Russia Test Preparation Market Size, Share, Trends and Forecast by Exam, End User, Learning Model, Gender, and Region, 2025-2033

Russia Test Preparation Market Size and Share:

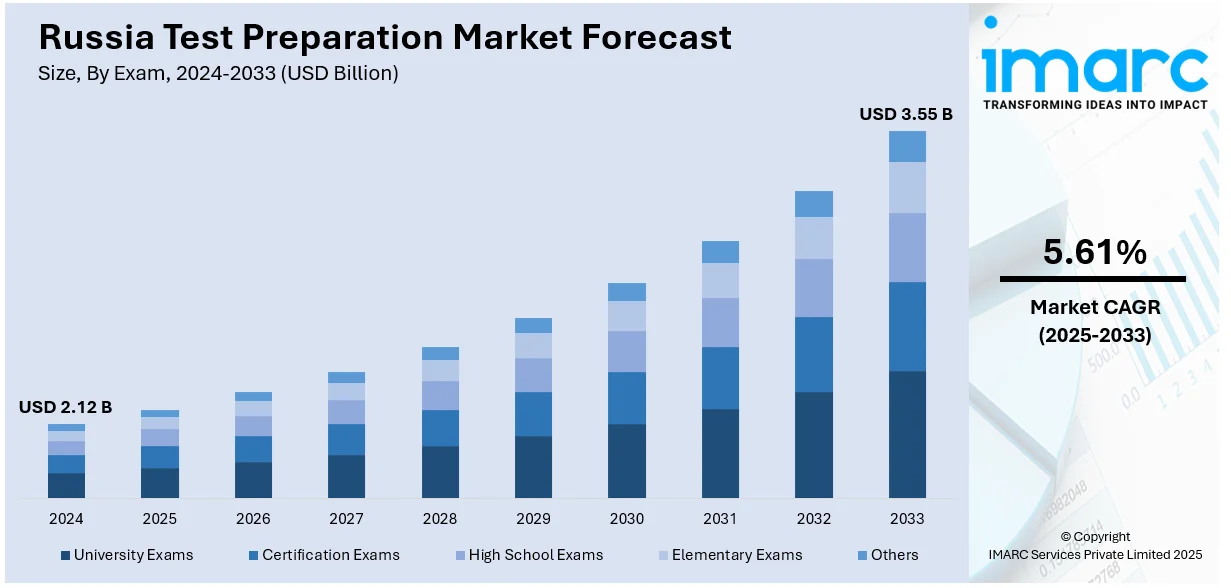

The Russia test preparation market size was valued at USD 2.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.55 Billion by 2033, exhibiting a CAGR of 5.61% from 2025-2033. The market is fueled by the increasing competition for professional certification and higher education with tests like the Unified State Exam (USE) and global exams like TOEFL and IELTS being an integral part of it. Furthermore, the growth of parental expenditure on education and demand for special training also fuels the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.12 Billion |

| Market Forecast in 2033 | USD 3.55 Billion |

| Market Growth Rate 2025-2033 | 5.61% |

The Russia test preparation market is primarily driven by the increasing emphasis on higher education and professional certifications. As the job market becomes more competitive, students and professionals are seeking to enhance their qualifications through standardized tests such as the Unified State Exam (USE), international exams such as TOEFL and IELTS, and specialized certifications. This demand is further fueled by the growing awareness of the importance of quality education and the need to meet global standards. According to the Russia test preparation market forecast, the rise of digital learning platforms and online resources has made test preparation more accessible, catering to a wider audience across the country.

In addition, the government’s focus on improving educational outcomes and aligning them with international benchmarks is significantly supporting the market. Policies aimed at modernizing the education system and increasing enrollment in higher education institutions have created a Russia test preparation market demand. On 12th April 2024, Russia announced 500 scholarships for Indian students across disciplines such as medicine, engineering, and aerospace. With a target of increasing scholarships fivefold in the coming years, Moscow hopes to upgrade its educational cooperation with New Delhi. As many as 20,000 Indians currently study there, benefiting from low-priced education and job prospects at graduation time. Furthermore, the expansion of private tutoring and coaching centers, coupled with the increasing affordability of online courses, has made these services more attainable for a broader demographic. The growing middle class, with higher disposable incomes, is also contributing to the Russia test preparation market share, as parents and individuals are willing to invest in quality preparation to secure better academic and career opportunities.

Russia Test Preparation Market Trends:

Rising Adoption of AI-Powered Learning Tools

The Russia test preparation market is witnessing a rise in the integration of artificial intelligence (AI) into educational platforms. During the AI Journey conference, Russian President Vladimir Putin underscored the significant impact of artificial intelligence on various sectors. Concurrently, Sberbank pointed out the necessity for more than 2.5 million AI and data professionals by the year 2027, reflecting Russia's commitment to AI education and sustainable development initiatives. Additionally, experts deliberated on AI's capacity to generate new job opportunities and promote environmental, social, and governance (ESG) objectives, with Sberbank actively investing in digital innovations and training platforms for professionals. AI-driven tools are being used to personalize learning experiences, offering tailored study plans, adaptive practice tests, and real-time feedback. These technologies help students identify their strengths and weaknesses, enabling more efficient preparation. Companies are increasingly leveraging AI to enhance user engagement and improve outcomes, making it one of the key Russia test preparation market trends shaping the future of the market. This shift is particularly appealing to tech-savvy younger generations who prefer interactive and flexible learning methods over traditional classroom-based approaches.

Expansion of Mobile-First Learning Solutions

With smartphone penetration on the rise in Russia, mobile-first test preparation platforms are gaining traction. These solutions allow students to access study materials, practice tests, and video lectures on-the-go, catering to their busy schedules. In early 2024, Russia had 130.4 million internet users with 90.4% penetration and 106.0 million social media users taking the composition to 73.5% of the population. The country had also registered 219.8 million mobile connections more than the total population at 152.5%. The convenience and affordability of mobile apps are driving their popularity, especially among students in remote areas with limited access to physical coaching centers. This trend is further supported by the increasing availability of affordable mobile data plans, making online learning more accessible. As a result, providers are focusing on developing lightweight, user-friendly apps to capture this growing segment.

Growing Demand for Niche and Specialized Test Prep Services

While traditional exams including the Unified State Exam (USE) remain popular, there is a noticeable increase in demand for preparation services targeting niche and specialized tests. These include exams for international universities, professional certifications, and language proficiency tests such as DELF or Goethe-Zertifikat. This trend reflects the aspirations of Russian students and professionals to pursue global opportunities and diversify their skill sets. The Professional Certificates market is projected to reach USD 21.49 Million in 2025 at a 3.58% annual growth rate, reaching USD 24.74 Million by 2029. User numbers will reach 1.2 million by 2029, and user penetration will rise from 0.7% to 0.9% with an average revenue per user of USD 21.39. Providers are responding by offering tailored courses and resources for these exams, often incorporating bilingual or multilingual support to cater to the unique needs of this audience. This diversification is helping the Russia test preparation market outlook.

Russia Test Preparation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia test preparation market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on exam, end user, learning model, and gender.

Analysis by Exam:

- University Exams

- Certification Exams

- High School Exams

- Elementary Exams

- Others

The Russia test preparation market for university exams is highly competitive, driven by the demand for admission to prestigious institutions. Services include comprehensive courses, mock tests, and personalized tutoring, focusing on subjects including mathematics, physics, and literature. Providers leverage digital platforms to offer flexible learning solutions, catering to students across regions. This segment is characterized by a focus on high-quality content and strategic partnerships with educational institutions to enhance credibility and reach.

The certification exam segment targets professionals seeking career advancement through credentials such as language proficiency (e.g., TOEFL, IELTS) or technical certifications (e.g., IT, finance). Preparation services emphasize practical skills, exam strategies, and industry-specific knowledge. Online platforms and mobile apps dominate this segment, offering self-paced learning and real-time feedback. Providers often collaborate with certification bodies to align their offerings with exam requirements, ensuring relevance and effectiveness.

High school exam preparation in Russia focuses on standardized tests including the Unified State Exam (USE). This segment is driven by parental investment in their children’s academic success. Services range from group classes to one-on-one tutoring, with an emphasis on core subjects. Digital tools, including video lectures and interactive quizzes, are increasingly popular. Providers differentiate themselves through experienced tutors, tailored study plans, and performance analytics to track student progress.

The elementary exam preparation market caters to younger students, focusing on foundational skills in subjects such as mathematics, reading, and science. Services are designed to be engaging, incorporating gamified learning and interactive content to maintain student interest. Parents play a key role in selecting programs that balance academic rigor with child-friendly approaches. Providers often emphasize holistic development, combining exam readiness with critical thinking and problem-solving skills to build a strong educational foundation.

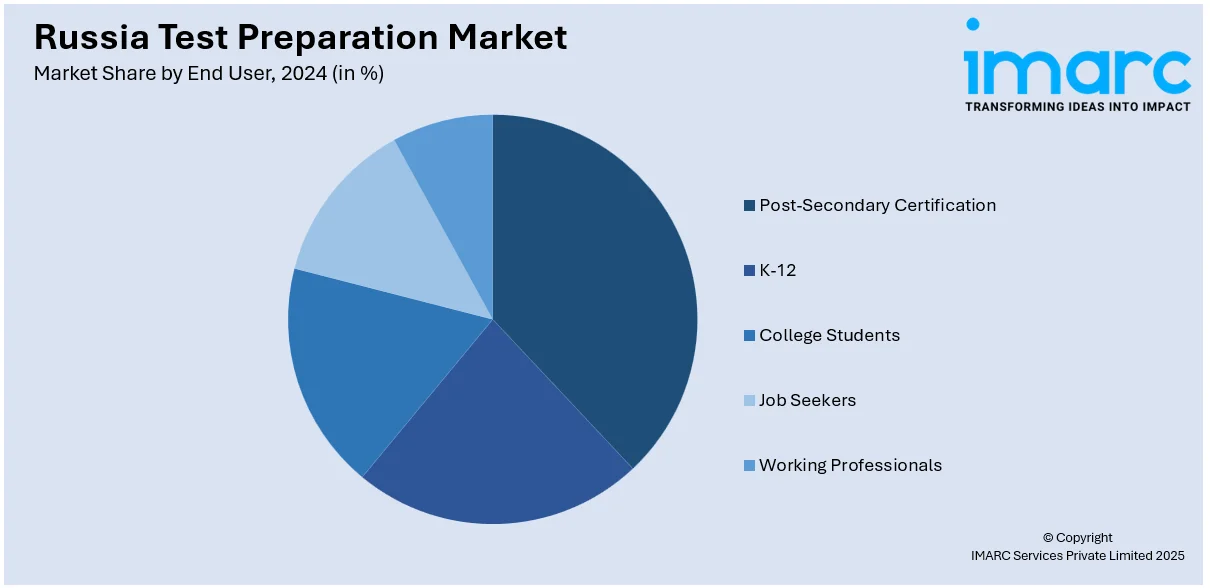

Analysis by End User:

- Post-Secondary Certification

- K-12

- College Students

- Job Seekers

- Working Professionals

The post-secondary certification segment in Russia’s test preparation market targets professionals and graduates aiming to enhance their qualifications. This group prioritizes flexible, time-efficient learning solutions, such as online courses and mobile apps, to balance preparation with work commitments. Providers focus on delivering industry-aligned content, practical exam strategies, and certification-specific resources. Partnerships with certification bodies and employers are key to building trust and ensuring the relevance of preparation materials for career-oriented learners.

The K-12 segment is driven by parents seeking to secure their children’s academic success through early preparation for standardized exams. Services include tutoring, group classes, and digital learning platforms tailored to school curricula. Providers emphasize interactive and engaging content to maintain student interest while building foundational skills. This segment benefits from parental involvement and a growing preference for hybrid learning models that combine in-person and online instruction.

College students in Russia’s test preparation market focus on competitive exams for postgraduate programs, scholarships, or international education opportunities. This segment values comprehensive, high-quality resources, including mock tests, video lectures, and peer discussion forums. Providers cater to tech-savvy learners by offering mobile-friendly platforms and on-demand access to study materials. Customized study plans and performance tracking tools are critical to meeting the diverse needs of this academically driven demographic.

Analysis by Learning Model:

- Blended

- Online

The blended learning model in Russia’s test preparation market combines traditional classroom instruction with digital tools, offering a balanced approach to education. This model appeals to students who benefit from face-to-face interaction with tutors while leveraging the flexibility of online resources. Providers focus on integrating interactive content, live sessions, and self-paced modules to enhance engagement and retention. Blended learning is particularly effective for exam preparation, catering to diverse learning styles and schedules.

The online learning model dominates Russia’s test preparation market, driven by its convenience and accessibility. This model offers video lectures, interactive quizzes, and real-time performance analytics, enabling students to study at their own pace. Providers emphasize user-friendly platforms, mobile compatibility, and personalized learning paths to cater to tech-savvy learners. The online model is especially popular among working professionals and students in remote areas, ensuring widespread reach and cost-effective solutions.

Analysis by Gender:

- Male

- Female

The male segment in Russia’s test preparation market often prioritizes technical and competitive exams, such as engineering, IT certifications, and university entrance tests. Providers tailor offerings to include analytical problem-solving modules, practical exam simulations, and career-oriented content. Digital platforms with gamified learning and performance tracking tools are particularly effective in engaging male learners. This segment values efficiency, structured study plans, and measurable outcomes, driving demand for high-quality, results-driven preparation resources.

The female segment in Russia’s test preparation market shows a strong preference for comprehensive and flexible learning solutions, often balancing academic goals with personal commitments. Providers focus on offering supportive, interactive platforms with personalized tutoring and community-driven learning experiences. Subjects including language proficiency, teaching certifications, and healthcare-related exams are popular. Emphasizing accessibility, emotional support, and holistic development, this segment benefits from tailored programs that foster confidence and long-term academic success.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District, including Moscow, dominates Russia’s test preparation market due to high population density and access to premium educational resources. Demand is driven by competitive university and certification exams. Providers focus on advanced digital platforms and in-person tutoring, catering to affluent, academically ambitious students. This region’s market is characterized by high competition and a preference for innovative, technology-driven learning solutions.

The Volga District shows steady growth in the test preparation market, fueled by increasing awareness of educational opportunities. Demand spans high school and certification exams, with a preference for affordable, blended learning models. Providers emphasize regional language support and localized content to address diverse needs. This region benefits from rising internet penetration, enabling wider adoption of online learning platforms and expanding market reach.

The Urals District’s test preparation market is driven by industrial and technical certification demands, reflecting the region’s economic focus. Students and professionals seek courses in engineering, IT, and vocational exams. Providers leverage hybrid learning models, combining online resources with local tutoring centers. The market is growing, supported by increasing investments in education and infrastructure, making it a key area for expansion.

The Northwestern District, including St. Petersburg, has a strong demand for university and language proficiency exams. The region’s emphasis on international education drives the need for IELTS and TOEFL preparation. Providers offer premium, English-language content and personalized tutoring. High internet accessibility and a tech-savvy population favor online learning platforms, making this region a hub for innovative and high-quality test preparation services.

The Siberian District’s test preparation market is emerging, with demand for high school and university entrance exams. Limited infrastructure challenges are offset by growing online learning adoption. Providers focus on cost-effective, digital solutions to reach remote areas. Government initiatives to improve educational access are enhancing market potential, making this region a promising area for scalable, technology-driven test preparation services.

Competitive Landscape:

The competitive landscape for the test preparation market in Russia is highly dynamic, driven by increasing demand for academic and professional certification exams. Numerous players, ranging from large established firms to smaller local providers, offer diverse services, including online courses, in-person tutoring, and self-study materials. The market is characterized by intense competition, with providers striving to differentiate through innovative teaching methods, personalized learning experiences, and affordable pricing. Technological advancements, such as AI-driven platforms and mobile apps, are reshaping the industry, enabling greater accessibility and convenience. Additionally, the growing emphasis on standardized testing for university admissions and career advancement has fueled market expansion. Providers are also focusing on regional outreach to tap into underserved areas, further intensifying competition.

The report provides a comprehensive analysis of the competitive landscape in the Russia test preparation market with detailed profiles of all major companies.

Latest News and Developments:

- October 22, 2024: China and Russia enhanced their education and cultural ties using agreements signed between universities. These include the agreements between Peking University and Lomonosov Moscow State University, aiming at joint research, talent training, and language learning. The Confucius Institutes, which were established, for example, at Novosibirsk State Technical University, have been pivotal in the expansion of Chinese language education and the development of mutual cultural exchange: nearly 150 students have visited Chinese universities via scholarships since 2007.

- October 16, 2024: A Russian-led research team prepared the QRate's quantum key distribution (QKD) system for formal certification against detector attacks using the BB84 protocol and decoy states. The system at 312.5 MHz aims to enable secure communication of sensitive information. A countermeasure in the form of photocurrent measurement would be employed to address identified hardware flaws in the system.

- September 18, 2024: Russia rolled out a pilot of an electronic military call-up register, which will come into full operation on November 1, 2024, informing conscripts through Gosuslugi and imposing travel restrictions on them. The register will contain health, place of residence, and work information; the conscription age has been pushed to 30 and the extension of service from one year to two years is suggested amidst preparation for protracted conflict.

Russia Test Preparation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Exams Covered | University Exams, Certification Exams, High School Exams, Elementary Exams, Others |

| End Users Covered | Post-Secondary Certification, K-12, College Students, Job Seekers, Working Professionals |

| Learning Models Covered | Blended, Online |

| Genders Covered | Male, Female |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia test preparation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia test preparation market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia test preparation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia test preparation market was valued at USD 2.12 Billion in 2024.

The market is driven by the increasing emphasis on higher education and professional certifications, the competitive job market, government policies modernizing education, and the rise of digital learning platforms. Additionally, the growing middle class and affordability of online courses are contributing to Russia test preparation market growth.

The Russia test preparation market is projected to exhibit a CAGR of 5.61% during 2025-2033, reaching a value of USD 3.55 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)