Saudi Arabia 3D Sensors Market Size, Share, Trends and Forecast by Type, Technology, End User, and Region, 2026-2034

Saudi Arabia 3D Sensors Market Summary:

The Saudi Arabia 3D sensors market size was valued at USD 56.60 Million in 2025 and is projected to reach USD 217.43 Million by 2034, growing at a compound annual growth rate of 16.13% from 2026-2034.

The Saudi Arabia 3D sensors market is advancing rapidly, driven by the Kingdom's commitment to industrial modernization and smart infrastructure development. Growing adoption across the manufacturing, automotive, and healthcare sectors reflects increasing demand for precision depth-sensing technologies. Government-led digital transformation initiatives and expanding automation ecosystems are fostering innovations, positioning the Kingdom as a regional hub for advanced sensing solutions and technological excellence.

Key Takeaways and Insights:

- By Type: Image sensor dominates the market with a share of 46% in 2025, owing to its extensive utilization in consumer electronics, automotive safety systems, and industrial automation applications. Growing demand for facial recognition and augmented reality (AR) technologies is fueling the market expansion.

- By Technology: Projected light/structured light leads the market with a share of 32% in 2025. This dominance is driven by superior precision in depth sensing, widespread adoption in quality control processes, and increasing integration into industrial inspection systems.

- By End User: Industrial comprises the largest segment with a market share of 25% in 2025, reflecting the Kingdom's strategic focus on manufacturing modernization and factory automation aligned with Vision 2030 industrial transformation objectives.

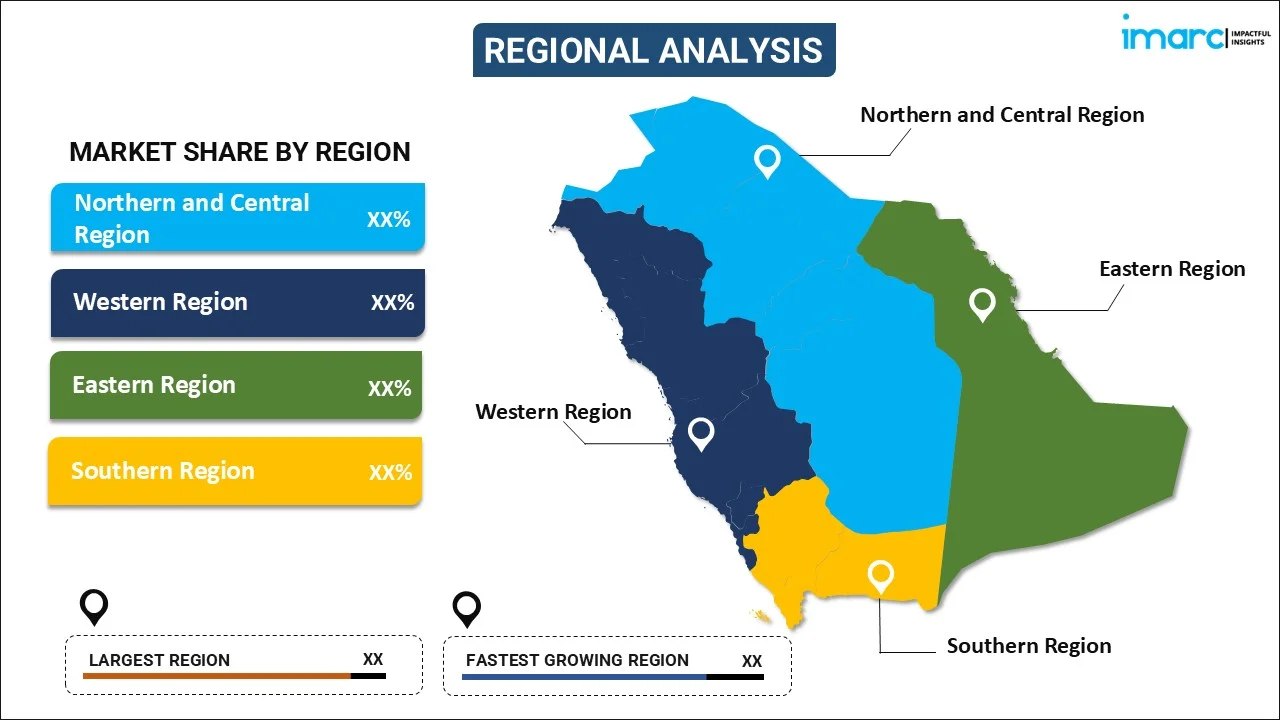

- By Region: Northern and Central Region represents the largest region with 29% share in 2025, driven by Riyadh's concentration of technology companies, manufacturing facilities, and government-backed innovation initiatives supporting digital transformation.

- Key Players: Key players drive the Saudi Arabia 3D sensors market by expanding product portfolios, enhancing sensor accuracy, and strengthening regional distribution networks. Their investments in research and development (R&D) activities, strategic partnerships with technology providers, and focus on customized solutions boost adoption across the industrial, automotive, and consumer sectors.

The Saudi Arabia 3D sensors market is experiencing robust growth, as the Kingdom accelerates its technological transformation agenda. The integration of advanced sensing technologies into industrial processes, smart city infrastructure, and automotive applications reflects a strategic commitment to building a knowledge-based economy. Manufacturing facilities across the Kingdom are increasingly deploying 3D sensing solutions for quality control, robotic guidance, and predictive maintenance applications. In February 2025, E-Photonics partnered with Lumotive to lead cutting-edge production of LiDAR and 3D sensing technologies in Saudi Arabia, marking a significant milestone for local production capabilities. The firm would utilize Lumotive’s innovative Light Control Metasurface (LCM™) technology to create and produce advanced 3D sensing solutions for robotics, drones, and intelligent infrastructure uses. This development aligns with Vision 2030's objectives for technological self-sufficiency and industrial diversification.

Saudi Arabia 3D Sensors Market Trends:

Rise of Solid-State LiDAR and Advanced Sensing Solutions

The Saudi Arabia 3D sensors market is witnessing accelerated adoption of solid-state LiDAR technology, characterized by compact designs, reduced complexity, and enhanced durability compared to traditional mechanical systems. These sensors deliver precise depth perception essential for autonomous vehicle navigation, robotic guidance, and infrastructure monitoring. The shift towards software-defined beam-steering technology enables dynamic performance optimization and real-time parameter adjustments, supporting diverse deployment scenarios across industrial automation and smart transportation applications throughout the Kingdom.

Integration with Smart City Infrastructure Development

Smart city initiatives across Saudi Arabia are driving substantial demand for 3D sensing technologies in urban planning, traffic management, and environmental monitoring applications. As per IMARC Group, the Saudi Arabia smart cities market size reached USD 14,424.9 Million in 2025. 3D sensors enable high-resolution mapping essential for optimizing urban mobility, enhancing public safety, and supporting sustainable development objectives. The integration of depth-sensing capabilities with digital twin platforms allows urban planners to simulate future scenarios, predict traffic patterns, and manage city resources more efficiently, aligning with the Kingdom's ambitious smart infrastructure development programs.

Growing Industrial Automation and Robotics Adoption

Industrial facilities throughout Saudi Arabia are increasingly deploying 3D sensors for automated quality control, pick-and-place robotics, and warehouse automation applications. These technologies deliver unmatched precision for object detection, dimensional measurement, and environment sensing, enabling manufacturers to enhance operational efficiency and product quality. The convergence of artificial intelligence (AI) with 3D sensing capabilities supports predictive maintenance strategies and real-time production optimization, reducing downtime and improving overall manufacturing competitiveness within the regional industrial landscape.

How Vision 2030 is Transforming the Saudi Arabia 3D Sensors Market:

Vision 2030 is transforming the Saudi Arabia 3D sensors market by accelerating digitalization, smart manufacturing, and advanced technology adoption across key sectors. Government investments in smart cities, automation, and Industry 4.0 initiatives are driving demand for 3D sensors in robotics, quality inspection, security, and autonomous systems. Large-scale projects, such as smart infrastructure developments, require precise depth-sensing and imaging solutions. Vision 2030’s focus on localizing high-tech manufacturing is also encouraging global technology providers to establish regional operations and partnerships, supporting knowledge transfer and capability building. In healthcare, retail, and consumer electronics, rising adoption of automation and touchless technologies is expanding application scope.

Market Outlook 2026-2034:

The Saudi Arabia 3D sensors market outlook remains highly favorable, as government-led transformation initiatives and private sector investments continue to reshape the industrial landscape. Growing emphasis on manufacturing excellence, automotive safety innovations, and healthcare modernization is creating sustained demand for advanced depth-sensing technologies. The market generated a revenue of USD 56.60 Million in 2025 and is projected to reach a revenue of USD 217.43 Million by 2034, growing at a compound annual growth rate of 16.13% from 2026-2034. Strategic partnerships between international technology providers and local enterprises are accelerating knowledge transfer and manufacturing localization. The expansion of autonomous vehicle testing programs, deployment of intelligent transportation systems, and modernization of industrial facilities will sustain robust market expansion throughout the forecast period.

Saudi Arabia 3D Sensors Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Image Sensor |

46% |

|

Technology |

Projected Light/Structured Light |

32% |

|

End User |

Industrial |

25% |

|

Region |

Northern and Central Region |

29% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Acoustic Sensor

- Accelerometer

- Image Sensor

- Others

Image sensor dominates with a market share of 46% of the total Saudi Arabia 3D sensors market in 2025.

Image sensor forms the foundational type, enabling 3D depth perception across consumer electronics, automotive safety systems, and industrial automation applications in Saudi Arabia. These sensors capture visual data essential for facial recognition, AR experiences, and advanced driver assistance functionalities. Increasing investments in smart city projects are further strengthening demand for advanced image sensing technologies. In November 2024, Tilal Real Estates initiated a new project to develop a smart city in the eastern region of the Gulf Kingdom, valued at approximately 6 Billion Saudi riyals (USD 1.6 Billion).

The proliferation of image sensors in Saudi Arabia reflects broader regional trends towards smart device adoption and intelligent automation systems. Healthcare applications are increasingly incorporating these sensors for medical imaging, surgical robotics, and diagnostic equipment requiring precise visual data capture. The Industrial sector is also leveraging image sensors for quality inspection, machine vision, and predictive maintenance use cases. Additionally, rising demand for security and surveillance systems is supporting wider deployment across commercial and public infrastructure.

Technology Insights:

- Projected Light/Structured Light

- Stereo Vision

- Time-of-Flight

- Ultrasound

Projected light/structured light leads with a share of 32% of the total Saudi Arabia 3D sensors market in 2025.

Projected light/structured light delivers optimal precision in depth sensing, making it indispensable for quality control, reverse engineering, and industrial inspection applications throughout Saudi Arabia. These systems project known light patterns onto object surfaces, analyzing deformations to create detailed three-dimensional models with exceptional accuracy. Saudi manufacturing facilities increasingly deploy structured light systems for automated component inspection, ensuring dimensional accuracy and product quality across automotive, aerospace, and industrial production lines.

The advancement of structured light technology enables high-speed scanning capabilities essential for modern manufacturing environments in the Kingdom. These sensors excel at capturing complex shapes and fine details, delivering reliable depth accuracy in controlled industrial settings. The integration of AI with structured light systems enhances defect detection capabilities, supporting Saudi Arabia's manufacturing modernization objectives and quality improvement initiatives. Growing investments in Industry 4.0 and smart factory deployments are further accelerating the adoption of projected light/structured light depth sensing solutions across various industries.

End User Insights:

- Industrial

- Automotive

- Logistics

- Aerospace and Defense

- Consumer Electronics

- Healthcare and Medical Devices

Industrial exhibits a clear dominance with a 25% share of the total Saudi Arabia 3D sensors market in 2025.

Industrial's leadership in the Saudi Arabia 3D sensors market reflects the Kingdom's strategic commitment to manufacturing modernization under Vision 2030 objectives. Factories deploy these sensors for automated quality control, robotic guidance, and machine vision applications requiring precise dimensional measurement. In May 2024, Saudi Arabia unveiled the Advanced Manufacturing and Production Center, a program designed to accelerate industrial transformation utilizing the Fourth Industrial Revolution technologies, including AI, automation, and intelligent sensing systems. This initiative demonstrates the government's dedication to building globally competitive manufacturing capabilities.

Industrial automation applications in Saudi Arabia increasingly incorporate 3D sensing technologies for predictive maintenance, process optimization, and production monitoring functions. The integration of sensors with Industrial Internet of Things (IIoT) platforms enables real-time data collection and analysis, supporting informed decision-making and operational efficiency improvements. As adoption expands, manufacturers are also using 3D sensors to enhance workplace safety through collision avoidance and human–machine interaction systems. Additionally, rising investments in robotics and smart warehousing solutions are broadening the scope of 3D sensor deployment across Saudi Arabia’s industrial ecosystem.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the leading region with a 29% share of the total Saudi Arabia 3D sensors market in 2025.

Northern and Central Region's market leadership stems from Riyadh's position as the Kingdom's economic and technological hub. The capital city hosts major technology companies, manufacturing facilities, and government institutions, driving 3D sensor adoption across diverse applications. Strategic infrastructure investments, innovation centers, and business-friendly policies attract international technology providers seeking regional expansion opportunities. The concentration of industrial parks and technology clusters creates sustained demand for advanced sensing solutions.

Government-backed initiatives reinforce the region's market dominance by supporting manufacturing excellence and technological innovation. The establishment of technology accelerators, research institutions, and innovation hubs fosters ecosystem development essential for sustained market growth. Riyadh's role as the administrative capital ensures proximity to decision-makers and regulatory bodies influencing technology adoption policies across industrial, healthcare, and smart city applications throughout the Kingdom. Additionally, the region benefits from superior digital infrastructure and connectivity, enabling faster deployment and integration of advanced 3D sensing technologies across both public and private sector projects.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia 3D Sensors Market Growing?

Vision 2030 Industrial Transformation Initiatives

Saudi Arabia's Vision 2030 framework establishes a comprehensive roadmap for economic diversification and industrial modernization, creating substantial opportunities for 3D sensor deployment across manufacturing, logistics, and infrastructure sectors. The government's commitment to reducing oil dependency through technology-driven industrial growth stimulates investments in advanced automation systems requiring precise sensing capabilities. Public-private partnerships (PPPs) facilitate technology transfer and local capability building, accelerating sensor integration into existing industrial ecosystems. The establishment of special economic zones with favorable regulatory frameworks attracts international technology providers seeking regional manufacturing bases. In April 2023, His Royal Highness Prince Mohammed bin Salman, the Crown Prince and Prime Minister, inaugurated four new special economic zones, aimed at fostering economic growth and diversification, positioning the Kingdom as a leading global investment hub, consistent with Vision 2030. These coordinated efforts create a supportive environment for sustained market expansion as industrial facilities modernize operations and embrace digital transformation initiatives aligned with national development objectives.

Smart City Development and Urban Modernization

Ambitious smart city projects throughout Saudi Arabia are driving unprecedented demand for 3D sensing technologies essential for urban planning, traffic management, and environmental monitoring applications. These developments leverage advanced sensors to create interconnected urban ecosystems where infrastructure, transportation, and public services operate efficiently through data-driven decision-making processes. Urban digital twin platforms integrate depth-sensing capabilities to simulate future scenarios, optimize resource allocation, and enhance citizen services delivery. Environmental monitoring applications utilize sensors for air quality assessment, waste management optimization, and sustainability tracking aligned with national environmental commitments. These large-scale urban development initiatives generate sustained demand for diverse sensing applications, positioning the Kingdom as a regional leader in smart city technology implementation and innovation. In December 2025, New Murabba, a company under the Public Investment Fund, established a strategic Memorandum of Understanding (MoU) with the Ministry of Municipalities and Housing (MOMAH) to promote urban development. The agreement examined the integration of land uses for key projects in Riyadh, such as the New Murabba destination.

Expanding Automotive Sector and Advanced Driver Assistance Systems (ADAS) Adoption

The Saudi Arabia automotive sector's evolution towards ADAS and autonomous vehicle technologies creates substantial opportunities for 3D sensor deployment across safety, navigation, and in-cabin monitoring applications. Government investments in electric vehicle (EV) infrastructure and autonomous mobility testing programs stimulate demand for LiDAR, radar, and camera-based sensing solutions essential for next-generation transportation systems. Regulatory frameworks increasingly mandate safety features requiring sophisticated depth-sensing capabilities for collision avoidance, lane departure warning, and adaptive cruise control functionalities. The Kingdom's strategic location and infrastructure investments position it as a regional hub for automotive technology testing and deployment. Local manufacturing initiatives aim to establish domestic capabilities in automotive sensor production, reducing import dependency and supporting technology localization objectives. The convergence of electrification trends and autonomous driving developments creates compounding demand for diverse 3D sensing applications throughout the automotive value chain.

Market Restraints:

What Challenges the Saudi Arabia 3D Sensors Market is Facing?

High Technology Costs and Implementation Expenses

Advanced 3D sensing technologies, particularly LiDAR and high-precision structured light systems, require substantial capital investments that may limit adoption among small and medium enterprises. Implementation costs extend beyond equipment acquisition to include system integration, calibration, training, and ongoing maintenance requirements. The complexity of deploying sophisticated sensing solutions demands specialized technical expertise and infrastructure upgrades that increase total ownership costs, potentially slowing market penetration across price-sensitive industry segments.

Limited Local Technical Expertise and Skilled Workforce

The deployment and maintenance of advanced 3D sensing systems require specialized technical knowledge that remains limited within the local workforce. Organizations face challenges in recruiting qualified engineers and technicians capable of designing, implementing, and troubleshooting sophisticated sensor applications. While educational institutions and training programs are expanding, the gap between technology advancement and workforce readiness may constrain market growth potential and slow adoption timelines across certain industry verticals.

Dependency on Technology Imports and Supply Chain Vulnerabilities

Saudi Arabia's reliance on imported 3D sensor components and systems creates supply chain vulnerabilities and potential delays in project implementations. Limited local manufacturing capabilities for advanced sensor technologies increase costs and extend lead times for equipment procurement. While localization initiatives are underway, establishing domestic production capacity for sophisticated sensing components requires substantial investment, technology partnerships, and time to achieve meaningful self-sufficiency and reduce import dependency.

Competitive Landscape:

The Saudi Arabia 3D sensors market features a dynamic competitive environment, characterized by international technology leaders and emerging regional players pursuing diverse growth strategies. Market participants differentiate through technological innovation, application-specific solutions, and strategic partnerships with local enterprises seeking automation capabilities. Competition intensifies as companies expand product portfolios to address requirements across industrial, automotive, healthcare, and smart infrastructure applications. Investments in R&D activities enable continuous performance improvements in sensor accuracy, processing speed, and environmental resilience. Strategic collaborations between global technology providers and Saudi enterprises facilitate knowledge transfer and market access while supporting localization objectives.

Saudi Arabia 3D Sensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Acoustic Sensor, Accelerometer, Image Sensor, Others |

| Technologies Covered | Projected Light/Structured Light, Stereo Vision, Time-of-Flight, Ultrasound |

| End-Users Covered | Industrial, Automotive, Logistics, Aerospace & Defense, Consumer Electronics, Healthcare & Medical Devices |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia 3D sensors market size was valued at USD 56.60 Million in 2025.

The Saudi Arabia 3D sensors market is expected to grow at a compound annual growth rate of 16.13% from 2026-2034 to reach USD 217.43 Million by 2034.

Image sensor dominated the market with a share of 46%, driven by extensive utilization in consumer electronics, automotive safety systems, and industrial automation applications requiring precise visual data capture and depth perception capabilities.

Key factors driving the Saudi Arabia 3D sensors market include Vision 2030 industrial transformation initiatives, smart city development projects, growing automotive ADAS adoption, expanding manufacturing automation, and government support for technology localization.

Major challenges include high technology implementation costs, limited local technical expertise and skilled workforce, dependency on imported components, supply chain vulnerabilities, and the complexity of integrating advanced sensing systems into existing industrial infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)