Saudi Arabia Advanced Wound Care Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2026-2034

Saudi Arabia Advanced Wound Care Market Overview:

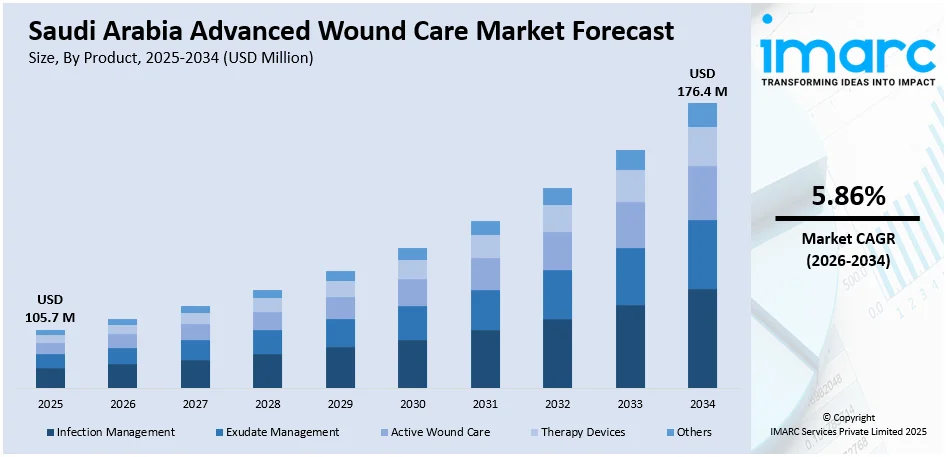

The Saudi Arabia advanced wound care market size reached USD 105.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 176.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.86% during 2026-2034. At present, the growing awareness about proper injury care and the importance of early intervention is driving the demand for advanced wound care products. Besides this, the rising expenditure on the development of modern healthcare infrastructure is contributing to the expansion of the Saudi Arabia advanced wound care market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 105.7 Million |

| Market Forecast in 2034 | USD 176.4 Million |

| Market Growth Rate 2026-2034 | 5.86% |

Saudi Arabia Advanced Wound Care Market Trends:

Growing prevalence of diabetes

Increasing incidence of diabetes is fueling the market growth. As per industry reports, as of October 2024, diabetes emerged as a significant public health issue in Saudi Arabia, with an estimated prevalence of 18.5% among adult Saudis. Diabetes is becoming increasingly common in Saudi Arabia, with the country experiencing a considerable spike in the number of diagnosed cases. This is leading to an increased demand for advanced wound care products and therapies to manage and repair persistent diabetic wounds. Advanced wound care solutions, such as hydrocolloids, hydrogels, and antimicrobial dressings, are vital in promoting faster healing, avoiding infections, and improving patient outcomes. As diabetes-related problems, including neuropathy and poor circulation, make wound healing more difficult, patients need more efficient care. Healthcare providers in Saudi Arabia are adopting advanced wound care technologies to address this challenge and improve the quality of life for diabetic patients. Additionally, the increasing awareness about proper wound care and the importance of early intervention is driving the demand for these items. As the diabetic population continues to rise, the need for advanced wound care treatments to treat diabetic ulcers is becoming urgent, further propelling the growth of the market. This shift towards advanced wound care solutions is supporting better healing, lowering healthcare costs, and enhancing the overall management of diabetes-related complications in Saudi Arabia.

To get more information on this market Request Sample

Increasing expenditure on healthcare

Rising investments in the healthcare sector are impelling the Saudi Arabia advanced wound care market growth. The government and private sector are investing in modern medical technologies and advanced treatments to enhance patient care, particularly in managing chronic conditions like diabetic ulcers and other complex wounds. These investments are helping healthcare providers adopt advanced wound care products, such as hydrocolloids, antimicrobial dressings, and tissue-engineered skin substitutes. The rise in healthcare spending is also encouraging the development of specialized wound care centers and the training of medical professionals in advanced techniques. In May 2024, the Government of Saudi Arabia intended to allocate USD 65 Billion for revamping healthcare infrastructure, educating and motivating local healthcare workers, restructuring and privatizing health services and insurance, establishing 21 health clusters nationwide, and enhancing the delivery of e-health services. Moreover, as healthcare facilities are upgrading their equipment and treatment options, they are more likely to incorporate advanced wound care solutions to ensure better healing outcomes and reduced complications. These improvements are contributing to more efficient management of wounds and promote faster recovery, which ultimately minimizes long-term healthcare costs.

Saudi Arabia Advanced Wound Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, application, and end user.

Product Insights:

- Infection Management

- Silver Wound Dressings

- Non-silver Dressings

- Collagen Dressings

- Exudate Management

- Hydrocolloids Dressings

- Foam Dressings

- Alginate Dressings

- Hydrogel Dressings

- Active Wound Care

- Skin Substitutes

- Growth Factors

- Therapy Devices

- Negative Pressure Wound Therapy (NPWT)

- Oxygen and Hyperbaric Oxygen Equipment

- Electromagnetic Therapy Devices

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes infection management (silver wound dressings, non-silver dressings, and collagen dressings), exudate management (hydrocolloids dressings, foam dressings, alginate dressings, and hydrogel dressings), active wound care (skin substitutes and growth factors), therapy devices (negative pressure wound therapy (NPWT), oxygen and hyperbaric oxygen equipment, and electromagnetic therapy devices), and others.

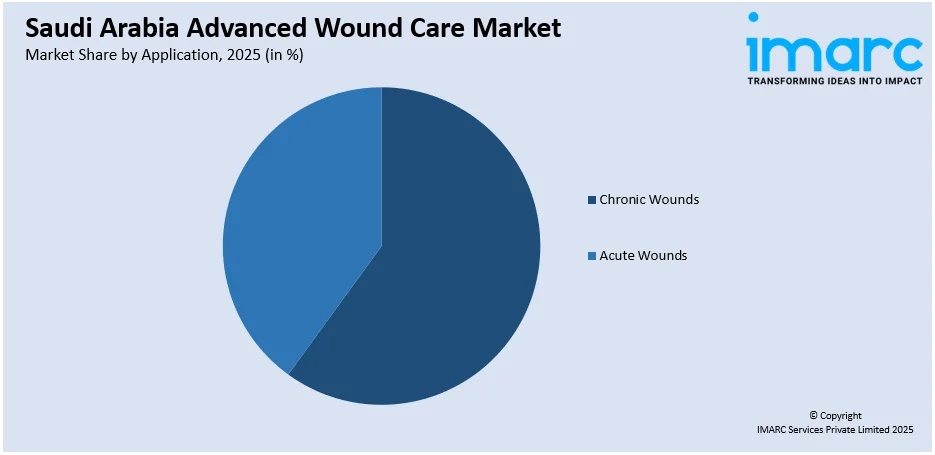

Application Insights:

Access the comprehensive market breakdown Request Sample

- Chronic Wounds

- Pressure Ulcers

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Arterial Ulcers

- Acute Wounds

- Burns and Trauma

- Surgical Wounds

The report has provided a detailed breakup and analysis of the market based on the application. This includes chronic wounds (pressure ulcers, diabetic foot ulcers, venous leg ulcers, and arterial ulcers) and acute wounds (burns and trauma and surgical wounds).

End User Insights:

- Hospitals

- Community Health Service Centers

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and community health service centers.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Advanced Wound Care Market News:

- In April 2025, King Faisal Specialist Hospital and Research Center, based in Saudi Arabia, employed an advanced arterial stent technique. The process included placing a bioresorbable stent via a catheter in the thigh, bypassing open surgery. It reinstated blood circulation, alleviated discomfort, accelerated wound healing, and decreased the likelihood of amputation.

- In November 2024, DEBx Medical, a pioneering innovator in advanced wound care, successfully concluded its second round of capital investment, led by TVM Capital Healthcare. It aimed to deliver innovative solutions to the MENA region, especially in the Kingdom of Saudi Arabia. The funding round was set to speed up the commercialization of DEBRICHEM® and allowed DEBx Medical to reach more patients and reduce the pain caused by non-healing wounds.

Saudi Arabia Advanced Wound Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered |

|

| End Users Covered | Hospitals, Community Health Service Centers |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia advanced wound care market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia advanced wound care market on the basis of product?

- What is the breakup of the Saudi Arabia advanced wound care market on the basis of application?

- What is the breakup of the Saudi Arabia advanced wound care market on the basis of end user?

- What is the breakup of the Saudi Arabia advanced wound care market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia advanced wound care market?

- What are the key driving factors and challenges in the Saudi Arabia advanced wound care?

- What is the structure of the Saudi Arabia advanced wound care market and who are the key players?

- What is the degree of competition in the Saudi Arabia advanced wound care market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia advanced wound care market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia advanced wound care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia advanced wound care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)