Russia Venture Capital Investment Market Size, Share, Trends and Forecast by Sector, Fund Size, Funding Type, and Region, 2025-2033

Russia Venture Capital Investment Market Size and Share:

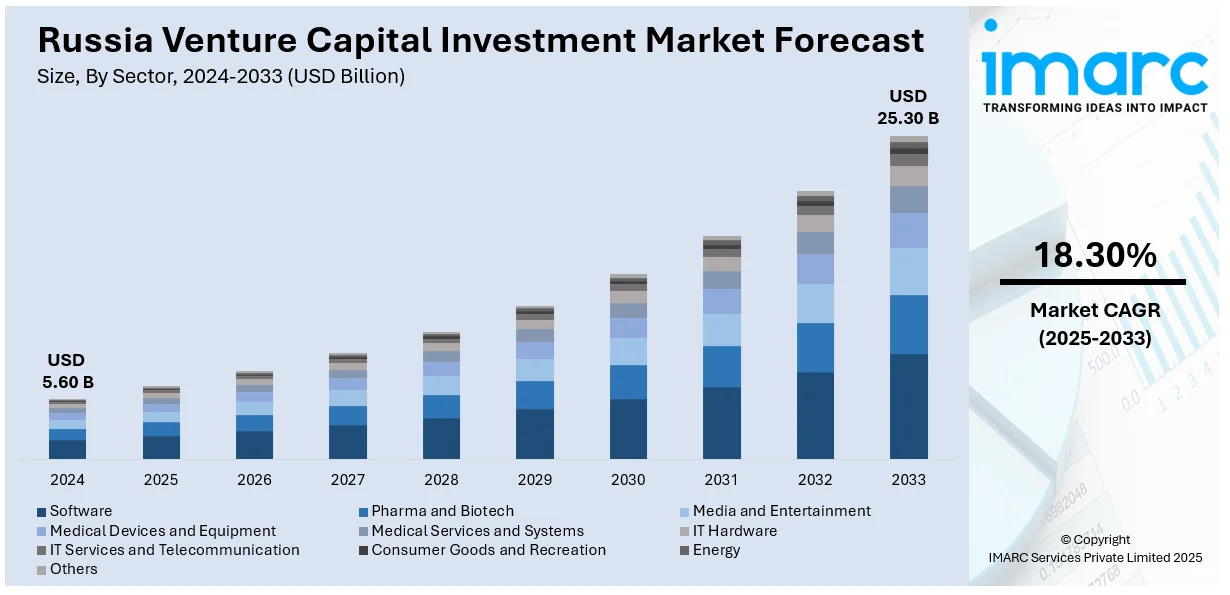

The Russia venture capital investment market size was valued at USD 5.60 Billion in 2025-2033. Looking forward, IMARC Group estimates the market to reach USD 25.30 Billion by 2033, exhibiting a CAGR of 18.30% from 2025-2033. The market is driven by a heightened focus on ESG principles, increasing deep-tech investments in AI and biotechnology, and growing regional investment outside Moscow and St. Petersburg, all supported by government initiatives and rising demand for innovation across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.60 Billion |

| Market Forecast in 2033 | USD 25.30 Billion |

| Market Growth Rate (2025-2033) | 18.30% |

The growth of the Russian market is driven by a strong focus on technological innovations and digital transformations. In line with this, expanding tech ecosystem, with a rise in startups specializing in AI, blockchain, and fintech, is making the country a prime destination for venture capital. Furthermore, government support through initiatives like tax incentives, innovation centers, and public-private partnerships further fosters private investment. Sberbank’s announcement on February 6, 2025, to collaborate with Chinese researchers on AI projects, following the success of its GigaChat model, reflects the deepening AI cooperation between Russia and China. This growing interest in sectors like healthcare, finance, and manufacturing fosters the Russia venture capital investment market growth, attracting heightened activity and increased funding in technology-driven ventures.

In addition to this, the country's highly skilled workforce and a rapidly changing tech ecosystem is impelling the market. As the number of graduates in fields like engineering, computer science, and data analytics rises, Russia is increasingly positioned as a global technology leader. In line with this, Moscow and St. Petersburg are increasingly hosting numerous startups and incubators, attracting domestic and international investors, which results in expanding the Russia venture capital investment market share. Besides this, favorable government initiatives, such as tax incentives and funding programs, further enhance the VC landscape, encouraging investment in innovative tech ventures. Notably, the 2024 XV VTB Investment Forum "RUSSIA CALLING!" in Moscow, focused on economic policies, innovation, and financial stability, with key discussions led by President Vladimir Putin and prominent financial leaders from Russia and abroad.

Russia Venture Capital Investment Market Trends:

Emphasis on Environmental, Social, and Governance (ESG) Criteria

The increasing importance of ESG factors is driving the market. Increasing global attention toward sustainability has caused investors to place greater emphasis on companies that resonate with ESG principles. The Russia venture capital market trends indicate a transition toward investing in businesses that demonstrate environmental responsibility, social impact, and sound governance structures. It is driven not only by external pressure but also by the recognition of long-term value from domestic entrepreneurs. Venture capitalists in Russia will be more likely to support companies that meet these criteria, thus offering opportunities in sectors such as green technology, responsible manufacturing, and social enterprises. ESG focus will be a leading driver of Russian venture capital (VC) market dynamics in the years to come.

Growth of Deep-Tech Investments

The Russia venture capital market outlook is focused ever more intently on deep tech sectors. Investors aim to bet their money on innovators with solutions that promise innovative growth over time. New fields, including quantum computing and artificial intelligence are attracting major funds from interested players. With disruption potential, there is rising Russian startup success related to high demands for cutting-edge technological solutions all over the globe. Deep-tech investments have now emerged as an important space that VC firms should be paying much attention to. High returns and impact across several sectors makes deep-tech very crucial in the future economic agenda of Russia. As more people begin demanding solutions at a higher technology level, the VC environment continues to shift in ways to enable the support of such progress.

Expansion of Regional Investment Beyond Moscow and St. Petersburg

The growing interest in regional startups outside Moscow and St. Petersburg is strengthening the Russia venture capital market demand. Traditionally, these cities have dominated the VC landscape, but there is now a noticeable trend toward investing in other regions such as Kazan, Yekaterinburg, and Novosibirsk. This regional diversification reflects a broader demand for untapped entrepreneurial talent and innovation beyond the major metropolitan hubs. Investors are attracted by lower operational costs, a rising pool of skilled workers, and the government’s support for regional economic development. As more businesses in these regions show potential, Russian venture capital firms are increasingly directing resources toward fostering growth and innovation in these areas. This shift is expected to fuel economic growth and help balance the VC market, providing opportunities across Russia.

Russia Venture Capital Investment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia venture capital investment market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on sector, fund size, and funding type.

Analysis by Sector:

- Software

- Pharma and Biotech

- Media and Entertainment

- Medical Devices and Equipment

- Medical Services and Systems

- IT Hardware

- IT Services and Telecommunication

- Consumer Goods and Recreation

- Energy

- Others

Expansion in the software sector of the Russia venture capital market is notable and linked to the growing demand for digital transformation across industries. Substantial investments in startups developing software solutions, enterprise solutions, cloud computing, and cybersecurity have also been witnessed. Venture capitalists have a strong interest in software solutions that target key emerging challenges within Russia, such as better e-commerce options, improved data security, and automation. The government's efforts to augments digital innovation and local software development add to the appeal of the sector. More importantly, internationalization is also an emerging trend among software startups, which raises the appeal for foreign investors in search of scalable solutions.

Russia is also attracting a great deal of interest from venture capitalists in the pharmaceutical and biotechnology sectors due to the focus that the country places on healthcare development and advancing research in medicine. Biotechnology start-ups are designing innovative solutions such as gene therapy, immunotherapy, and personalized medicine that have the potential to revolutionize healthcare. Russia's growing emphasis on innovation in the pharmaceutical sector, combined with favorable government policies and funding programs, fostering a dynamic investment environment. VC firms are attracted to the long-term potential of biotech companies, which are increasingly working on solutions to combat chronic diseases, cancer, and infectious diseases, while also benefiting from government incentives for domestic production.

The media and entertainment industry are experiencing a rise in venture capital investment, driven by the digitalization of content consumption and the increasing popularity of online platforms. Russian startups in this sector are capitalizing on the demand for digital streaming, video-on-demand services, gaming, and content creation platforms. The rise of local content creators and the growing trend of digital entertainment consumption, particularly among younger audiences, have attracted significant VC interest. Additionally, advancements in virtual reality (VR), augmented reality (AR), and gaming technologies are creating new opportunities for media startups. Government support for creative industries and infrastructure development further accelerates the sector's growth potential.

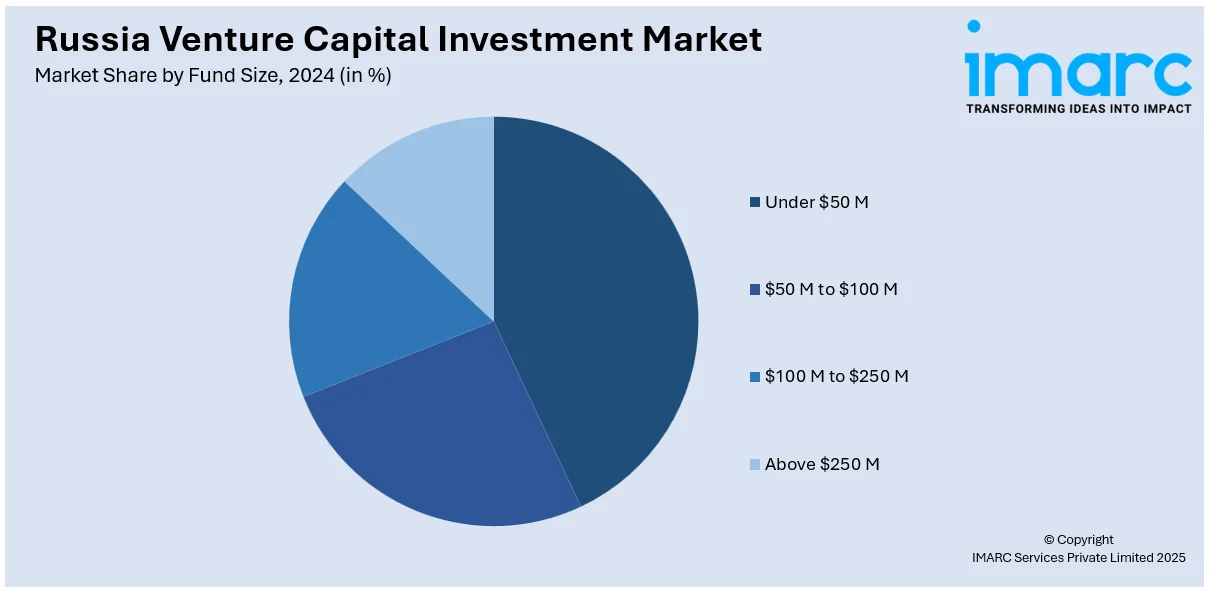

Analysis by Fund Size:

- Under $50 M

- $50 M to $100 M

- $100 M to $250 M

- Above $250 M

In the Russia market, investments under $50 million are typically directed towards early-stage startups in various sectors, including tech, fintech, and consumer goods. These investments are often aimed at companies with high growth potential but needing capital for research, product development, and market expansion. Investors in this segment often look for high returns within a short to medium-term horizon, usually through seed funding or Series A rounds. The lower investment amounts reflect the inherent risks of early-stage ventures, but also present opportunities for investors to tap into innovative ideas in their infancy, fostering long-term growth as these startups mature.

The $50 million to $100 million investment range in Russia's venture capital market typically targets growth-stage companies with proven business models and strong potential for scalability. Startups in this range have moved beyond their initial stages, demonstrating a clear market fit and often generating revenue. These investments are often focused on expanding market reach, enhancing technological capabilities, or increasing production capacity. Investors in this segment tend to take a more calculated approach, balancing potential risks with promising returns. Sectors such as software, e-commerce, and fintech commonly attract these mid-range investments as they are poised for significant market expansion and competitive advantage.

Venture capital investments ranging from $100 million to $250 million in Russia are aimed at established companies or late-stage startups that require significant capital for scaling, entering new markets, or making strategic acquisitions. These investments often target high-growth sectors like biotech, deep tech, and energy. Companies receiving such funding are usually on the cusp of rapid expansion and have demonstrated the ability to generate substantial revenues or disrupt established industries. Investors in this category tend to have a longer-term outlook and are focused on securing substantial returns through either market leadership or major exits via IPOs or acquisitions, ensuring robust growth.

Analysis by Funding Type:

- First-Time Venture Funding

- Follow-on Venture Funding

First-time venture funding in the Russia market targets early-stage startups that have innovative ideas but require capital to validate their concepts, develop products, and attract initial customers. This type of funding is often sought by founders who have minimal operational history but possess strong technical skills or domain expertise. Investors provide seed funding or Series A rounds, taking on higher risks in exchange for the potential of high returns if the startup succeeds. The Russian market has seen an increase in first-time funding, particularly in sectors like software, fintech, and deep tech, where there is growing potential for scalability and innovation. This investment is critical for startups to reach milestones that attract further capital.

Follow-on venture funding refers to the additional capital invested in startups that have already received initial funding and are looking to scale. In the Russia venture capital market, follow-on funding is often deployed in Series B or later rounds, aimed at businesses that have demonstrated growth, market fit, and an established customer base. These companies require larger funding to bolster operations, stimulate their product offerings, or enter new markets. Investors provide follow-on funding when they see continued potential for growth and profitability. This funding stage is crucial for startups to accelerate their expansion and increase their competitive advantage, making them more attractive for strategic acquisitions or IPOs.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District of Russia, which includes Moscow, is the leading hub for venture capital investment in the country. The concentration of financial institutions, tech startups, and a highly skilled workforce makes this region a prime destination for VC funding. Moscow, as the capital, is home to numerous incubators, accelerators, and innovation hubs that attract both domestic and international investors. The district benefits from strong infrastructure, a broad talent pool, and proximity to government institutions, making it an ideal location for high-growth sectors such as fintech, software development, and artificial intelligence. Venture capital in this region is expected to continue driving innovation and economic growth.

The Volga District, encompassing cities like Kazan and Nizhny Novgorod, is emerging as an increasingly attractive region for venture capital investments. This area is characterized by its growing technology sector, particularly in software development, engineering, and manufacturing. The Volga region also benefits from government-backed initiatives aimed at fostering innovation and augmenting regional entrepreneurship. With lower operational costs compared to Moscow, the region offers investors opportunities to support startups that may not be able to compete in more saturated markets. Venture capitalists are increasingly recognizing the potential in this region, as it offers both growth opportunities and a more cost-effective environment for scaling businesses.

The Urals District, which includes cities like Yekaterinburg and Chelyabinsk, has become a key area for venture capital investments in Russia, particularly in heavy industry, energy, and technology-driven manufacturing. This region boasts a strong industrial base, skilled labor, and a growing number of tech startups. The Urals is becoming increasingly attractive for VC firms looking to invest in sectors such as renewable energy, industrial automation, and advanced materials. The presence of research institutions and technological universities further boosts innovation in the region. With expanding infrastructure and favorable business conditions, the Urals is positioning itself as an emerging hub for high-tech ventures, attracting venture capital interest.

Competitive Landscape:

The competitive environment in Russia's venture capital industry is rapidly changing, with rising domestic and foreign investors seeking attractive high-growth opportunities. Increasingly, homegrown Russian VC firms are struggling to compete against foreign funds, the most promising ones include the Chinese, investors from the Middle East and Europe are attracted to the innovative sectors in Russia and its more affordable operating conditions. Domestic players are responding by focusing on niche areas such as deep-tech, biotech, and software and trying to be different with sector expertise. Corporate venture arms are also playing a larger role by partnering with startups to foster innovation while securing strategic advantages. The competition is growing as the market matures, forcing innovation and compelling Russian startups to refine their offerings and accelerate growth to meet the expectations of sophisticated investors.

The report provides a comprehensive analysis of the competitive landscape in the Russia venture capital investment market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: Balchug Capital, an Armenian investment fund, received approval to take over Goldman Sachs' Russian unit. This acquisition aligns with Armenia's growing investment footprint in Russia.

- October 2024: President Vladimir Putin visited an exhibition by the Russian Direct Investment Fund (RDIF), highlighting AI-driven projects from companies like Motorika and NtechLab. During the event, RDIF proposed establishing a BRICS investment platform and an AI alliance, aiming to significantly enhance mutual investments and secure leading positions in artificial intelligence among BRICS nation which enhances cross-border funding, thereby strengthening Russia’s venture ecosystem.

Russia Venture Capital Investment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Software, Pharma and Biotech, Media and Entertainment, Medical Devices and Equipment, Medical Services and Systems, IT Hardware, IT Services and Telecommunication, Consumer Goods and Recreation, Energy, Others |

| Fund Sizes Covered | Under $50 M, $50 M to $100 M, $100 M to $250 M, Above $250 |

| Funding Types Covered | First-Time Venture Funding, Follow-on Venture Funding |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia venture capital investment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia venture capital investment market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia venture capital investment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia venture capital investment market was valued at USD 5.60 Billion in 2024.

The growth of the Russia market is largely driven by a strong focus on technological innovation, increasing investments in deep-tech sectors like AI and biotech, supportive government initiatives, expanding regional investments, and the rising demand for sustainable practices aligned with ESG principles, fostering long-term market development.

The Russia venture capital investment market is projected to reach a value of USD 25.30 Billion by 2033, growing at a CAGR of 18.30% from 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)