Russia Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Russia Vegan Cosmetics Market Overview:

The Russia vegan cosmetics market size reached USD 299.27 Million in 2024. Looking forward, the market is expected to reach USD 662.43 Million by 2033, exhibiting a growth rate (CAGR) of 8.27% during 2025-2033. The market is fueled by growing consumer concerns regarding animal welfare, environmental friendliness, and a rising interest in clean, plant-based product offerings. Consumers in Russia are also becoming more selective, opting for brands with transparency, ethical sourcing, and simplified formulations that suit the country's varied climate. E-commerce growth and influencer promotion have further boosted demand, particularly among youth and urban consumers, which continues to sustain the growth of the Russia vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 299.27 Million |

| Market Forecast in 2033 | USD 662.43 Million |

| Market Growth Rate 2025-2033 | 8.27% |

Russia Vegan Cosmetics Market Trends:

Consumer Shift Amid Local Sourcing and Russian Botanical Heritage

In Russia, the vegan beauty market is on the rise as consumers increasingly prefer plant-based products that tap into indigenous botanical heritage, from Siberian pine, birch sap, and sea buckthorn to chamomile and linden infusions. Russian brands are welcoming such ingredients, combining them with vegan formulations to produce products that are both exotic and culturally relatable. This domestic botanical heritage allows brands to stand out from imported clean beauty, particularly among customers who pride themselves on locally sourced ingredients. Both rural and urban communities see the growth of green consumers as a reason to place products as cruelty‑free, halal‑friendly, and vegan. Russian consumers are also known to value transparency in terms of ingredient provenance, and the use of Siberian wild‑harvested botanicals is often a signal of pure, unpolluted origins. Consequently, the Russian vegan cosmetics market is expanding via a solid combination of ethical appeals and national heritage, transforming perceptions of cruelty-free beauty in the country and providing indigenous manufacturers with an exclusive competitive edge over international competitors, which further contributes to the Russia vegan cosmetics market growth.

Retail Evolution and Online Marketplaces Across Regions

The Russian distribution scene is changing fast, with vegan beauty stretching out from high-end Moscow and Saint Petersburg shops into local retail chains and regional online stores. Although large Russian cities have had specialty organic stores and high‑end beauty boutiques for years, the popularity of e‑commerce sites, particularly those configured to deliver throughout the vast nation, has made it possible for smaller vegan makeup brands to connect with customers in Siberia, the Urals, and the Far East. It is also reinforced by customer demand from millennial and Gen Z shoppers who follow environmental influencers and seek cruelty‑free labeling. Local websites now have carefully curated vegan beauty sections, frequently highlighting homegrown startups alongside international vegan companies. Beauty box subscription and influencer‑hosted pop‑up shops also help to raise awareness, bringing cruelty‑free products to light in provinces where global players might be low or nonexistent. Therefore, Russia's vegan beauty movement extends beyond major cities, it is reaching across the country's diverse regional profile, supported by online access, moral narrative, and interest in affordable, plant‑based beauty.

Climate‑Adapted Formulation Innovation and Moral Branding

Russia's distinctive climate, varying from cold to extremes of humidity, toughens competition in vegan formulation innovation responding to local demands. Brands are creating weather-resistant moisturizers, soft cleansers, and protective serums infused with Siberian herbs, Arctic berry extracts, and adaptogenic ingredients that are formulated for skin stressed by cold, wind, or urban pollution. This creates vegan products that both perform and have regional relevance. At the same time, there's increased focus on ethical packaging innovations, like refill systems, recyclable glass jars, and minimal design, that appeals to Russian consumers increasingly concerned with environmental impact. Of the country's vegan home brands, messaging tends to connect cruelty‑free business with Russian values for preserving nature and national heritage. Russian and border state-based influencers further sustain the narrative through tutorials that highlight the ability of local botanical blends to withstand extreme weather conditions. Together, these trends situate Russia's vegan cosmetics market as one that is based on climate‑resilient science, moral storytelling, and the exceptional natural richness of Russia's landscape, establishing a sector that is both global in focus and inherently local.

Russia Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

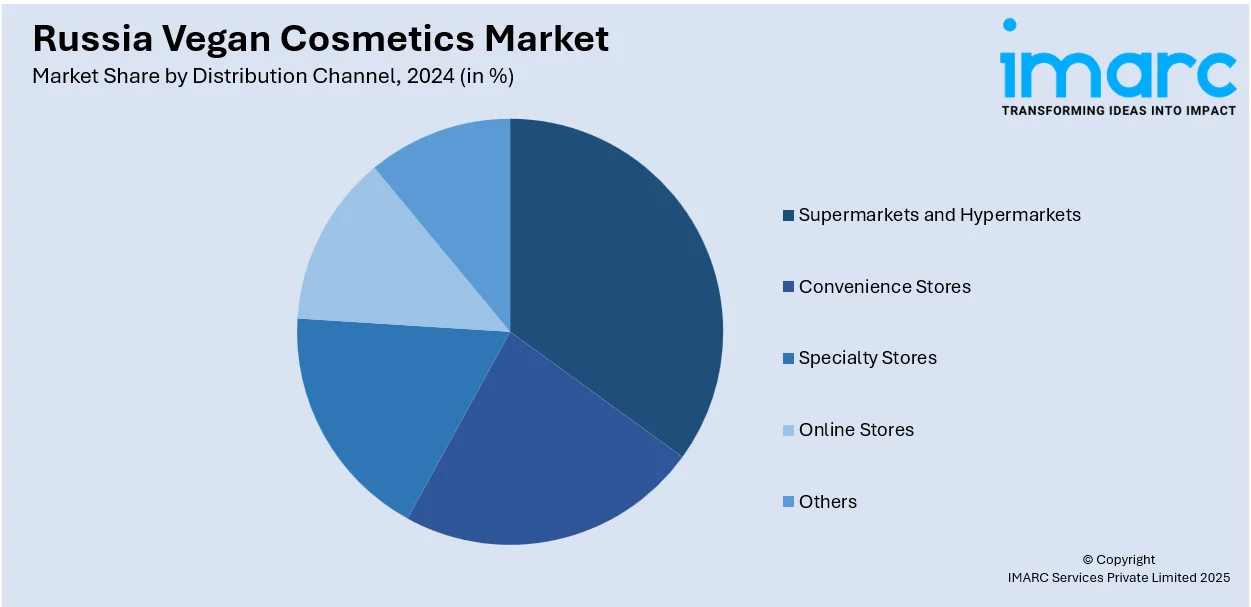

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central district, Volga district, Urals district, Northwestern district, Siberian district, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia vegan cosmetics market on the basis of product type?

- What is the breakup of the Russia vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Russia vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the Russia vegan cosmetics market?

- What are the key driving factors and challenges in the Russia vegan cosmetics market?

- What is the structure of the Russia vegan cosmetics market and who are the key players?

- What is the degree of competition in the Russia vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)