Saudi Arabia Activewear Market Size, Share, Trends and Forecast by Product Type, Material Type, Pricing, Age Group, Distribution Channel, End User and Region, 2025-2033

Saudi Arabia Activewear Market Overview:

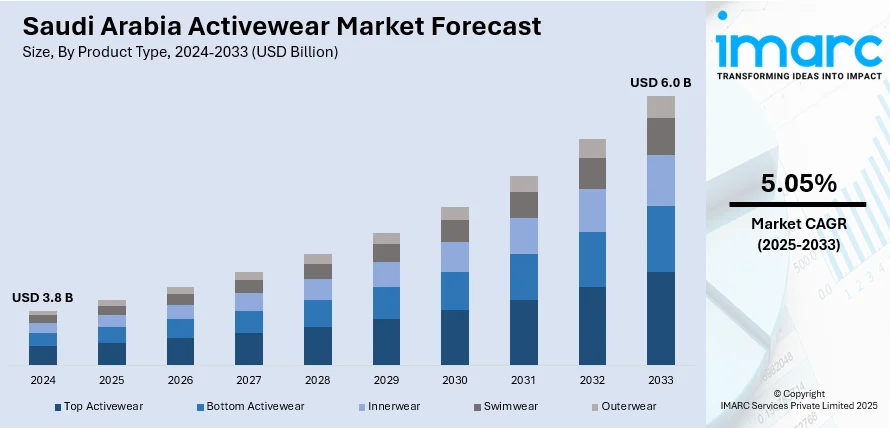

The Saudi Arabia activewear market size reached USD 3.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5.05% during 2025-2033. The market is fueled by the growing health and fitness consciousness, rising emphasis on wellness, and increasing number of gyms and fitness clubs. Moreover, the impact of social media, inflating disposable incomes, and a fashion-conscious youth population looking for comfortable yet fashionable activewear also fuel the Saudi Arabia activewear market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Market Growth Rate 2025-2033 | 5.05% |

Saudi Arabia Activewear Market Trends:

Increasing Popularity of Athleisure

In Saudi Arabia, athleisure has gained prominence as an important trend in the activewear industry. Athleisure refers to clothing that is fashioned with room for muscle movement while also keeping in mind everyday usage; the aesthetics are therefore fusions of fashion with high-performance activewear fabric. As per estimates by the IMARC Group, the size of Saudi Arabia athleisure market in 2024 reached USD 3,735.6 Million, and is further expected to reach USD 4,872.1 Million by 2033, exhibiting a growth rate (CAGR) of 3.0% during 2025-2033. The trend is growing among Saudi purchasers owing to an increasing adoption of fitness lifestyle coupled with wanting to wear and have fashion clothing with versatile attributes. With a more active participation of Saudi women in sports, fitness, and recreational activities, the demand is growing for activewear that easily transitions from gym to social events. Social media and fitness bloggers have played a huge role in advancing the athleisure trend, with many showcasing upscale workout pieces that double as everyday casual wear. There are several more athleisure lines forthcoming from established international brands and native players alike, boosting the Saudi Arabia activewear market share. The trend in athleisure will sustain with consumers hunting for both stylized and functional activewear.

Women's Activewear Market Expansion

The women's activewear market in Saudi Arabia is rapidly growing, reflecting the changing social and cultural context of the country. With the increasing number of Saudi women being engaged in fitness activities-such as yoga, jogging, and gym workouts-there is an increasing demand for functional, high-quality, and fashionable activewear that suits their needs. Several women have ventured into the arena of physical fitness because of government policies such as women's empowerment and encouraging sports participation, thus leading to the increased consumption of activewear. Moreover, the growing popularity of women's sports events and fitness competitions is also boosting the market. And as brands are offering more and more options in terms of size, design, and fabric, women can count on being catered for with fashionable yet comfortable activewear. With a growing focus on matters of inclusivity and body diversity, the women's activewear segment is bound to continue with its upward trend and contributes largely to the entire activewear market in Saudi Arabia.

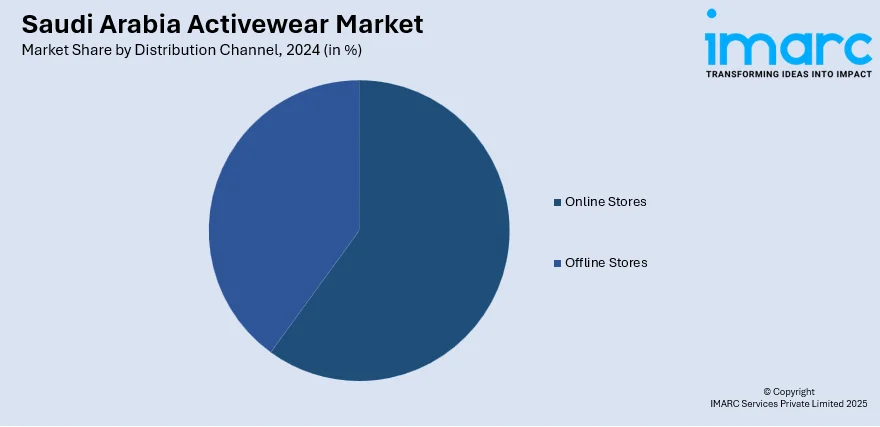

Growth of Online Shopping and E-Commerce

The Saudi Arabian market for activewear is witnessing an upsurge in online shopping as a result of the growing number of e-commerce websites and changing consumer behavior. Digitalization and internet penetration are also influencing the Saudi Arabia activewear market outlook. Consumers today prefer online shopping for activewear, which provides convenience, a wider range, and the ability to compare prices. E-commerce websites have a wide range of products, from international activewear brands to local designers, from which consumers can select; in most cases, these goods are also available at highly competitive prices and along with attractive promotions. Due to the COVID-19 pandemic, consumers preferred to stay at home and buy clothes, which highly contributed to the popularity of this trend. Apart from this, social media advertising and influencer/direct marketing have significantly contributed to e-commerce sales, as more fitness influencers endorse their favorite activewear on social media channels, which in turn boosts sales. With increasing acceptance of shopping online, e-commerce is predicted to remain a key propellant for the activewear segment in Saudi Arabia.

Saudi Arabia Activewear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, material type, pricing, age group, distribution channel, and end user.

Product Type Insights:

- Top Activewear

- Bottom Activewear

- Innerwear

- Swimwear

- Outerwear

The report has provided a detailed breakup and analysis of the market based on the product type. This includes top activewear, bottom activewear, innerwear, swimwear, and outerwear.

Material Type Insights:

- Nylon

- Polyester

- Cotton

- Neoprene

- Polypropylene

- Spandex

The report has provided a detailed breakup and analysis of the market based on the material type. This includes nylon, polyester, cotton, neoprene, polypropylene, and spandex.

Pricing Insights:

- Economy

- Premium

The report has provided a detailed breakup and analysis of the market based on the pricing. This includes economy and premium.

Age Group Insights:

- 1-15 Years

- 16-30 Years

- 31-44 Years

- 45-64 Years

- More than 65 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 1-15 years, 16-30 years, 31-44 years, 45-64 years, and more than 65 years.

Distribution Channel Insights:

- Online Stores

- Offline Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online stores and offline stores

End User Insights:

- Men

- Women

- Kids

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and kids.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Activewear Market News:

- On October 16th, 2023, Adidas held its inaugural regional runway show in collaboration with the Saudi fashion brand Kaf by Kaf, which is part of the Saudi 100 brands initiative, showcasing the Spring-Summer 2025 Sportswear Collection before Riyadh Fashion Week. The SS25 Sportswear Collection, crafted by Kawthar Alhoraish, the visionary behind Kaf by Kaf, features a blend of Saudi Arabia's traditional attire with modern athletic fashion. The collection highlights versatility through unisex items, drawing inspiration from classic garments like abayas and headscarves. It blends contemporary features with the core of classic designs, providing a variety of chic choices from cozy loungewear to active wear.

Saudi Arabia Activewear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Top Activewear, Bottom Activewear, Innerwear, Swimwear, Outerwear |

| Material Types Covered | Nylon, Polyester, Cotton, Neoprene, Polypropylene, Spandex |

| Pricings Covered | Economy, Premium |

| Age Groups Covered | 1-15 Years, 16-30 Years, 31-44 Years, 45-64 Years, More Than 65 Years |

| Distribution Channels Covered | Online Stores, Offline Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia activewear market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia activewear market on the basis of product type?

- What is the breakup of the Saudi Arabia activewear market on the basis of material type?

- What is the breakup of the Saudi Arabia activewear market on the basis of pricing?

- What is the breakup of the Saudi Arabia activewear market on the basis of age group?

- What is the breakup of the Saudi Arabia activewear market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia activewear market on the basis of end user?

- What is the breakup of the Saudi Arabia activewear market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia activewear market?

- What are the key driving factors and challenges in the Saudi Arabia activewear market?

- What is the structure of the Saudi Arabia activewear market and who are the key players?

- What is the degree of competition in the Saudi Arabia activewear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia activewear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia activewear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia activewear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)