Saudi Arabia 5G Chipset Market Size, Share, Trends and Forecast by Chipset Type, Operational Frequency, End User, and Region, 2026-2034

Saudi Arabia 5G Chipset Market Overview:

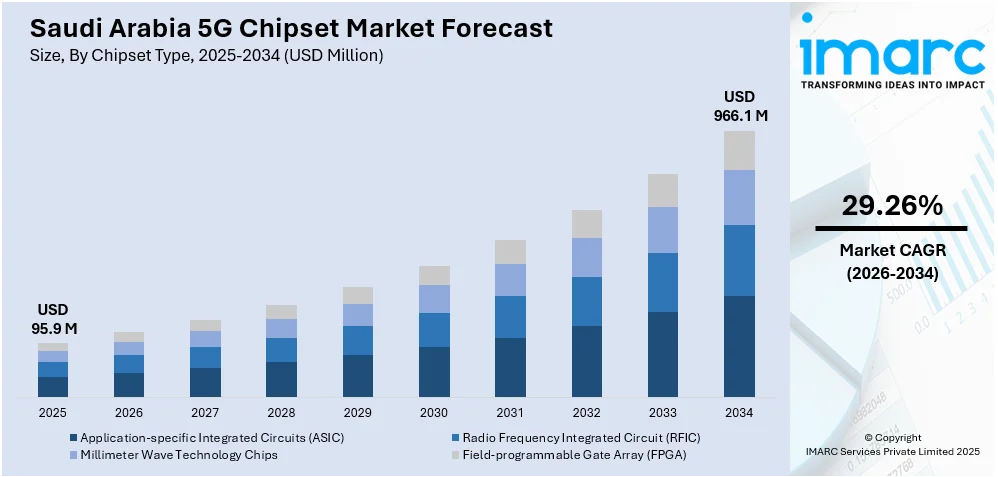

The Saudi Arabia 5G chipset market size reached USD 95.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 966.1 Million by 2034, exhibiting a growth rate (CAGR) of 29.26% during 2026-2034. Vision 2030 initiatives, smart city infrastructure, multi-mode chipset demand, industrial-grade connectivity, LPWA module integration, hybrid network support, intelligent transportation systems, edge processing applications, secure defense communications, ruggedized chipset use, UAV connectivity, encryption-enabled firmware, energy sector automation, public-private localization programs, domestic semiconductor testing, critical broadband expansion are some of the factors positively impacting the Saudi Arabia 5G chipset market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 95.9 Million |

| Market Forecast in 2034 | USD 966.1 Million |

| Market Growth Rate 2026-2034 | 29.26% |

Saudi Arabia 5G Chipset Market Trends:

Vision 2030 and Digital Infrastructure Modernization

Saudi Arabia’s Vision 2030 strategy has placed digital transformation at the core of national development, with 5G adoption serving as a central pillar for smart governance, economic diversification, and technological leadership. The modernization of infrastructure under this initiative is significantly driving demand for 5G chipsets capable of enabling high-capacity, ultra-low-latency connectivity across a broad spectrum of applications. From connected healthcare to intelligent transportation systems, chipsets are essential components underpinning these advancements. An instrumental driver within this context is the Saudi Arabia 5G chipset market forecast, which indicates rising demand for integrated chipsets with multi-mode capabilities that support hybrid networks. As telecom operators scale their investments in urban and industrial zones, the need for chipsets optimized for harsh environments and uninterrupted service is becoming evident. At the Global AI Summit in Riyadh, Qualcomm Technologies and Aramco Digital announced the world’s first processors with native support for 5G in the 450MHz spectrum, specifically the QCM8550 and QCM6490 chipsets. These processors are engineered for resilient, wide-area IoT connectivity in industrial environments and will enable the deployment of a nationwide 5G-enabled Industrial and Enterprise IoT network across Saudi Arabia. This marks a key advancement in the Kingdom’s digital transformation strategy, enhancing coverage and accelerating adoption of 5G-based edge computing and AI-driven IoT solutions. These chipsets are expected to serve not only mobile handsets but also mission-critical infrastructure, including oil and gas monitoring systems and smart utilities. Saudi Arabia is also positioning itself as a hub for next-gen manufacturing and logistics automation, necessitating real-time data transmission and edge-processing capabilities. This strategic direction is generating strong Saudi Arabia 5G chipset market growth, particularly in areas such as low-power wide-area (LPWA) connectivity, 5G NR (New Radio) modules, and AI-enhanced signal processing.

To get more information on this market Request Sample

Defense, Energy Sector Demand and Geopolitical Prioritization

The national demand for 5G chipsets is also influenced by defense, critical infrastructure protection, and strategic energy management. Saudi Arabia’s emphasis on securing its geopolitical and economic assets has accelerated investments in secure, reliable, and high-throughput communication systems—many of which depend on 5G chipsets tailored for ruggedized, always-on environments. These include surveillance systems, UAV communication platforms, and remote asset monitoring in energy fields. This trend corresponds to the evolving Saudi Arabia 5G chipset market outlook, which reflects specialized demand for chipsets with embedded encryption, custom firmware, and tamper-resistant design. Defense contractors, national security agencies, and energy consortiums are increasingly sourcing chipsets that meet stringent reliability and cybersecurity standards, ensuring system integrity even under extreme operational stress. Strategic procurement policies are aligning with global supply chain resilience goals to guarantee uninterrupted access to advanced semiconductor technologies. Additionally, the Kingdom is scaling public-private partnerships to localize parts of the 5G supply chain. These partnerships support capacity-building in semiconductor packaging, chip design, and advanced testing labs within the country. For instance, on March 4, 2025, Saudi Telecom Company (stc) announced it is expanding its 5G network to 75 cities and regions across Saudi Arabia, supported by Juniper Networks’ core network and data center solutions. The deployment of 400G routing infrastructure, including PTX10008 and MX10008 routers, has increased 100G capacity by 1,340%, boosted 400G port density by 864 ports, and reduced power consumption by up to 87%. This expansion is central to Saudi Arabia’s Vision 2030 goals and underscores growing demand for high-efficiency infrastructure to support next-gen 5G chipset deployment.

Saudi Arabia 5G Chipset Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on chipset type, operational frequency, and end user.

Chipset Type Insights:

- Application-specific Integrated Circuits (ASIC)

- Radio Frequency Integrated Circuit (RFIC)

- Millimeter Wave Technology Chips

- Field-programmable Gate Array (FPGA)

The report has provided a detailed breakup and analysis of the market based on the chipset type. This includes application-specific integrated circuits (ASIC), radio frequency integrated circuit (RFIC), millimeter wave technology chips, and field-programmable gate array (FPGA).

Operational Frequency Insights:

- Sub 6 GHz

- Between 26 and 39 GHz

- Above 39 GHz

The report has provided a detailed breakup and analysis of the market based on the operational frequency. This includes sub 6 GHz, between 26 and 39 GHz, and above 39 GHz.

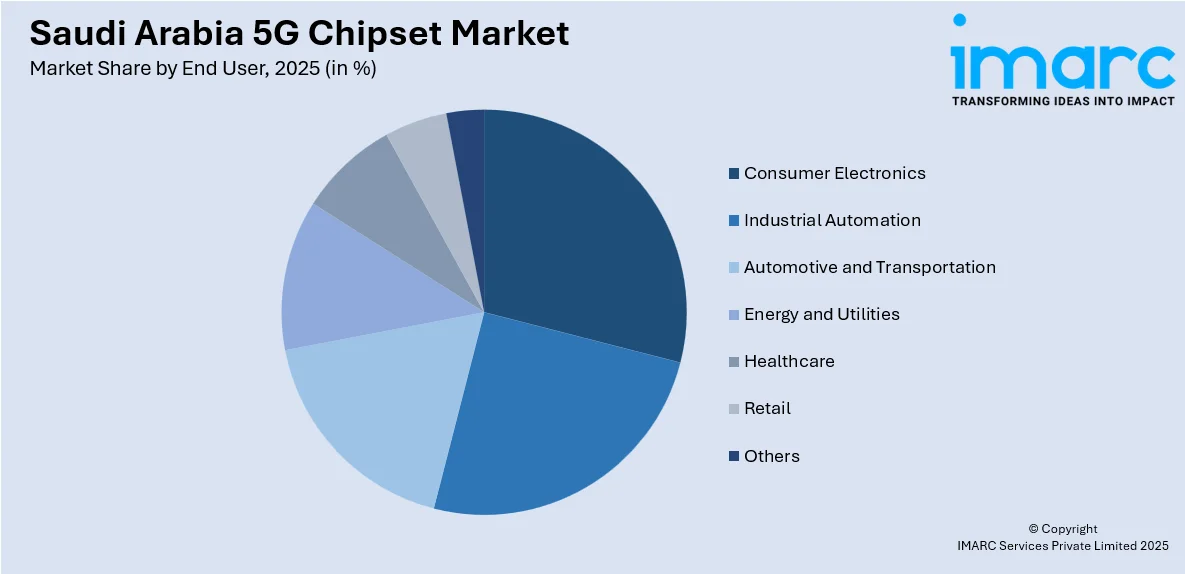

End User Insights:

Access the comprehensive market breakdown Request Sample

- Consumer Electronics

- Industrial Automation

- Automotive and Transportation

- Energy and Utilities

- Healthcare

- Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes consumer electronics, industrial automation, automotive and transportation, energy and utilities, healthcare, retail, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia 5G Chipset Market News:

- January 17, 2025: GCT Semiconductor participated in the Aramco Digital and 450 MHz Alliance event in Dhahran, Saudi Arabia, to discuss innovations in private networks and 450 MHz-enabled 5G chipsets. GCT’s upcoming chipsets are designed for critical infrastructure applications, emphasizing low-power, high-reliability connectivity, with integration of AI and machine learning to optimize device performance. This collaboration reinforces Saudi Arabia’s push for industrial-grade 5G deployments and highlights the country’s growing role in the global evolution of specialized 5G semiconductor solutions.

Saudi Arabia 5G Chipset Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chipset Types Covered | Application-specific Integrated Circuits (ASIC), Radio Frequency Integrated Circuit (RFIC), Millimeter Wave Technology Chips, Field-programmable Gate Array (FPGA) |

| Operational Frequencies Covered | Sub 6 GHz, Between 26 and 39 GHz, Above 39 GHz |

| End Users Covered | Consumer Electronics, Industrial Automation, Automotive and Transportation, Energy and Utilities, Healthcare, Retail, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia 5G chipset market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia 5G chipset market on the basis of chipset type?

- What is the breakup of the Saudi Arabia 5G chipset market on the basis of operational frequency?

- What is the breakup of the Saudi Arabia 5G chipset market on the basis of end user?

- What is the breakup of the Saudi Arabia 5G chipset market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia 5G chipset market?

- What are the key driving factors and challenges in the Saudi Arabia 5G chipset market?

- What is the structure of the Saudi Arabia 5G chipset market and who are the key players?

- What is the degree of competition in the Saudi Arabia 5G chipset market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia 5G chipset market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia 5G chipset market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia 5G chipset industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)