Saudi Arabia Adult Diaper Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Adult Diaper Market Summary:

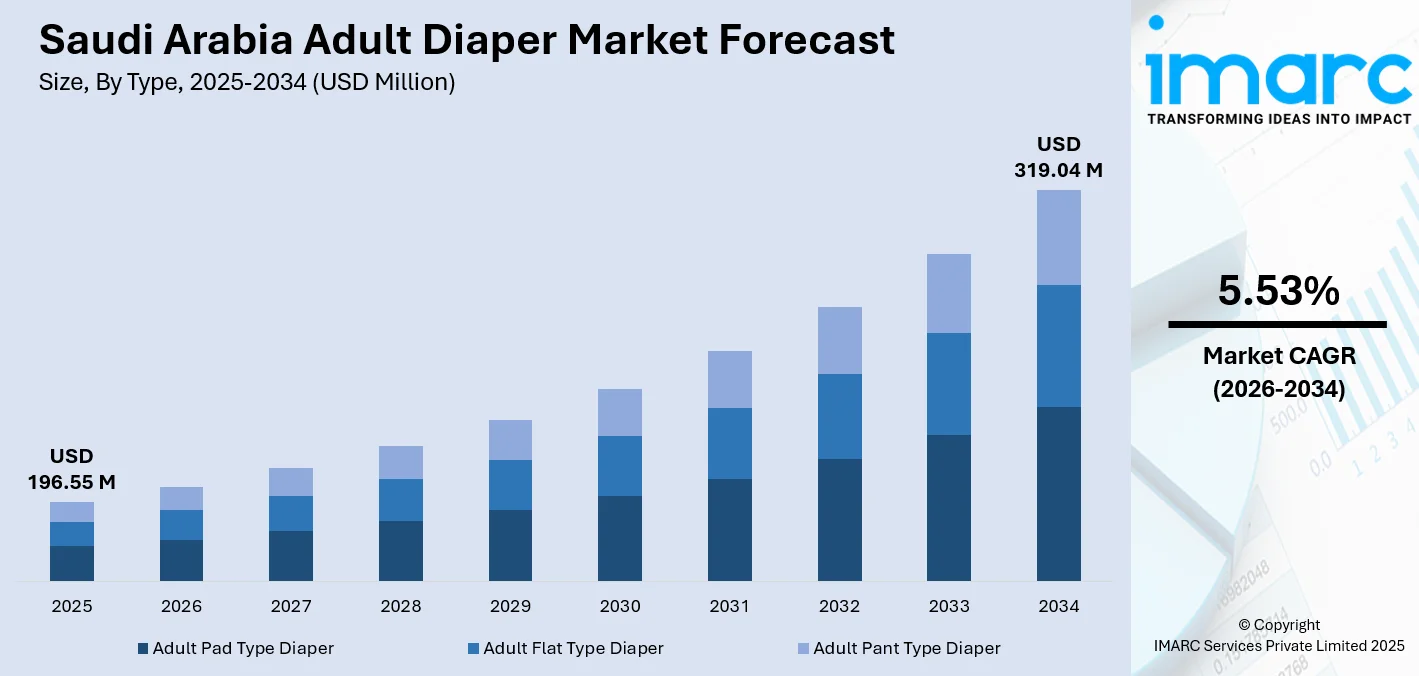

The Saudi Arabia adult diaper market size was valued at USD 196.55 Million in 2025 and is projected to reach USD 319.04 Million by 2034, growing at a compound annual growth rate of 5.53% from 2026-2034.

The market growth is fueled by the Kingdom's rapidly aging demographic profile, enhanced healthcare accessibility under Vision 2030, and diminishing social barriers surrounding incontinence management. Increased life expectancy combined with rising prevalence of age-related chronic conditions, such as diabetes and mobility impairments is creating sustained demand for convenient, dignified hygiene solutions. Government healthcare infrastructure investments and evolving family structures further expands the Saudi Arabia adult diaper market share.

Key Takeaways and Insights:

- By Type: Adult pad type diaper dominates the market with a share of 51.86% in 2025, driven by superior cost-effectiveness and wider acceptance among price-conscious consumers.

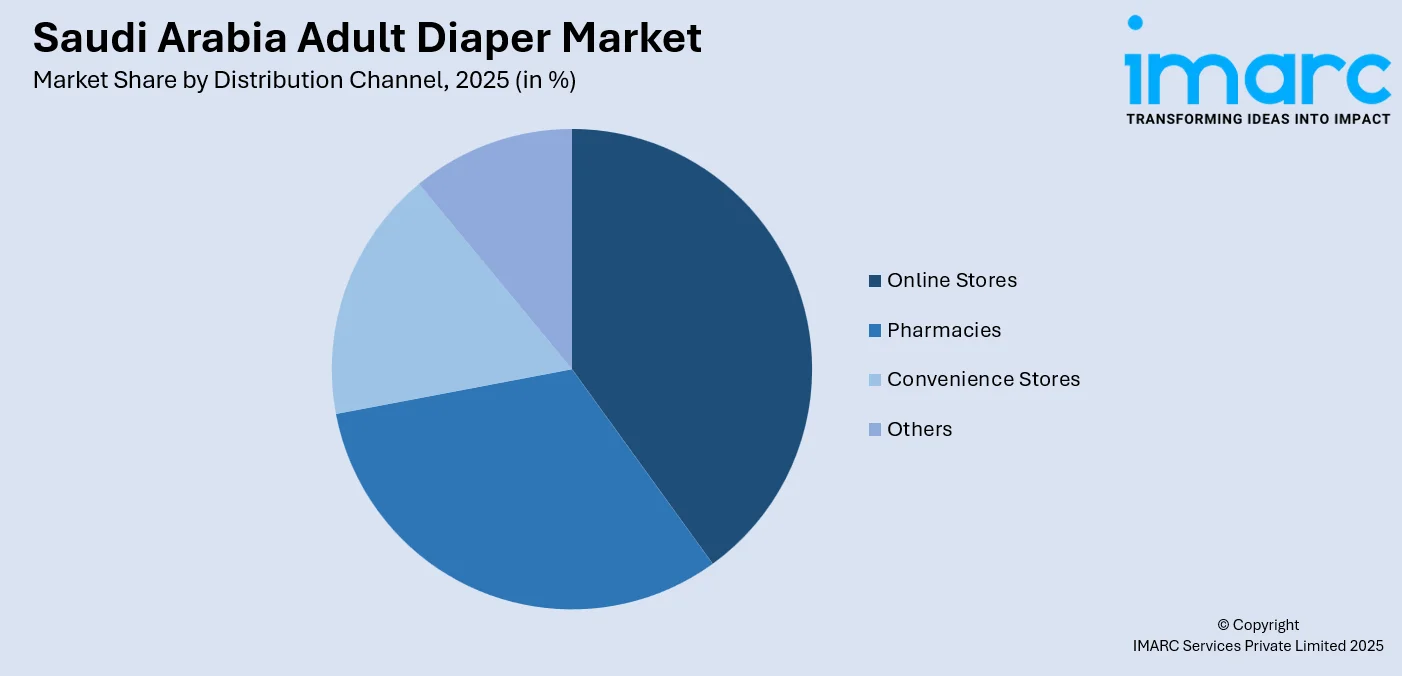

- By Distribution Channel: Online stores lead the market with a share of 40.06% in 2025, owing to discreet purchasing options, convenient home delivery, and expanding digital commerce infrastructure.

- By Region: Northern and central region represent the largest segment with a market share of 33% in 2025, supported by Riyadh's concentration of elderly population and advanced healthcare facilities.

- Key Players: The Saudi Arabia adult diaper market features moderate competitive intensity, with established multinational hygiene corporations competing alongside regional Gulf Cooperation Council manufacturers across diverse price segment.

To get more information on this market Request Sample

Saudi Arabia's adult diaper market is experiencing robust expansion driven by demographic transformation and healthcare modernization. The Elderly Survey 2025 indicated that the number of individuals aged 60 and above in the Kingdom of Saudi Arabia reached around 1.7 million by 2025, representing 4.8% of the overall population. Results also indicated that Saudis made up 69.0% of the senior population, while non-Saudis represented 31.0%. Regarding gender, females made up 43.0% while males accounted for 57.0%. This demographic shift coincides with Vision 2030's healthcare infrastructure investments, including expanded geriatric care facilities, rehabilitation centers, and home healthcare services. Cultural attitudes toward incontinence management are evolving positively, with awareness campaigns reducing historical stigma and encouraging product adoption across urban and rural communities. The Saudi Arabia e-commerce market's expansion exemplifies how digital channels are revolutionizing product accessibility and consumer purchasing behavior in the hygiene sector.

Saudi Arabia Adult Diaper Market Trends:

Rise of Sustainable and Biodegradable Product Innovations

Environmental consciousness is reshaping product development strategies as manufacturers introduce biodegradable adult diapers utilizing plant-based materials and compostable components. This transformation aligns with the Kingdom's Vision 2030 sustainability objectives while addressing growing consumer preferences for eco-responsible hygiene solutions. Saudi manufacturers launched enhanced biodegradable adult diapers in February 2025 featuring improved odor control technologies and skin-friendly materials, demonstrating the industry's commitment to balancing environmental responsibility with performance excellence. These innovations appeal particularly to educated urban consumers who prioritize sustainable consumption patterns while maintaining quality standards. Moreover, the occurrence of various events promoting sustainability and conservation is further educating people about sustainable choices in their lifestyle products. On March 27, Saudi Arabia observes its second annual Saudi Green Initiative Day, marking the inception of the Saudi Green Initiative (SGI) by His Royal Highness Mohammed bin Salman, Crown Prince and Prime Minister. SGI is a community-led effort aimed at directing the execution of significant, measurable environmental and climate initiatives to enhance the quality of life throughout the Kingdom, aligning with the objectives of Saudi Vision 2030.

Digital Commerce Transformation and Subscription Service Expansion

E-commerce platforms are fundamentally transforming how consumers purchase adult diapers by offering discreet, convenient, and personalized shopping experiences. Online retailers provide comprehensive product information, customer reviews, and direct-to-door delivery services that eliminate traditional purchasing barriers associated with social stigma. E-commerce platforms broadened subscription options, providing tailored delivery times and discreet packaging that improve convenience for senior users and their caregivers. This digital transformation enables consumers to compare products, access specialized information, and maintain privacy throughout the purchasing process. The rapid growth of Saudi Arabia's e-commerce infrastructure, characterized by improved logistics networks and mobile payment adoption, facilitates seamless transactions and repeat purchasing behavior that strengthens customer loyalty. IMARC Group predicts that the Saudi Arabia e-commerce market is projected to attain USD 708.7 Billion by 2033.

Integration of Smart Technology and IoT Solutions

Healthcare facilities are increasingly adopting intelligent monitoring systems that enhance patient care quality and caregiver efficiency through real-time data transmission. Smart diaper technology incorporating moisture sensors enables timely diaper changes, reducing skin irritation risks and improving dignity for incontinence patients. Major healthcare providers integrated artificial intelligence (AI)-powered moisture sensors into adult diapers, creating systems that alert caregivers when changes are needed through connected mobile applications. These technological advances optimize resource allocation in medical facilities while enhancing patient comfort and reducing infection risks. Moreover, the country’s focus on AI advancement is further increasing the availability of efficient products aided with smart features. The government of Saudi Arabia intends to establish a fund of approximately $40 billion to invest in AI. Representatives from Saudi Arabia's Public Investment Fund (PIF) engaged in talks about a possible collaboration with U.S. venture capital firm Andreessen Horowitz and various other investors for this initiative.

How Vision 2030 is Transforming the Saudi Arabia Adult Diaper Market:

Saudi Arabia’s Vision 2030 is significantly reshaping the adult diaper market, driven by a push for improved healthcare services, innovation, and sustainable solutions. The increasing demand for adult diapers stems from an aging population and rising healthcare awareness, which Vision 2030 addresses through initiatives aimed at enhancing the quality of life for the elderly and people with disabilities. With a focus on developing the healthcare sector, Vision 2030 promotes the use of advanced technologies in medical products, including adult diapers. Furthermore, the government is encouraging local manufacturing and research to reduce reliance on imports and boost economic growth. Sustainability is another key element, with a move towards eco-friendly materials and production methods. Companies are increasingly adopting biodegradable and skin-friendly materials, catering to the growing environmentally-conscious consumer base. These changes, alongside economic diversification and improved healthcare infrastructure, are positioning Saudi Arabia as a leader in the adult diaper market in the Middle East.

Market Outlook 2026-2034:

Saudi Arabia's adult diaper market is positioned for sustained expansion as demographic trends intersect with technological innovation and cultural evolution. The convergence of aging population dynamics, government healthcare investments, and declining social stigma creates favorable conditions for market growth across all segments. Product innovation focusing on enhanced absorbency, breathability, and discretion addresses consumer demands for comfort and dignity in warm climate conditions. The market generated a revenue of USD 196.55 Million in 2025 and is projected to reach a revenue of USD 319.04 Million by 2034, growing at a compound annual growth rate of 5.53% from 2026-2034. Digital commerce infrastructure development facilitates broader market access while subscription models ensure consistent product availability.

Saudi Arabia Adult Diaper Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Adult Pad Type Diaper |

51.86% |

|

Distribution Channel |

Online Stores |

40.06% |

|

Region |

Northern and Central Region |

33% |

Type Insights:

- Adult Pad Type Diaper

- Adult Flat Type Diaper

- Adult Pant Type Diaper

Adult pad type diaper dominates with a market share of 51.86% of the total Saudi Arabia adult diaper market in 2025.

Adult pad type diapers command the largest market segment due to their superior cost-effectiveness, offering consumers financial advantages of 40 to 50% lower per-unit costs compared to pant-type alternatives. This economic benefit resonates strongly with price-conscious consumers and healthcare institutions managing large-scale procurement budgets. The product format provides psychological acceptability for users transitioning to incontinence management, as the design resembles traditional sanitary products rather than full-body undergarments. This familiarity reduces emotional barriers to adoption among individuals experiencing mild to moderate incontinence conditions who maintain active lifestyles.

The pad-type configuration offers versatile application across diverse incontinence severity levels, enabling users to customize absorption capacity according to individual needs without purchasing entirely different product categories. Healthcare facilities appreciate the ease of application for caregivers assisting mobility-impaired patients, while the lower profile design enhances discretion under regular clothing. Manufacturing efficiencies associated with pad-type production enable competitive pricing structures that support market accessibility across socioeconomic segments, reinforcing the segment's market dominance through affordability combined with functional effectiveness.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Pharmacies

- Convenience Stores

- Online Stores

- Others

Online stores lead with a share of 40.06% of the total Saudi Arabia adult diaper market in 2025.

Online distribution channels have emerged as the dominant retail avenue by addressing fundamental consumer concerns regarding privacy, convenience, and product accessibility. Digital platforms eliminate social discomfort associated with in-store adult diaper purchases by providing anonymous browsing and discreet home delivery services. The expansion of Saudi Arabia’s e-commerce infrastructure creates robust logistical foundations supporting reliable order fulfillment. Consumers benefit from comprehensive product information, customer reviews, and price comparisons unavailable in traditional retail environments, enabling informed purchasing decisions.

E-commerce platforms introduced enhanced subscription services, offering personalized delivery schedules that ensure consistent product availability while eliminating repetitive ordering tasks for caregivers and elderly users. Mobile commerce applications facilitate seamless transactions through integrated payment systems and order tracking capabilities that enhance user experience. Digital marketing strategies effectively reach target demographics through targeted advertising while educational content reduces stigma by normalizing incontinence management discussions. The 24/7 availability of online channels accommodates diverse consumer schedules, particularly benefiting working caregivers who manage elderly family members' needs outside traditional shopping hours.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region exhibits a clear dominance with a 33% share of the total Saudi Arabia adult diaper market in 2025.

The Northern and Central Region commands the largest market segment through its concentration of elderly population in Riyadh metropolitan area, which serves as the Kingdom's administrative and healthcare epicenter. Riyadh's population is expected to double by 2030 under Vision 2030 development framework, intensifying demand for elder care products and services. The region benefits from superior healthcare infrastructure density, including specialized geriatric facilities such as King Faisal Specialist Hospital & Research Centre and King Fahd Medical City that generate substantial institutional procurement volumes. Urban development patterns and higher disposable income levels in the capital region facilitate premium product adoption and brand consciousness among consumers.

The region's healthcare facilities have documented a rise in patients requiring bladder management support between, reflecting both improved diagnostic capabilities and growing awareness of treatment options. Government investment in home healthcare services and elderly care initiatives particularly concentrates in this region, creating established distribution networks and consumer education infrastructure that support market growth. Cultural evolution occurs more rapidly in metropolitan environments where exposure to global trends and healthcare information reduces traditional stigma surrounding incontinence management, accelerating product adoption rates compared to less urbanized regions.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Adult Diaper Market Growing?

Rapidly Expanding Elderly Population and Increased Life Expectancy

Saudi Arabia's demographic transformation represents the fundamental driver of adult diaper market expansion, with the proportion of citizens aged 65 and above projected to increase from 2030. The Saudi Arabia geriatric healthcare market size is expected to exhibit a growth rate (CAGR) of 6.50% during 2025-2033 according to IMARC Group. This dramatic shift reflects improvements in healthcare access, disease management, and living standards that have elevated life expectancy to approximately 75 years. Traditional family caregiving structures are evolving as urbanization and changing lifestyles limit families' capacity to provide intensive in-home care, creating reliance on formal care services and product-based incontinence management.

Vision 2030 Healthcare Infrastructure Development and Government Investment

The Kingdom's transformative Vision 2030 initiative encompasses massive healthcare sector investments specifically targeting elderly care infrastructure, rehabilitation services, and long-term care facilities. Government healthcare expenditure priorities include establishing specialized geriatric hospitals, expanding rehabilitation center capacity, and developing comprehensive home healthcare service networks that integrate incontinence product provision. The Health Sector Transformation Program emphasizes value-based healthcare delivery that prioritizes disease prevention and quality-of-life improvements for aging populations, creating institutional demand for high-quality incontinence management solutions. The ‘Jam Artificial Intelligence’ initiative has been launched by Saudi Arabia’s Ministry of Health to enhance healthcare quality for women and elderly individuals. Consequently, the initiative will concentrate on creating inventive solutions, tackling health issues, and utilizing contemporary tools and techniques. The Ministry encourages all stakeholders to present their health innovations. The submission timeframe began in February 2025. Government-backed elderly care initiatives include provision of incontinence supplies to patients at little or no cost through Ministry of Health programs and government hospital systems such as King Saud Medical City. These programs reduce financial barriers to product access while normalizing adult diaper usage through healthcare provider endorsement.

Declining Cultural Stigma and Enhanced Public Awareness

Cultural transformation regarding incontinence management represents a critical market enabler as historical taboos gradually diminish through targeted awareness campaigns and healthcare provider education initiatives. Public health campaigns by the Ministry of Health and private healthcare networks emphasize dignity, hygiene, and quality-of-life benefits associated with proper incontinence management, normalizing adult diaper usage across demographic segments. Healthcare professionals receive training on appropriate product recommendations and patient counseling techniques that reduce psychological barriers to adoption, creating trusted intermediaries who facilitate initial product trials. The government is also launching public electronic consultation programs to promote important health topics. For instance, in 2025, The Ministry of Health declared the initiation of a public online consultation intended to pinpoint the key health issues for which medical advice should be provided via virtual healthcare services. This project is part of the Ministry’s efforts to improve digital health service quality and ensure they align with the changing needs and expectations of beneficiaries, particularly with the swift expansion of remote healthcare services.

Market Restraints:

What Challenges the Saudi Arabia Adult Diaper Market is Facing?

Persistent Cultural Barriers and Social Stigma

Despite progressive awareness initiatives, significant cultural resistance toward adult diaper usage persists across certain demographic and geographic segments. Many individuals experience embarrassment or reluctance surrounding incontinence management, particularly among middle-aged adults with mild conditions who avoid seeking solutions due to perceived social judgment. Traditional cultural norms in some regions associate incontinence with weakness or loss of dignity, discouraging open discussions between family members and healthcare providers. Limited public understanding of incontinence as a manageable medical condition rather than inevitable aging consequence creates psychological barriers that delay product adoption until conditions become severe, limiting preventive management opportunities.

Cost Constraints and Limited Insurance Coverage

High-quality adult diapers represent ongoing expenses that strain household budgets, particularly for fixed-income elderly individuals and low-income families managing caregiving responsibilities. Premium products offering superior absorbency, skin-friendly materials, and advanced odor control technologies command higher price points that exclude price-sensitive consumer segments from accessing optimal solutions. Lack of comprehensive government reimbursement programs or insurance coverage for incontinence products means consumers bear full costs, unlike many chronic disease medications that receive subsidization. Rural populations face additional accessibility challenges where product availability remains limited and distribution costs elevate retail prices beyond urban market levels.

Raw Material Price Volatility and Supply Chain Uncertainties

Manufacturing costs experience significant fluctuations due to volatile pricing for essential raw materials including superabsorbent polymers, non-woven fabrics, and wood pulp derivatives. Global supply chain disruptions impact material availability and transportation costs, creating pricing pressure that manufacturers must balance against competitive market positioning. Currency exchange rate variations affect import costs for raw materials and finished products, introducing pricing unpredictability that complicates inventory management and retail planning. Manufacturers face tension between maintaining affordability for price-sensitive consumers while preserving profit margins amid rising production costs, potentially limiting product innovation investments and market expansion initiatives.

Competitive Landscape:

The Saudi Arabia adult diaper market exhibits moderate competitive intensity characterized by established multinational corporations competing alongside regional Gulf Cooperation Council manufacturers across differentiated price segments. Market leaders leverage extensive distribution networks, brand recognition, and product innovation capabilities to maintain premium positioning, while regional players capture market share through competitive pricing and localized marketing strategies. Multinational brands command premium segments through advanced technology integration, comprehensive product ranges, and established healthcare provider relationships that drive institutional procurement. Regional manufacturers focus on value-oriented segments by offering competitively priced alternatives that address cost-conscious consumer needs without compromising essential functionality. Competitive strategies emphasize product differentiation through enhanced absorbency technologies, breathable materials adapted for warm climates, and discreet designs that reduce visible bulk. Major players invest in sustainability initiatives, developing biodegradable materials and eco-friendly manufacturing processes that align with Vision 2030 environmental objectives. Distribution channel expansion represents critical competitive battleground as brands establish direct-to-consumer e-commerce platforms while maintaining traditional pharmacy and retail partnerships.

Saudi Arabia Adult Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Adult Pad Type Diaper, Adult Flat Type Diaper, Adult Pant Type Diaper |

| Distribution Channels Covered | Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia adult diaper market size was valued at USD 196.55 Million in 2025.

The Saudi Arabia adult diaper market is expected to grow at a compound annual growth rate of 5.53% from 2026-2034 to reach USD 319.04 Million by 2034.

Adult pad type diaper dominated the market with a 51.86% share in 2025, driven by its cost-effectiveness offering 40-50% lower per-unit costs compared to pant-type alternatives, psychological acceptability for users transitioning to incontinence management, and versatile application across diverse severity levels.

Key factors driving the Saudi Arabia adult diaper market include the rapidly expanding elderly population projected to grow, substantial government healthcare infrastructure investments under Vision 2030 targeting geriatric care facilities and rehabilitation services, declining cultural stigma through awareness campaigns normalizing incontinence management, expanding e-commerce infrastructure enabling discreet purchasing with convenient home delivery, and technological innovations introducing biodegradable materials and AI-powered smart monitoring systems.

Major challenges include persistent cultural barriers and social stigma in certain regions creating psychological reluctance toward product adoption, high costs of premium products combined with limited government reimbursement or insurance coverage restricting accessibility for low-income segments, raw material price volatility affecting superabsorbent polymers and non-woven fabrics creating production cost uncertainties, and traditional cloth diaper preferences in some demographic segments resisting disposable product adoption despite modern alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)