Saudi Arabia Agribusiness Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Saudi Arabia Agribusiness Market Size and Share:

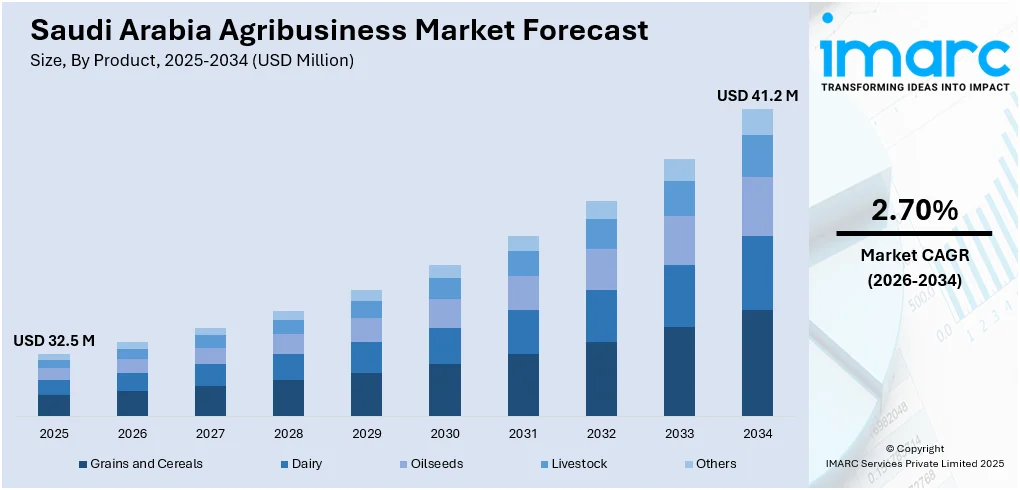

The Saudi Arabia agribusiness market size reached USD 32.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 41.2 Million by 2034, exhibiting a growth rate (CAGR) of 2.70% during 2026-2034. The market is expanding, driven by proactive policies of the Saudi Arabian government under Vision 2030, accelerated use of precision agriculture, hydroponics, aquaponics, vertical farming, and greenhouses, and rising demand for food security and local food production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 32.5 Million |

| Market Forecast in 2034 | USD 41.2 Million |

| Market Growth Rate 2026-2034 | 2.70% |

Saudi Arabia Agribusiness Market Trends:

Government Support and Vision 2030 Reforms

Proactive policies of the Saudi Arabian government under Vision 2030 contribute significantly to driving the agribusiness industry. In line with its agenda for diversification, the government wants to lower its dependence on petroleum revenue and boost sustainable food production and rural growth. This incorporates monetary subsidies, deliberate investment in farm infrastructure, and positive policy regimes meant to lure both foreign and domestic investment into agribusiness. The Ministry of Environment, Water and Agriculture (MEWA) has established a host of programs to enhance agricultural innovation, water conservation, and land restoration. Initiatives such as the Sustainable Agricultural Rural Development Program are designed to maximize productivity while maintaining natural resources. In 2024, Saudi Arabia's MEWA obtained SAR 37 billion ($9.8 billion) in private investment to develop the kingdom's agriculture and food sectors. The investments span a broad spectrum of projects, ranging from crop cultivation and livestock to fisheries, processing, and infrastructure development.

To get more information on this market, Request Sample

Adoption of Advanced Agricultural Technologies

Technological advancement is making a big difference in Saudi Arabia's agricultural business. Due to the unforgiving climatic conditions of the country, such as limited fertile land and scarcity of water, the use of advanced farming practices is not only desirable but indispensable. The industry is seeing accelerated use of precision agriculture, hydroponics, aquaponics, vertical farming, and greenhouses with controlled climates to maximize yield, conserve water, and enhance food security. Businesses and research centers are now using data analytics, internet of things (IoT) sensors, artificial intelligence (AI), and drone technology to track the health of crops, use water efficiently, and predict agricultural yield. For example, intelligent irrigation systems have slashed water usage, essential in a nation where water resources are strained. In 2025, Vertical Farms Company (VFCo), Mowreq Specialized Agriculture, and YesHealth Group jointly developed Saudi’s first indoor Vertical farming project in Riyadh.

Rising Demand for Food Security and Local Food Production

Food security is a strategic national imperative for Saudi Arabia, especially against the backdrop of global supply chain disruptions and geopolitical tensions. The growing population and increasing per capita income are propelling greater consumption of varied and nutritious food items, further highlighting the imperative to increase local production. This demand is driving investments along the agricultural value chain from agriculture and food processing to storage and distribution. The government is also aimed at becoming self-sufficient in the key foodstuffs like poultry, dairy, fruits, and vegetables. The policies are being geared towards promoting farming in the country, minimizing imports, and stabilizing the domestic prices of foodstuffs. Moreover, Saudi Arabia's Agricultural Development Fund (ADF) will raise its approvals of loans to SAR 7.4 billion ($2 billion) in 2025, backing strategic projects under the National Agriculture and Food Security Strategies, based on Asharq Al-Awsat.

Saudi Arabia Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product and application.

Product Insights:

- Grains and Cereals

- Dairy

- Oilseeds

- Livestock

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains and cereals, dairy, oilseeds, livestock, and others.

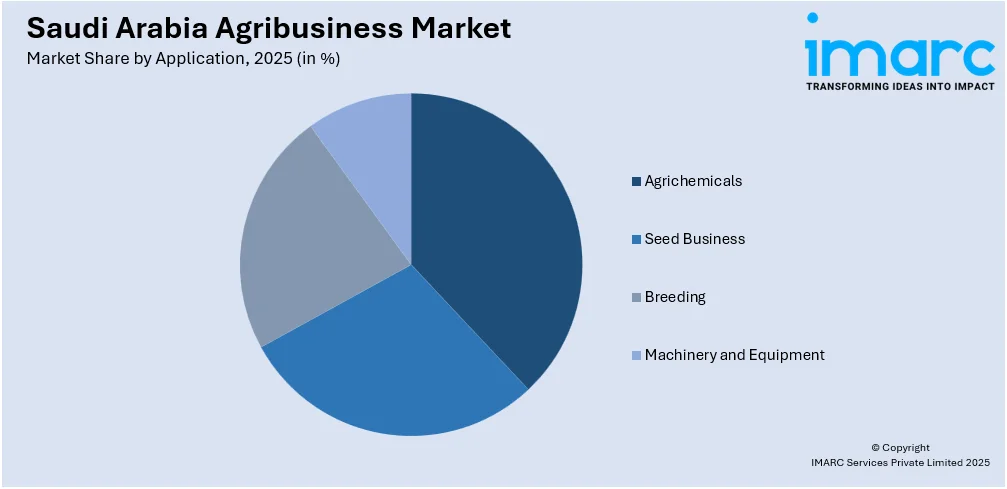

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Agrichemicals

- Seed Business

- Breeding

- Machinery and Equipment

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes agrichemicals, seed business, breeding, and machinery and equipment.

Regional Insights:

- Northern And Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include northern and central region, western region, eastern region, and southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Grains And Cereals, Dairy, Oilseeds, Livestock, Others |

| Applications Covered | Agrichemicals, Seed Business, Breeding, Machinery and Equipment |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia agribusiness market on the basis of product?

- What is the breakup of the Saudi Arabia agribusiness market on the basis of application?

- What is the breakup of the Saudi Arabia agribusiness market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia agribusiness market?

- What are the key driving factors and challenges in the Saudi Arabia agribusiness?

- What is the structure of the Saudi Arabia agribusiness market and who are the key players?

- What is the degree of competition in the Saudi Arabia agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia agribusiness market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the [Saudi Arabia agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)