Saudi Arabia 2-Ethylhexanol (2-EH) Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Saudi Arabia 2-Ethylhexanol (2-EH) Market Overview:

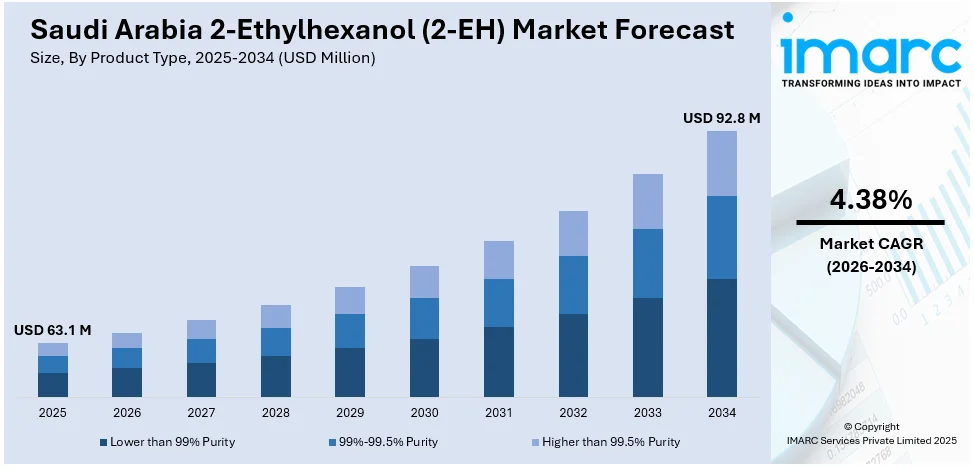

The Saudi Arabia 2-ethylhexanol (2-EH) market size reached USD 63.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 92.8 Million by 2034, exhibiting a growth rate (CAGR) of 4.38% during 2026-2034. The heightened demand for plasticizers, mainly for the manufacturing of polyvinyl chloride (PVC) products, is impelling the market growth. The Vision 2030 program of the country aimed at diversifying the economy and decreasing dependence on oil is also promoting the development of non-oil sectors, such as chemicals and petrochemicals. Moreover, the growing innovation in formulation of lubricants for vehicles and coatings are expanding the Saudi Arabia 2-ethylhexanol (2-EH) market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 63.1 Million |

| Market Forecast in 2034 | USD 92.8 Million |

| Market Growth Rate 2026-2034 | 4.38% |

Saudi Arabia 2-Ethylhexanol (2-EH) Market Trends:

Growing Demand in Plasticizers Industry

The market for 2-ethylhexanol (2-EH) is experiencing rapid growth in Saudi Arabia with the heightened demand for plasticizers, mainly for the manufacturing of polyvinyl chloride (PVC) products. The application of 2-EH as a major ingredient in plasticizers is constantly on a rise, fueled by the growing demand for flexible, long-lasting materials in different industries, such as construction, automotive, and packaging. While the region is focusing on urban developments, there is greater demand for materials used in construction that require top-grade plasticizers, which in turn are manufactured from 2-EH. This trend is driving the market, with industry players working at full capacity to boost production volumes to keep pace with demand for these critical additives. The persistent investment in infrastructure and real estate projects, in addition to the increasing use of PVC pipes in the construction industry, are impelling the market growth. The IMARC Group predicts that the Saudi Arabia PVC pipes market size is expected to reach USD 1,823.8 Million by 2033.

To get more information on this market Request Sample

Chemical Industry and Industrial Innovations

Saudi Arabia's chemical sector is constantly driving the demand for 2-EH, as it plays a vital role as an intermediate in the manufacture of several chemicals, such as surfactants, lubricants, and coatings. The Vision 2030 program of the country, aimed at diversifying the economy and decreasing dependence on oil, is promoting the development of non-oil sectors, such as chemicals and petrochemicals. With growing investments in the construction of chemical manufacturing plants, Saudi Arabia is emerging as a top specialty chemical producer in the Middle East. This constant industrialization is leading to greater use of 2-EH as an important raw material for the production of a variety of industrial products. Therefore, this is an increase in the demand for 2-EH both in local markets and exports, making Saudi Arabia a major player in the international chemical supply chain. The Saudi Arabia specialty chemicals market size is expected to reach USD 10,456.9 Million by 2033, according to the predictions of the IMARC Group.

Rising Demand in Automotive and Coatings Sectors

The increasing demand for 2-EH in the coatings and automotive sectors is contributing to the Saudi Arabia 2-ethylhexanol (2-EH) market growth. 2-EH finds extensive use in the formulation of lubricants for vehicles and coatings because of its capacity to improve product durability and performance. The continuous innovations in the automotive industry in Saudi Arabia, driven by increased demand for cars and the incentives provided by the government for local production, is facilitating the adoption of high-performance lubricants and coatings to pick up. In addition, the increase in demand for decorative and protective coatings in construction and auto applications is supporting the market growth. Owing to the persisting developments within these sectors, demand for 2-EH as a crucial material in developing high-performance coatings continues to rise and is aiding in the country's overall market growth in Saudi Arabia. The Saudi Arabian paints and coatings market size is projected to attain USD 2,106.0 Million by 2033, stated by the IMARC Group.

Saudi Arabia 2-Ethylhexanol (2-EH) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and application.

Product Type Insights:

- Lower than 99% Purity

- 99%-99.5% Purity

- Higher than 99.5% Purity

The report has provided a detailed breakup and analysis of the market based on the product type. This includes lower than 99% purity, 99%-99.5% purity, and higher than 99.5% purity.

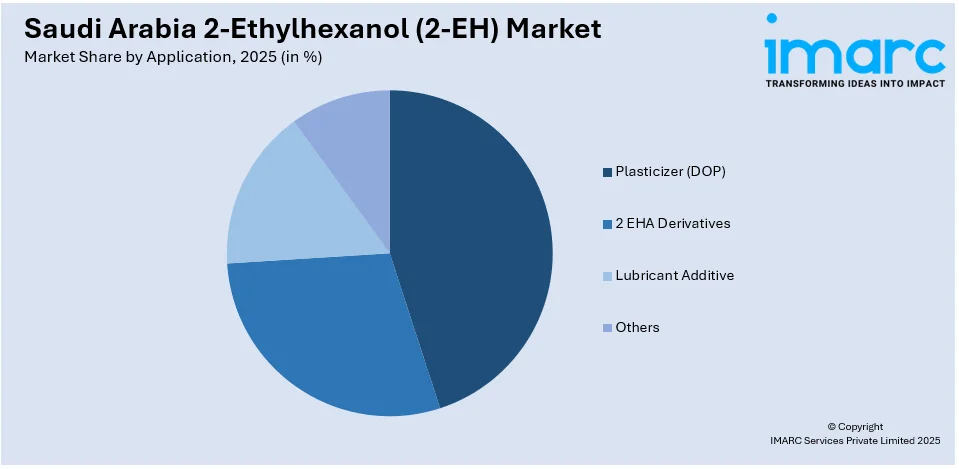

Application Insights:

Access the comprehensive market breakdown Request Sample

- Plasticizer (DOP)

- 2 EHA Derivatives

- Lubricant Additive

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes plasticizer (DOP), 2 EHA derivatives, lubricant additive, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia 2-Ethylhexanol (2-EH) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lower than 99% Purity, 99%-99.5% Purity, Higher than 99.5% Purity |

| Applications Covered | Plasticizer (DOP), 2 EHA Derivatives, Lubricant Additive, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia 2-ethylhexanol (2-EH) market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia 2-ethylhexanol (2-EH) market on the basis of product type?

- What is the breakup of the Saudi Arabia 2-ethylhexanol (2-EH) market on the basis of application?

- What is the breakup of the Saudi Arabia 2-ethylhexanol (2-EH) market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia 2-ethylhexanol (2-EH) market?

- What are the key driving factors and challenges in the Saudi Arabia 2-ethylhexanol (2-EH) market?

- What is the structure of the Saudi Arabia 2-ethylhexanol (2-EH) market and who are the key players?

- What is the degree of competition in the Saudi Arabia 2-ethylhexanol (2-EH) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia 2-ethylhexanol (2-EH) market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia 2-ethylhexanol (2-EH) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia 2-ethylhexanol (2-EH) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)