Saudi Arabia Agricultural Biologicals Market Size, Share, Trends and Forecast by Type, Source, Crop Type, Mode of Application, and Region, 2026-2034

Saudi Arabia Agricultural Biologicals Market Overview:

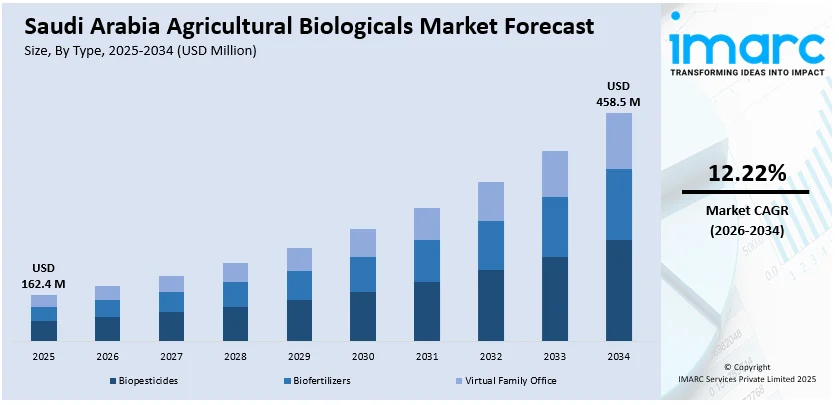

The Saudi Arabia agricultural biologicals market size reached USD 162.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 458.5 Million by 2034, exhibiting a growth rate (CAGR) of 12.22% during 2026-2034. The market is driven by government initiatives focused on sustainability, food security, and reducing reliance on conventional farming. The Vision 2030 framework prioritizes innovation in crop yield and environmental impact through biological inputs like biopesticides and biofertilizers. Increased adoption of organic farming, supported by incentives and awareness campaigns by governing authority, is also catalyzing the demand for agricultural biologicals. These initiatives aim to improve organic farming practices, meet certification standards, and contribute to long-term agricultural sustainability, thus expanding the Saudi Arabia agricultural biologicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 162.4 Million |

| Market Forecast in 2034 | USD 458.5 Million |

| Market Growth Rate 2026-2034 | 12.22% |

Saudi Arabia Agricultural Biologicals Market Trends:

Government Initiatives and Strategic Investments in Biotechnology

The expansion of Saudi Arabia's agricultural biologicals market is largely driven by the ongoing initiatives of the governing body to improve food security and lessen reliance on conventional farming methods. The governing authority, via the Vision 2030 initiative, is placing a high priority on creating sustainable and innovative agricultural solutions. This encompasses an emphasis on improving crop yield and minimizing environmental effects by utilizing biological inputs like biopesticides, biofertilizers, and biostimulants. The governing authority is supporting research operations in agricultural biotechnology, combined with encouragement for local production and application of biological solutions, is fostering a favorable Saudi Arabia agricultural biologicals market growth. Moreover, collaborations with international agricultural biotech companies and local partners are promoting knowledge sharing and enhancing the adoption of innovative biological technologies. These efforts are in line with the Kingdom's larger objectives of attaining enduring sustainability in agriculture, minimizing water consumption, and enhancing the overall resilience of its agricultural frameworks. In 2024, Saudi Arabia's Crown Prince launched the National Biotechnology Strategy, aiming to position the Kingdom as a global leader in biotechnology by 2040. The strategy focused on vaccines, bio-manufacturing, genomics, and plant optimization to enhance health, agriculture, and food security, creating jobs and boosting economic growth.

Increased Focus on Organic Farming and Certification Compliance

Saudi Arabia is experiencing an increase in organic farming methods as both international and local demand for organic products grows, fueled by consumer choices for health-focused and chemical-free food options. Reflecting this trend, farmers are progressively relying on agricultural biologicals, including biopesticides, biofertilizers, and biostimulants, to fulfill organic certification standards and comply with sustainable farming methods. These biological products act as vital substitutes for synthetic chemicals, allowing farmers to uphold organic certification while enhancing both crop yield and quality. Moreover, the governing body is supporting this transition by providing incentives and structures that promote organic agriculture and the application of biological products. This backing is clear in programs, such as the 2024 public awareness campaign initiated by the Ministry of Environment, Water, and Agriculture, which sought to foster organic food culture and highlight the health advantages of organic foods. The initiative aimed to stimulate innovation and enhance the standard of organic products. This is in line with the overall plan of the governing body to increase organic food consumption and foster the sector's development. With the increasing demand for organic products, the use of agricultural biologicals in Saudi Arabia is growing, enhancing the organic farming industry and aiding the Kingdom's larger food security and sustainability objectives. Such initiatives are establishing biologicals as a critical resource for growing the organic farming sector and improving the agricultural environment in Saudi Arabia.

Saudi Arabia Agricultural Biologicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, source, crop type, and mode of application.

Type Insights:

- Biopesticides

- Biofertilizers

- Biostimulants

The report has provided a detailed breakup and analysis of the market based on the type. This includes biopesticides, biofertilizers, and biostimulants.

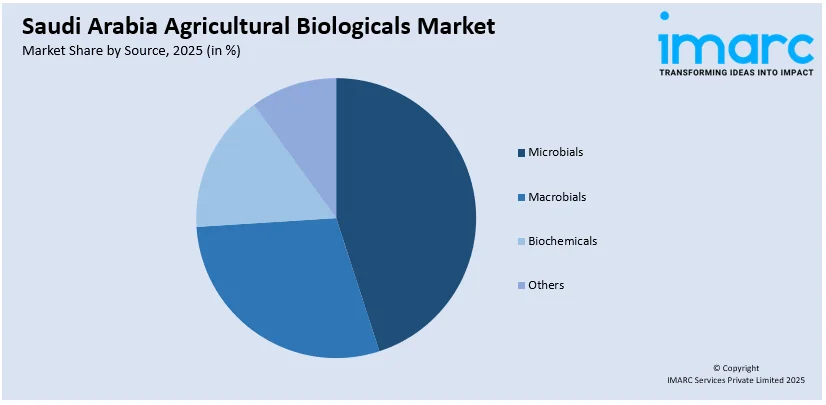

Source Insights:

- Microbials

- Macrobials

- Biochemicals

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes microbials, macrobials, biochemicals, and others.

Crop Type Insights:

- Cereals and Grains

- Oilseed and Pulses

- Fruits and Vegetables

- Turf and Ornamentals

- Others

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereals and grains, oilseed and pulses, fruits and vegetables, turf and ornamentals, and others.

Mode of Application Insights:

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Post-Harvest

A detailed breakup and analysis of the market based on the mode of application have also been provided in the report. This includes foliar spray, soil treatment, seed treatment, and post-harvest.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Agricultural Biologicals Market News:

- In December 2024, Saudi Arabia announced an investment in algae-based biostimulants to improve soil quality and enhance agricultural production. In collaboration with KAUST and other institutions, the project aimed to scale up production of biostimulants that promote plant growth and resilience without harming the environment. This initiative supported sustainable agriculture and enhances food security in the Kingdom.

Saudi Arabia Agricultural Biologicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Biopesticides, Biofertilizers, Biostimulants |

| Sources Covered | Microbials, Macrobials, Biochemicals, Others |

| Crop Types Covered | Cereals and Grains, Oilseed and Pulses, Fruits and Vegetables, Turf and Ornamentals, Others |

| Mode of Applications Covered | Foliar Spray, Soil Treatment, Seed Treatment, Post-Harvest |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia agricultural biologicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia agricultural biologicals market on the basis of type?

- What is the breakup of the Saudi Arabia agricultural biologicals market on the basis of source?

- What is the breakup of the Saudi Arabia agricultural biologicals market on the basis of crop type?

- What is the breakup of the Saudi Arabia agricultural biologicals market on the basis of mode of application?

- What is the breakup of the Saudi Arabia agricultural biologicals market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia agricultural biologicals market?

- What are the key driving factors and challenges in the Saudi Arabia agricultural biologicals market?

- What is the structure of the Saudi Arabia agricultural biologicals market and who are the key players?

- What is the degree of competition in the Saudi Arabia agricultural biologicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia agricultural biologicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia agricultural biologicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia agricultural biologicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)