Russia Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Russia Steel Tubes Market Overview:

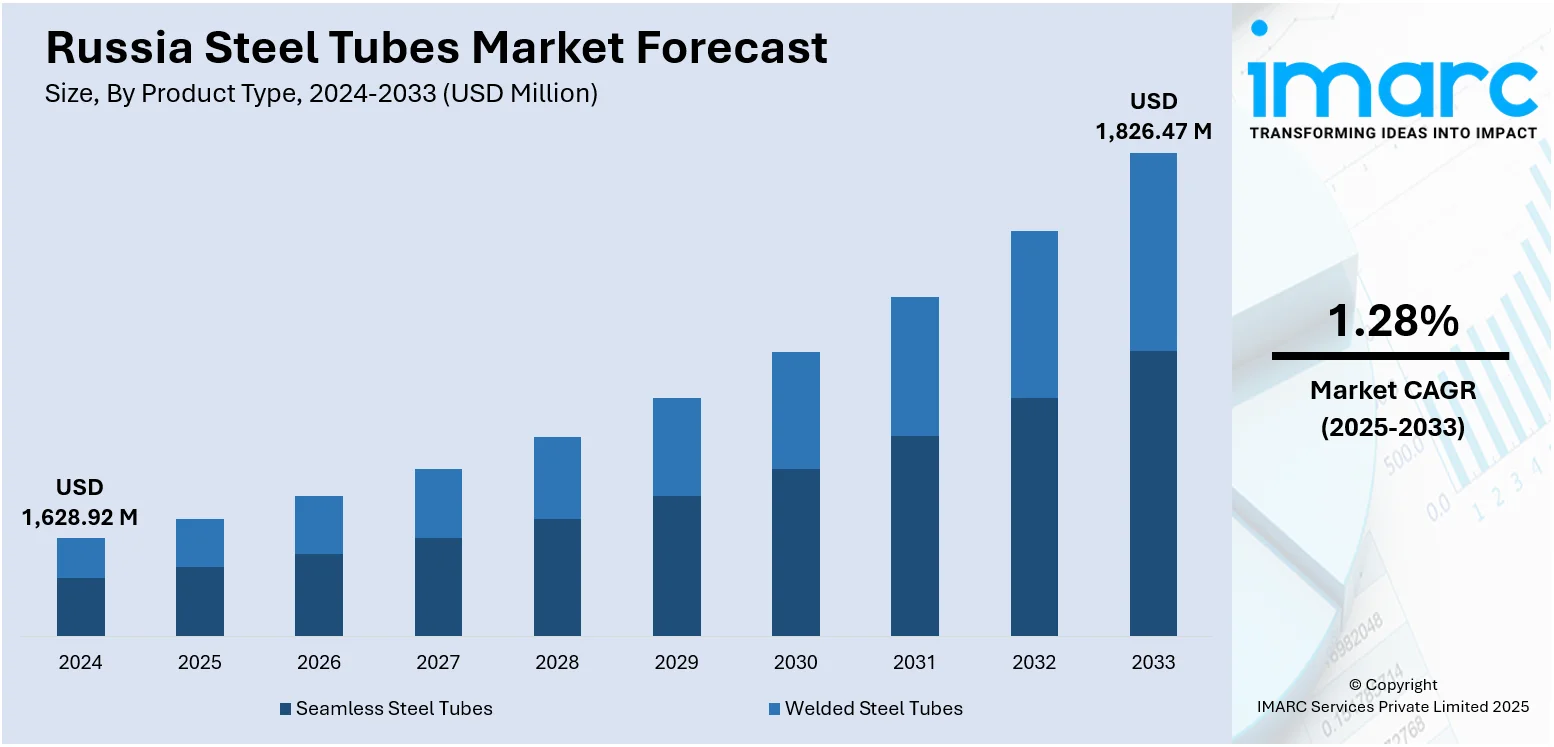

The Russia steel tubes market size reached USD 1,628.92 Million in 2024. The market is projected to reach USD 1,826.47 Million by 2033, exhibiting a growth rate (CAGR) of 1.28% during 2025-2033. The market is navigating a stable trajectory, propelled by robust demand from energy infrastructure, oil‑and‑gas, automotive, and machinery sectors. Manufacturers are increasingly deploying high‑strength, seamless products and advanced coatings to bolster durability under demanding conditions. Ongoing infrastructural and industrial investments continue to shape market dynamics and long‑term sustainability, ultimately influencing the Russia steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,628.92 Million |

| Market Forecast in 2033 | USD 1,826.47 Million |

| Market Growth Rate 2025-2033 | 1.28% |

Russia Steel Tubes Market Trends:

Infrastructure-Led Material Demand

In January 2025, Russia's national credit agency reaffirmed that total demand for tubes and pipes is expected to stagnate compared with the previous year. Although this could imply decelerating momentum, the steel tube market continues to be robustly backed by infrastructure maintenance and government-sponsored building projects. Particularly, upgrades by utilities and municipal repair initiatives continue to drive steady consumption, particularly by water supply networks, heat networks, and low-rise buildings. A prime example is the government's pipeline rehabilitation program across various regions, where regional governments prefer modern steel tubing to replace aging networks. Even as macroeconomic trends change, local infrastructure and building efforts have maintained a stable floor for tube procurement. Notably, these projects are not only located in major cities but also extend to cover smaller urban and industrial ones. This widespread coverage of demand is an indication of a resilient structural foundation that underpins tube producers and suppliers in Russia. Under these circumstances, Russia steel tubes market growth continues to be dominated by infrastructure development as a constant source of demand even without industry-wide momentum.

To get more information on this market, Request Sample

Seasonally Stabilizing Demand Despite Weak Consumption

As of May 2025, market observations from national steel industry forums pointed to a cooling in overall pipe consumption across Russia. While total output has eased, seasonal patterns remain visible, particularly in the demand for steel tubes used in utility maintenance and infrastructure rehabilitation. Municipal projects related to water, gas, and heating continue to require consistent volumes of structural tubing, especially during spring repair cycles. Across several regions, these efforts have provided a stabilizing effect for producers and distributors, even in the absence of broader growth. Stakeholders note that while inventory levels remain elevated in some segments, cyclical demand for utility-grade steel tubes prevents further contraction. Mid-sized and regional operators are still fulfilling supply contracts tied to annual maintenance budgets, which has created pockets of regular activity within an otherwise cautious market. These dynamics are helping to maintain engagement across the supply chain, offering some insulation from volatility. In summary, Russia steel tubes market trends are currently shaped more by recurring public sector repair demand than by expansion, keeping the market relatively balanced despite headwinds.

Innovation and Coating Technologies Propels Market

In May 2025, insights from Russia’s leading pipe industry conference highlighted a growing interest in advanced coating systems and material innovations across the steel tube sector. These developments are driving a shift in how products perform in demanding industrial and utility environments. Specifically, there is increasing use of corrosion-resistant coatings and high-strength alloys, tailored for extended service life in harsh climates like northern regions. Industry professionals report elevated inquiries about technology-led solutions, reflecting a desire for tubing that endure under stress and support longer maintenance intervals. Digital precision in production such as automated inspection, laser cutting, and real-time quality control are being adopted to meet these expectations, even without raw volume growth. Meanwhile, capacity enhancements in seamless and cold-formed stainless tube facilities are enabling customization to diverse application needs. Russian producers are responding to both domestic users and regional exporters by integrating more sophisticated manufacturing standards and eco-conscious materials. In this evolving landscape, technological advancement is becoming a defining force shaping the next stage of the Russia steel tubes market, aligning with global quality benchmarks and sustainability priorities.

Russia Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

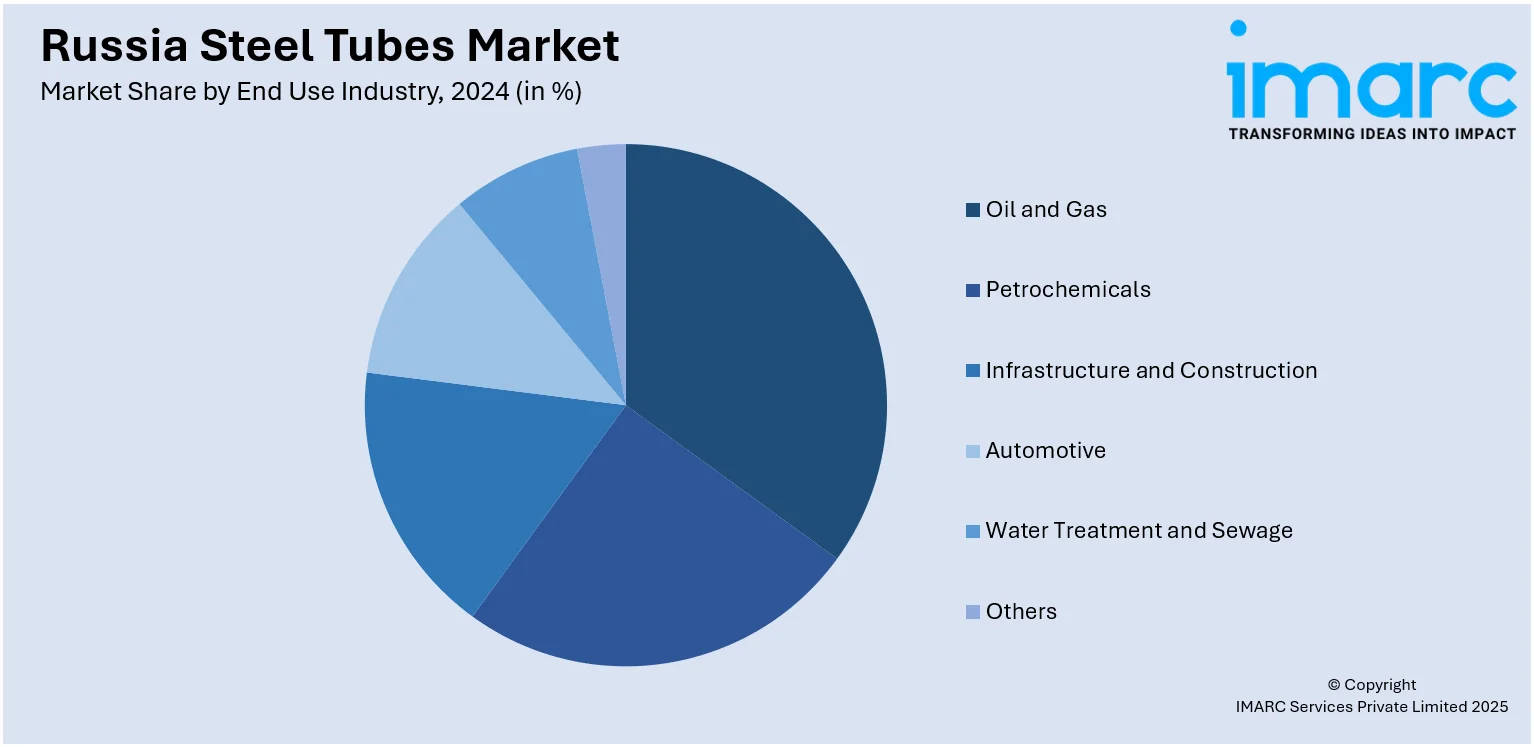

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Steel Tubes Market News:

- In June 2025: Cybersteel LLC launched a new seamless stainless steel pipe facility in Pervouralsk, Sverdlovsk Region. The ₽12 billion project, backed by a ₽5.2 billion loan, increases capacity 1.7-fold to 15,100 t/year. It targets reduced Chinese imports and supplies high-tech sectors, including nuclear, instrument-grade, and heat-exchange applications.

Russia Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia steel tubes market on the basis of product type?

- What is the breakup of the Russia steel tubes market on the basis of material type?

- What is the breakup of the Russia steel tubes market on the basis of end use industry?

- What is the breakup of the Russia steel tubes market on the basis of region?

- What are the various stages in the value chain of the Russia steel tubes market?

- What are the key driving factors and challenges in the Russia steel tubes market?

- What is the structure of the Russia steel tubes market and who are the key players?

- What is the degree of competition in the Russia steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)