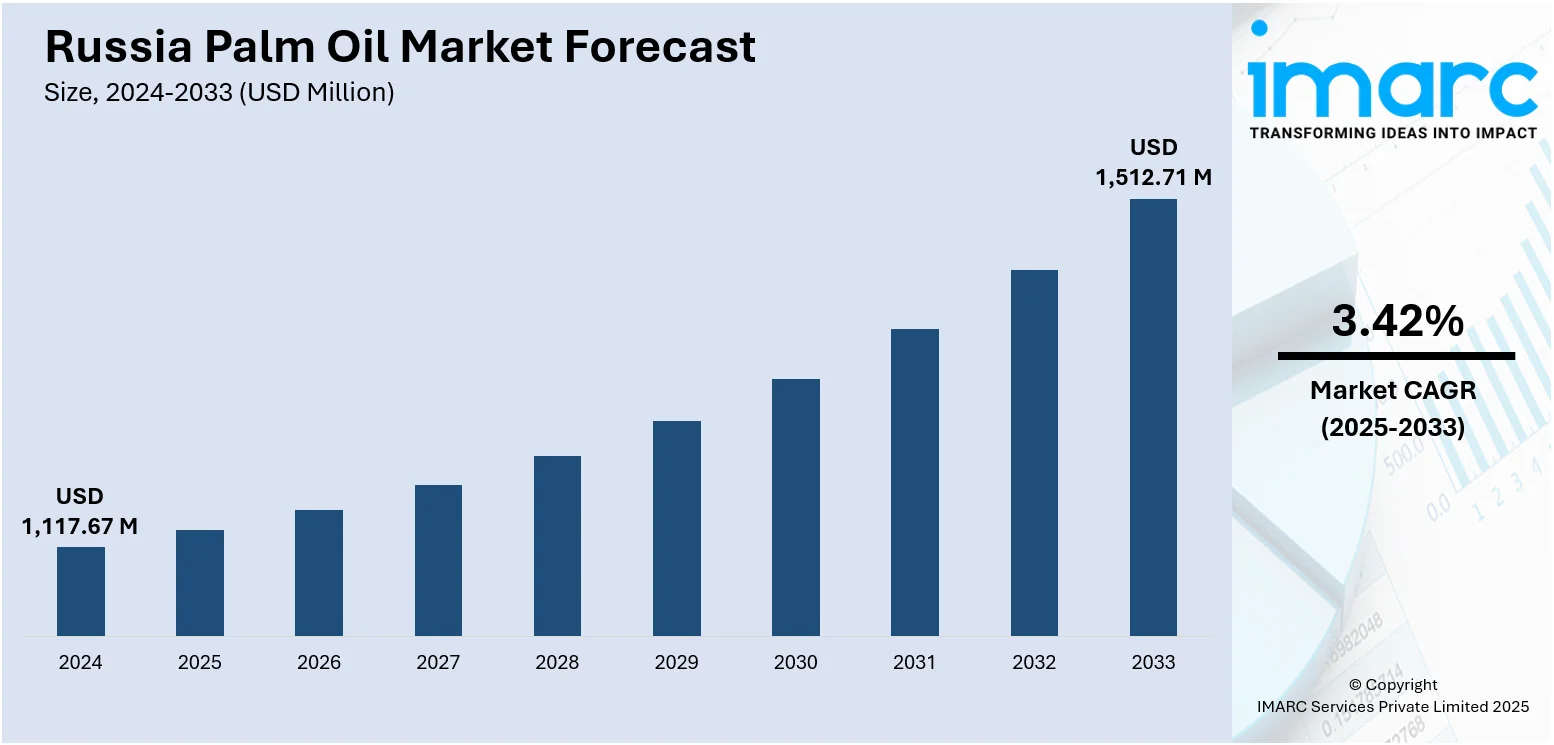

The Russia palm oil market size reached USD 1,117.67 Million in 2024. Looking forward, the market is expected to reach USD 1,512.71 Million by 2033, exhibiting a growth rate (CAGR) of 3.42% during 2025-2033. The market is driven by strong demand from the food processing, confectionery, and industrial sectors, with imports, primarily from Indonesia, playing a key role. As sustainability gains importance, RSPO-certified products are seeing wider acceptance. Ongoing diversification efforts aim to enhance domestic supply and processing capabilities, supporting overall growth in the Russia palm oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,117.67 Million |

| Market Forecast in 2033 | USD 1,512.71 Million |

| Market Growth Rate 2025-2033 | 3.42% |

Russia Palm Oil Market Trends:

Economic Affordability and Versatility in Food Manufacturing

Palm oil’s cost-effectiveness compared to other vegetable oils makes it a preferred ingredient for Russia’s food processing industry. Its stable shelf life, heat stability, and bland flavor are well-suited for application in baked foods, snack foods, margarine, and instant foods. This adaptability accommodates mass production and lowers manufacturers' operational expenses during escalating food inflation. Considering the economic strains and price sensitivity within the Russian consumer market, food manufacturers rely more and more on palm oil to ensure affordability without any trade-off in terms of quality. Its reliability and simple availability facilitate mass-scale adoption by regional and national food companies across Russia, maintaining demand even during times of global supply instability. The cost factor further ensures that palm oil remains a staple ingredient for Russia's growing packaged foods market.

To get more information on this market, Request Sample

Growth in Animal Feed and Non-Food Applications

Beyond food use, palm oil is gaining traction in Russia’s animal feed and industrial sectors. In livestock nutrition, palm-derived fats serve as a high-energy feed additive, particularly in dairy and poultry farming. This application helps improve animal growth and milk yields while lowering feed formulation costs, which is expected to fuel the Russia palm oil market growth. Simultaneously, palm oil is used in manufacturing lubricants, soaps, detergents, and cosmetics, owing to its high oxidative stability and emulsifying properties. As industrial diversification progresses, demand for multi-purpose oils like palm oil is expected to rise. The local market’s ability to repurpose palm oil across sectors enhances import justification and inventory efficiency. This growing non-edible usage segment broadens market penetration and supports steady import levels, especially as domestic oil alternatives remain limited.

Supportive Trade Partnerships and Import Logistics

Russia’s palm oil market benefits from stable trade relations with major producers like Indonesia and Malaysia, ensuring consistent supply flows. Bilateral agreements, logistical infrastructure improvements, and the use of Black Sea ports streamline palm oil imports into major Russian cities and processing hubs. The relatively smooth customs procedures and minimal trade barriers for palm oil further simplify procurement. Additionally, Russia’s pivot toward Asia-Pacific trade partners amid Western sanctions has enhanced focus on securing long-term palm oil supply chains. These partnerships not only guarantee availability but also foster investment in storage, refining, and downstream processing. This logistical and trade stability reduces supply disruptions and positions palm oil as a dependable raw material for Russia’s growing agribusiness and food sectors.

Russia Palm Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application.

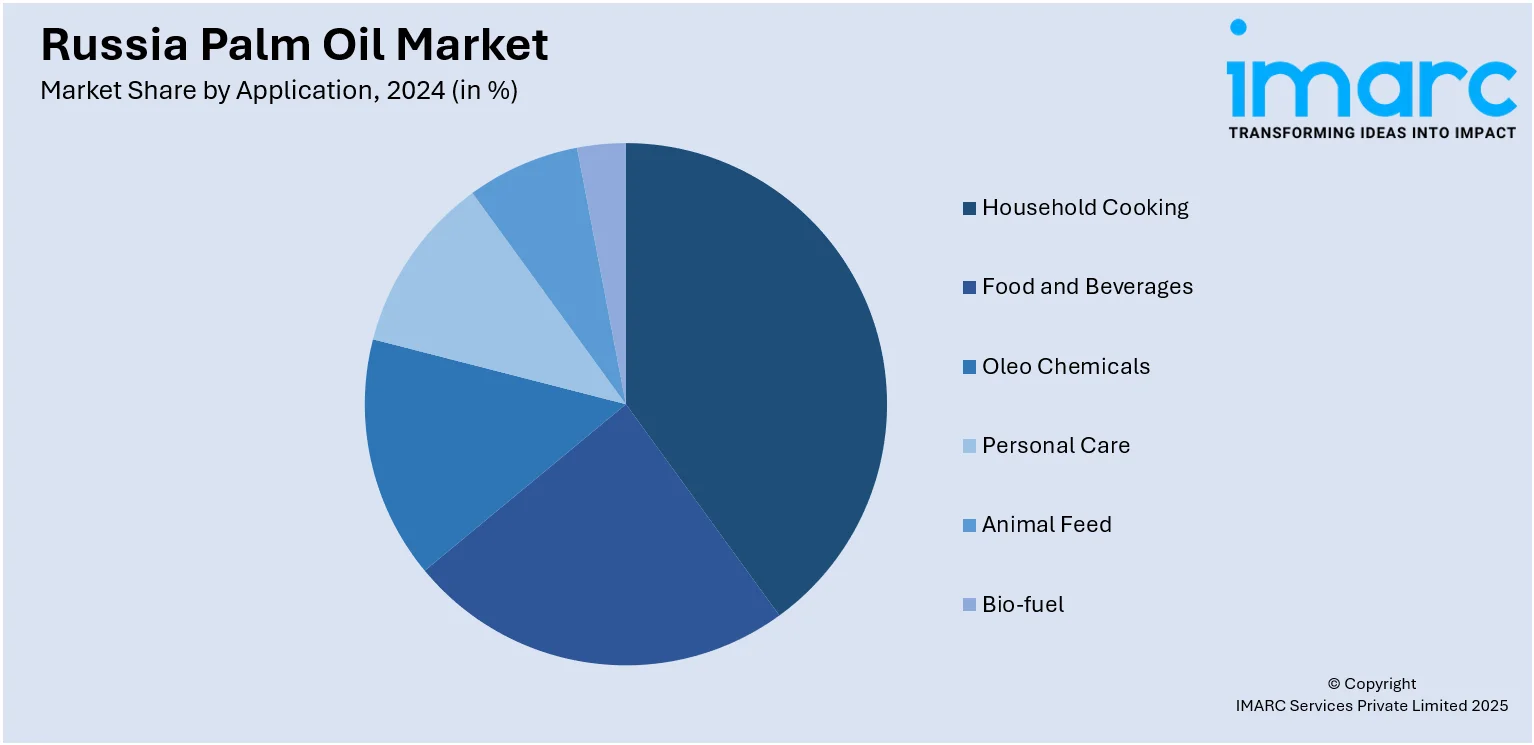

Application Insights:

- Household Cooking

- Food and Beverages

- Oleo Chemicals

- Personal Care

- Animal Feed

- Bio-fuel

The report has provided a detailed breakup and analysis of the market based on the application. This includes household cooking, food and beverages, oleo chemicals, personal care, animal feed, and bio-fuel.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Palm Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Household Cooking, Food and Beverages, Oleo Chemicals, Personal Care, Animal Feed, Bio-fuel |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia palm oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia palm oil market on the basis of application?

- What is the breakup of the Russia palm oil market on the basis of region?

- What are the various stages in the value chain of the Russia palm oil market?

- What are the key driving factors and challenges in the Russia palm oil market?

- What is the structure of the Russia palm oil market and who are the key players?

- What is the degree of competition in the Russia palm oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia palm oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia palm oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia palm oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)