Ruthenium Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Ruthenium Price Trend, Index and Forecast

Track real-time and historical ruthenium prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Ruthenium Prices October 2025

| Region | Price (USD/Kg) | Latest Movement |

|---|---|---|

| Global | 33,441.08 | 1.5% ↑ Up |

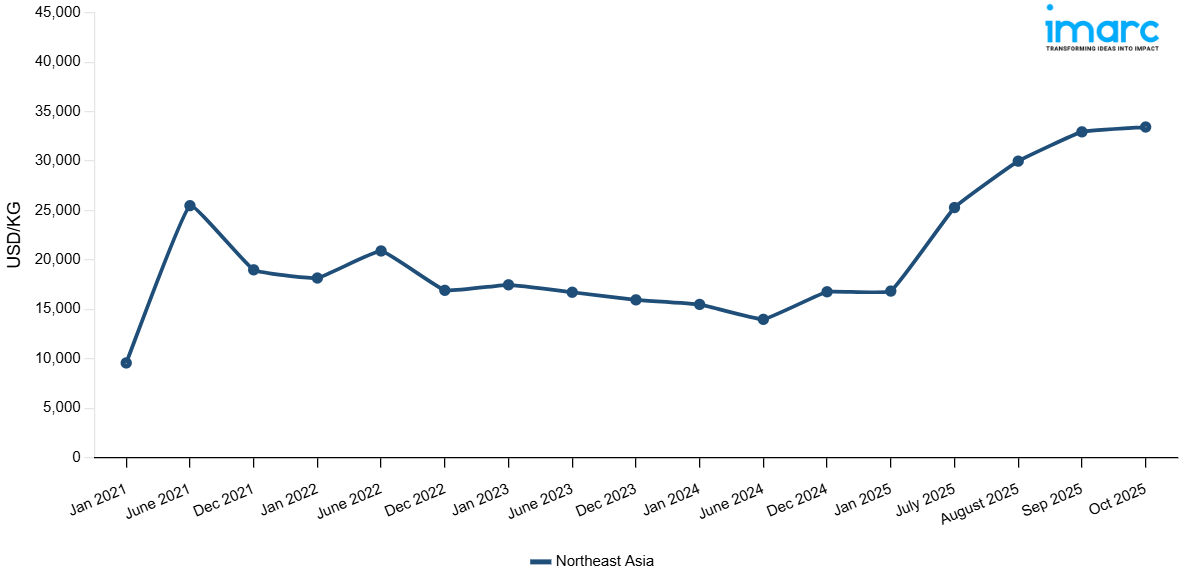

Ruthenium Price Index (USD/KG):

The chart below highlights monthly ruthenium prices across different regions.

Get Access to Monthly/Quaterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Global: On a global scale, the upward movement in ruthenium prices reflects tightening supply and resurgent industrial demand. Supply constraints, stemming from its derivation as a byproduct of platinum and nickel mining, amplified price sensitivity to even modest demand shifts. At the same time, growing applications in electronics, data storage, and clean energy reinforced buyer urgency and inventory restocking. The steep upward shift signals that market participants responded to both structural scarcity and renewed downstream pressure.

Ruthenium Price Trend, Market Analysis, and News

IMARC's latest publication, “Ruthenium Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the ruthenium market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of ruthenium at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed ruthenium prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting ruthenium pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

.webp)

Ruthenium Industry Analysis

The global ruthenium industry size reached 32.13 Tons in 2024. By 2033, IMARC Group expects the market to reach 44.90 Tons, at a projected CAGR of 3.61% during 2025-2033. The market is driven by rising demand in the electronics sector, particularly for data storage and chip components, alongside growing usage in chemical catalysis and energy applications such as fuel cells and electrolysis. Its limited supply as a byproduct metal further amplifies its strategic importance across high-tech and clean energy industries.

Latest developments in the Ruthenium Industry:

- June 2025: A recent study included photochemical ligand-based CO2 reduction mediated by ruthenium formyl species. The findings help in developing ligand-based hydride transfer mechanisms and establishing a foundation for the rational design of selective CO2 reduction catalysts.

- May 2024: Implats announced its partnership with Siyanda Resources Proprietary Limited (Siyanda Resources), which will lead the participation of the strategic empowerment consortium.

- July 2023: Vale signed a binding agreement with Manara Minerals, a joint venture between Ma’aden and Saudi Arabia's Public Investment Fund, under which Manara Minerals will invest in Vale Base Metals Limited (VBM), the holding entity for Vale’s energy transition metals business, at an implied enterprise value of US$ 26 billion.

Product Description

Ruthenium is a member of the platinum-group metals valued for its unique electrical, catalytic, and chemical stability characteristics. In electronics, it is used in thin‑film resistors, hard disk platters, and electrical contacts for its durability and conductivity. In catalysis, ruthenium supports key reactions in chemical and energy sectors, including hydrogenation, metathesis, and electrode applications in electrolysis. As demand intensifies, especially in data center expansion and green energy infrastructure, ruthenium commands attention as a critical specialty metal with volatile, demand-driven pricing dynamics.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Ruthenium |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ruthenium Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of ruthenium pricing, covering global and regional trends, spot prices at key ports, and a breakdown of ex-works, FOB, and CIF prices.

- The study examines factors affecting ruthenium price trend, including supply-demand shifts and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The ruthenium price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The ruthenium prices in October 2025 were 33,441.08 USD/KG globally.

The ruthenium pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for ruthenium prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)