Saudi Arabia Adhesive Tape Market Size, Share, Trends and Forecast by Material, Resin, Technology, Application, and Region, 2026-2034

Saudi Arabia Adhesive Tape Market Overview:

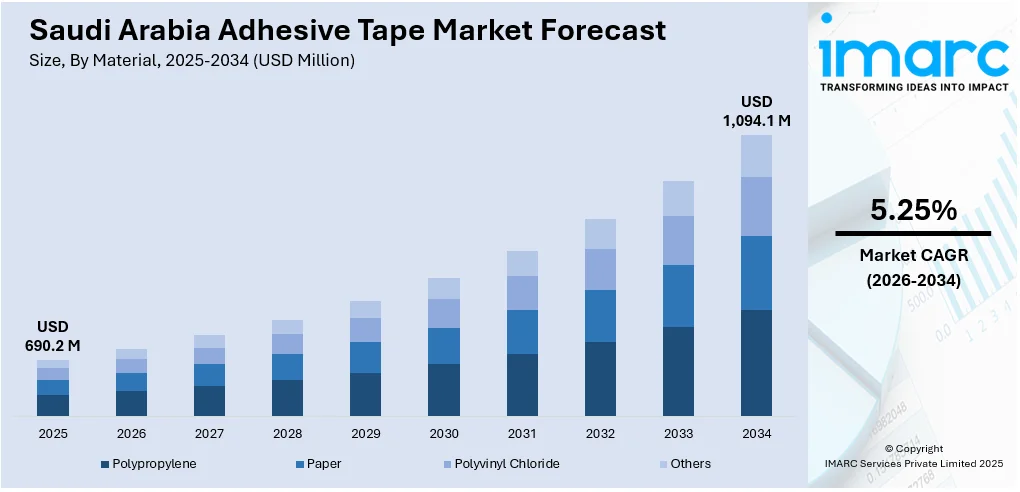

The Saudi Arabia adhesive tape market size reached USD 690.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,094.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.25% during 2026-2034. Saudi Arabia's industry is witnessing significant growth as the nation is growing its construction and infrastructure activities at a rapid rate under Vision 2030. This trend, along with the heightened innovation in the automotive industry through local manufacturing and aftermarket services, is impelling the market growth. Moreover, the rapid modernization of the healthcare sector is expanding the Saudi Arabia adhesive tape market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 690.2 Million |

| Market Forecast in 2034 | USD 1,094.1 Million |

| Market Growth Rate 2026-2034 | 5.25% |

Saudi Arabia Adhesive Tape Market Trends:

Growth in Automotive and Transportation Sectors

Expanding vehicle assembly operations, component manufacturing, and maintenance activities rely on specialized tapes that enhance operational efficiency, reduce assembly time, and support weight optimization. Adhesive solutions are increasingly preferred over traditional fastening systems for their ability to improve aesthetics, reduce vibration, and provide consistent performance under varying temperatures. Additionally, the expansion of public transport projects, rail networks, and mobility infrastructure is creating new opportunities for high-strength and temperature-resistant adhesive materials. For example, in 2024, Saudi Arabia's Transport Minister, Eng. Saleh Al-Jasser, announced plans to expand the Kingdom's rail network to over 8,000 km, reinforcing its position as a global logistics hub. Suppliers are responding by offering tailored products designed for automotive interiors, exteriors, and electrical systems. These advancements complement national objectives to localize vehicle production and attract foreign investment in mobility technologies. As the transportation landscape diversifies, the need for dependable bonding and insulation solutions continues to rise, positioning adhesive tapes as essential materials in modern automotive engineering and infrastructure development across the Kingdom.

To get more information on this market Request Sample

Expansion of Packaging and Consumer Goods Industry

The fast-growing retail, e-commerce, and consumer goods industries in Saudi Arabia are driving the demand for effective, long-lasting, and economical packaging solutions that provide product safety and facilitate seamless logistics. Adhesive tapes are essential for sealing, labeling, and bundling tasks on high-speed packaging lines, providing accuracy, dependability, and compatibility with various substrates. With the growing significance of brand visibility and shelf display, manufacturers are looking for tapes that offer robust adhesion alongside printable, clear, or visually appealing finishes. The move towards lightweight, recyclable, and environment-friendly packaging options shows an increased alignment with corporate sustainability goals and environmental laws. Automation, robotics, and advanced packaging technologies are advancing the industry, enhancing steady performance and operational effectiveness. As per the IMARC Group, the packaging industry in Saudi Arabia, projected to be worth USD 16.0 Billion by 2033, is increasingly relying on high-performance adhesives to enhance competitiveness. By improving supply chain reliability, regulatory adherence, and customer satisfaction, advanced adhesive tapes are bolstering the market’s resilience and preparedness for global trade.

Growing Investments in Research and Local Manufacturing Capacity

Increasing investments in research, product evaluation, and local manufacturing are influencing Saudi Arabia’s adhesive tape market. Local producers are setting up modern facilities featuring precision coating, lamination, and converting technologies to comply with changing industrial standards. This localized strategy minimizes reliance on imports, decreases lead times, and improves adaptability to industry-specific needs. Joint initiatives among governmental bodies, private funders, and educational organizations are fostering advancements in adhesive chemistry and performance evaluation, leading to the development of tailored products that meet local climates and industrial requirements. The enhancement of quality control and certification systems guarantees uniformity, safety, and adherence throughout manufacturing processes. Furthermore, these efforts play a role in the Kingdom’s wider strategy to develop self-sufficiency in high-value manufacturing. With the expansion of research capabilities and the growth of local expertise, Saudi Arabia is evolving into a competitive center for specialized adhesive solutions, enhancing job creation, export opportunities, and long-term market stability in accordance with Kingdom’s development objectives.

Saudi Arabia Adhesive Tape Market Growth Drivers:

Expanding Manufacturing and Construction Activities

The rise in local manufacturing and large-scale construction projects throughout Saudi Arabia is catalyzing the demand for adhesive tapes. These industries are progressively depending on sophisticated bonding, sealing, and insulation materials to enhance operational effectiveness, reduce waste, and guarantee structural integrity. increasing number of infrastructure projects, especially in industrial areas and housing projects, are resulting in higher usage of high-performance adhesives engineered to endure the Kingdom's varying weather conditions. A significant instance is Saudi Arabia’s National Housing Co. launching eleven residential projects in Riyadh’s Khuzam area in 2024, which included over 10,000 housing units, comprising upscale villas and contemporary apartments. This extensive project, in line with Vision 2030’s goal to improve homeownership, require long-lasting construction materials like heat-resistant and weatherproof tapes. With the enhancement of local manufacturing capacity, manufacturers can provide customized adhesive solutions rapidly, bolstering continuous investment in housing, energy, and logistics.

Technological Advancements and Product Innovation

Ongoing technological advancements and product innovation are transforming the adhesive tape market in Saudi Arabia, allowing producers to meet more complex industrial demands. Manufacturers are launching innovative tapes with enhanced stickiness, heat resistance, and durability, guaranteeing reliable operation in challenging environments across various industries. The development of pressure-sensitive, heat-resistant, flame-retardant, and solvent-free formulations indicates a movement towards safety, effectiveness, and environmental care. Research efforts are concentrating on attaining increased tensile strength, reduced surface residue, heightened elasticity, and better weather resistance, which are attributes crucial for precise applications in electronics, construction, and transportation. These advancements broaden the range of applications while reducing downtime, maintenance costs, and operational inefficiencies. The implementation of smart manufacturing and automation in production enables uniform quality control and enhanced customization, guaranteeing that each tape variant complies with industry-specific standards.

Rising Emphasis on Sustainability and Regulatory Compliance

Sustainability is becoming a crucial focus in Saudi Arabia, influenced by changing environmental regulations and increasing corporate accountability. The growing use of low-volatile organic compounds, solvent-free, and recyclable adhesives matches Kingdom’s goals that advocate for environment-friendly, energy-efficient manufacturing processes. Producers are dedicating resources to innovative methods that reduce emissions, decrease material waste, and save resources, promoting a circular manufacturing system. Increased attention to workplace safety and product compliance are resulting in the establishment of stringent quality criteria, ensuring that tapes comply with accepted environmental and performance standards. Regulatory changes, bolstered by Vision 2030’s focus on sustainable development, are encouraging manufacturers to shift to eco-certified materials and cleaner production methods. Moreover, renewable energy developments, sustainable construction initiatives, and eco-friendly industrial areas are driving the need for durable adhesives that minimize lifecycle expenses and ecological effects.

Saudi Arabia Adhesive Tape Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on material, resin, technology, and application.

Material Insights:

- Polypropylene

- Paper

- Polyvinyl Chloride

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes polypropylene, paper, polyvinyl chloride, and others.

Resin Insights:

- Acrylic

- Rubber

- Silicone

- Others

The report has provided a detailed breakup and analysis of the market based on the resin. This includes acrylic, rubber, silicone, and others.

Technology Insights:

- Water-Based Adhesive Tapes

- Solvent-Based Adhesive Tapes

- Hot-Melt-Based Adhesive Tapes

The report has provided a detailed breakup and analysis of the market based on the technology. This includes water-based adhesive tapes, solvent-based adhesive tapes, and hot-melt-based adhesive tapes.

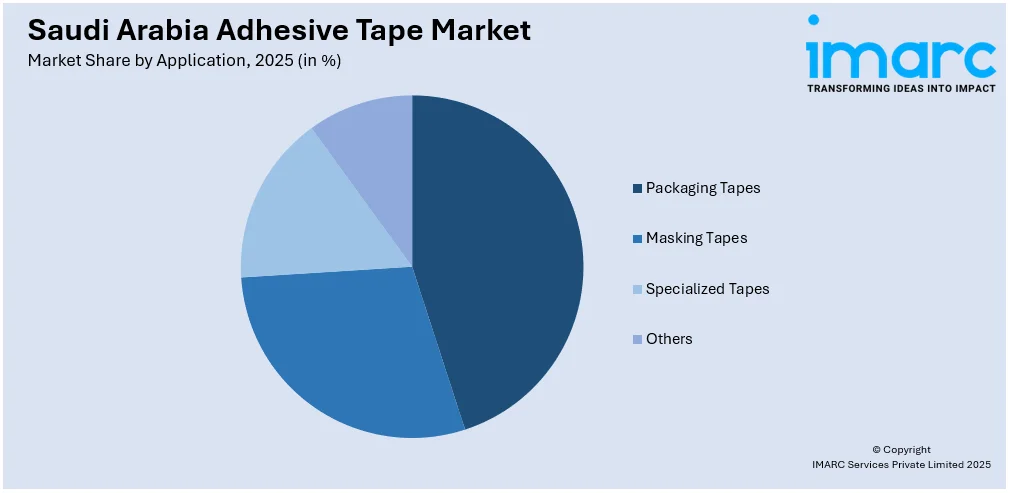

Application Insights:

Access the comprehensive market breakdown Request Sample

- Packaging Tapes

- Masking Tapes

- Specialized Tapes

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes packaging tapes, masking tapes, specialized tapes, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Adhesive Tape Market News:

- April 2025: The Gulf 4P Dammam 2025, Saudi Arabia's premier Plastics, Packaging, Printing, and Petrochemicals Expo, will take place from December 1-4, 2025, at the Dhahran Expo. This B2B expo in Saudi Arabia will feature a wide range of innovations, including adhesive tapes, along with other technologies in plastics, printing, and petrochemicals, offering networking and business expansion opportunities.

Saudi Arabia Adhesive Tape Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Polypropylene, Paper, Polyvinyl Chloride, Others |

| Resins Covered | Acrylic, Rubber, Silicone, Others |

| Technologies Covered | Water-Based Adhesive Tapes, Solvent-Based Adhesive Tapes, Hot-Melt-Based Adhesive Tapes |

| Applications Covered | Packaging Tapes, Masking Tapes, Specialized Tapes, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia adhesive tape market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia adhesive tape market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia adhesive tape industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The adhesive tape market in Saudi Arabia was valued at USD 690.2 Million in 2025.

The Saudi Arabia adhesive tape market is projected to exhibit a CAGR of 5.25% during 2026-2034, reaching a value of USD 1,094.1 Million by 2034.

The Saudi Arabia adhesive tape market is growing due to rising demand across construction, automotive, packaging, and electronics sectors. The growing emphasis on sustainable and energy-efficient materials, along with technological improvements in tape formulations, is supporting adoption. Increasing government initiatives for infrastructure development and strong manufacturing activities are further bolstering the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)