Saudi Arabia Agriculture Drones Market Size, Share, Trends and Forecast by Offering, Component, Farming Environment, Application, and Region 2026-2034

Saudi Arabia Agriculture Drones Market Summary:

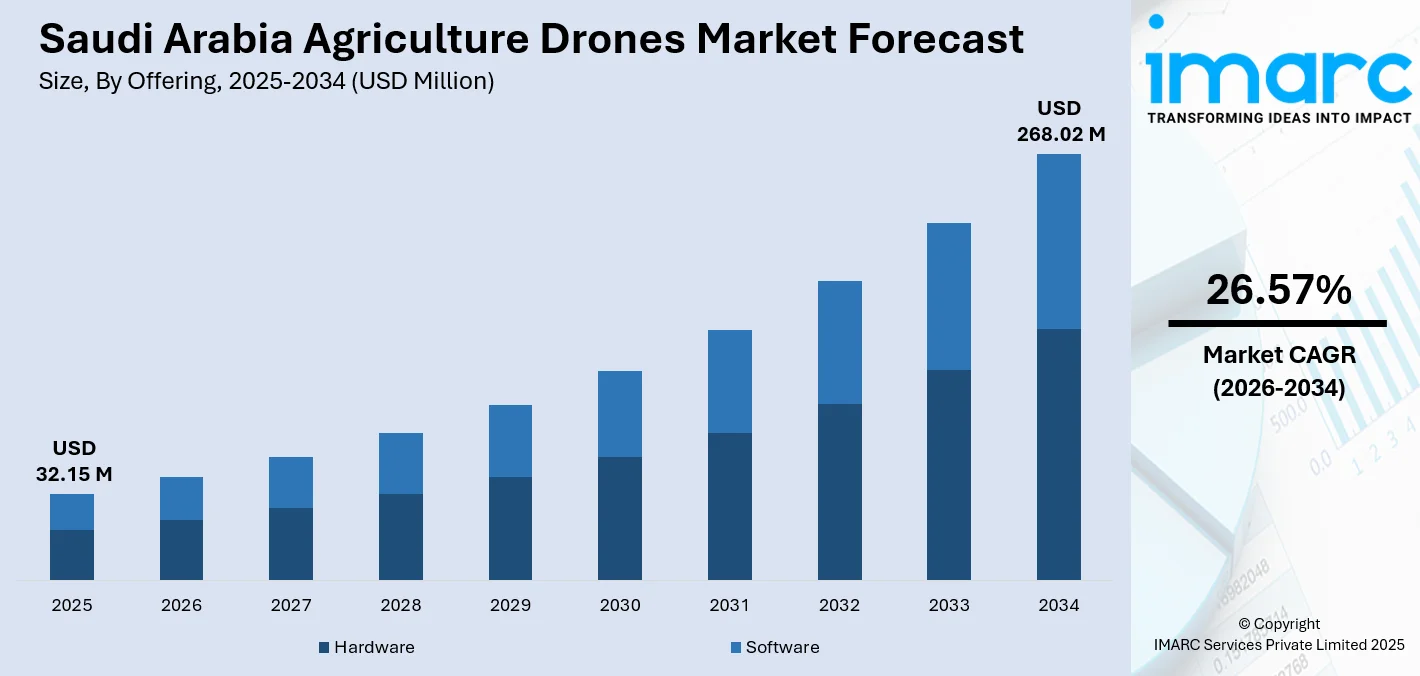

The Saudi Arabia agriculture drones market size was valued at USD 32.15 Million in 2025 and is projected to reach USD 268.02 Million by 2034, growing at a compound annual growth rate of 26.57% from 2026-2034.

The Saudi Arabia agriculture drones market growth is driven by the Kingdom’s Vision 2030 initiatives focused on agricultural modernization, food security, and sustainable resource management. Government support for precision farming, combined with expansion of large-scale commercial agriculture, is accelerating adoption of drone-based solutions. Farmers increasingly recognize drones for efficient crop monitoring, irrigation planning, and targeted input application. These technologies support water conservation, yield optimization, and cost control, contributing to a rapidly evolving agricultural technology ecosystem across the Kingdom.

Key Takeaways and Insights:

- By Offering: Hardware dominates the market with a share of 71% in 2025, driven by the fundamental requirement for physical drone platforms, sensors, and aerial imaging equipment essential for precision agriculture applications.

- By Component: Cameras lead the market with a share of 25% in 2025. This dominance is because of the critical importance of high-resolution and multispectral imaging capabilities for crop health assessment, pest detection, and irrigation monitoring in precision farming operations.

- By Farming Environment: Outdoor represents the largest segment with a market share of 90% in 2025, owing to the extensive scale of commercial farming operations across Saudi Arabia's agricultural regions where large-scale field monitoring, aerial spraying, and terrain mapping require outdoor drone deployment.

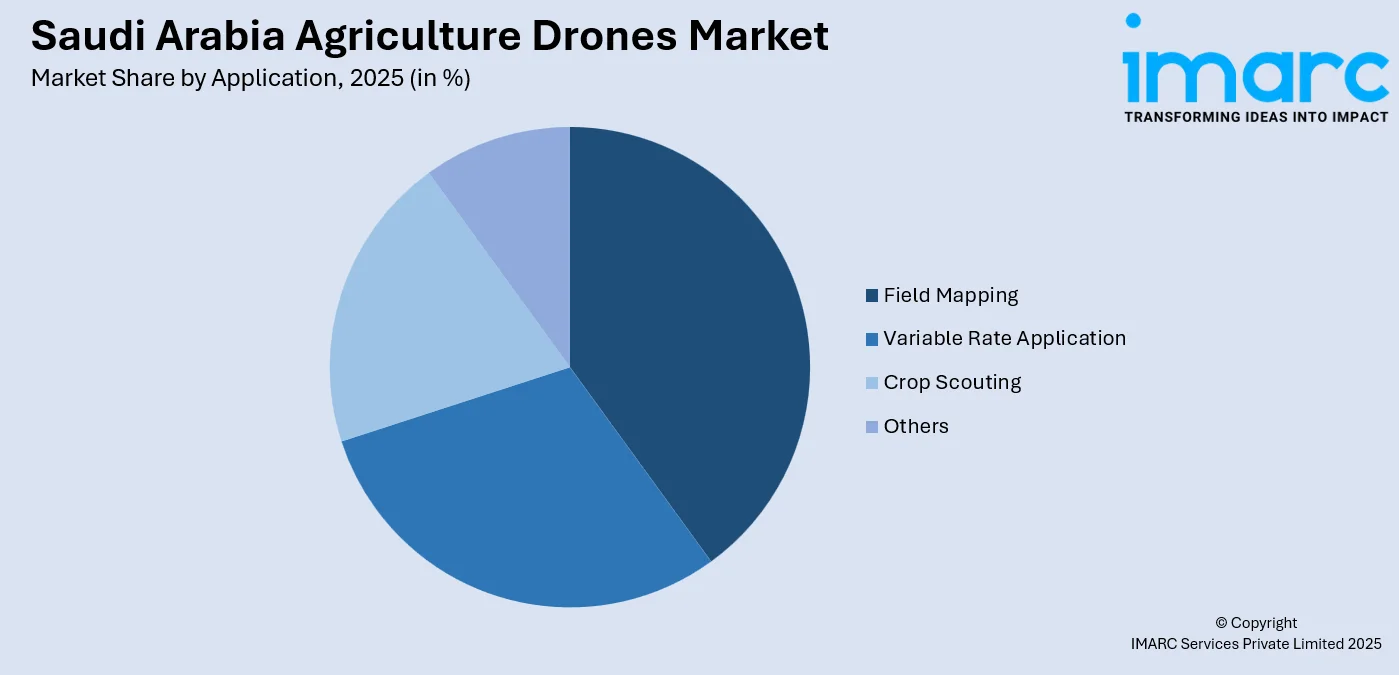

- By Application: Field Mapping dominates the market with a share of 39% in 2025, due to the essential role of aerial surveying in optimizing irrigation systems, assessing soil conditions, and planning agricultural operations across the Kingdom's vast commercial farming zones.

- By Region: Northern and Central Region leads the market with a share of 35% in 2025, supported by the concentration of major agricultural zones, including Qassim's date palm plantations and the presence of key agricultural research institutions supporting precision farming adoption.

- Key Players: The Saudi Arabia agriculture drones market exhibits moderate competitive intensity, with international technology providers competing alongside emerging local service companies across various agricultural applications and price segments.

To get more information on this market Request Sample

The Saudi Arabia agriculture drones market is experiencing notable growth, supported by the governing body's strategic investments in sustainable farming practices and technological advancements. In 2025, Saudi Arabia launched 181 environmental, water, and agriculture projects in Riyadh, valued at over $10 billion, in a concerted effort to enhance sustainability and support the goals of Vision 2030. These projects focus on increasing agricultural productivity while conserving precious water resources and reducing environmental impact. Drones, with their ability to monitor crop health, optimize irrigation, and manage pest control efficiently, are becoming indispensable tools for achieving these objectives. By enabling precision agriculture, drones help farmers make data-driven decisions that maximize yields and minimize resource waste. As the governing authority continues to invest in such initiatives, the adoption of agricultural drones is increasing, positioning the Kingdom’s farming sector as a global leader in sustainable and high-tech agricultural practices.

Saudi Arabia Agriculture Drones Market Trends:

Public Awareness and Education in Agricultural Technology

Increasing public awareness and education about agricultural technology are accelerating the adoption of drones in Saudi Arabia. As more farmers, agribusinesses, and educational institutions recognize the benefits of precision agriculture, drone technologies are gaining prominence as essential tools for modern farming. Universities, agricultural schools, and industry conferences are offering training and resources to demonstrate how drones can improve efficiency, resource management, and crop yields. In 2026, Saudi Arabia signed a $5 million deal with CGIAR to enhance agricultural innovation, focusing on sustainable practices and food security. This agreement aims to integrate high-tech solutions, train local workers, and improve irrigation efficiency, aligning with the Kingdom’s Vision 2030 objectives.

Rising Demand for Precision Agriculture

The growing emphasis on precision agriculture is driving the adoption of drones in Saudi Arabia's agricultural sector. Precision agriculture leverages data-driven insights to optimize farming practices, reduce costs, and boost yields. Drones provide real-time monitoring of crop health, soil conditions, and pest infestations, enabling farmers to apply fertilizers, pesticides, and water only where needed. This targeted approach not only improves yields and reduces resource utilization but also supports sustainable farming practices. For example, in 2026, Saudi Arabia's Ministry of Environment, Water, and Agriculture launched a project in Asir to modernize farming, utilizing advanced techniques and precision agriculture to enhance regional productivity and sustainability.

Environmental and Sustainability Pressures

Environmental sustainability is a growing concern in Saudi Arabia's agricultural sector, with drones playing a key role in reducing agriculture’s ecological footprint. By enabling precise pesticide spraying, fertilizer application, and irrigation management, drones minimize the overuse of chemicals and water resources, contributing to more sustainable farming practices. In 2024, Saudi Arabia secured $9.8 billion in private investments to enhance its agriculture and food sectors as part of Vision 2030. These investments will support projects focused on sustainability, crop production, and infrastructure development, further promoting eco-friendly practices and increasing the demand for drones in sustainable agriculture.

How Vision 2030 is Transforming the Saudi Arabia Agriculture Drones Market:

Vision 2030 is transforming the Saudi Arabia agriculture drones market by accelerating the adoption of advanced technologies to improve productivity, sustainability, and food security. National programs supporting precision agriculture encourage the use of drones for crop monitoring, soil analysis, and optimized irrigation management. Investment incentives, research initiatives, and partnerships with agri-tech providers are strengthening local capabilities and technology transfer. Emphasis on water conservation and efficient resource use aligns closely with drone-enabled data collection and analytics. In addition, modernization of large-scale commercial farming and improved digital infrastructure are expanding practical applications, positioning agricultural drones as a key component of the Kingdom’s long-term agricultural transformation strategy.

Market Outlook 2026-2034:

The Saudi Arabia agriculture drones market demonstrates robust growth potential throughout the forecast period, underpinned by Vision 2030–driven agricultural modernization and rising adoption of precision farming practices. Increasing focus on water efficiency, crop monitoring, and yield optimization is accelerating drone deployment across large commercial farms. Government support for agri-technology, improving digital infrastructure, and the growing awareness about data-driven farming further contribute to the market growth. The market generated a revenue of USD 32.15 Million in 2025 and is projected to reach a revenue of USD 268.02 Million by 2034, growing at a compound annual growth rate of 26.57% from 2026-2034.

Saudi Arabia Agriculture Drones Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Offering |

Hardware |

71% |

|

Component |

Cameras |

25% |

|

Farming Environment |

Outdoor |

90% |

|

Application |

Field Mapping |

39% |

|

Region |

Northern and Central Region |

35% |

Offering Insights:

- Hardware

- Fixed Wing

- Rotary Wing

- Hybrid Wing

- Software

- Data Management Software

- Imaging Software

- Data Analytics Software

- Others

Hardware dominates with a market share of 71% of the total Saudi Arabia agriculture drones market in 2025.

Hardware holds the biggest market share due to the essential role of physical drone platforms in enabling aerial data collection and field operations. As farmers continue to embrace drone technology, there is higher investment in essential hardware components, such as durable airframes, sensors, cameras, and navigation systems. These advanced systems are vital for conducting accurate crop monitoring, field mapping, and precision spraying, which are key to enhancing farm productivity and ensuring optimal resource use across expansive agricultural lands.

The dominance of hardware segment is further reinforced by the high initial equipment costs associated with drone adoption. For drones to perform reliably in large-scale farming operations, advanced hardware components are essential. These include multispectral sensors, GPS-enabled systems, and high-quality cameras, which are critical for obtaining accurate data on crop health, soil conditions, and irrigation efficiency. The need for precise and durable technology is heightened in vast farming environments, where reliability and performance are paramount.

Component Insights:

- Controller Systems

- Propulsion Systems

- Cameras

- Batteries

- Navigation Systems

- Others

Cameras lead with a market share of 25% of the total Saudi Arabia agriculture drones market in 2025.

Cameras dominate the market owing to their critical role in crop monitoring, field mapping, and data-driven farm management. High-resolution cameras and multispectral imaging systems allow farmers to gather detailed insights into crop health, detect early signs of stress, and accurately monitor irrigation patterns over large agricultural areas. These capabilities are especially important for optimizing crop performance and identifying areas that need attention, whether due to water deficiencies, nutrient imbalances, or pest infestations.

The dominance of segment is further reinforced by the growing reliance on imaging technologies in precision agriculture. Cameras enable farmers to gain actionable insights that directly contribute to the optimization of crop yields and the efficient use of resources, such as water, fertilizers, and pesticides. As farming practices become more data-driven, the need for precise imaging tools is rising. Cameras equipped with advanced sensors, including multispectral and thermal imaging, help farmers monitor plant health, assess soil moisture levels, and track irrigation effectiveness, all in real-time.

Farming Environment Insights:

- Indoor

- Outdoor

Outdoor exhibits a clear dominance with a 90% share of the total Saudi Arabia agriculture drones market in 2025.

Outdoor represents the largest segment, driven by the widespread practice of large-scale open-field farming across the Kingdom. Given the vast expanses of agricultural land, efficient aerial monitoring solutions are essential to cover these extensive areas. Drones provide an ideal tool for surveying crops, assessing soil health, and managing irrigation across expansive outdoor farms. By utilizing drone technology, farmers are able to gather real-time, high-resolution data on crop conditions, water usage, and other critical parameters. This efficiency in monitoring significantly enhances farm productivity and reduces the time and cost associated with traditional ground-based surveying methods.

The dominance of the segment is further reinforced by the unique climatic and geographic conditions found in Saudi Arabia, which are especially conducive to outdoor farming operations. The country's arid climate and vast, open landscapes present challenges in terms of water management and crop health, but drones are well-suited to address these issues. They enable farmers to monitor crop performance under challenging weather conditions, such as extreme heat and limited rainfall, and provide valuable insights into soil moisture levels, nutrient deficiencies, and pest infestations. This ability to optimize resource use, especially water, is critical in a region where water scarcity is a major concern.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Field Mapping

- Variable Rate Application

- Crop Scouting

- Others

Field mapping dominates with a market share of 39% of the total Saudi Arabia agriculture drones market in 2025.

Field mapping leads the market attributed to the growing demand for accurate land assessments and detailed planning across large farming areas. As agricultural operations grow in scale, efficient and precise land evaluation becomes essential. Drone-based mapping offers a highly effective way to assess various aspects of the farm, such as field boundaries, elevation profiles, and soil variability. This data is crucial for enhancing crop planning, optimizing irrigation layouts, and enabling farmers to make well-informed decisions that directly contribute to improved farm productivity and sustainability.

In addition to improving crop planning and irrigation efficiency, field mapping through drone technology aids in effective resource management by identifying uneven terrain, drainage patterns, and soil conditions. By providing high-resolution, real-time maps, drones offer valuable insights into the variability across the landscape. Farmers can use these insights to optimize their planting strategies, tailor fertilizer and pesticide application, and reduce input waste. This ability to target specific areas with precision enhances crop yield while minimizing costs. With agriculture increasingly focusing on sustainability and cost-efficiency, drone-enabled field mapping is quickly becoming an indispensable tool for modern farmers in Saudi Arabia.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region lead with a market share of 35% of the total Saudi Arabia agriculture drones market in 2025.

Northern and Central Region hold the biggest market share, as they are home to a significant concentration of large-scale commercial farms, where agricultural practices are highly intensive. Government-supported agricultural initiatives are further propelling the development of modern farming techniques, encouraging the adoption of innovative technologies like drones. Precision monitoring and resource optimization are particularly crucial in these expansive farming areas, where the need for accurate data and efficient management systems is paramount. This growing reliance on advanced technologies has made drones an essential tool for maximizing productivity and ensuring sustainable agricultural practices.

This regional leadership is further supported by improved access to digital infrastructure, training facilities, and agri-tech service providers, driving the adoption of agriculture drones. The presence of research centers and pilot projects further accelerates drone deployment. In 2024, Saudi Arabia secured $9.8 billion in private investments to enhance sustainable agriculture, focusing on crop production, livestock, and infrastructure as part of Vision 2030. These investments will support modern agricultural technologies, reinforcing the demand for drones while boosting food security and economic resilience.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Agriculture Drones Market Growing?

Vision 2030 Agricultural Modernization and Food Security Initiatives

The Saudi government's Vision 2030 framework prioritizes agricultural transformation and food security enhancement as central components of economic diversification strategy. The governing body has launched comprehensive initiatives promoting precision agriculture technologies, including drone deployment for crop monitoring, irrigation management, and resource optimization across the Kingdom's farming operations. In addition, the Agricultural Development Fund distributes approximately USD 220 Million between 2021 and 2025 for high-tech agricultural infrastructure including greenhouse systems and precision farming technologies, creating substantial market opportunities for drone solution providers.

Critical Water Conservation Requirements in Arid Environment

Saudi Arabia's arid climate and severe water scarcity challenges position drone technology as an essential tool for sustainable agricultural development. According to information in 2024, Saudi Arabia will face an 88% increase in agricultural droughts by 2050 due to escalating climate change, with rising temperatures and extreme heat waves exacerbating food insecurity. Drone-based monitoring enables farmers to identify irrigation system inefficiencies, detect soil moisture variations, and implement targeted watering strategies that conserve the Kingdom's precious water resources while maintaining agricultural productivity across commercial farming operations.

Cost Efficiency and Labor Shortages

Labor shortages and rising labor costs in Saudi Arabia’s agricultural sector are driving the adoption of drones as a more cost-effective alternative to traditional farming methods that rely heavily on manual labor. Drones can efficiently monitor large areas, reducing the need for extensive human labor. Additionally, according to the Elderly Survey 2025, around 1.7 million people aged 60 and above now represent 4.8% of the population, reflecting the growing senior segment. As this demographic shift continues, drones provide a sustainable and efficient solution, making them an increasingly attractive investment for farmers and agribusinesses seeking to optimize operations.

Market Restraints:

What Challenges the Saudi Arabia Agriculture Drones Market is Facing?

High Initial Investment and Technology Costs

The substantial upfront costs associated with advanced drone systems, specialized sensors, and supporting software infrastructure present significant barriers for small and medium-scale agricultural operations. While precision agriculture delivers long-term cost savings, the initial investment requirements for comprehensive drone solutions may exceed the financial capacity of many farmers without government subsidies or financing support programs.

Technical Limitations and Operational Constraints

Current agricultural drone technology faces operational limitations, including restricted battery life and flight duration that challenge coverage of extensive farmlands. Technical issues related to extreme temperature performance in Saudi Arabia's harsh climate conditions, sand and dust exposure, and maintenance requirements in remote agricultural areas create operational complexities that impact adoption among less technologically advanced farming operations.

Skilled Workforce Shortage and Training Requirements

The effective deployment of agricultural drone technology requires specialized skills in drone operation, data interpretation, and maintenance that remain scarce across the Kingdom's farming workforce. While training programs are expanding, the current shortage of qualified operators and agricultural technology specialists constrains broader market adoption, particularly among traditional farming communities transitioning to precision agriculture practices.

Competitive Landscape:

The Saudi Arabia agriculture drones market exhibits moderate competitive intensity characterized by the presence of international drone manufacturers alongside emerging local service providers and regional distributors. Market dynamics reflect strategic positioning across hardware platforms, software solutions, and integrated agricultural drone services tailored to the Kingdom's precision farming requirements. The competitive landscape is increasingly shaped by technological innovation in imaging capabilities, AI-powered analytics integration, partnerships with agricultural research institutions, and alignment with government-supported precision agriculture initiatives that support widespread technology adoption across commercial farming operations.

Saudi Arabia Agriculture Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Components Covered | Controller Systems, Propulsion Systems, Cameras, Batteries, Navigation Systems, Others. |

| Farming Environments Covered | Indoor, Outdoor |

| Applications Covered | Field Mapping, Variable Rate Application, Crop Scouting, Others |

| Regions Covered | Northern And Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia agriculture drones market size was valued at USD 32.15 Million in 2025.

The Saudi Arabia agriculture drones market is expected to grow at a compound annual growth rate of 26.57% from 2026-2034 to reach USD 268.02 Million by 2034.

Hardware dominates the market with 71% revenue share in 2025, driven by the fundamental requirement for physical drone platforms, sensors, and imaging equipment essential for precision agriculture applications across the Kingdom's commercial farming operations.

Key factors driving the Saudi Arabia agriculture drones market include the growing focus on precision agriculture, which leverages data-driven insights to optimize farming practices, reduce costs, and boost yields. For example, in 2026, Saudi Arabia's Ministry of Environment launched a project in Asir to modernize farming using precision agriculture. Drones enable real-time monitoring of crop health, soil conditions, and pest infestations, allowing targeted application of resources.

Major challenges include high initial investment and technology costs limiting adoption among smaller operations, technical limitations related to battery life and extreme temperature performance, skilled workforce shortage requiring expanded training programs, and regulatory compliance requirements for commercial drone operations across agricultural zones.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)