Sardine Market Size, Share, Trends and Forecast by Species, Type, Distribution Channel, and Region, 2025-2033

Sardine Market Size and Share:

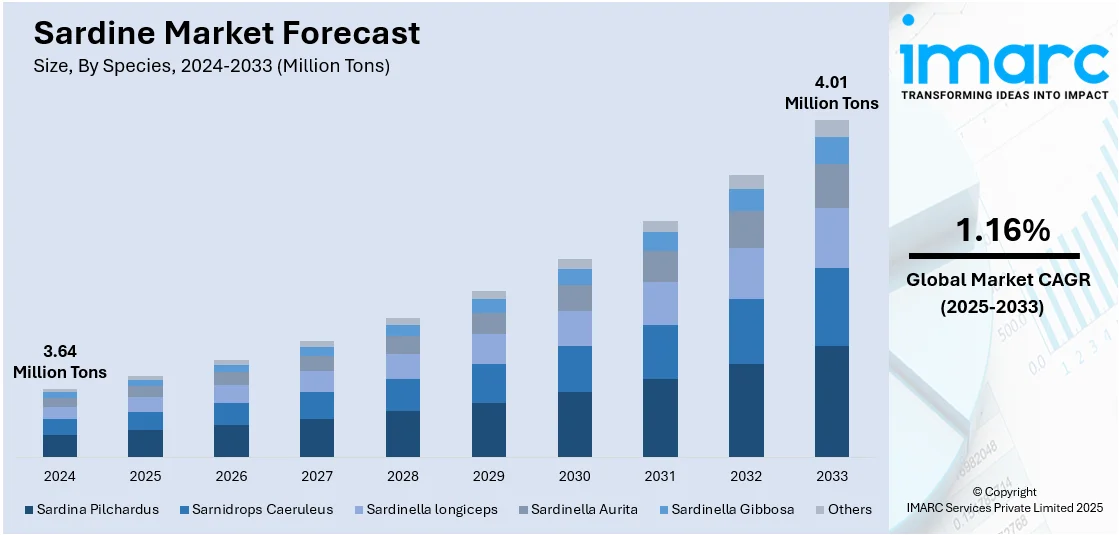

The global sardine market size was valued at 3.64 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 4.01 Million Tons by 2033, exhibiting a CAGR of 1.16% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 40.0% in 2024. The market is growing due to the increasing awareness among consumers about the health benefits of sardine, including their high content of omega-3 fatty acids, which has fueled demand for the fish as a healthy food option. Additionally, the increasing popularity of sustainable and responsibly sourced seafood products has encouraged producers and consumers alike to focus on environment-friendly practices in sardine fishing. Moreover, packaging innovations, including extended shelf-life products, and the growth of online shopping platforms have also helped to increase the popularity of the sardine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 3.64 Million Tons |

| Market Forecast in 2033 | 4.01 Million Tons |

| Market Growth Rate (2025-2033) | 1.16% |

The sardine industry is being driven by convergence of health, sustainability, and convenience trends. Increased consumer consciousness regarding the health benefits of sardines due to their content of omega-3 fatty acids, calcium, protein, and vitamins has placed them in higher demand among consumers of health-oriented food. The contribution of sardines toward cardiovascular health as well as mental functioning makes them a sought-after commodity in developed as well as developing economies. Sustainability is also a key driver, as sardines are one of the more sustainable seafood choices because they are so plentiful and have a short food chain. This fits with increasing global demand for sustainable diets and sustainable fishing practices. Moreover, advances in canning technology and packaging have improved shelf life and increased product appeal. The convenience of ready-to-consume sardine products is well adapted to busy lifestyles, and online shopping and international trade have made it more accessible. These trends combined are driving both higher consumer demand and increased investment in sardine processing and distribution facilities.

The United States stands out as a key market disruptor, driven by its changing consumer tastes, regulatory environments, and import dynamics. Historically not a prominent consumer of sardines, the U.S. is witnessing renewed demand for the product on account of health trends focusing on clean eating, omega-3 consumption, and environmentally friendly sources of protein. This rising demand is impacting global supply chains, as the U.S. increasingly imports sardines from major producers such as Morocco, Portugal, and the Philippines. American food firms are also experimenting with value-added and flavored sardine products that find a wider audience and alter market expectations worldwide. U.S. regulatory requirements for sustainability and food safety also compel exporters to improve quality standards. As U.S. retailers and online shopping platforms introduce shelf-stable, wholesome seafood options, the sardine's revival is changing demand patterns globally. This disruption brings with it challenges and opportunities for established producers who want to satisfy the expectations of a health-oriented U.S. market.

Sardine Market Trends:

Growth of Nutritional Awareness and Health Consciousness

Sardines are viewed as a nutritional powerhouse, loaded with vital nutrients such as omega-3 fatty acids, protein, calcium, and vitamin D. With an increasing number of people becoming aware of their food choices and looking for healthier alternatives, sardines have risen in popularity as a practical and easy source of these essential nutrients. The omega-3 fatty acids found in sardines are especially valued for their established advantages in enhancing heart health, decreasing inflammation, and aiding brain function. The Global Wellness Institute reports that the worldwide wellness economy hit USD 6.3 Trillion in 2023 and is expected to expand to USD 9 Trillion by 2028, indicating a notable transition towards preventive health, nutrition, and overall wellness. Furthermore, the soft, consumable bones of sardines are a fantastic source of calcium, appealing to those aiming to fortify their bones and avoid osteoporosis. With consumers placing greater emphasis on health and wellness, the appetite for sardines as a healthy food option is anticipated to keep fueling expansion in the sardine industry.

Sustainable Fishing Practices and Environmental Concerns

Sardines play an essential role in ocean ecosystems, acting as food for bigger fish and marine mammals. Excessive fishing and unsustainable collection of sardines can disturb these ecosystems and negatively impact marine biodiversity. According to Rare, nearly 500 million people worldwide are depending on small-scale fisheries or participate in them for subsistence, highlighting the importance of preserving marine resources for ecological balance and for livelihoods and food security. The increasing environmental awareness and worries regarding overfishing, numerous nations and organizations have established regulations and quotas to encourage sustainable sardine fishing. Shoppers are increasingly likely to select items that have eco-friendly certifications, like the Marine Stewardship Council (MSC) label, which guarantees that the sardines have been sustainably sourced. Firms in the sardine industry are progressively embracing sustainable fishing methods and clear supply chains to satisfy consumer needs for ethical and eco-friendly products. This emphasis on sustainability aids the environment and improves the reputation and market appeal of these products.

Diverse Culinary Applications and Globalization of Food Culture

Sardines have a rich history of incorporation into diverse cuisines globally, ranging from Mediterranean recipes to Asian specialties. The adaptability of sardines in various cooking methods, including grilling, frying, smoking, or canning, renders them a desirable ingredient for both chefs and home cooks. With the growth of international travel and cultural exchange, people encounter diverse culinary practices, and sardines frequently appear in fusion recipes that blend tastes from multiple areas. As reported by UN Tourism, approximately 1.4 billion international travelers journeyed in 2024, fostering a cross-cultural culinary exchange that has enhanced the visibility of traditional ingredients such as sardines. Additionally, the ease of using canned sardines has rendered them a favored option for quick and simple meals, boosting their popularity. As consumers grow bolder in their food choices and search for novel flavors, the sardine market gains from this shift. The global spread of food culture and the eagerness to try sardines in various dishes enhances the sardine market growth, as they increasingly feature in a variety of cuisines around the globe.

Sardine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sardine market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on species, type, and distribution channel.

Analysis by Species:

- Sardina Pilchardus

- Sarnidrops Caeruleus

- Sardinella longiceps

- Sardinella Aurita

- Sardinella Gibbosa

- Others

Sardina Pilchardus stands as the largest component in 2024, holding around 34.5% of the market. Sardina pilchardus is renowned for its delicious flavor, which blends a unique, rich taste with a soft and juicy texture. The distinctive taste of Sardina Pilchardus distinguishes them and plays a crucial role in their market supremacy. Additionally, Sardina Pilchardus serve as a primary catch for commercial fisheries, since they can be collected in significant numbers during their peak seasons. Their prevalence in specific areas, along with their appropriateness for canning and transforming into various products like sardines in oil or tomato sauce, reinforces their position as the largest segment in the sardine market. These canned sardines have an extended shelf life, allowing them to be available to customers globally. Moreover, the adaptability of Sardina Pilchardus goes further than just canned goods. They are likewise utilized in the creation of fishmeal and fish oil, which are essential elements in aquaculture and livestock feed.

Analysis by Type:

- Canned Sardine

- Frozen Sardine

- Fresh Sardine

Canned Sardine leads the market with around 45.0% of market share in 2024. Canning maintains the taste and freshness of sardines, letting consumers relish them throughout the year, no matter the seasonal supply. This aspect of convenience fits seamlessly with contemporary lifestyles, where the value of time-efficient meal preparation is greatly appreciated. Additionally, canned sardines are recognized for being inexpensive. They offer an affordable source of top-notch protein, omega-3 fatty acids, and various vital nutrients, making them appeal to cost-sensitive buyers. They frequently appear as an affordable protein option that maintains both nutrition and flavor. Additionally, canned sardines are very easy to carry, which makes them a practical snack or meal choice for individuals who are忙. Their small packaging makes them a perfect option for picnics, hiking, camping, or as a fast office meal. The convenient availability of canned sardines in grocery stores and convenience shops further strengthens their market dominance.

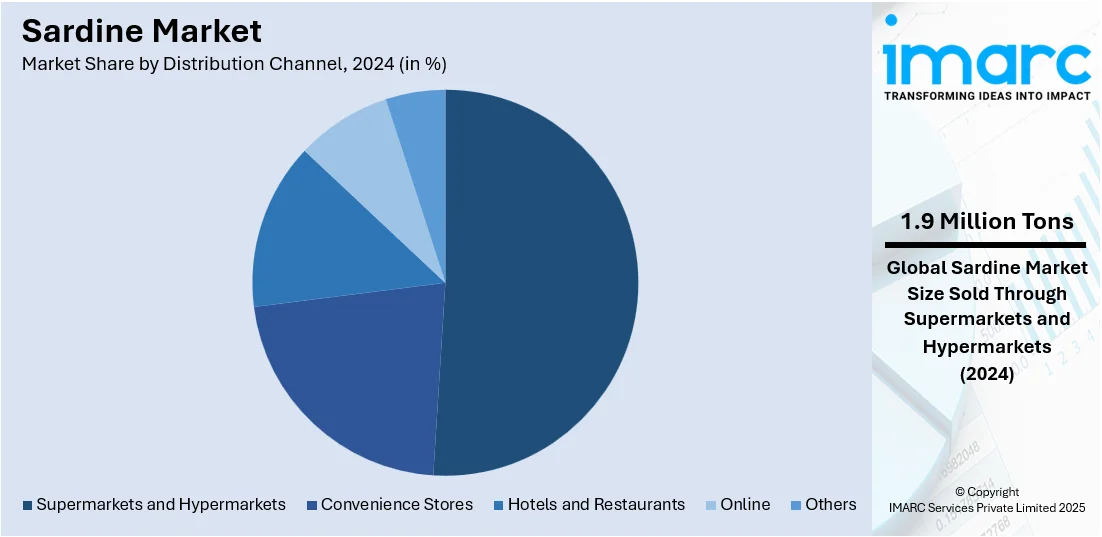

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Hotels and Restaurants

- Online

- Others

Supermarkets and hypermarkets lead the market with around 50.8% of market share in 2024. Supermarkets and hypermarkets provide a wide variety of products all in one place, giving shoppers exceptional convenience. Consumers can discover a range of sardine brands, flavors, and packaging choices conveniently arranged on shelves, facilitating straightforward comparison and selection. This wide range of products meets the varied tastes of customers, whether they seek canned sardines, fresh sardines, or sardine-derived items like spreads and snacks. Additionally, the extensive storage capacity and refrigeration systems in supermarkets and hypermarkets guarantee that sardine products remain fresh and properly preserved, upholding their quality and flavor. This is essential because sardines are frequently perishable and require suitable storage conditions to stay attractive to buyers. The rise of supermarkets and hypermarkets is also due to their capacity to provide competitive prices. These retailers take advantage of economies of scale and significant negotiating leverage with suppliers, enabling them to offer sardine products at attractive prices.

Analysis by Region:

- Asia Pacific

- Middle East and Africa

- Americas

- Europe

In 2024, Asia-Pacific accounted for the largest market share of over 40.0%. The Asia Pacific area has risen as a leading power in sardine production, exerting considerable control over the distribution of this vital seafood resource. The area's dominance in sardine production can be linked to various essential factors that have come together to establish a conducive setting for sardine fisheries to thrive. Moreover, the strong infrastructure and cutting-edge technology in the Asia Pacific area have enhanced sardine production capacity. Contemporary fishing boats, advanced processing plants, and robust supply networks facilitate the prompt and efficient capture, storage, and delivery of sardines to both local and global markets. Moreover, government initiatives and favorable regulations have also played a role in the leading position of the Asia Pacific region in sardine production. Numerous governments have acknowledged the economic significance of the fishing sector and have adopted initiatives to promote sustainable fishing methods and the protection of sardine stocks.

Key Regional Takeaways:

United States Sardine Market Analysis

In 2024, the United States accounted for over 79.80% of the sardine market in North America. The U.S. sardine market is growing due to increased awareness about its nutritional value, a shift toward protein-rich, shelf-stable food, evolving dietary preferences, product diversification, innovative packaging formats, and sustainability trends. Consumers are increasingly choosing health-conscious and Mediterranean diets, while product diversification and innovative packaging formats enhance appeal in urban markets. The expansion of distribution channels, including specialty food retailers and e-commerce, is further boosting the visibility and accessibility of sardine products. Additionally, rising interest in low-carb and keto-friendly foods continues to create favorable conditions for sardine consumption. The market's expansion is also supported by ongoing promotional efforts and nutritional awareness campaigns. Notably, fish featured on around 75% of U.S. restaurant menus in 2024, according to Seafoodsource, indicating a strong presence of seafood in out-of-home dining. This further reinforces the visibility and relevance of sardine-based offerings. As consumers increasingly seek natural, high-protein, and low-calorie food options, the sardine segment is poised for continued relevance in the evolving food landscape. The sardine market outlook remains positive, with steady volume and value growth anticipated across the retail and food service sectors over the coming years.

Europe Sardine Market Analysis

The European sardine market reflects a mature yet dynamic segment of the seafood industry. Demand is supported by a well-established tradition of sardine consumption and a strong preference for nutrient-rich and sustainable seafood options. Increasing emphasis on heart-healthy diets and eco-friendly food sourcing continues to influence consumer behavior. Convenience remains a key factor, with ready-to-eat and preserved sardine products gaining traction across multiple retail formats. Urban populations are increasingly incorporating sardines into regular diets due to their affordability and nutritional benefits. Notably, Denmark leads the way with 6% pescatarians, contributing to the 38% of Europeans, according to ProVeg International. This dietary shift is reinforcing the appeal of seafood alternatives like sardines. Moreover, evolving packaging techniques and innovative product offerings are driving renewed interest in sardine-based meals. The market, bolstered by robust domestic processing, integrated distribution, seasonal promotions, health-oriented marketing, and growing demand for clean-label, protein-rich foods, is expected to witness steady growth.

Asia Pacific Sardine Market Analysis

The Asia Pacific sardine market is growing due to rising health awareness, disposable incomes, and dietary preferences. Sardines, known for their nutritional value and long shelf life, are becoming popular among working-class consumers. Expanding retail networks, cold chain logistics, health awareness campaigns, and cultural acceptance contribute to stable demand. Government initiatives are also playing a key role in strengthening the regional seafood ecosystem. As per the Ministry of Fisheries, Animal Husbandry & Dairying, an investment of ₹179.81 crores is being made in five integrated aqua parks across India to enhance the fisheries value chain and optimize production. Such infrastructure development is expected to support processing efficiency and supply chain reliability, benefiting sardine availability and market competitiveness. As consumer preferences evolve toward easy-to-prepare and nutrient-dense foods, sardines are becoming increasingly integrated into daily consumption patterns. Continued investments in packaging innovation and supply chain optimization are expected to support market growth in the years ahead.

Latin America Sardine Market Analysis

The sardine market in Latin America is expanding due to rising demand for nutritious, affordable protein options, shelf-stable seafood products, and ease of preparation, particularly in regions with limited refrigeration access. Regional dietary patterns that include fish consumption are further reinforcing demand. Significantly, Brazil's aquaculture industry experienced remarkable growth in exports in 2024, with export values rising by 138% compared to 2023, totaling USD 59 Million, according to Seafood Media. This surge reflects a broader regional momentum in seafood production and distribution, indirectly supporting sardine availability and market activity. Sardines remain relevant in daily diets due to improved distribution systems, health-oriented diets, convenient packaging, and rising demand for practical and value-oriented food options.

Middle East and Africa Sardine Market Analysis

The Middle East and Africa sardine market is experiencing growth due to changing consumption patterns, rising demand for affordable protein, and the popularity of nutrient-dense seafood products. Modern retail outlets and improved supply chains are enhancing product visibility and availability. Growing health awareness is also driving consumer interest in naturally rich food sources like sardines. Regional initiatives are also playing a role in strengthening the sector. For instance, Mali's Ministry of Livestock and Fisheries, in January 2025, announced a significant investment of USD 11.1 Million to boost the country's fisheries sector, a move poised to benefit the sardine market. Such targets are expected to boost local seafood availability and support broader market expansion across the region. As the market evolves, the sardine market forecast is expecting continued emphasis on convenience and nutritional benefits, which will support its steady growth trajectory.

Competitive Landscape:

Numerous large corporations are implementing sustainable fishing methods to tackle issues related to overfishing and safeguard marine environments. They might pursue certifications from governmental agencies to showcase their dedication to responsible sourcing. Businesses are broadening their product ranges to meet various consumer tastes. This involves providing sardines in various flavors, sauces, and packaging types to attract a larger audience. Moreover, top companies are significantly investing in quality assurance processes and follow stringent food safety guidelines to guarantee that their sardine offerings meet elevated industry benchmarks. Businesses are creating innovations by launching new products made from sardines, including spreads, snacks, and ready-to-eat dishes. These advancements address evolving consumer habits and desires. Additionally, businesses are leveraging technology to inform consumers about the source of their sardine products, fostering transparency and responsibility.

The competitive landscape of the market has been studied in the report with the detailed profiles of the key players operating in the market.

Latest News and Developments:

- March 2025: Tanzanian renewable energy company Millennium Engineers Ltd. introduced solar-powered fishing lamps and greenhouse drying facilities around Lake Victoria. The project aims to reduce drying times from 12 to five hours, cut fishermen's costs by 40%, and improve product hygiene.

- February 2025: US-based Patagonia Provisions launched a new line of tinned sardines and beans, available exclusively at Whole Foods outlets. This announcement tapped into the "beans and 'dines" trend, combining sardines with plant-based proteins to meet consumer demand for convenient, high-protein, and fiber-rich foods.

- February 2025: TradeDepot, a Nigerian B2B e-commerce platform, launched its own food brand, Mangrove, to produce and distribute affordable food items, including sardines.

- October 2024: American seafood firm Bumble Bee Seafoods launched 11 new products, including sardines, tuna, salmon, shrimp, and snack kits.

- August 2024: UK-based retail company Morrisons inaugurated a GBP 12.8 million Falfish Freezing Center. Capable of individually quick freezing up to 180 tons of sardines and other fish daily, the center is expected to triple sardine processing capacity within two years.

Sardine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons, Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Species Covered | Sardina Pilchardus, Sardinops Caeruleus, Sardinella Iongiceps, Sardinella Aurita, Sardinella Gibbosa, Others |

| Types Covered | Canned Sardine, Frozen Sardine, Fresh Sardine |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Hotels and Restaurants, Online, Others |

| Regions Covered | Asia Pacific, Middle East and Africa, Americas, Europe |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sardine market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sardine market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sardine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sardine market was valued at 3.64 Million Tons in 2024.

The sardine market is projected to exhibit a CAGR of 1.16% during 2025-2033, reaching a value of 4.01 Million Tons by 2033.

The global sardine market is experiencing growth driven by sustainable fishing practices and responsible sourcing, which is gaining importance among environmentally conscious consumers. The rise of e-commerce platforms has further expanded accessibility to sardine products. Moreover, innovations in packaging and flavor variations are enhancing product appeal, while the growing popularity of ready-to-eat meals supports market expansion.

Asia Pacific currently dominates the sardine market, driven by rising health awareness, increasing seafood consumption, and innovations in packaging and product offerings. Sardines are valued for their nutritional benefits, including omega-3 fatty acids and vitamins. The growing middle class and urbanization in countries like China and India further propel demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)