Russia Travel Insurance Market Size, Share, Trends and Forecast by Insurance Type, Coverage, Distribution Channel, End User, and Region, 2025-2033

Russia Travel Insurance Market Size and Share:

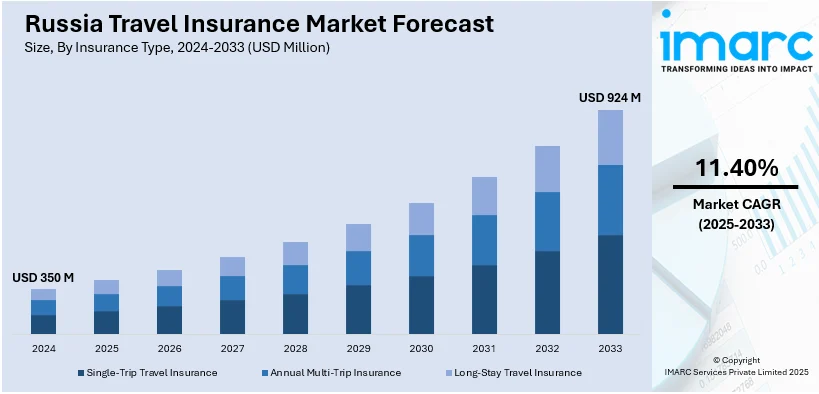

The Russia travel insurance market size was valued at USD 350 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 924 Million by 2033, exhibiting a CAGR of 11.40% from 2025-2033. The market is fueled by rising tourism, increasing awareness of travel risks, regulatory requirements, digital insurance platforms, and geopolitical uncertainties. Demand is fueled by mandatory insurance for Schengen visas, medical emergency coverage, and evolving traveler preferences post-COVID-19.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 350 Million |

| Market Forecast in 2033 | USD 924 Million |

| Market Growth Rate (2025-2033) | 11.40% |

The growing tourism sector, both domestic and international, plays a crucial role. According to industry reports, the prospects for the development of domestic tourism in Russia were assessed during the SPIEF 2023 sessions. Domestic tourism, according to experts, has become not only a fast-growing but also a high-tech sector of the economy in recent years, with a major growth in tourist numbers. Tourism currently contributes 4% of GDP, which is insufficient. During the Forum's plenary session, Russian President Vladimir Putin directed the acceleration of regional tourism infrastructure development. Russia is a popular destination for travelers, and its citizens are increasingly exploring global destinations, driving demand for comprehensive travel insurance policies. The rise in disposable income and changing lifestyle preferences further contribute to this trend.

Regulatory frameworks and government mandates significantly impact the market. Many countries require foreign travelers to have valid health insurance before entry, pushing Russian tourists to purchase policies. Moreover, the expansion of digital platforms and online insurance providers has made policy comparison and purchasing more accessible, contributing to market growth. Insurers are offering customized plans with flexible pricing, further attracting consumers. Geopolitical uncertainties and economic fluctuations also influence travel insurance adoption, as travelers seek financial security against unforeseen circumstances. For instance, in June 2024, Russia and India discussed a bilateral deal to relax visa restrictions, to introduce visa-free group tourist exchanges. Indian travelers may soon be able to visit Russia without requiring a visa, with the new arrangement potentially beginning as early as spring 2025. This follows a decision in August 2023 that made Indian passengers eligible for e-visas to Russia, which are normally approved within four days.

Russia Travel Insurance Market Trends:

Rising Outbound Travel

The increasing number of Russians traveling abroad for tourism, business, and education is a key driver of the travel insurance market. According to figures from the Russian Federal Security Service's Border Guard Service, Russians traveled overseas more than 29 million times in 2024, with 11.5 million for tourism purposes, a 25% increase over 2023. Popular destinations, including Europe, Asia, and the Middle East, often require mandatory travel insurance for visa approvals. As more Russians explore international travel opportunities, demand for comprehensive coverage, including medical expenses, trip cancellations, and lost baggage protection, continues to grow. Additionally, the expansion of low-cost airlines and travel agencies offering package deals encourages more outbound trips, further fueling the need for travel insurance policies that ensure financial security against unexpected travel-related risks.

Growth of Business and Education Travel

The rise in international business engagements and student exchanges is significantly driving the Russian travel insurance market growth. Russian professionals frequently travel for global trade, corporate meetings, and conferences, requiring multi-trip and long-stay insurance plans. Similarly, a growing number of Russian students studying abroad in Europe, China, and the U.S. require comprehensive insurance coverage for medical expenses and emergencies. Many universities and corporate employers mandate travel insurance, ensuring a steady demand. As globalization strengthens economic and academic ties, the number of insured business travelers and students is expected to rise, boosting market expansion. For instance, in October 2024, The Russian government intends to increase international student recruitment to domestic colleges, particularly those from the West, by more than 40% over the next five years as part of a campaign to boost the country's worldwide impact.

Digitalization and Online Insurance Platforms

The rapid digitalization of the insurance sector has made purchasing travel insurance more convenient for Russian travelers. According to industry reports, Russia is among the top 20 most digitally advanced countries in the world. E-commerce increased by 39% in the first quarter of 2024 compared to the same period the previous year, reaching 1.9 Trillion roubles. Payment platforms, recommendation systems, and other digitally enabled services are required for online retail. Online insurance platforms and mobile applications allow customers to compare policies, receive instant quotes, and purchase coverage seamlessly. This accessibility has increased awareness and adoption rates, especially among younger travelers who prefer digital transactions. Insurers are also incorporating AI-driven customer support, instant claims processing, and personalized policy recommendations, enhancing the user experience. As technology continues to transform the industry, online sales channels will play a crucial role in expanding the Russia travel insurance market.

Russia Travel Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia travel insurance market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on insurance type, coverage, distribution channel, and end user.

Analysis by Insurance Type:

- Single-Trip Travel Insurance

- Annual Multi-Trip Insurance

- Long-Stay Travel Insurance

Single-trip travel insurance is expected to hold significant Russia travel insurance market share due to the high number of travelers taking short-term trips abroad for tourism, business, or study. Many Russian citizens prefer cost-effective coverage for a specific journey rather than an annual plan, making single-trip policies highly popular. Additionally, with fluctuating geopolitical situations and varying entry requirements in different countries, travelers seek short-term coverage tailored to each trip’s needs. The ease of purchasing single-trip insurance online or through travel agencies further contributes to its strong market share, as it offers flexibility and affordability.

Annual multi-trip travel insurance is gaining popularity among frequent travelers in Russia, including business professionals, expatriates, and international commuters. This type of insurance offers convenience and cost savings compared to purchasing separate policies for each trip. With increasing business engagements, international conferences, and tourism activities, many travelers prefer the continuous coverage provided by annual policies. Additionally, as Russia strengthens economic ties with global markets, corporate travel is expected to rise, further fueling demand. The ability to cover multiple destinations and trips under one policy makes it a practical choice for individuals who travel internationally multiple times per year.

Long-stay travel insurance holds a substantial Russia travel insurance market share due to the increasing number of Russian citizens relocating abroad for extended work assignments, education, or leisure stays. Many students, digital nomads, and expatriates require comprehensive medical and travel coverage for prolonged periods. Additionally, international regulations often mandate long-term insurance for visa approvals, further driving demand. With the rise of remote work and flexible travel lifestyles, more individuals seek extended coverage for peace of mind. The need for medical assistance, emergency evacuation, and trip-related contingencies during long stays makes this insurance type a crucial segment in Russia’s travel insurance market.

Analysis by Coverage:

- Medical Expenses

- Trip Cancellation

- Trip Delay

- Property Damage

- Others

Medical expenses are expected to dominate the Russian travel insurance market due to the high costs of healthcare abroad and the necessity for emergency treatment. Many countries require visitors to have medical coverage for visa approvals, further driving demand. Additionally, unexpected illnesses or accidents during travel can lead to significant financial burdens, making comprehensive medical insurance essential. Russian travelers prioritize policies that cover hospitalization, outpatient treatment, and emergency evacuations, ensuring peace of mind during international trips.

Trip cancellation coverage holds a major share of the Russian travel insurance market due to unpredictable travel disruptions caused by political instability, visa rejections, or sudden personal emergencies. Russian vacationers normally choose policies that return previously settled flight and hotel expenses when they must cancel their travels due to unexpected events. Experienced travelers purchase this coverage especially for high-cost vacations and business trips because such plans protect significant monetary losses. People continue to purchase trip cancellation insurance persistently due to ongoing travel uncertainties.

Trip delay insurance is a key component of Russia’s travel insurance market as flight disruptions, extreme weather, and logistical issues frequently affect international travel. Many Russian travelers face long layovers, missed connections, and unexpected delays, leading to additional accommodation and meal expenses. Trip delay coverage ensures reimbursement for such costs, making it a valuable policy feature. With increasing airline disruptions and changing global travel conditions, Russian travelers prioritize insurance that mitigates financial losses from unforeseen delays.

Property damage coverage is highly sought after in Russia’s travel insurance market due to concerns over lost, stolen, or damaged belongings during international trips. Luggage theft, mishandling by airlines, and personal item losses are common risks faced by travelers. High-value items such as electronics, jewelry, and business equipment require protection, making this coverage essential. As international travel increases, Russian travelers prioritize policies that compensate for damaged or stolen property, ensuring financial security against unexpected losses.

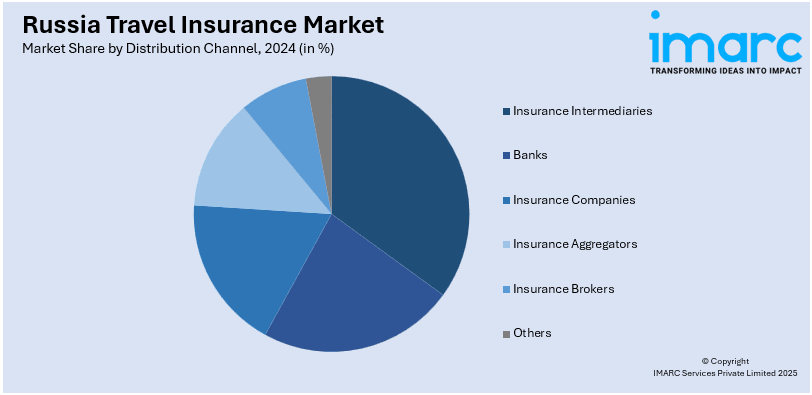

Analysis by Distribution Channel:

- Insurance Intermediaries

- Banks

- Insurance Companies

- Insurance Aggregators

- Insurance Brokers

- Others

Insurance intermediaries, including agents and brokers, are expected to dominate the Russian travel insurance market due to their strong distribution networks and expertise in offering tailored policies. Many travelers rely on intermediaries for personalized recommendations, competitive pricing, and guidance on policy selection. These intermediaries collaborate with multiple insurers, providing a wide range of options to suit different travel needs. Additionally, the complexity of travel insurance, including medical coverage, trip cancellation, and property protection, makes professional assistance valuable. As digital platforms grow, intermediaries also leverage online sales channels, increasing accessibility and boosting their market share in Russia’s travel insurance sector.

Banks hold a substantial share of Russia’s travel insurance market due to their established customer base, credibility, and ability to bundle insurance products with financial services. Many Russian banks offer travel insurance as an add-on to credit cards, premium accounts, and loan packages, making it convenient for travelers. Customers often prefer purchasing travel insurance from banks they already trust, ensuring seamless transactions. Additionally, banks partner with leading insurers to provide customized policies, enhancing their market presence. With the rise of digital banking, online insurance purchases through banking apps and websites have further strengthened banks’ role in this market.

Insurance companies play a major role in Russia’s travel insurance market as primary providers of policies covering medical expenses, trip cancellations, and property damage. These companies leverage their industry expertise, risk assessment capabilities, and underwriting experience to design comprehensive travel insurance plans. Many leading insurers also invest in digital platforms, enabling direct-to-consumer sales, instant policy issuance, and efficient claims processing. Additionally, partnerships with airlines, travel agencies, and corporate clients further expand their reach. With increasing travel demand and evolving risk factors, insurance companies continue to innovate, ensuring their dominance in the Russian travel insurance sector.

Analysis by End User:

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

- Others

Senior citizens are expected to hold a significant share of Russia’s travel insurance market due to their higher health risks and medical needs while traveling. Many countries require elderly travelers to have comprehensive medical coverage, driving demand. Seniors often seek policies covering pre-existing conditions, emergency medical care, and trip cancellations. With rising life expectancy and increased travel among retirees, insurance providers offer specialized plans for this demographic, ensuring financial protection and peace of mind during international trips.

Education travelers, including students studying abroad, contribute significantly to Russia’s travel insurance market due to visa requirements and the need for long-term coverage. Many universities and host countries mandate insurance for international students, covering medical expenses, emergency evacuations, and personal liability. Russian students studying in Europe, the U.S., and Asia seek policies tailored for extended stays. With increasing global educational exchanges, demand for student travel insurance remains strong, ensuring continuous market growth in this segment.

Business travelers represent a major share of Russia’s travel insurance market due to frequent international trips for corporate meetings, conferences, and partnerships. Companies prioritize comprehensive travel insurance to protect employees against medical emergencies, trip cancellations, and lost business equipment. Many business professionals require multi-trip policies, making insurance essential for seamless travel. As Russia strengthens its global trade and business relations, corporate travel continues to rise, fueling demand for tailored insurance solutions that minimize financial risks.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District, including Moscow, drives Russia’s travel insurance market due to its high outbound travel volume for business, education, and tourism. Moscow, as Russia’s economic hub, has a large number of corporate travelers requiring insurance for frequent trips. Additionally, many embassies and visa centers in this district mandate travel insurance for international trips. The growing middle class, increased disposable income, and access to digital insurance platforms contribute to the rising demand for travel insurance in this region.

The Volga District sees strong travel insurance demand due to its expanding industrial and educational sectors. Many students from cities like Kazan and Nizhny Novgorod travel abroad for studies, requiring mandatory insurance. Business travel is also increasing, particularly in the manufacturing and energy industries, leading to higher demand for corporate travel insurance. Additionally, rising outbound tourism from this region fuels the need for policies covering medical expenses, trip cancellations, and travel disruptions, ensuring steady market growth.

The Urals District, home to Yekaterinburg and major industrial centers, contributes to Russia’s travel insurance market through business travel and expatriate movement. Many professionals from this region work internationally in energy, mining, and engineering sectors, necessitating long-stay and corporate travel insurance. The region's economic stability and growing middle-class travelers further drive demand. Additionally, educational travel among students from major universities in Yekaterinburg boosts insurance sales, particularly for medical coverage and trip protection.

The Northwestern District, including Saint Petersburg, is a major driver of Russia’s travel insurance market due to its high tourism and business activity. Saint Petersburg is a major cultural and economic hub with a significant number of outbound travelers. Its proximity to Europe increases cross-border travel, necessitating Schengen-compliant travel insurance. Additionally, strong educational institutions send students abroad, further driving insurance demand. The region’s access to digital insurance services and partnerships with travel agencies also boost market growth.

The Siberian District drives travel insurance demand due to increasing outbound travel for tourism, education, and employment. Major cities like Novosibirsk and Krasnoyarsk have growing student populations studying abroad, requiring comprehensive insurance. Additionally, professionals in the energy and natural resource sectors frequently travel for work, increasing demand for business travel insurance. As international travel accessibility improves, more residents opt for coverage to protect against medical emergencies, flight cancellations, and baggage loss, supporting the region’s strong market growth.

Competitive Landscape:

The Russia travel insurance market is highly competitive, with major domestic and international insurers, banks, and intermediaries vying for market share. Leading players include companies such as Sogaz, AlfaStrakhovanie, Rosgosstrakh, Ingosstrakh, and VSK Insurance, which dominate through strong brand presence and extensive distribution networks. Banks like Sberbank and VTB also play a crucial role by bundling travel insurance with financial products. Additionally, digital insurance providers and online aggregators are gaining traction, offering instant policy issuance and competitive pricing. The market is shaped by regulatory requirements, partnerships with travel agencies, and increasing consumer awareness. As outbound travel rises, insurers are focusing on innovative coverage options, seamless digital platforms, and enhanced customer service to maintain a competitive edge.

Russia Travel Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Single-Trip Travel Insurance, Annual Multi-Trip Insurance, Long-Stay Travel Insurance |

| Coverages Covered | Medical Expenses, Trip Cancellation, Trip Delay, Property Damage, Others |

| Distribution Channels Covered | Insurance Intermediaries, Banks, Insurance Companies, Insurance Aggregators, Insurance Brokers, Others |

| End Users Covered | Senior Citizens, Education Travelers, Business Travelers, Family Travelers, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia travel insurance market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia travel insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia travel insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The travel insurance market in Russia was valued at USD 350 Million in 2024.

The Russia travel insurance market is driven by rising inbound and outbound tourism, increasing awareness of travel risks, regulatory requirements, and digital insurance platforms. Mandatory insurance for Schengen visas, medical emergency coverage, trip cancellations, and geopolitical uncertainties further boost demand, alongside evolving traveler preferences and post-COVID-19 precautions. The factors, collectively, are creating the Russia travel insurance market outlook across the country.

The Russia travel insurance market is projected to exhibit a CAGR of 11.40% during 2025-2033, reaching a value of USD 924 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)