Russia Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2025-2033

Russia Real Estate Market Size and Share:

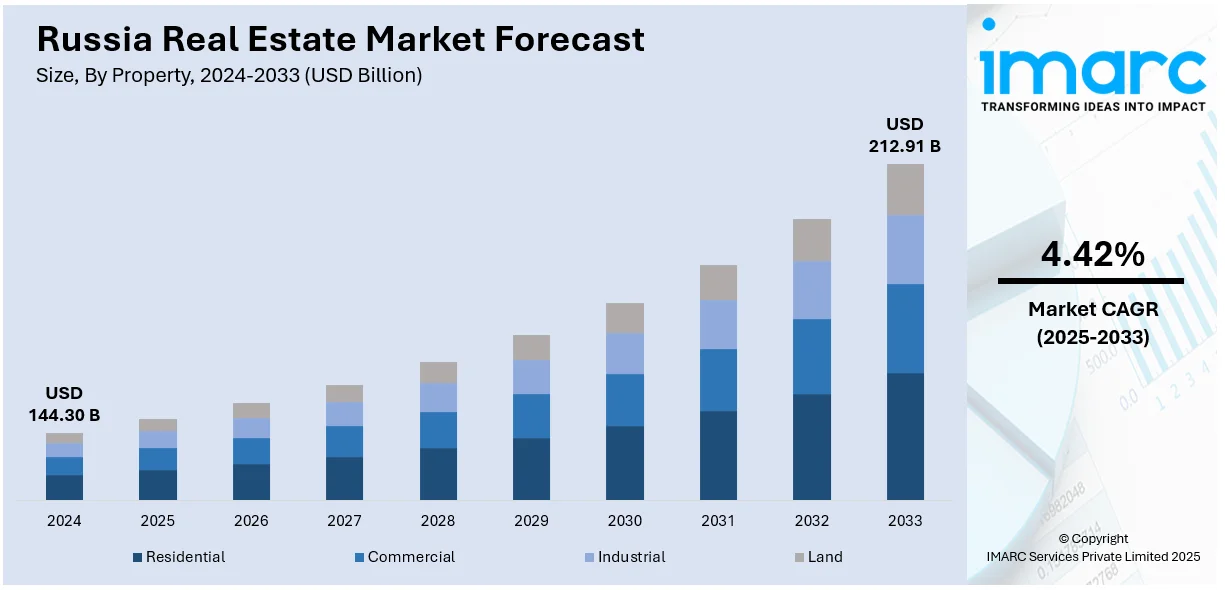

The Russia real estate market size was valued at USD 144.30 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 212.91 Billion by 2033, exhibiting a CAGR of 4.42% from 2025-2033. The market is experiencing consistent growth with the aid of economic stability, urbanization, infrastructure construction, and pro-government policies. Rising disposable incomes, domestic migration to cities, and growing demand for residential and commercial properties are also fueling market growth. Construction of public infrastructure and access to affordable finance options also improve the market appeal. Moreover, these factors are reinforcing investor confidence and sustaining growth throughout the industry in the Russia real estate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 144.30 Billion |

| Market Forecast in 2033 | USD 212.91 Billion |

| Market Growth Rate (2025-2033) | 4.42% |

Infrastructure development is a key driver of the Russia real estate market growth. Investments in transportation systems, such as metro lines, roads, and airports, have greatly enhanced intra-city connectivity and inter-city connectivity of urban areas and suburban or new regions. As per the reports, in October 2023, Moscow Exchange revealed plans to launch blockchain-based real estate investments by 2024, providing digital financial assets to democratize investment, lower entry barriers, and tie profits to housing price appreciation. Furthermore, the increased accessibility has increased the appeal of peripheral regions for housing and business development, fueling urban sprawl and easing pressure on city centers. The development of contemporary public facilities like hospitals, schools, and recreational centers further amplifies the livability index of these areas, promoting population migration and property investment. Further, growth in utility infrastructure, such as stable electricity, water supply, and internet access has provided conducive conditions for industrial and commercial growth. These infrastructure upgrades not only enhance property values but also lower operating costs and travel times, thus spurring demand across residential, commercial, and industrial sectors. The underpins long-term investor confidence in the Russian real estate market growth.

Population trends, such as changes in family configurations and population density, are important drivers of Russia's real estate market. According to the sources, in 2024, 19.4% of Russia's real estate market was sold through electronic platforms, a 5.7% increase from 2023, as digitalization enhances the speed, transparency, and security of transactions, though with possible risks of data. Moreover, with younger generations more inclined towards independent living, there is a greater need for smaller housing units like apartments and townhouses, particularly in urban settings. This is in line with the growing age of first-time homebuyers and a greater desire for proximity to employment centers and schools. At the same time, rural-to-urban migration continues to redefine housing requirements, especially in urban centers where jobs and better living standards are within reach. Additionally, population clusters are growing in satellite towns and new districts, fueled by lifestyle and affordability factors. Household composition changes, including growth in single-person households and dual-income households, also underpin demand for differentiated housing forms and amenities. These demographic trends underpin ongoing real estate innovation, with developers responding by adapting projects to changing lifestyle choices, thus driving long-term growth in residential and rental markets.

Russia Real Estate Market Trends:

Economic Growth and Stability

The economic stability of Russia is playing an important role in growing its real estate market. The GDP of the country, in 2023, was USD 2.02 trillion, up from 3.6%, signifying economic strength and recovery. The growth has been boosted through selective government initiatives aimed at ruble stabilization, taming inflation, and maintaining investor confidence. These economic enhancements are attracting foreign and local investments into housing, commercial, and industrial assets. Increased disposable income among Russian nationals has further spurred demand for living and shopping facilities. While so, growth in major industries like energy, tech, and manufacturing is also creating jobs, hastening migration towards urban areas. This trend is creating heightened demand for property, especially in the big cities such as Moscow and St. Petersburg. Favorable economic expectations are therefore upholding investor sentiment, sustaining long-term growth and development in Russia real estate market forecast.

Urbanization Trends

Urbanization at a fast rate is one of the main stimulants driving Russia's property sector, especially in the major metropolitan cities such as Moscow, St. Petersburg, and Novosibirsk. Now, 75.04% of Russia's population—more than 108 million people—live in urban regions, an indication of intense migration from the countryside to the cities. Such demographic movement is largely driven by greater access to work, schooling, and a quality of life in cities. The ensuing concentration of population has severely boosted demand for residential housing, further inflating housing deficits in major cities. Urban areas have also witnessed an upsurge in demand for commercial properties, such as office buildings, shopping centers, and logistics facilities, as economic activities become more centralized. Developers are reacting by launching large-scale residential and mixed-use developments. Urbanization is also encouraging governments and private players to invest in public infrastructure like transport, healthcare, and education services. These investments increase the quality of life and desirability of urban settings, further propelling growth within Russia real estate market outlook.

Government Initiatives

The government of Russia is key to the progress of the real estate market by way of supporting it with targeted policy. There has been a string of measures introduced to enable real estate investment to be made more accessible and desirable, particularly for first-time homebuyers and families. A prominent program is the subsidized mortgage program, providing mortgages at lower interest rates; through July 2024, families with young children can obtain mortgages at only 6% interest, an initiative extended through 2030. Such favorable financing has increased homeownership, thus enhancing residential demand. Aside from mortgage assistance, the government provides tax incentives and subsidies for property developers, promoting the building of new homes and commercial establishments. These initiatives are intended to alleviate housing shortages and address increasing demand in cities. Combined, these efforts have greatly stimulated real estate development, attracted investments into infrastructure, and lent support to the overall economic objective of housing affordability and accessibility.

Russia Real Estate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia real estate market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on property, business, and mode.

Analysis by Property:

- Residential

- Commercial

- Industrial

- Land

The Russian residential property market is experiencing growth from improving disposable incomes, urbanization, and government policies. New developments are being driven by demand for affordable housing, especially in big cities such as Moscow and St. Petersburg. Increased migration towards cities and rising purchasing power drive this trend.

Russian commercial real estate market is growing, with growth stimulated by demand for office space, retail premises, and industrial buildings. Economic growth and urbanization are major drivers. As the business environment expands, major cities' prime sites are being sought after more, increasing the growth of commercial property.

Russia's industrial real estate market is experiencing growth, particularly in logistics and manufacturing units. Growth in e-commerce and the development of infrastructure is boosting demand for industrial property. Ease of access to major transportation points and urban areas is driving warehouse, distribution, and production facility growth throughout the nation.

The Russian land market is enjoying growing demand for both agricultural and development purposes. With expanding urban zones and growth in infrastructure projects, the need for land perfect for residential and commercial developments is on the rise. Investors are more and more looking to purchase top-grade land as a future opportunity in urbanized areas.

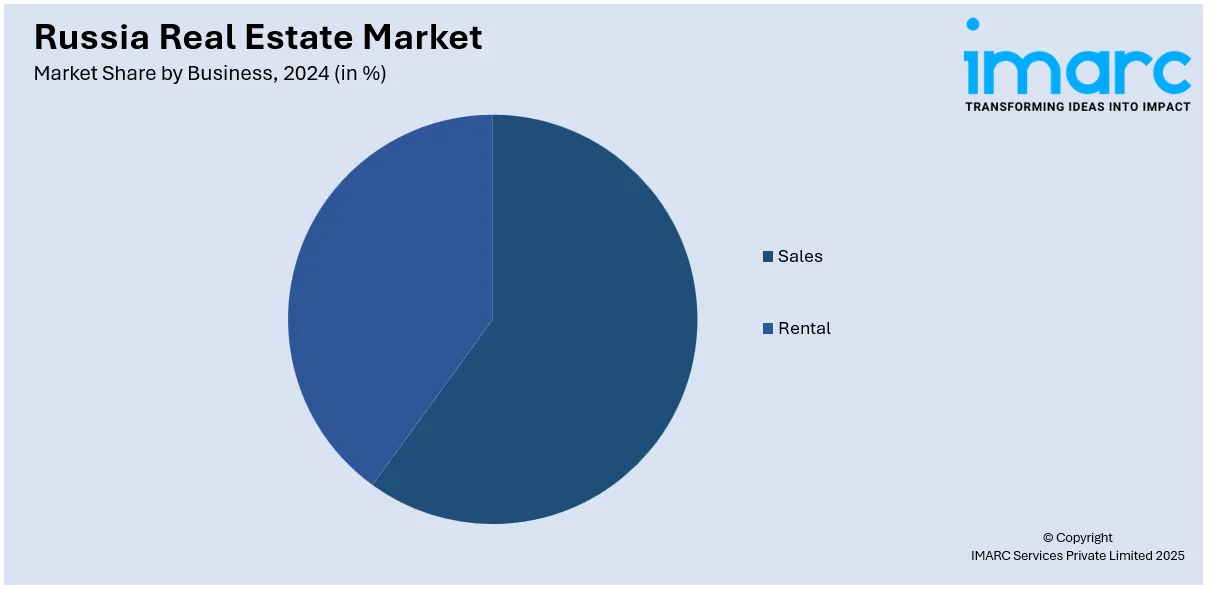

Analysis by Business:

- Sales

- Rental

In Russia real estate market report, sales sector is witnessing growth as residential and commercial property demand increases, fueled by economic recovery, urbanization, and government stimulus packages. Subsidized mortgage rates and affordable housing programs have also promoted property buying, which has made ownership and commercial property buying affordable for residents and investors.

The Russian rental market is booming due to growing demand for residential and commercial properties. As urban migration grows, most residents prefer renting, particularly in urban areas. In the same manner, companies are renting commercial buildings to accommodate expanding customer bases. Affordability of rentals in major cities facilitates ongoing demand for rental properties.

Analysis by Mode:

- Online

- Offline

Russia's real estate market online segment is growing quickly, fueled by digitalization and evolving consumer demand. Prospective buyers and renters are increasingly accessing property search, virtual tours, and transaction processing through online portals. This transformation provides convenience and wider access to listings, extending market reach to sellers.

Offline mode continues to be a major component of Russia's real estate market, with old-school practices like in-person viewings, agent-mediated negotiations, and direct deals still dominating most regions. Offline transactions promote personal relationships and trust, which are extremely important in the real estate business. Even with the growth of online platforms, most prefer direct contact for big investments.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District, which hosts Russia's capital, Moscow, has the most influence over the real estate market. Its intense demand for residential, commercial, and industrial properties fuels heavy market activity. It has strong infrastructure, access to business opportunities, and an increasing population, making it the main center of real estate investment in Russia.

Volga District has become a developing area for real estate, with urbanization in the cities of Nizhny Novgorod and Samara. There is growing demand for commercial and residential space due to the more diversified economy, investment in infrastructure, and growth in industrial sectors, rendering it an important player in Russia's real estate market.

The Urals Region experiences steady growth in industrial and residential real estate, predominantly fueled by the industrial base of the region and major cities such as Yekaterinburg. With continued growth in manufacturing and mining industries, the demand for housing as well as commercial properties in the urban areas increases, further driving the real estate market.

The Northwestern District, which is led by St. Petersburg as an economic and cultural hub, enjoys a well-developing real estate sector. Demand for commercial and residential property is still high, driven by the strong economy of the city, tourism, and trade and commerce-oriented strategic position, which brings both foreign and local investment.

Siberian District is experiencing consistent development, especially in urban areas such as Novosibirsk and Krasnoyarsk, as economic diversification and infrastructural enhancement bring new investment. Residential and commercial properties are experiencing a rush in demand due to migration into urban areas caused by prospects in technology, manufacturing, and energy industries.

Other parts of Russia, such as the Southern and Far Eastern Districts, are witnessing fluctuating real estate growth. The areas are holding promise in relation to affordable dwelling places, office space, and infrastructure projects, though their general market share continues to be less than that of more urban and economically developed districts.

Competitive Landscape:

The Russia real estate market's competitive environment is dominated by a combination of local and foreign players, with several real estate developers, investors, and construction firms driving the growth of the sector. These players are involved in residential, commercial, and industrial developments, driven by the growing demand fueled by urbanization and economic growth. The market is also highly fragmented, with developers concentrating in specific areas or segments of properties, ranging from affordable housing to high-end projects. Technology-led construction innovation and green building standards are increasingly acting as a competitive differentiator, with most participants adopting green certifications and energy-saving designs. Also, government initiatives like mortgage subsidy and tax exemptions make it attractive for both major and minor players to venture into the market. As competition becomes higher, property firms are banking on customer-focused strategies, providing convenient payment schemes and varied property offerings to meet the increasing needs for contemporary residential spaces and business facilities.

The report provides a comprehensive analysis of the competitive landscape in the Russia real estate market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: At the State Council meeting, the government announced major infrastructure initiatives, including new social housing, industrial facilities, and the Yunost sports complex in Dokuchayevsk. The government also pledged to expand the number of public spaces to boost urban living standards across Russia.

- April 2025: Russian real estate platform DomClick launched a new tool for prospective homebuyers to view anonymized information about apartment complex occupants before making a purchase. The goal of the upgrade is to assist second-hand homebuyers in making better judgments before purchase.

- January 2025: Yandex redesigned its landing page for the pre-sales of newly constructed properties. The page will now display offers from developers for recently announced projects. A "Sales Starting Soon" column was also added in the new section to show projects whose sales are about to begin soon. Customers can sign up for these properties to receive updates as soon as they go up for sale.

Russia Real Estate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia real estate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia real estate market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The real estate market in the Russia was valued at USD 144.30 Billion in 2024.

The Russia real estate market is projected to exhibit a CAGR of 4.42% during 2025-2033, reaching a value of USD 212.91 Billion by 2033.

Dominant drivers for the Russia property market are economic stability, urbanization, growing disposable incomes, government support in terms of subsidized mortgages and tax holidays, and expansion of infrastructure. Growth in industries, such as energy and technology is also enhancing job creation and immigration to cities, adding to demand for real estate.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)