Saudi Arabia Adhesives and Sealants Market Size, Share, Trends and Forecast by Adhesive Type, Sealant Type, Technology, Application, and Region, 2026-2034

Saudi Arabia Adhesives and Sealants Market Summary:

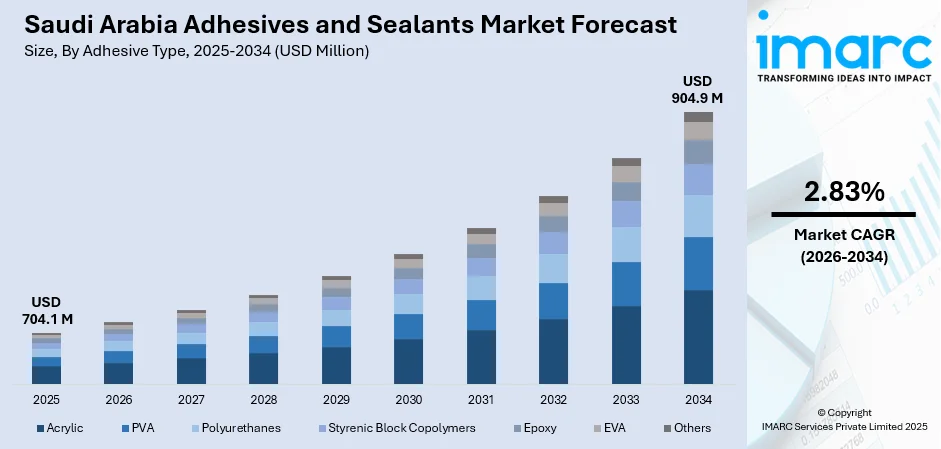

The Saudi Arabia adhesives and sealants market size was valued at USD 704.1 Million in 2025 and is projected to reach USD 904.9 Million by 2034, growing at a compound annual growth rate of 2.83% from 2026-2034.

The Saudi Arabia adhesives and sealants market is experiencing robust growth, driven by the Kingdom's ambitious Vision 2030 diversification strategy and unprecedented investments in construction, manufacturing, and packaging sectors. Expanding industrial activities across automotive assembly, heating, ventilation, and air conditioning (HVAC) systems, and consumer goods production are accelerating the demand for high-performance bonding solutions. The market benefits from increasing adoption of sustainable formulations, shifting regulatory frameworks favoring low volatile organic compounds (VOC) products, and rising e-commerce packaging requirements that collectively strengthen the market share.

Key Takeaways and Insights:

-

By Adhesive Type: PVA dominates the market with a share of 28.05% in 2025, owing to its cost-effectiveness, versatility in woodworking and packaging applications, and environmentally favorable water-based composition. Rising demand from furniture manufacturing and paper converting industries continues to fuel segment expansion.

-

By Sealant Type: Silicone leads the market with a share of 40.12% in 2025,This dominance is driven by superior weather resistance, flexibility, and durability characteristics essential for glazing, façade applications, and joint sealing across the Kingdom's extensive construction projects.

-

By Technology: Water-based represents the largest segment with a market share of 46.09% in 2025, reflecting growing regulatory emphasis on reducing volatile organic compound emissions and increasing environmental awareness among manufacturers and end users seeking sustainable bonding solutions.

-

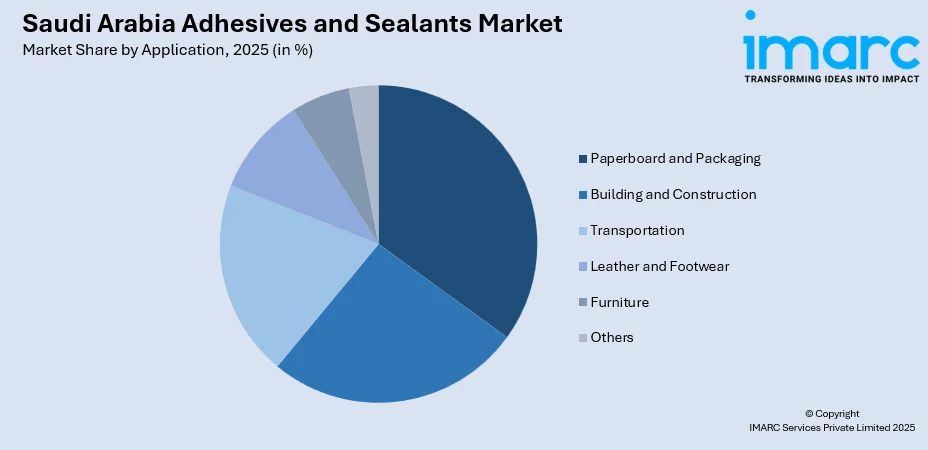

By Application: Paperboard and packaging exhibit a clear dominance with 32.08% share in 2025, propelled by the thriving e-commerce sector, expanding food and beverage (F&B) industry, and rising consumer demand for sustainable packaging materials across the Kingdom.

-

By Region: Northern and Central Region comprises the largest region with 46% share in 2025, propelled by the concentration of manufacturing facilities in Riyadh, government-backed industrial initiatives, and proximity to major infrastructure development projects, including NEOM and Qiddiya.

-

Key Players: Key players drive the Saudi Arabia adhesives and sealants market by expanding manufacturing capabilities, investing in sustainable product formulations, and strengthening regional distribution networks. Their focus on localized production, eco-friendly technologies, and strategic partnerships with construction and packaging sectors accelerates market penetration and supports Vision 2030 industrial objectives.

To get more information on this market Request Sample

The Saudi Arabia adhesives and sealants market is propelled by transformative infrastructure development under Vision 2030, which has positioned construction as a primary growth engine. The Kingdom's construction sector, valued at USD 101.4 Billion in 2024 and projected to reach USD 138.4 Billion by 2030, creates substantial demand for structural adhesives, weatherproofing sealants, and high-performance bonding solutions across residential, commercial, and industrial projects. Major initiatives, including NEOM's smart city development, the Red Sea tourism project, and Qiddiya entertainment destination, require advanced adhesive technologies for glazing, insulation, flooring, and modular construction applications. Simultaneously, rapid expansion in automotive manufacturing amplifies demand for specialty adhesives used in vehicle assembly, interior bonding, and lightweight material applications. In parallel, rising focus on sustainability and localization is driving the adoption of low-VOC, durable adhesives while encouraging domestic production and innovations.

Saudi Arabia Adhesives and Sealants Market Trends:

Rising Adoption of Biobased Hot Melt Adhesives in Packaging Applications

Increasing adoption of biobased hot melt adhesives in packaging applications is driving the Saudi Arabia adhesives and sealants market by supporting sustainability and performance requirements. Packaging producers are shifting towards renewable, low-emission adhesive solutions to align with environmental goals and brand commitments. Biobased hot melts offer fast setting times, strong bonding, and compatibility with high-speed packaging lines. Growing demand from food, beverage, and consumer goods packaging is accelerating usage, encouraging innovations and expanding the market for eco-friendly adhesive technologies.

Increasing Demand for Specialty High-Performance Formulations

Growing industrial diversification is intensifying demand for specialty adhesive formulations tailored to high-performance applications across automotive, HVAC, construction, and renewable energy sectors. Manufacturers are shifting focus towards polyurethane, epoxy, and silicone-based solutions offering enhanced durability, thermal resistance, and bonding strength. In December 2024, BCI inaugurated a fully automated polyurethane manufacturing plant in Riyadh's Second Industrial City spanning 10,000 square meters with initial production capacity of 40,000 Tons annually, targeting automotive, insulation, and HVAC applications.

Growth of Automotive and Transportation Manufacturing

Expansion of automotive and transportation manufacturing is significantly propelling the market growth in Saudi Arabia. Adhesives are increasingly replacing mechanical fasteners to reduce vehicle weight, improve fuel efficiency, and enhance design flexibility. Sealants are widely used for noise reduction, vibration control, corrosion protection, and weatherproofing. Growth in local vehicle assembly, commercial transport, and aftermarket services supports rising consumption. As per IMARC Group, the Saudi Arabia auto parts aftermarket size is set to exhibit a growth rate (CAGR) of 3.90% during 2025-2033. Advanced adhesive solutions also enable bonding of lightweight materials, such as plastics and composites. As transportation manufacturing scales up, demand for specialty and structural adhesives continues to rise steadily.

How Vision 2030 is Transforming the Saudi Arabia Adhesives and Sealants Market:

Vision 2030 is transforming the Saudi Arabia adhesives and sealants market by accelerating industrial diversification, infrastructure development, and domestic manufacturing growth. Large-scale construction projects, smart cities, and transportation infrastructure are increasing demand for construction-grade adhesives and sealants used in flooring, insulation, glazing, and joint sealing. The push to localize manufacturing is encouraging investments in downstream chemical production, boosting domestic supply of specialty adhesives for automotive, packaging, electronics, and industrial assembly applications. Vision 2030 also promotes sustainability and quality standards, catalyzing the demand for high-performance, low-VOC, and durable adhesive solutions. The growth of sectors, such as renewable energy, healthcare, and consumer goods, further supports market expansion. In parallel, improved logistics, industrial zones, and private sector participation are strengthening supply chains and reducing import dependence.

Market Outlook 2026-2034:

The Saudi Arabia adhesives and sealants market outlook remains exceptionally positive through the forecast period, underpinned by sustained infrastructure investment and industrial diversification initiatives. Continued expansion of mega-construction projects, growing automotive manufacturing presence, and thriving e-commerce packaging requirements collectively strengthen demand trajectories. The market generated a revenue of USD 704.1 Million in 2025 and is projected to reach a revenue of USD 904.9 Million by 2034, growing at a compound annual growth rate of 2.83% from 2026-2034. Localized manufacturing investments and sustainability-focused product innovations position the market for robust long-term growth.

Saudi Arabia Adhesives and Sealants Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Adhesive Type |

PVA |

28.05% |

|

Sealant Type |

Silicone |

40.12% |

|

Technology |

Water-Based |

46.09% |

|

Application |

Paperboard and Packaging |

32.08% |

|

Region |

Northern and Central Region |

46% |

Adhesive Type Insights:

- Acrylic

- PVA

- Polyurethanes

- Styrenic Block Copolymers

- Epoxy

- EVA

- Others

PVA dominates with a market share of 28.05% of the total Saudi Arabia adhesives and sealants market in 2025.

PVA maintains market leadership due to its exceptional versatility, cost-effectiveness, and environmentally favorable water-based composition. PVA formulations offer strong bonding capabilities for porous substrates, including wood, paper, and textiles, making them indispensable across furniture manufacturing, woodworking, and paper converting applications. The Kingdom's expanding furniture production sector, supported by localization initiatives encouraging domestic manufacturing, continues to drive substantial PVA consumption volumes.

The segment benefits from increasing preference for sustainable adhesive solutions aligned with environmental regulations and consumer expectations. PVA adhesives produce minimal volatile organic compound emissions during application and curing, supporting compliance with government regulations. Growing packaging industry demand, particularly from the corrugated box and folding carton sectors serving e-commerce logistics, further reinforces PVA's market position across Saudi Arabia's industrial landscape.

Sealant Type Insights:

- Acrylic

- Silicone

- Polyurethane

- Butyl

- Others

Silicone leads with a share of 40.12% of the total Saudi Arabia adhesives and sealants market in 2025.

Silicone adhesives and sealants command the largest market share owing to their superior flexibility, weather resistance, and durability characteristics essential for the Kingdom's demanding construction environment. These products excel in glazing applications, curtain wall systems, and expansion joint sealing where exposure to extreme temperatures, ultraviolet (UV) radiation, and humidity fluctuations requires exceptional long-term performance.

Massive infrastructure projects, including NEOM, Red Sea Project, and numerous luxury hotel developments, are intensifying demand for high-performance silicone sealants meeting international quality standards. As per industry reports, 17 luxury hotels and resorts set to open in Saudi Arabia in 2025. The segment benefits from ongoing product innovations focused on improved adhesion, faster curing times, and enhanced UV resistance. Manufacturers are developing low-VOC and neutral-cure silicone formulations to address sustainability requirements while maintaining the mechanical properties that construction professionals require for structural and architectural sealing applications.

Technology Insights:

- Water-Based

- Solvent-Based

- Hot Melt

- Reactive

- Others

Water-based exhibits a clear dominance with a 46.09% share of the total Saudi Arabia adhesives and sealants market in 2025.

Water-based adhesive technologies maintain market leadership driven by increasingly stringent environmental regulations and growing preference for sustainable manufacturing practices. These formulations offer low volatile organic compound emissions, reduced environmental impact, and improved workplace safety compared to solvent-based alternatives.

The technology segment benefits from continuous advancements in polymer emulsion chemistry enabling improved adhesion, faster drying times, and enhanced moisture resistance. Water-based adhesives are increasingly preferred in packaging, woodworking, and textile applications where environmental compliance and worker safety are priorities. The expanding e-commerce sector's demand for sustainable packaging solutions further strengthens water-based adhesive consumption, with manufacturers integrating these formulations into high-speed automated production lines serving the Kingdom's growing logistics and distribution networks.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Paperboard and Packaging

- Building and Construction

- Transportation

- Leather and Footwear

- Furniture

- Others

Paperboard and packaging represent the leading segment with a 32.08% share of the total Saudi Arabia adhesives and sealants market in 2025.

The paperboard and packaging segment commands the largest application share, driven by the Kingdom's thriving e-commerce sector and expanding F&B industry. The Saudi Arabia paper and paperboard packaging market, valued at USD 1.99 Billion in 2025, creates substantial adhesive demand for corrugated box manufacturing, folding carton production, and flexible packaging applications. E-commerce sector expansion intensifies requirements for reliable carton sealing adhesives and labeling solutions supporting high-volume distribution operations.

Rising consumer preferences for sustainable packaging materials accelerate the adoption of water-based and biobased adhesive formulations compatible with recyclable substrates. Hot melt adhesives remain widely utilized in automated packaging lines where rapid bonding and high throughput are essential. The segment benefits from increasing demand across the food processing, pharmaceutical packaging, and consumer goods industries, with manufacturers investing in advanced formulations offering improved heat resistance, clean machine operation, and enhanced sustainability credentials aligned with Vision 2030 environmental objectives.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region dominate the market with a 46% share of the total Saudi Arabia adhesives and sealants market in 2025.

The Northern and Central Region maintain market leadership, driven by the concentration of industrial activities, manufacturing facilities, and government-backed entertainment and commercial infrastructure projects centered in Riyadh. On December 31, 2025, Qiddiya is set to launch its inaugural entertainment venue, Six Flags, representing a notable enhancement to the entertainment industry. The capital city serves as the primary hub for construction materials consumption, automotive component manufacturing, and packaging production, creating substantial adhesive and sealant demand across multiple end-use sectors. Government initiatives supporting industrial localization and the establishment of manufacturing facilities in industrial cities strengthen regional market positioning.

Major infrastructure developments, including Diriyah Gate, King Salman Park, and extensive residential construction, under the Vision 2030 housing program intensify adhesive consumption in the region. Proximity to key transportation networks and strategic location relative to northern mega-projects, such as NEOM, positions the Northern and Central Region as the dominant market for adhesives and sealants throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Adhesives and Sealants Market Growing?

Rising Focus on Sustainability and Advanced Material Performance

Rising focus on sustainability and advanced material performance is reshaping the market landscape. Manufacturers and end users are increasingly adopting low-VOC, solvent-free, and biobased adhesive solutions to meet environmental and workplace safety expectations. Demand for durable sealants that reduce energy loss, improve insulation, and minimize maintenance is also increasing. Advanced formulations offer improved heat resistance, flexibility, and long service life, making them suitable for harsh climatic conditions. Sustainability goals encourage lightweight designs and material efficiency, increasing reliance on adhesives instead of traditional fastening methods. Innovations in adhesive chemistry support compatibility with new materials, such as composites and engineered plastics. As regulatory awareness and sustainability priorities grow, demand shifts toward high-performance, eco-friendly products. This transition is driving product innovation and premiumization, supporting long-term growth of the Saudi Arabia adhesives and sealants market.

Broadening of Automotive and Transportation Manufacturing

Expansion of automotive and transportation manufacturing is significantly fueling the growth of the Saudi Arabia adhesives and sealants market. In December 2024, sales of motor vehicles in Saudi Arabia reached 805,034 units, an increase from 758,791 units in 2023. Adhesives are increasingly replacing welding and mechanical fastening in vehicle assembly to reduce weight, improve fuel efficiency, and enable modern vehicle designs. They are used extensively for body panels, interior components, structural bonding, and lightweight material integration. Sealants play a critical role in noise reduction, vibration damping, corrosion protection, and weatherproofing. Growth in local vehicle assembly, commercial vehicle fleets, and transportation equipment manufacturing supports rising consumption of specialty adhesives. Demand also extends to maintenance, repair, and aftermarket applications. Advanced adhesive technologies allow bonding of metals, plastics, composites, and glass, supporting design flexibility. As transportation manufacturing scales and quality expectations rise, manufacturers increasingly rely on high-performance bonding solutions, reinforcing automotive and transportation as strong contributors to adhesives and sealants market expansion.

Growth of Packaging and Consumer Goods Industries

Growth of packaging and consumer goods industries is a key factor driving the market expansion in Saudi Arabia. Adhesives are essential for carton sealing, labeling, flexible packaging lamination, and product assembly across food, beverage, pharmaceutical, and personal care segments. Rising urbanization, changing lifestyles, and higher consumption of packaged products are increasing demand for reliable and fast-setting adhesive solutions. Manufacturers prefer hot melt and water-based adhesives that support high-speed packaging lines and ensure strong bonding performance. Sealants also play a role in protecting packaged goods from moisture, contamination, and leakage. Increased focus on branding and shelf appeal further boosts demand for precision labeling and finishing adhesives. As consumer goods production expands and packaging complexity increases, adhesive usage continues to rise. This sustained growth in packaging activity provides a consistent and scalable demand base for adhesives and sealants across Saudi Arabia.

Market Restraints:

What Challenges the Saudi Arabia Adhesives and Sealants Market is Facing?

Raw Material Price Volatility and Supply Chain Constraints

The adhesives and sealants market faces significant challenges from fluctuating petrochemical raw material prices that impact production costs and profit margins. Dependence on imported specialty chemicals and polymer feedstocks creates supply chain vulnerabilities, while global commodity price fluctuations complicate cost planning for manufacturers operating in price-sensitive market segments.

Stringent Environmental Regulations and Compliance Requirements

Increasingly stringent environmental regulations mandating reduced volatile organic compound emissions require substantial investment in product reformulation and testing. Manufacturers face elevated research and development (R&D) costs to achieve compliance with Saudi Standards, Metrology and Quality Organization (SASO) technical regulations while maintaining performance characteristics. Smaller market participants may struggle to meet certification requirements and adapt product portfolios to evolving regulatory standards.

Limited Domestic Production Capacity and Import Dependence

The Saudi adhesives market remains partially dependent on imported products and raw materials, creating exposure to currency fluctuations and international supply disruptions. While domestic manufacturing capacity is expanding, certain specialty formulations and advanced polymer systems continue to be sourced from international suppliers, constraining the market's ability to respond rapidly to localized demand fluctuations.

Competitive Landscape:

The Saudi Arabia adhesives and sealants market exhibits a competitive structure comprising established multinational corporations alongside regional manufacturers and specialized formulators. Global leaders maintain significant market positions through advanced research capabilities, comprehensive product portfolios, and established distribution networks. Regional players leverage local market knowledge, manufacturing presence, and relationships with domestic end users to compete effectively. Competition intensifies around product innovations, sustainability credentials, technical service capabilities, and pricing strategies. Strategic investments in local production facilities, acquisitions of regional businesses, and partnerships with Vision 2030 projects characterize the competitive dynamics shaping market evolution.

Saudi Arabia Adhesives and Sealants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Adhesive Types Covered | Acrylic, PVA, Polyurethanes, Styrenic Block Copolymers, Epoxy, EVA, Others |

| Sealant Types Covered | Acrylic, Silicone, Polyurethane, Butyl, Others |

| Technologies Covered | Water-Based, Solvent-Based, Hot Melt, Reactive, Others |

| Applications Covered | Paperboard and Packaging, Building and Construction, Transportation, Leather and Footwear, Furniture, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia adhesives and sealants market size was valued at USD 704.1 Million in 2025.

The Saudi Arabia adhesives and sealants market is expected to grow at a compound annual growth rate of 2.83% from 2026-2034 to reach USD 904.9 Million by 2034.

PVA dominated the market with a share of 28.05%, driven by its cost-effectiveness, versatility in woodworking and packaging applications, and environmentally favorable water-based composition supporting sustainable manufacturing practices.

Key factors driving the Saudi Arabia adhesives and sealants market include unprecedented infrastructure development under Vision 2030, expanding automotive manufacturing sector, thriving e-commerce and packaging industry, and growing adoption of sustainable adhesive formulations.

Major challenges include raw material price volatility affecting production costs, stringent environmental regulations requiring product reformulation investments, limited domestic production capacity for specialty formulations, and supply chain constraints impacting import-dependent market segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)