Russia Renewable Energy Market Size, Share, Trends and Forecast by Type, End user, and Region, 2025-2033

Russia Renewable Energy Market Size and Share:

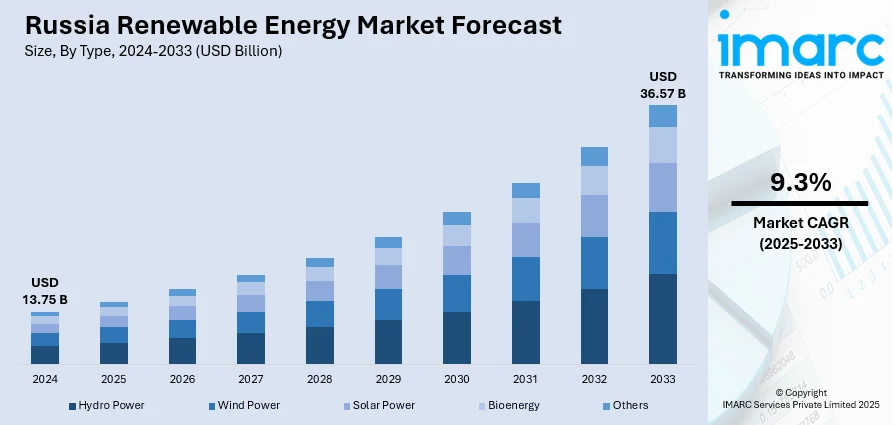

The Russia renewable energy market size was valued at USD 13.75 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 36.57 Billion by 2033, exhibiting a CAGR of 9.3% from 2025-2033. The market is experiencing strong growth driven by ongoing advancements in wind turbine and solar panel technologies are making renewable energy generation more efficient and cost-effective. Additionally, the large-scale renewable energy projects, such as wind, solar, and hydropower, are also supported by the availability of vast geographical expanses and river systems. Additionally, the efficiency, dependability, and integration of energy distribution are being improved by the growing use of smart grid technology, which is aiding the Russia renewable energy market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.75 Billion |

| Market Forecast in 2033 | USD 36.57 Billion |

| Market Growth Rate (2025-2033) | 9.3% |

Government policies and regulatory support are among the strongest drivers of Russia’s renewable energy market, fostering steady capacity growth. As of July 1, 2024, the country’s total renewable energy installed capacity reached approximately 6.18 GW, highlighting the impact of policy-backed initiatives. Competitive auctions for renewable projects have encouraged private investments and created a structured pathway for expanding wind and solar capacity. The government has also introduced measures to promote low‑carbon electricity and enhance sector transparency, attracting both domestic and international investors. Additionally, large state-backed entities are actively involved, providing financing and technological expertise. This robust policy framework is creating a favorable environment for the expansion of wind, solar, and other renewable energy sources.

To get more information on this market, Request Sample

Russia’s extensive geography provides abundant renewable energy resources, including hydropower, wind, solar, biomass, and geothermal potential. Many of these resources remain largely untapped, offering opportunities for significant growth in clean energy generation. Regions such as the southern steppes, coastal areas, and the North Caucasus are particularly suitable for large-scale wind and solar projects. In response to growing demand and international challenges, Russia is also focusing on building its domestic industrial capacity to support renewable energy development. This includes efforts to localize the production of essential equipment and reduce reliance on foreign suppliers. The combination of vast natural resources and expanding domestic capabilities is positioning Russia renewable energy market demand.

Russia Renewable Energy Market Trends:

Abundant Renewable Resources

The extensive land area of Russia offers numerous high-potential locations for solar and wind energy. Additionally, the extensive river system provides notable opportunities for hydropower development. There are 120,000 rivers over 10 km long. Their total length within the Russian Federation equals 2.3 million km. The availability of agricultural and forestry residues presents the potential for biomass energy. Russia is home to more than one-fifth of the world's forest areas. Around 33.5% of the total forested area is composed of primary forests. By harnessing these resources, Russia is expanding its energy mix and lessening its dependence on fossil fuels. These geographic and climatic advantages create a strong foundation for the development of the renewable energy sector, making it an attractive investment opportunity for both domestic and international stakeholders. This potential for renewable energy development aligns with efforts to move towards cleaner energy sources. This shift towards cleaner energy sources enhances the Russia renewable energy market share, attracting both domestic and international investment.

Modernization of Energy Infrastructure

Investments from both the government and private sectors are focusing on upgrading and expanding the national grid to integrate renewable energy sources better is another Russia renewable energy market trends. This modernization involves the advancement of smart grid technologies, enhancing the efficacy and dependability of energy distribution. Enhanced transmission infrastructure is crucial for ensuring a stable supply and minimizing energy losses. Furthermore, these funds aid in the implementation of decentralized energy systems including microgrids and distributed generation, which are vital for maximizing the effective use of renewable energy. By updating its infrastructure, the country is able to decrease reliance on fossil fuels, reach a more environment-friendly energy future, and maximize its abundant renewable resources. For instance, according to reports, as of January 1, 2024, Russia confirmed oil reserves of 80 billion barrels and the largest natural gas reserves, amounting to 1,688 trillion cubic feet (Tcf).

Technological Advancements and Innovation

The development of more efficient and cost-effective renewable energy technologies like advanced wind turbines and solar panels is making it feasible to harness renewable energy resources even in the challenging climatic conditions of the country. Moreover, advancements in energy storage and grid integration are improving the dependability and resilience of renewable energy systems. Furthermore, rising research and development (R&D) efforts, backed by partnerships between the government and private sector, are resulting in advancements in renewable energy technologies. These developments are reducing the price of producing renewable energy, increasing its competitiveness with fossil fuels. In 2024, Eco News announced that Russia created an innovative solar panel technology with 80% efficiency, signaling the obsolescence of traditional silicon-based panels. The new perovskite-silicon solar thermal modules, produced in collaboration with Sunmaxx PVT and Oxford PV, combined electrical and thermal efficiencies to achieve this record performance.

Russia Renewable Energy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia renewable energy market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on type and end user.

Analysis by Type:

- Hydro Power

- Wind Power

- Solar Power

- Bioenergy

- Others

Based on the Russia renewable energy market forecast, the hydro power account for the majority of shares of 89.6% driven by the country’s abundant river systems and favorable geography, which provide immense potential for large-scale hydroelectric projects. This dominance is driven by the established infrastructure of numerous dams and hydro stations that have been developed over decades, making hydropower a reliable and cost-effective energy source. Its ability to provide base-load power while supporting grid stability further enhances its importance in the energy mix. Additionally, hydropower projects benefit from relatively low operating costs and long lifespans, ensuring consistent returns on investment. These factors collectively position hydropower as the cornerstone of Russia’s renewable energy sector, maintaining its leading share in the market.

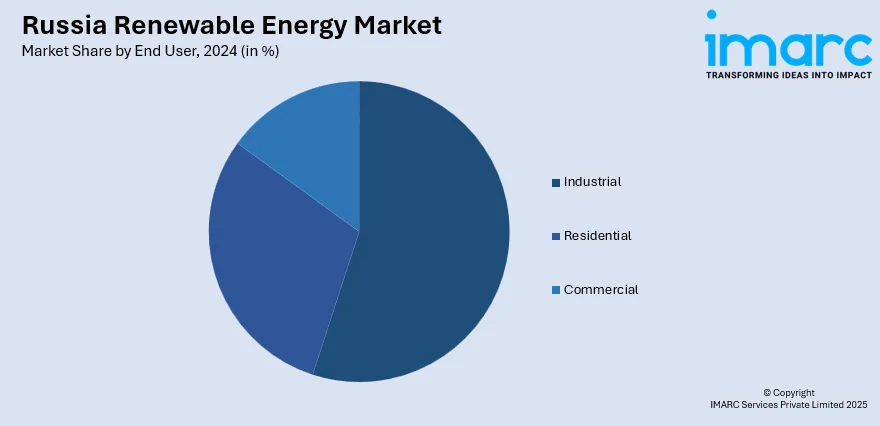

Analysis by End User:

- Industrial

- Residential

- Commercial

Utility-scale projects dominate Russia’s renewable energy market analysis due to their ability to generate large amounts of electricity efficiently and meet the growing demand for stable, grid-connected power. These projects benefit from economies of scale, reducing the cost per unit of energy produced and making them more financially viable compared to smaller installations. Government support through competitive auctions and favorable policies has further encouraged the development of large-scale wind, solar, and hydro facilities. Additionally, utility-scale projects play a critical role in enhancing grid reliability and supporting industrial and urban energy needs. Their capacity to integrate advanced technologies and attract significant investments positions them as the primary driver of renewable energy growth in the country.

Breakup by Region:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District has moderate renewable energy potential, focusing mainly on solar and small-scale wind projects. Its proximity to major urban and industrial centers makes it a key hub for energy consumption. Renewable development here supports regional energy security while complementing existing power infrastructure and reducing dependence on traditional energy sources.

Additionally, the Volga District benefits from vast river systems, making it a significant contributor to hydropower generation. It also has growing potential for wind and biomass energy projects. With strong industrial activity and supportive infrastructure, this district plays an important role in expanding Russia’s renewable energy portfolio and improving regional energy resilience.

In line with this, the Urals District is a crucial industrial region with growing interest in renewable integration to support energy-intensive industries. Its wind potential and opportunities for biomass utilization are increasingly explored. Renewable energy development here aims to balance industrial demand, reduce carbon emissions, and enhance the sustainability of one of Russia’s key economic zones.

Besides this, the Northwestern District has promising wind energy potential, especially along coastal areas. Its proximity to European markets also supports cross-border renewable energy collaboration. Development in this district focuses on wind and bioenergy projects, contributing to regional decarbonization goals while diversifying the energy mix and reducing reliance on fossil fuel-based generation.

Furthermore, the Siberian District is rich in hydropower resources, with vast rivers offering opportunities for large-scale hydro projects. It also has significant potential for wind and biomass energy. Renewable development in this district supports remote communities, industrial operations, and overall grid stability, making it vital for Russia’s long-term clean energy expansion strategy.

Also, the other regions, including the Far East and southern territories, hold considerable renewable energy potential, especially for solar and wind projects. These areas are strategically important for supplying power to remote settlements and supporting cross-border energy initiatives. Development here enhances energy access, drives regional economic growth, and strengthens Russia’s overall renewable portfolio.

Competitive Landscape:

The competitive landscape is characterized by a mix of domestic developers, technology providers, and investors driving the growth of wind, solar, and hydropower projects. Government-backed programs and competitive auctions have encouraged participation from both established players and emerging companies, fostering a more dynamic and diverse market. The focus is shifting toward enhancing local manufacturing capabilities for renewable energy equipment to reduce dependence on imports. Collaboration between public and private sectors is crucial, with increasing interest in joint ventures and technology transfer to accelerate development. Overall, the market is evolving toward greater competition, innovation, and localization, positioning it for steady long-term growth in the renewable energy sector.

The report provides a comprehensive analysis of the competitive landscape in the Russia renewable energy market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: Asean and Russia initiated talks on a new energy partnership plan for 2026–2028, aligning Russia’s innovation strengths with Asean’s regional energy goals. The discussions, held at the 16th SOME-Russia meeting in Kuching, focused on advancing renewable energy cooperation and clean technology strategies.

- April 2025: Russia launched its first renewable energy facility for producing flexible solar modules in the Republic of Mordovia, as announced by the Rusnano Group. The plant used CIGS thin-film technology and targeted applications in the housing and utilities sector due to the modules' lightweight and efficient design.

- March 2025: Russia supported Mali’s renewable energy expansion by financing a 200 MW solar power plant through Aera Group, marking West Africa’s largest solar project. This initiative aimed to reduce fossil fuel reliance and improve electricity access for 200,000 Malians by 2025.

- January 2025: Russia advanced its renewable energy goals as Unigreen Energy launched a 63 MW solar power plant in Kalmykia's Lagansky District, raising the region’s total solar capacity to 297 MW. This positioned Kalmykia among Russia’s top three regions in solar energy output, with solar now contributing 55.6% to its energy mix.

- January 2025: Russia installed its first wind turbine at the Novolakskaya Wind Power Plant, marking progress in the country’s largest renewable energy project. Built by Rosatom Renewable Energy JSC, the plant was planned to host 120 turbines totalling 300 MW, aiming for 1.7 GW by 2027.

Russia Renewable Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydro Power, Wind Power, Solar Power, Bioenergy, Others |

| End Users Covered | Industrial, Residential, Commercial |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia renewable energy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia renewable energy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia renewable energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The renewable energy market in the Russia was valued at USD 13.75 Billion in 2024.

The Russia renewable energy market is projected to exhibit a CAGR of 9.3% during 2025-2033, reaching a value of USD 36.57 Billion by 2033.

The Russia renewable energy market is driven by abundant natural resources, including vast hydropower, wind, and solar potential, alongside supportive government policies promoting clean energy development. Growing energy demand, efforts to enhance grid reliability, localization of equipment production, and the need to diversify the energy mix further accelerate renewable energy adoption nationwide.

Hydropower account for the majority of shares of 89.6% due to its extensive river systems, favourable geography, and well-established infrastructure. Its ability to provide reliable, low-cost, and large-scale electricity generation, while supporting grid stability and long-term energy security, makes it the cornerstone of the country’s renewable sector.

Utility-scale dominate Russia’s renewable energy growth as they offer large-scale, cost-effective power generation to meet industrial and urban demand. Supported by government auctions and policies, these projects ensure grid stability, attract significant investments, and integrate advanced technologies, making them central to the country’s renewable energy expansion strategy.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)