Russia Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2025-2033

Russia Paper Packaging Market Overview:

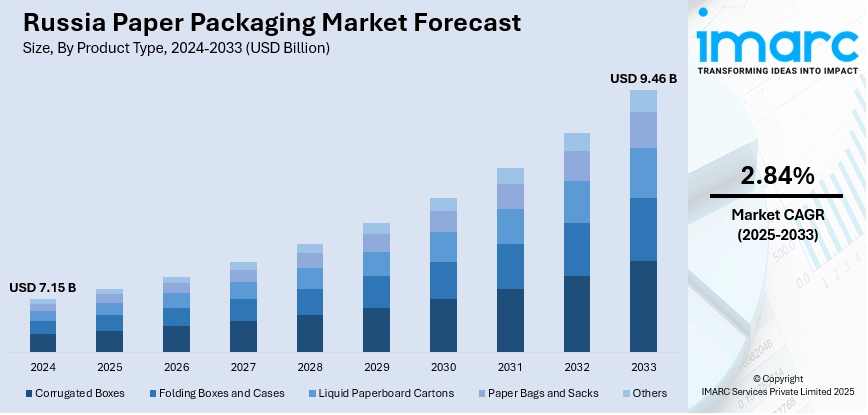

The Russia paper packaging market size reached USD 7.15 Billion in 2024. The market is projected to reach USD 9.46 Billion by 2033, exhibiting a growth rate (CAGR) of 2.84% during 2025-2033. The market is driven by the rapid growth of e‑commerce and food‑processing industries, which require durable, lightweight, and customizable packaging for shipping, branding, and hygiene, government‑backed import‑substitution policies that encourage investments in local mills and converting facilities, enhancing self‑sufficiency and reducing reliance on imports, and a strong regulatory and consumer push toward sustainability, with bans on single‑use plastics and rising demand for recyclable and biodegradable materials is aiding the Russia paper packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.15 Billion |

| Market Forecast in 2033 | USD 9.46 Billion |

| Market Growth Rate 2025-2033 | 2.84% |

Russia Paper Packaging Market Trends:

Growing E‑commerce and Food‑Processing Needs

The rapid expansion of e‑commerce in Russia has significantly increased the demand for corrugated boxes and versatile secondary packaging. Online retailing requires durable, lightweight, and customizable solutions to ensure products reach consumers safely, which makes paper-based packaging a natural fit. At the same time, the food‑processing industry is expanding and modernizing, creating a need for folding cartons and specialized food‑grade packaging. Paper packaging suits these requirements because it is adaptable for branding, provides sufficient protection, and aligns with hygiene and traceability needs. As a result, packaging manufacturers are increasingly developing more efficient, innovative paper‑based solutions for both logistics and retail environments. The growing variety of goods being shipped and sold drives the need for reliable and cost‑effective packaging, ensuring paper remains a key material in meeting evolving consumer and business demands.

To get more information on this market, Request Sample

Import‑Substitution Policies and Domestic Investments

Government policies promoting import substitution are a significant Russia paper packaging market trend. Authorities are encouraging domestic production of packaging materials, leading to significant investments in local paper mills and converting facilities. This shift reduces reliance on foreign suppliers and supports the development of higher‑quality, locally produced paperboard and corrugated materials. Domestic producers are upgrading their operations to meet the rising expectations of industries such as food, retail, and e‑commerce, while also responding to stricter procurement guidelines that favor locally sourced materials. These policies create a supportive environment for businesses to expand capacity and improve product quality. As a result, the market is becoming more self‑sufficient, resilient, and competitive. The combination of regulatory backing and private investment ensures that domestic producers can meet growing demand with innovative and reliable paper‑packaging solutions.

Sustainability Shift and Regulatory Pressure

Environmental regulations and growing awareness about sustainability are driving a shift from plastic to paper‑based packaging in Russia. Policies targeting single‑use plastics and promoting recyclable alternatives are encouraging businesses to adopt fiber‑based materials. Paper packaging is seen as an eco‑friendly solution that meets these regulatory requirements while also appealing to environmentally conscious consumers. Retailers, food brands, and e‑commerce companies are increasingly opting for recyclable, biodegradable, or compostable paper options to enhance their sustainability image. This shift is supported by the versatility of paper, which allows for creative branding, functional designs, and compliance with evolving environmental standards. Paper packaging is becoming the go-to option for businesses looking to strike a balance between cost-effectiveness, functionality, and environmental responsibility as government and consumer expectations continue to change thus supporting the Russia paper packaging market growth.

Russia Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, packaging level, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes solid bleached, coated recycled, uncoated recycled, and others.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

A detailed breakup and analysis of the market based on the packaging level have also been provided in the report. This includes primary packaging, secondary packaging, and tertiary packaging.

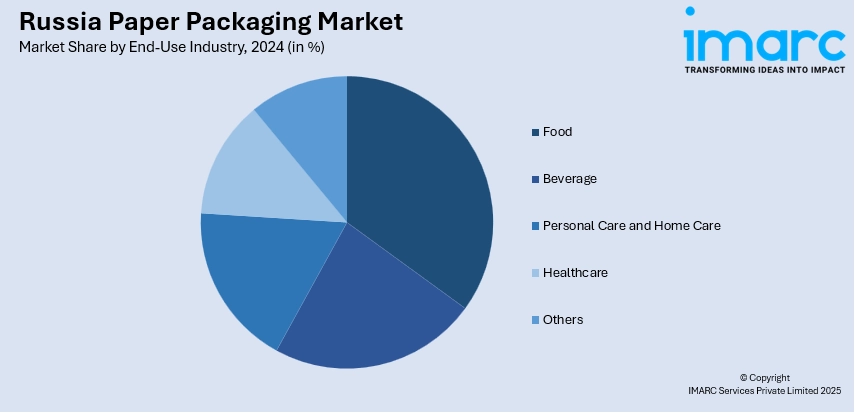

End-Use Industry Insights:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes food, beverage, personal care and home care, healthcare, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Paper Packaging Market News:

- In July 2025, United Paper Mills announced a strategic shift from containerboard production to comprehensive paper and paperboard packaging solutions at RosUpack‑2025. CEO Dmitry Dulkin highlighted the company’s expanded portfolio, now including corrugated packaging, gift and recycled paper bags, V‑bottom bags, moisture‑resistant paper, vegetable parchment, and multilayer cardboard. Emphasizing sustainability, OBF integrates waste‑paper collection and eco‑friendly materials, aiming to deliver innovative, branded, and cost‑efficient packaging for food, medical, and retail industries.

- In January 2025, Sveza Group, Russia’s largest aspen fiber paper and global birch plywood producer, has acquired MMPOF, the country’s largest printed boxes and specialized paper producer. The deal includes three sites: MMPOF Packaging and MMPOF Rotogravure in Leningrad Region, and Nevskiye Grani in Pskov. CEO Anatoly Frishman said the acquisition, approved by Russia’s Anti‑Monopoly Service, strengthens Sveza’s packaging portfolio and enhances synergies with its previously acquired Kama assets.

Russia Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia paper packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia paper packaging market on the basis of product type?

- What is the breakup of the Russia paper packaging market on the basis of grade?

- What is the breakup of the Russia paper packaging market on the basis of packaging level?

- What is the breakup of the Russia paper packaging market on the basis of end-use industry?

- What is the breakup of the Russia paper packaging market on the basis of region?

- What are the various stages in the value chain of the Russia paper packaging market?

- What are the key driving factors and challenges in the Russia paper packaging market?

- What is the structure of the Russia paper packaging market and who are the key players?

- What is the degree of competition in the Russia paper packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia paper packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)