Russia Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Vendor Type, Fuel Type, Sales Channel, and Region, 2025-2033

Russia Used Car Market Overview:

The Russia used car market size reached USD 41.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 80.50 Billion by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. The market is growing due to the increasing availability of financing options, rapid technological advancements in online marketplaces, shifting consumer preferences towards sustainability, imposition of supportive government policies, heightened focus on efficient supply chains, and growing consumer trust in used car companies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 41.70 Billion |

| Market Forecast in 2033 | USD 80.50 Billion |

| Market Growth Rate (2025-2033) | 6.80% |

Russia Used Car Market Trends:

Increasing Availability of Financing Options

The growth of financial services and the availability of different financing options that facilitate consumers to buy second-hand cars are fueling the Russia used cars market growth. According to reports, Russian banks achieved unprecedented profits of 4 trillion roubles ($40.7 billion) in 2024, driven by high interest rates and loan growth. However, lending growth began to slow as soaring borrowing costs deterred companies from seeking financing for development projects. In line with this, banks and financial institutions are launching loan packages that are specifically tailored for the used automobile sector. These loans provide flexible terms, lower interest rates compared to new car loans, and a variety of repayment schedules to suit different financial conditions. Moreover, the convenience of access to finance, enabling a larger portion of the public to own a used car, is increasing the expansion of this sector. Apart from this, the accessibility of innovative finance opportunities, for instance, peer-to-peer lending services that offer better rates and increased lenient loan terms is fostering the growth in the market.

Rapid Technological Advancements and the Emergence of Online Marketplaces

The speedy digitalization of the automobile purchase process that simplifies it, makes it transparent, and brings it closer to consumers is significantly boosting the Russia used car market share. In addition to this, the advent of online marketplaces offers consumers large databases of available cars, detailed specifications, and good-quality images that are fueling the market growth. These sites provide detailed search filters, through which users can limit their choices by price, make, model, year, mileage, and other factors. This convenience of access and ease of comparing several alternatives at one go has rendered online marketplaces extremely popular among buyers of used cars. Also, speedy technological developments making use of tools like vehicle history reports to supply extensive information on the previous ownership of a vehicle, accident records, and repair history are favoring the adoption of used cars in the region. For instance, in 2024, Russians frequently utilized services like "Auto.ru Reports" to verify the history of used cars, with BMW being the most checked brand, indicating a growing consumer emphasis on transparency and informed purchasing decisions. These reports increase consumer trust and confidence through the provision of knowledge regarding the reliability and condition of a used car, which plays an important role in the purchase decision.

Changing Consumer Preferences and Mobility Trends

The shifting consumer behavior and changing mobility patterns are enhancing the Russia used car market outlook. For example, Russians spent 6.3 trillion rubles on used cars in the first 11 months of 2024, surpassing the total expenditure of 5.8 trillion rubles for the entire previous year. This significant increase in spending reflects the rising preference for used vehicles as a cost-effective and sustainable choice among consumers. In confluence with this, the increasing numbers of Russians are becoming environmentally conscious about the choices they make, including the mode of transport they use. Moreover, used cars are perceived as a greener alternative to new cars, as buying them decreases demand for new vehicle manufacturing and its resultant environmental burden. This green thinking encourages most consumers to go for used cars in consonance with their values of responsible consumption and sustainability. Apart from this, the growing popularity of shared mobility solutions like car-sharing and ride-hailing services that provide easy and flexible modes of transportation are impelling the market demand for used cars.

Russia Used Car Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on vehicle type, vendor type, fuel type, and sales channel.

Vehicle Type Insights:

.webp)

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes hatchbacks, sedan, sports utility vehicle, and others.

Vendor Type Insights:

- Organized

- Unorganized

A detailed breakup and analysis of the market based on the vendor type have also been provided in the report. This includes organized and unorganized.

Fuel Type Insights:

- Gasoline

- Diesel

- Others

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes gasoline, diesel, and others.

Sales Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes online and offline.

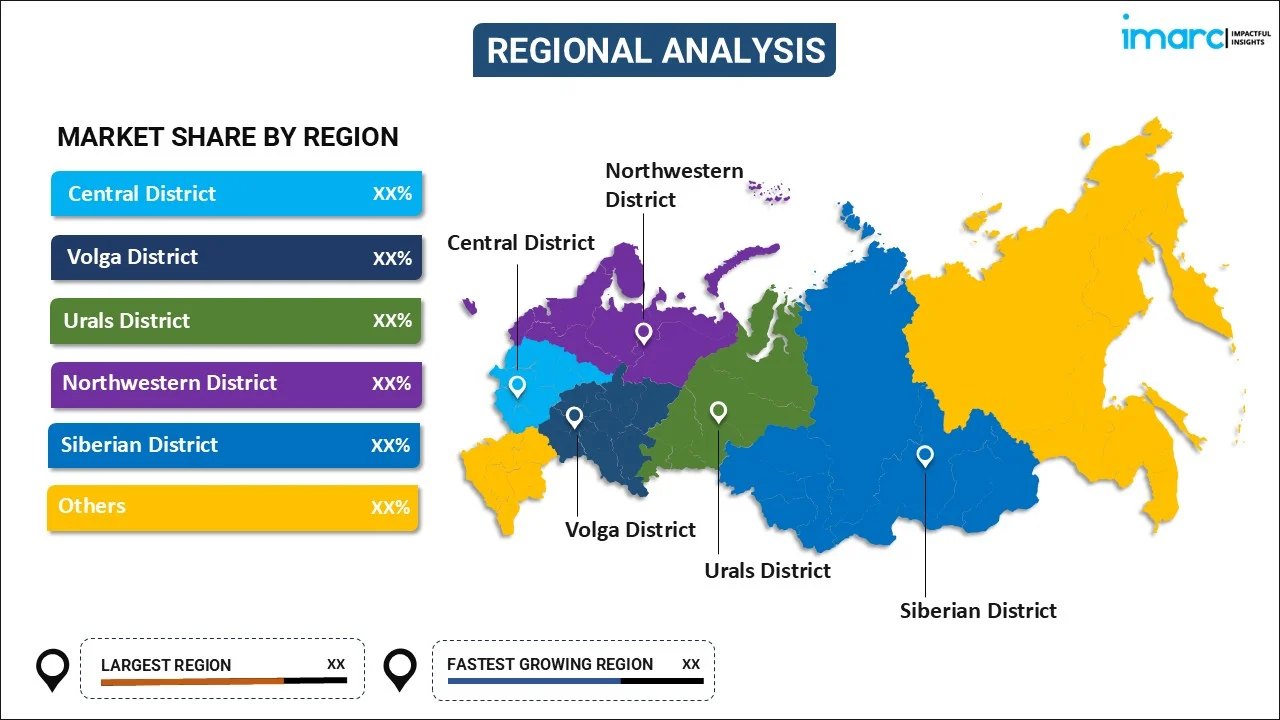

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Used Car Market News:

- In July 2024, TrueCar, Inc. launched the next generation of TrueCar+, enabling consumers to buy a car entirely online. With more than 3,200 new, used, and certified pre-owned vehicles at their fingertips, the platform provides an effortless buying experience. It combines TrueCar's vast vehicle data, accurate pricing information, and inventory from over eleven brands, with trade-in, financing, and delivery capabilities.

- In June 2024, Avito partnered with government agency Avtodor to add data on unpaid tolls for its Avtoteka used cars online inspection reports. Avtodor has a database that captures information from its network of speed and toll cameras, and this will now be used by Avito Auto. Avito will enable Avtodor to reach its millions of users through communication channels. This partnership will increase the transparency of transactions in the used car market and improve the quality and safety of services for users of Avito Auto.

Russia Used Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchbacks, Sedan, Sports Utility Vehicle, Others |

| Vendor Types Covered | Organized, Unorganized |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia used car market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia used car market on the basis of vehicle type?

- What is the breakup of the Russia used car market on the basis of vendor type?

- What is the breakup of the Russia used car market on the basis of fuel type?

- What is the breakup of the Russia used car market on the basis of sales channel?

- What is the breakup of the Russia used car market on the basis of region?

- What are the various stages in the value chain of the Russia used car market?

- What are the key driving factors and challenges in the Russia used car?

- What is the structure of the Russia used car market and who are the key players?

- What is the degree of competition in the Russia used car market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia used car market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia used car market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia used car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)