Russia Seeds Market Size, Share, Trends and Forecast by Type, Seed Type, Traits, Availability, Seed Treatment, and Region, 2025-2033

Russia Seeds Market Overview:

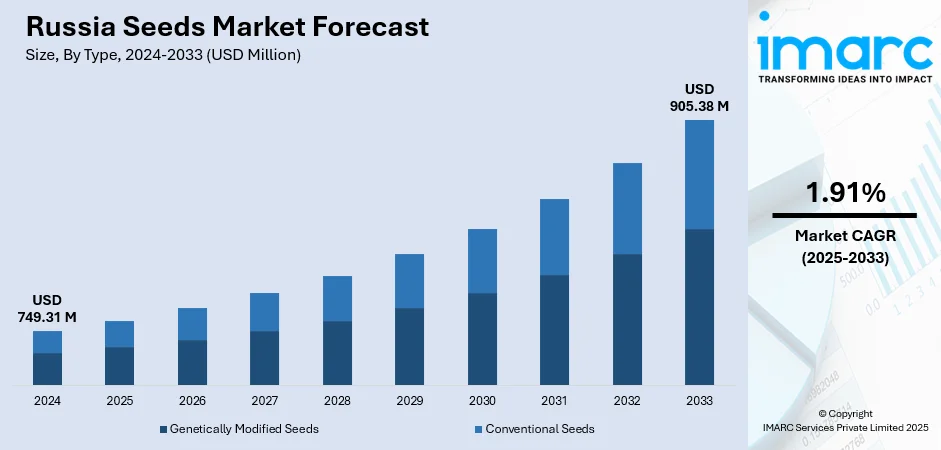

The Russia seeds market size reached USD 749.31 Million in 2024. The market is projected to reach USD 905.38 Million by 2033, exhibiting a growth rate (CAGR) of 1.91% during 2025-2033. The market is witnessing dynamic shifts driven by a growing focus on domestic self-sufficiency and climate-resilient agriculture. Key trends include increased use of disease-resistant and drought-tolerant seed traits, expanded access to treated seed offerings, and diversification across crop types to align with regional growing conditions. Regional variations reflect distinct agro-climatic zones, influencing availability channels, from farm gate distribution to digital networks. Innovation in seed treatment and trait development continues to be supported by governmental policies and research collaborations to enhance the Russia seeds market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 749.31 Million |

| Market Forecast in 2033 | USD 905.38 Million |

| Market Growth Rate 2025-2033 | 1.91% |

Russia Seeds Market Trends:

Strengthening Domestic Seed Supply through Import Substitution

In February 2025, Russia’s Ministry of Agriculture reported a significant drop in seed imports for the previous year, reflecting a broader national push for agricultural independence. In 2024, state policy limiting seed imports from unfriendly countries came into effect, prompting rapid expansion of domestic breeding and multiplication programmes. Across key crops like wheat, sunflower, and maize, domestic seed producers increased certified volumes, supported by regional breeding stations and state subsidies. As a result, farmers now have wider access to certified Russian-origin seed adapted to local agro-climatic zones. This shift has also boosted traceability and compliance with national seed quality standards. In some regions, use of domestic sunflower seeds surpassed previous benchmarks, showing growing trust in local varieties. These developments indicate that Russia is moving toward a more self-sufficient and quality-driven seed system. Over time, strengthened domestic capacity may position Russia as a competitive supplier in neighbouring markets. Russia seeds market growth is now being fuelled by strategic policies aimed at reducing dependence on imports while elevating national production capabilities.

To get more information on this market, Request Sample

Enhanced Regulatory Oversight to Ensure Seed Quality

In February 2025, the National Seed Alliance of Russia estimated that seeds of unknown origin may account for a significant percentage of the total market volume of the year. To counter this, the government has been increasing the application of its digital seed tracking platform in monitoring origin, certification, and sale of seeds across the country. This action is designed to reduce the incidence of false seeds which do not have credible documentation, purity examination, or conformity with national seed standards. Controls are being tightened at retail and production levels, with higher penalties for non-conforming suppliers. The online system also allows farmers and distributors to check batches of seeds prior to purchase, instilling confidence and responsibility across the supply chain. In certain areas, regulators have already confiscated several shipments of seeds that did not pass certification tests, affirming the necessity for traceability. The institutional emphasis on quality verification and assurance is among the prime drivers of recent Russia seeds market trends towards more organized and reputable supply chains.

Diversification of Local Varieties Across Key Crops

Russia is expanding its use of indigenous seed varieties, especially in legumes and cereals, to increase resilience and regional adaptation in farming systems. In January 2025, national agricultural analysts confirmed that all major agroholdings would switch entirely to domestic pea seed varieties for the upcoming season, compared to partial adoption in previous years. This shift marks a broader trend of reducing genetic dependency on foreign seed inputs and accelerating domestic breeding efforts. Crop development programs are prioritising varieties tailored to Russia’s soil types, temperature fluctuations, and rotational practices, improving both yield consistency and disease resistance. Additionally, the number of approved domestic seed varieties for crops like barley, flax, and soy has steadily increased across multiple regions, contributing to a more diverse and stable planting base. Farmers are gaining access to certified seeds developed within their own agro-zones, which increases performance reliability while reducing transport and input costs. As more seed types become available under official certification, market trust and access continue to grow.

Russia Seeds Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, seed type, traits, availability, and seed treatment.

Type Insights:

- Genetically Modified Seeds

- Conventional Seeds

The report has provided a detailed breakup and analysis of the market based on the type. This includes genetically modified seeds and conventional seeds.

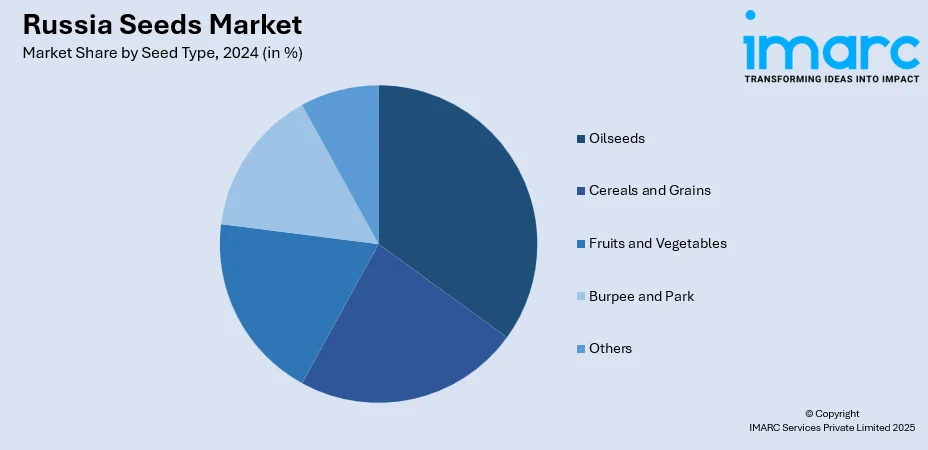

Seed Type Insights:

- Oilseeds

- Soybean

- Sunflower

- Cotton

- Canola/Rapeseed

- Cereals and Grains

- Corn

- Wheat

- Rice

- Sorghum

- Fruits and Vegetables

- Tomatoes

- Lemons

- Brassica

- Pepper

- Lettuce

- Onion

- Carrot

- Burpee and Park

- Others

A detailed breakup and analysis of the market based on the seed type have also been provided in the report. This includes oilseeds (soybean, sunflower, cotton, and canola/rapeseed), cereals and grains (corn, wheat, rice, and sorghum), fruits and vegetables (tomatoes, lemons, brassica, pepper, lettuce, onion, and carrot), burpee and park, and others.

Traits Insights:

- Herbicide-Tolerant (HT)

- Insecticide-Resistant (IR)

- Others

The report has provided a detailed breakup and analysis of the market based on the traits. This includes herbicide-tolerant (HT), insecticide-resistant (IR), and others.

Availability Insights:

- Commercial Seeds

- Saved Seeds

A detailed breakup and analysis of the market based on the availability have also been provided in the report. This includes commercial seeds and saved seeds.

Seed Treatment Insights:

- Treated

- Untreated

The report has provided a detailed breakup and analysis of the market based on the seed treatment. This includes treated and untreated.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Seeds Market News:

- February 2024: Russia-based Syngenta Russia and KWS remain the country’s foremost seed importers amid government import quota policies. These companies secured key allocations to supply hybrid seeds such as sunflower, rapeseed, corn, and sugar beet to Russia. The move aligns with state-led efforts to increase domestic seed production under food security mandates, which require farmers to use locally produced seed. This reinforces Russia’s strategic direction toward self-sufficiency and a more localized seed industry.

Russia Seeds Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Genetically Modified Seeds, Conventional Seeds |

| Seed Types Covered |

|

| Traits Covered | Herbicide-Tolerant (HT), Insecticide-Resistant (IR), Others |

| Availabilities Covered | Commercial Seeds, Saved Seeds |

| Seed Treatments Covered | Treated, Untreated |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia seeds market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia seeds market on the basis of type?

- What is the breakup of the Russia seeds market on the basis of seed type?

- What is the breakup of the Russia seeds market on the basis of traits?

- What is the breakup of the Russia seeds market on the basis of availability?

- What is the breakup of the Russia seeds market on the basis of seed treatment?

- What is the breakup of the Russia seeds market on the basis of region?

- What are the various stages in the value chain of the Russia seeds market?

- What are the key driving factors and challenges in the Russia seeds market?

- What is the structure of the Russia seeds market and who are the key players?

- What is the degree of competition in the Russia seeds market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia seeds market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia seeds market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia seeds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)