Russia Perfume Market Size, Share, Trends and Forecast by Perfume Type, Category, Distribution Channel, and Region, 2025-2033

Russia Perfume Market Size and Share:

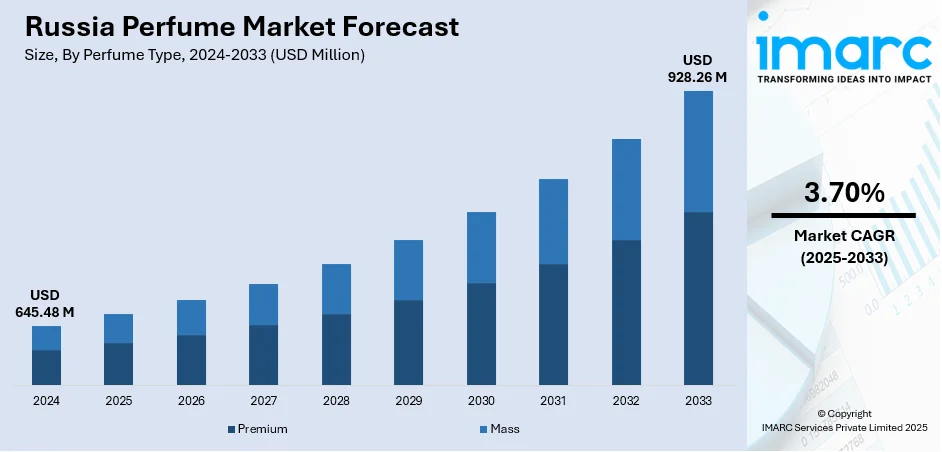

The Russia perfume market size was valued at USD 645.48 Million in 2024. Looking forward, the market is expected to reach USD 928.26 Million by 2033, exhibiting a CAGR of 3.70% during 2025-2033. The market is fueled by growing consumer expenditure on personal care, rapid urbanization, and rising demand for luxury and premium perfumes. Western fashion culture, rising social media penetration, especially among the young population, and expanding e-commerce industry are also escalating product demand to reach more customers nationwide. Growth of local fragrance companies and increased demand for niche and artisan fragrances enhance market growth. Seasonal gift-giving and cultural love for scents further spur sales and highly influence the Russia perfume market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 645.48 Million |

| Market Forecast in 2033 | USD 928.26 Million |

| Market Growth Rate (2025-2033) | 3.70% |

A deep cultural preference for perfumes is a key factor driving the Russia perfume market. While in some countries perfume is kept for special occasions, in Russia perfume wearing is viewed as an everyday grooming ritual for many, regardless of age or social class. This deeply ingrained preference makes perfumes a staple of personal care routines and not an indulgence. The market in Russia is typified by increasing consumer sophistication on the part of many of them, who look for unique, high-end fragrances that denote personal taste and style. This has induced both international and local brands to diversify their products with a broader choice of types of perfume, such as extrait de parfum and niche scents. Moreover, vintage Russian etiquette of giving gifts, particularly during celebrations such as New Year's and International Women's Day, has fostered steady demand for perfumes, since they are nice and appreciated gifts.

To get more information on this market, Request Sample

Urbanization and the shift in the retail environment are main drivers of the Russia perfume market demand and development. Large cities such as Moscow and St. Petersburg are trendsetters where global perfume companies and prestigious brands launch new collections initially, which are later gradually taken up by smaller regional markets. Upscale department stores, shopping malls, and specialty perfume shops have become widespread, particularly in cities, enabling consumers to shop and try an extensive variety of scents. Additionally, the accelerated development of online shopping, fueled by technology-advanced Russian buyers and improvements in logistics, has made luxury and niche perfumes widely available throughout the country. Russian online marketplaces and e-commerce websites usually include virtual fragrance consultations and customized advice, assisting in the selection of perfumes when they cannot be physically tested. With the increased accessibility and the emerging middle class that is willing to pay for high-quality items, retail growth and digitization serve as an aggressive driver of Russia's perfume industry.

Russia Perfume Market Trends:

Growing Consumer demand for Premium and Niche Fragrances

With the rising demand for unique and high-quality products, the Russian perfume market is experiencing a strategic shift toward premium and niche fragrances. The demand for these products can be attributed to the increasing disposable income levels, specifically among the urban residents, which is increasing their urge of investing in luxury items, such as perfumes. The WORLD BANK reports that the country's level of disposable income increased by 0.8% in 2019 compared to 2018. Furthermore, the US Energy Information Administration (EIA) reports that in 2022, Russia's per capita disposable income was USD 15,436. By 2050, it is predicted to have grown by 1.4% to USD 22,753. High-end and specialty scents are renowned for their uniqueness, artistry, and excellence. They serve as a status symbol and a means of self-expression. This desire is particularly evident among the younger, wealthier demographic, who are eager to stand out from the crowd with distinctive fragrances. In addition, the market is seeing an increase in the quantity of boutique perfume companies and the accessibility of global luxury brands in the area, further propelling the Russia perfume market growth.

Influence of Social Media and Celebrity Endorsement

In the Russian perfume sector, social media and celebrity endorsements are crucial in influencing customer tastes and boosting sales. The way people find and buy perfumes has changed due to the widespread influence of apps like Instagram and TikTok. By January 2023, 106.0 million Russians, or 73.3% of the population, were active on various social media platforms, according to DATA REPORTAL. Russian customers, especially the younger generation, are greatly impacted by celebrity endorsements, influencer suggestions, and internet reviews. By giving brands direct access to their target markets, these platforms help them foster brand loyalty and generate excitement about new products. Celebrity-endorsed fragrances have been quite successful because Russian customers are attracted to the glitz and glamour of their favorite celebrities. As companies use social media more and more to engage with customers, this trend is anticipated to continue to transform the Russia perfume market outlook.

Expansion of Online Retail Channels

The expansion of online retail channels has been a key driver of the Russia perfume market. For instance, as per the UNITED NATIONS INDUSTRIAL DEVELOPMENT ORGANIZATION (UNIDO), the projected volume of the Russian e-commerce market is estimated at between US$ 21 and 24.5 Billion, in the year 2017. The shift toward e-commerce has opened up new avenues for both domestic and international perfume brands to reach a wider audience. Online platforms offer convenience, a broader selection of products, and competitive pricing, which appeal to tech-savvy Russian consumers. The rise of e-commerce has also been supported by improvements in logistics and delivery services, making it easier for consumers across Russia, including those in remote areas, to access their preferred perfumes. Online shopping being one of the most prominent Russia perfume market trends, is likely to persist, driven by ongoing digital transformation and changing consumer habits, further propelling growth. For example, a 2024 report by the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) states that 60% of Russians are receiving various services online, indicating that the country is undergoing a strong digital transformation.

Russia Perfume Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia perfume market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on perfume type, category, and distribution channel.

Analysis by Perfume Type:

- Premium

- Mass

Mass stands as the largest component in 2024. According to the Russia perfume market analysis, the mass segment controls the market to a large extent, due to its affordability, broad availability, and popularity in a wide consumer base. The perfumes of this segment are affordably priced and thus more likely to be used on a daily basis as opposed to special occasions. Russian consumers tend to prefer value-for-money items with nice, familiar fragrances without an expensive price to pay, and mass-market brands fulfill this requirement perfectly. Most local producers have won trust over several decades by providing products that combine cultural tradition with contemporary packaging and enhanced formulates. The perfumes are typically available in supermarkets, drugstores, and local cosmetics chains, making them readily accessible to both urban and regional markets. The fact that smaller bottle sizes, which are 30 ml and 50 ml, are popular further contributes to the convenience and affordability of mass products. In addition, local production stabilizes prices and provides consistent supply despite global trade fluctuations, supporting the mass segment's dominant position in Russia's perfume market.

Analysis by Category:

- Female Fragrances

- Male Fragrances

- Unisex Fragrances

Female fragrances lead the market share in 2024. The Russian perfume market segment is dominated overwhelmingly by female fragrances based on cultural inclination, everyday beauty routines, and changing lifestyle roles of women. Perfume is perceived as a luxury and as a social and personal need, with women frequently wearing perfume every day and reapplying it during the day. Urban cities like St. Petersburg and Moscow have especially high demand for women's perfumes, where image and presentation are high cultural importance. Contemporary Russian women are opting for fragrances that combine classic femininity with strong, empowering accents such as wood and spices, echoing their active roles in society. Floral and fruit floras continue to be in demand due to their timelessness. Packaging is also important, with simple, sophisticated bottle designs resonating with career women who desire understated elegance. This combination of function, cultural relevance, and emotional appeal serves to keep female scents the market leader in the Russian perfume market.

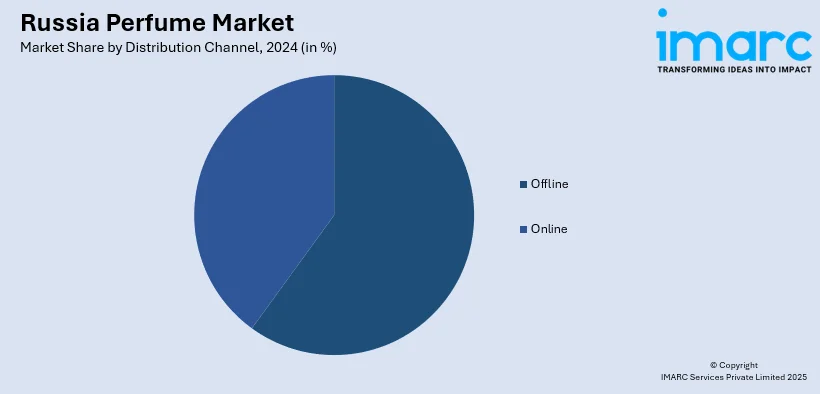

Analysis by Distribution Channel:

- Offline

- Online

Offline leads the market with 87.6% of market share in 2024. Offline channels are the dominant distribution segment in the Russia perfume market as a result of numerous one-of-a-kind factors. Bricks-and-mortar stores like specialty perfumeries, department stores, and cosmetics chains give consumers the ability to smell fragrances for themselves, which is important in a market where scent choice is extremely personal. In-store testers and professional advice are frequently offered by retailers, enabling shoppers to make informed decisions. Shopping malls and high-street stores continue to be social hubs that consumers like to visit to view a broad choice of brands and products. Despite the growth of e-commerce, many Russian consumers still prefer offline shopping for perfumes because it allows them to assess scent longevity and intensity before purchase. The presence of well-established retail chains across urban and regional areas ensures accessibility and convenience. Offline distribution also supports gift-giving traditions, with beautifully packaged perfumes readily available for special occasions, further cementing its dominance in the Russian market.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District is the biggest and most powerful perfume market area in Russia, based on Moscow. It has the highest density of luxury and premium perfume stores, catering to high-income consumers that fuel international and niche brand demand. The district is a trendsetter for the entire country.

The Volga Region boasts a diversified consumer market with increasing interest in both mass and premium fragrances. Urban metropolitan areas such as Nizhny Novgorod and Kazan are developing retail infrastructures, merging traditional fragrance profiles with rising exposure to international trends. Domestic brands also enjoy robust presence together alongside international counterparts.

Industrial cities with growing middle-class populations in the Urals District fuel consistent perfume usage. Demand is balanced between value for money and quality, with mid-range and mass-market fragrances being favored. Retailing expansion, both in-store and online, is increasingly extending market coverage throughout the region.

Northwestern District, which encompasses St. Petersburg, has a reputation for high-end consumers who appreciate the best and niche perfumes. A high level of cultural penetration and tourism ensures active perfume business, facilitated by solid retail chain development and increasing numbers of boutique perfume stores.

The Siberian Region is confronted with logistics issues but indicates increasing demand for hardy, multi-use perfumes that adapt to extreme climates. Local consumers prefer affordability and practicality, with improved access to offline shops and online sites, opening up the market from leading cities.

Competitive Landscape:

Major players in the Russia perfume market are already embracing various strategies to consolidate their presence and build growth in this competitive scenario. Numerous international and local brands are investing on localized product development, adapting fragrances to cater to Russian consumers' distinctive tastes, which typically incorporate traditional floral and woody notes with contemporary, innovative fragrance profiles. Top players are aiming to grow their retail presence by making tie-ups with leading departmental stores, specialist perfumeries, and well-known cosmetic chain stores, having a widespread presence in metropolitan cities and mass markets alike. Brands are also improving the store experience through professional counseling, personalized product suggestions, and special launches to capture and retain customers. E-commerce too has emerged as a critical priority; major players are refining their web platforms and partnering with popular marketplaces to benefit from the expanding digitally educated consumer base, providing easy access and virtual trial options. Marketing campaigns highlight cultural relevance, integrating Russian holidays and gift-giving practices into campaigns in order to create stronger emotional links with purchasers. Sustainability and clean beauty trends are shaping product formulation and packaging to match worldwide consumer values as well as to address local need. As per the Russia perfume market forecast, through innovation, targeted retail expansion, and consumer-driven strategies, major players are poised to drive the Russia perfume market forward.

The report provides a comprehensive analysis of the competitive landscape in the Russia perfume market with detailed profiles of all major companies, including:

Latest News and Developments:

- February 2025: Yekaterinburg-based perfume and cosmetics brand Golden Apple announced its official expansion into Saudi Arabia. The company aims to launch offline locations and online services over the upcoming months. With this expansion, Golden Apple will be the very first Russian beauty brand in Saudi Arabia.

- October 2024: The 31st International Perfumery and Cosmetics Exhibition, InterCHARM, was officially held at Crocus Expo in Moscow from October 9 to October 12, 2024. The exhibition welcomed over 70,500 international professionals from the perfume and cosmetics sector.

- October 2024: Arnest Group, a renowned Russian perfume and cosmetics manufacturer, officially completed the purchase of Unilever’s Russian subsidiary. This agreement comprises all of Unilever's operations in Russia, including the company’s four manufacturing facilities in the country.

Russia Perfume Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Perfume Types Covered | Premium, Mass |

| Categories Covered | Female Fragrances, Male Fragrances, Unisex Fragrances |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia perfume market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia perfume market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia perfume industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The perfume market in the Russia was valued at USD 645.48 Million in 2024.

The Russia perfume market is projected to exhibit a CAGR of 3.70% during 2025-2033, reaching a value of USD 928.26 Million by 2033.

The Russia perfume market is driven by cultural affinity for fragrances, growing consumer sophistication, and increased interest in niche and local brands. Urbanization, expanding retail access, and strong e-commerce platforms further boost market growth, making perfumes more accessible and desirable across diverse demographics and regions within the country.

Offline leads the Russia perfume market share in 2024, driven by the prevalence of specialized perfumery and cosmetics retail chains like L’Etoile and Gold Apple, offering curated selections, in-store testers, and loyalty programs. Department stores such as TsUM provide premium experiences and expert consultations. Physical accessibility in malls across cities also reinforces offline dominance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)