Saudi Arabia Agricultural Equipment Market Size, Share, Trends and Forecast by Equipment Type, Application, and Region, 2026-2034

Saudi Arabia Agricultural Equipment Market Overview:

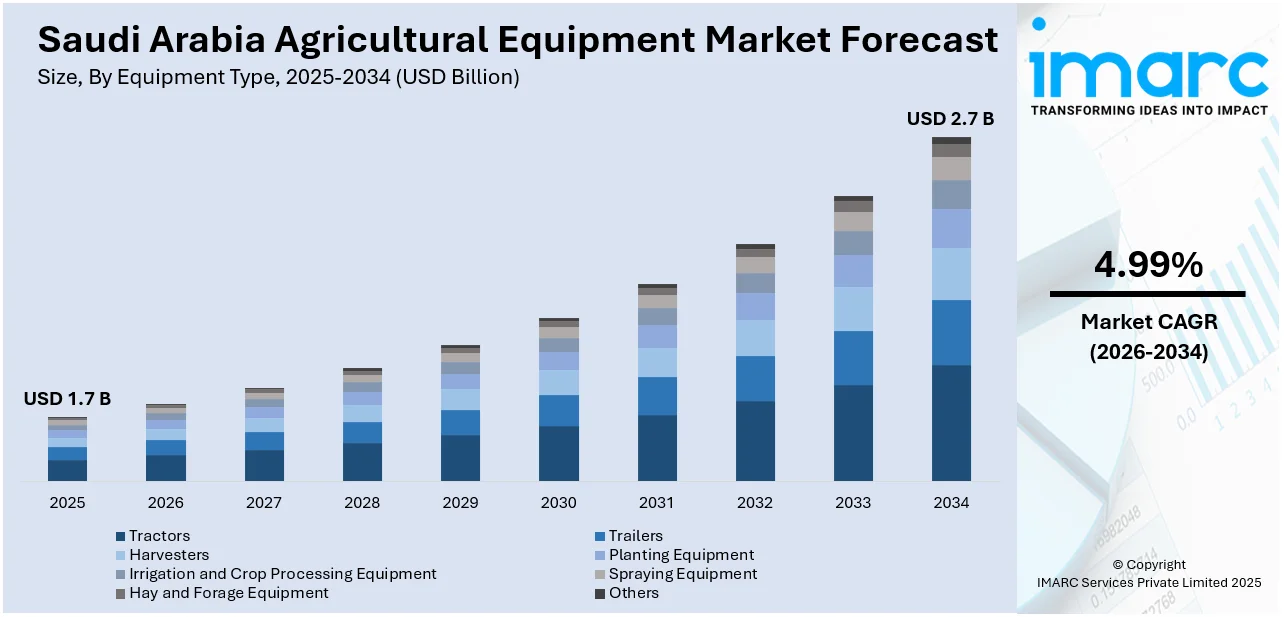

The Saudi Arabia agricultural equipment market size reached USD 1.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.99% during 2026-2034. The market is witnessing significant growth due to government-led mechanization, water-efficient technologies, and rising adoption of precision farming tools. Moreover, increasing greenhouse farming, sustainability focus, and private sector participation are also driving demand across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.7 Billion |

| Market Forecast in 2034 | USD 2.7 Billion |

| Market Growth Rate 2026-2034 | 4.99% |

Saudi Arabia Agricultural Equipment Market Trends:

Expansion of Greenhouse Farming

The growing shift toward greenhouse cultivation is reshaping the Saudi Arabia agricultural equipment market share, as farmers increasingly turn to protected agriculture to combat harsh climatic conditions and water scarcity. Controlled-environment farming methods are becoming essential for producing high-value crops such as tomatoes, cucumbers, and leafy greens year-round. This shift is accelerating demand for specialized equipment including automated irrigation systems, nutrient dosing units, ventilation and cooling mechanisms, and climate control technologies. Hydroponic systems are also gaining traction within greenhouses, enabling higher yields with minimal water use. For instance, in January 2025, Saudi Arabia's agritech startup Arable raised $2.55 million in seed funding, mainly from foreign investors, to advance hydroponic farming in Saudi Arabia. The initiative aims to leverage technology to increase local food production and address the Kingdom's agricultural challenges while aligning with Vision 2030 and promoting sustainability. Government subsidies, along with private investment in sustainable agriculture, are further propelling greenhouse adoption. As the country aims to strengthen its food security and reduce agricultural imports, demand for greenhouse-related machinery is expected to climb steadily. This trend will continue to shape the Saudi Arabia agricultural equipment market outlook over the next several years.

To get more information on this market Request Sample

Adoption of Precision Agriculture Technologies

Precision farming is transforming farm practice in the Kingdom, with more applications of advanced machinery like GPS-driven tractors, drones-based monitoring, and real-time sensor platforms. These technologies assist Saudi farmers in providing inputs like water, fertilizers, and pesticides at specific locations, reducing wastage and ensuring higher crop health. Satellite imaging and IoT platforms are also useful for better decision-making, particularly in tracking field variability and predicting harvest calendars. New players in the market are offering AI-enabled platforms and analytics solutions that help farmers optimize processes and improve yields. For instance, in December 2023, FarmERP, an agritech leader operating in over 30 countries, announced its expansion into Saudi Arabia, establishing a regional office. The company aims for a 200% yearly client increase and a 3x revenue growth, leveraging AI and machine learning to enhance food security, sustainability, and agricultural efficiency in the region. This shift is especially critical in Saudi Arabia, where resource efficiency is a priority due to arid conditions. As digital farming gains traction across the region, precision agriculture is becoming a key driver of productivity and sustainability playing a significant role in Saudi Arabia agriculture equipment market growth.

Saudi Arabia Agricultural Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on equipment type and application.

Equipment Type Insights:

- Tractors

- Trailers

- Harvesters

- Planting Equipment

- Irrigation and Crop Processing Equipment

- Spraying Equipment

- Hay and Forage Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes tractors, trailers, harvesters, planting equipment, irrigation and crop processing equipment, spraying equipment, hay and forage equipment, and others.

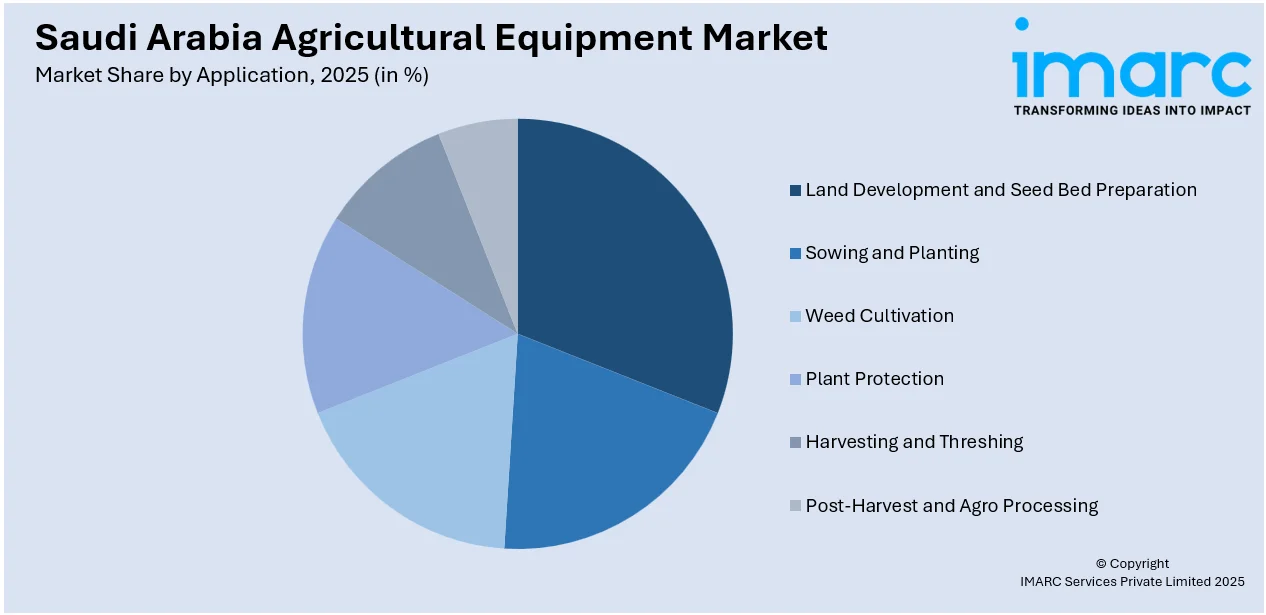

Application Insights:

Access the comprehensive market breakdown Request Sample

- Land Development and Seed Bed Preparation

- Sowing and Planting

- Weed Cultivation

- Plant Protection

- Harvesting and Threshing

- Post-Harvest and Agro Processing

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes land development and seed bed preparation, sowing and planting, weed cultivation, plant protection, harvesting and threshing, and post-harvest and agro processing.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Agricultural Equipment Market News:

- In February 2025, Hyliion Holdings Corp. signed a non-binding Letter of Intent with Al Khorayef Group to deploy up to twelve 200 kW KARNO generators for agricultural applications in Saudi Arabia. This partnership aims to support sustainability goals and enhance food security, utilizing efficient, low-emission technology for remote power generation.

- In December 2024, NEOM’s food company, Topian, launched a high-tech greenhouse in Oxagon aimed at sustainable farming. The four-hectare facility will produce 4,000 tonnes of fruits and vegetables annually while enhancing food security and minimizing resource use. It focuses on innovative agricultural technologies and renewable energy for sustainable food production.

- In October 2024, Saudi Arabia announced the launch of the National Food Production Initiative, a collaborative effort between iyris, Red Sea Global, and key partners. This project features a sustainable greenhouse on 0.75 hectares in Bada, transforming unproductive land into a viable agricultural facility, enhancing local food security, and supporting the Kingdom's Vision 2030 goals.

Saudi Arabia Agricultural Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Tractors, Trailers, Harvesters, Planting Equipment, Irrigation and Crop Processing Equipment, Spraying Equipment, Hay and Forage Equipment, Others |

| Applications Covered | Land Development and Seed Bed Preparation, Sowing and Planting, Weed Cultivation, Plant Protection, Harvesting and Threshing, Post-Harvest and Agro Processing |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia agricultural equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia agricultural equipment market on the basis of equipment type?

- What is the breakup of the Saudi Arabia agricultural equipment market on the basis of application?

- What is the breakup of the Saudi Arabia agricultural equipment market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia agricultural equipment market?

- What are the key driving factors and challenges in the Saudi Arabia agricultural equipment market?

- What is the structure of the Saudi Arabia agricultural equipment market and who are the key players?

- What is the degree of competition in the Saudi Arabia agricultural equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia agricultural equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia agricultural equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia agricultural equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)