Saudi Arabia Agriculture Market Report by Type (Food Crops/Cereals, Fruits, Vegetables, Oilseeds and Pulses), and Region 2026-2034

Saudi Arabia Agriculture Market Size:

Saudi Arabia agriculture market size reached USD 136.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 212.6 Billion by 2034, exhibiting a growth rate (CAGR) of 5.02% during 2026-2034. Saudi Arabia is investing heavily in its agricultural sector through advanced technologies, water management, and research initiatives to boost food security and self-sufficiency. Moreover, the government is promoting precision farming, hydroponics, and sustainable practices, while expanding irrigation and desalination efforts. With Vision 2030 guiding development, farming practices are improving, attracting significant investment in agritech, aimed at enhancing productivity and ensuring long-term sustainability in an arid climate, thereby expanding the Saudi Arabia agriculture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 136.9 Billion |

| Market Forecast in 2034 | USD 212.6 Billion |

| Market Growth Rate (2026-2034) | 5.02% |

Saudi Arabia Agriculture Market Analysis:

- Major Market Drivers: The market is principally driven by favorable initiatives by the Saudi Government such as the Vision 2030 that aims to attain food security and strengthen the economy. Moreover, the escalating demand for locally cultivated crops, majorly driven by a heightening population and intensifying health awareness, further fuels the market. In addition, international collaborations are further spurring innovation and promoting sustainable farming methods across the regional sector.

- Key Market Trends: The market experiences numerous key trends, such as the adoption of precision agriculture methods and controlled-environment agriculture (CEA), to upgrade resource utilization and enhance efficacy. Moreover, organic farming is gaining momentum as customer preferences are rapidly inclining towards eco-friendlier and healthier food options. Additionally, the expansion of digitalization in agriculture industry, which includes incorporation of data analytics and the Internet of Things (IoT), is also increasing Saudi Arabia agriculture market share. These trends are notably driven by necessity of sustainable agriculture in the country, mainly due to water shortage and dry weather condition.

- Competitive Landscape: Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- Challenges and Opportunities: The market experiences numerous challenges, including water scarcity and amplified reliance on certain crop imports. In addition, arid climate conditions cause disruptions in maintaining stable crop yield, which represents another factor hindering the market growth. Nonetheless, various growth opportunities are observed like amplifying government funds for advancing sustainable farming technologies and increasing demand for organic food products. Furthermore, strategic collaborations with international agribusinesses offer additional possibilities to tap new markets and innovate within the agricultural supply chain.

Saudi Arabia Agriculture Market Trends:

Policy Measures and Support from Government

The government of Saudi Arabia is actively pursuing all-round policies and financial support to bolster its agriculture sector. Through Vision 2030, the government is constantly focusing on food security, sustainability, and oil diversification. Seed, fertilizer, and advanced irrigation system subsidies are being given to farmers for improvement in productivity and efficiency. The Ministry of Environment, Water, and Agriculture (MEWA) is also introducing initiatives that are promoting advanced cultivation practices, greenhouse farming, and hydroponics. The government is also facilitating collaborations with multinational agricultural companies to implement innovative technologies and enhance local capabilities. Expenditure in research and development (R&D) is also being augmented in order to mitigate water shortage and increase crop tolerance in dry environments. These joint efforts are making agriculture a central pillar for economic diversification, guaranteeing sustainable viability over the long term, and increasing the country's independence in basic food items. In 2024, Saudi Arabia launched several research initiatives on more than 10 promising crops to enhance agricultural development and support the goal of attaining self-sufficiency in economically significant crops, according to the Saudi Press Agency (SPA). The National Research and Development Centre for Sustainable Agriculture (Estidamah) conducted research on crops including quinoa, azolla, guar, jojoba, stevia, moringa, asparagus, millet, sesbania, clitoria, and safflower.

Embracing Advanced Agricultural Technologies

Saudi Arabia is increasingly embracing state-of-the-art agricultural technologies to challenge the arid climate and scarce water resources challenge. Agriculturalists are incorporating precision agriculture practices, including drones, internet of things (IoT) sensors, and data analytics, to track crop health and optimize irrigation schedules. Smart irrigation systems are being used to reduce water loss and maximize efficiency, which is especially important in an area with perennial water scarcity. Vertical farming, hydroponics, and aquaponics are increasing in popularity as new ways to grow high yields in controlled environments. Moreover, genetically modified crops and biotechnology are being developed to enhance productivity as well as tolerance to extreme environmental conditions. New agricultural startups are also emerging with the backing of government grants and private investment to facilitate technological advancement in the industry. Such continuous technological revolution is highly improving efficiency, sustainability, and profitability in Saudi agriculture. IMARC Group predicts that the Saudi Arabia agritech market is anticipated to attain USD 628.66 Million by 2033.

Water Management and Irrigation Systems Development

In light of Saudi Arabia's semi-arid climate and paucity of freshwater supplies, effective water management is emerging as a mainstay of agricultural development. Saudi Arabia is heavily investing in sophisticated irrigation systems, including drip and sprinkler technologies, to enhance water use efficiency. Desalination and water recycling schemes are being increased to offer alternate sources of water for agriculture. Artificial Intelligence (AI) and remote sensing-based intelligent irrigation systems are being introduced to sense soil moisture and optimize water distribution. The government is implementing laws to stop the over-extraction of groundwater while encouraging the use of treated sewage water for irrigation. Research institutions are also conducting studies to improve crop water-use efficiency and soil moisture retention. These efforts are ensuring that agricultural growth remains sustainable despite environmental constraints, enabling the sector to thrive while conserving precious water resources for future generations. In 2024, the Saudi Water Forum took place where local and international experts and specialists gathered to discuss critical water-related issues, including, efficient usage of dam water, innovation in desalination and the integration of sectors for the efficient, sustainable, and reliable delivery of water services.

Saudi Arabia Agriculture Market Growth Drivers:

Rising Demand for Food Security

Saudi Arabia is constantly focusing on food security because of its extensive dependence on food imports and scarce arable land. With an increasing population and rising per capita income, local domestic food consumption is growing considerably, further increasing the demand for regional agricultural production. The government is actively putting money into projects to attain self-sufficiency in basic foods like wheat, dates, poultry, and dairy products. Strategic stockpiles and storage centers are being created to protect against international supply interruption. Further, agricultural research efforts are directed toward creating drought-resistant crops and maintaining soil fertility. Attempt is being made to boost domestic production while promoting natural resource use in a sustainable way. By promoting partnerships with global partners and investing in new farming technologies, Saudi Arabia is progressively reinforcing its food security system and lessening reliance on imports, thus furthering national resilience to external economic shocks.

Agri-Investments and Private Sector Entry

The Saudi agriculture market is being swept with increased private sector entry and foreign investments, prompted by encouraging government policies and incentives. Investors are increasingly seeing the potential of agriculture as a major driver of economic diversification and sustainability. Public-private partnerships (PPPs) are being formed to create big-scale farm schemes, food processing plants, and supply chain infrastructure. The Saudi Agricultural Development Fund (ADF) is lending financial support and low-interest loans to domestic and foreign investors involved in agricultural activities. In addition, Saudi companies are also partnering with international agribusiness firms to share knowledge, technology, and expertise. Investment areas specialized in agri-tech and sustainable agriculture are being created to encourage overseas investors. This increasing flow of funds is driving innovation, enhancing productivity, and enhancing export opportunities.

Growing Consumer Awareness of Sustainable and Organic Products

People in Saudi Arabia are becoming more health-conscious, sustainable, and environmentally aware, leading to an emerging demand for organic and locally grown food. Demand for pesticide-free, natural, and ethically produced products is continuously on the rise, motivating farmers to embrace sustainable farming practices. The government is encouraging organic certification schemes and providing financial support for organic farming to guarantee quality and genuineness. Supermarkets and retailers are increasing their lines of organic products, and e-commerce websites are making sustainable food items more widely available. Social media campaigns and educational campaigns are also creating awareness regarding the advantages of organic consumption and environmental-friendly farming. Therefore, the agriculture industry is constantly changing to match these evolving consumer tastes by adopting environment friendly methods of production. This transition towards sustainability is not only enhancing consumer health but also enhancing the environmental and economic resilience of Saudi agriculture.

Saudi Arabia Agriculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on type.

Breakup by Type:

- Food Crops/Cereals

- Fruits

- Vegetables

- Oilseeds and Pulses

The report has provided a detailed breakup and analysis of the market by type. This includes food crops/cereals, fruits, vegetables, and oilseeds and pulses.

In Saudi Arabia, food crops/cereals generally include barley and wheat, which are staple crops in the local diet. According to the USDA Foreign Agricultural Service, 129.43kg of wheat has been consumed in Saudi Arabia in marketing year 2023/2024. Although the country has dry climatic conditions, technological advancements in irrigation and profitable subsidies by government significantly promote cereal cultivation. Moreover, these crops are essential for both livestock feed and human consumption, with wheat being major grain that is utilized in numerous traditional dishes. Additionally, the government is actively investing in research activities to enhance crop yield and facilitate a steady domestic cereal supply.

The most prevalent fruit in Saudi Arabia agriculture market is dates, which are a cultural symbol as well as a staple food. As per industry reports, Saudi Arabia produces around 837,000 mt of dates annually. In addition, various other fruits like grapes, citrus, and melons are also produced, profiting from upgraded farming practices and CEA technique. Furthermore, the demand for excellent-quality and fresh fruits significantly drives expansion and innovation in the agriculture sector.

The vegetables segment encompasses various types of crops, including peppers, tomatoes, and cucumbers, generally cultivated in controlled environments, such as greenhouses, by deploying hydroponic systems. For instance, according to industry reports, Saudi Arabia for the first time exported tomatoes to Europe in February 2024. The cultivation of tomatoes in harsh environmental conditions was achieved through vertical farming and advanced greenhouses, along with the efforts of Dava Agricultural Co., a Saudi Arabian company. Such advanced methods aid in navigating the adverse climatic challenges, facilitating all-year production. Moreover, the vegetable market is oriented towards addressing both export prospects and domestic demands, with an increased focus on sustainability as well as quality. Additionally, rising awareness regarding health benefits among consumers also propels the demand for domestically-grown, fresh vegetables in the country.

The oilseeds and pulses are steadily expanding in the Saudi Arabia agriculture market primarily due to increasing health consciousness and the demand for protein-rich food. Major crops encompass chickpeas and soybeans, which are requisite for animal feed and food processing sectors. Additionally, the government is actively endorsing the cultivation of such crops through research projects and profitable incentives intended to enhance sustainability as well as productivity, aligning with country’s objective for food differentiation and security.

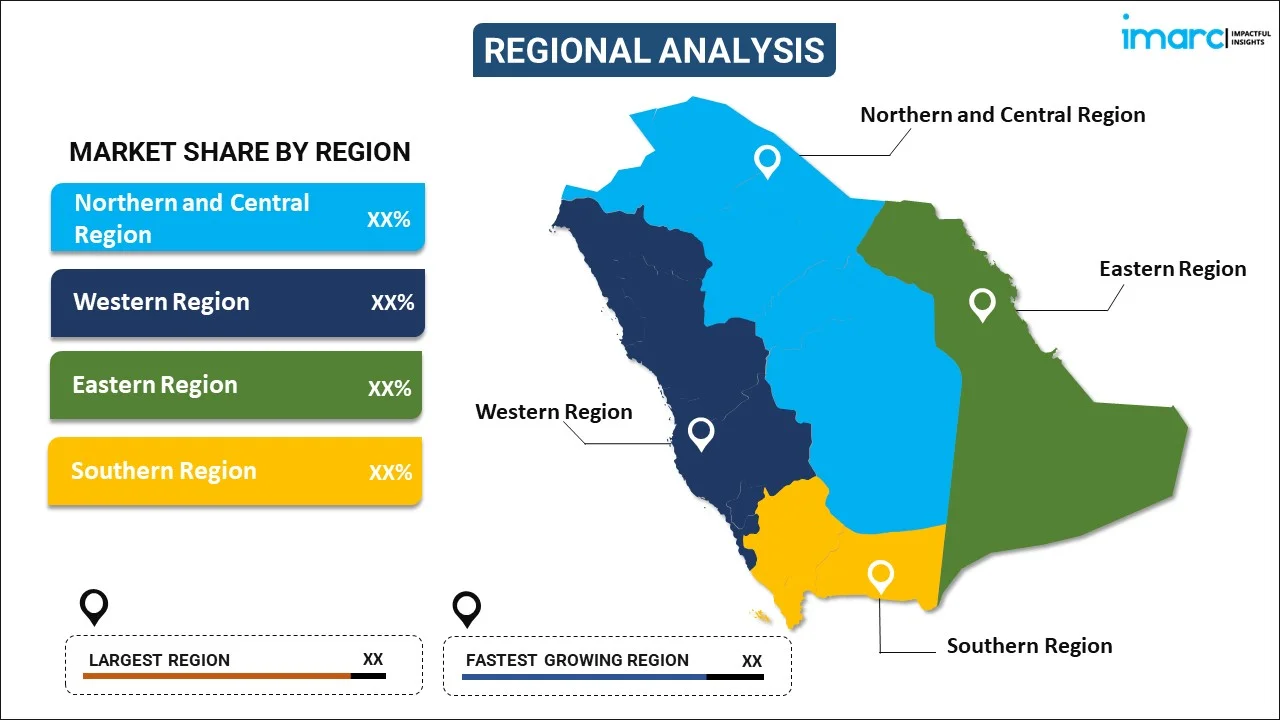

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of the Saudi Arabia agriculture market by region, including Northern and Central Region, Western Region, Eastern Region, and Southern Region.

The Northern and Central regions of Saudi Arabia play a crucial role in the agriculture market, primarily focusing on the cultivation of wheat, dates, and other staple crops. Leveraging advanced irrigation techniques and government support, these areas are optimizing water use in arid conditions. Moreover, with initiatives to enhance sustainable farming practices, the region is seeing increased investments in agricultural technology to improve crop yields and quality. In addition, this strategic focus contributes significantly to the country’s food security and agricultural diversification goals.

The Western region of Saudi Arabia is characterized by its horticultural and floricultural activities, benefiting from a relatively moderate climate and access to Red Sea water resources. This region emphasizes the production of fruits, vegetables, and flowers, supported by greenhouse farming and modern irrigation methods. Furthermore, as part of national efforts to boost agricultural productivity, the Western region is integrating advanced AgTech solutions to enhance efficiency and sustainability, playing a pivotal role in diversifying Saudi Arabia's agricultural output.

The Eastern region of Saudi Arabia is a key player in the agricultural market, particularly noted for its date farming and aquaculture activities. Proximity to the Arabian Gulf provides unique opportunities for fish farming and other marine agriculture ventures. Moreover, the region also focuses on leveraging innovative water management solutions to counteract water scarcity issues. In addition, with growing investments in modern agricultural practices and technologies, the Eastern region is enhancing its contribution to the nation’s overall agricultural sector and food security initiatives.

The Southern region of Saudi Arabia, with its distinct topography and climate, is known for cultivating coffee, honey, and various fruits. The region benefits from higher rainfall compared to other parts of the country, allowing for diverse agricultural practices. Additionally, initiatives to promote sustainable farming and local specialty crops are gaining momentum, supported by government programs and AgTech adoption. Furthermore, the Southern region’s focus on niche agricultural products is helping to strengthen the local economy and promote sustainable agricultural development.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- The competitive landscape is steered by a combination of international firms and domestic companies that rapidly adopting advanced techniques to bolster productivity in extreme environmental conditions. For instance, December 2023, Pure Harvest Smart Farms, a United Arab Emirates based company, announced the strategic acquisition of Red Sea’s CEA production facility in Saudi Arabia to strengthen its farm footprint in the country. Moreover, major Saudi Arabia agriculture companies are currently emphasizing on vertical farming to amplify plantation yields. In addition, heavy investments and international collaborations are escalating, mainly driven by Saudi Arabia’ Vision 2030 initiative to lower dependency on imports and improve food security, reinforcing an evolving and competitive market sentiment.

Saudi Arabia Agriculture Market News:

- In October 2025, In the Khotta region of Hail, located in northern Saudi Arabia, a polycarbonate greenhouse spanning 85,000 m² is presently under construction for Nole Agriculture. The initial planting is planned for the first quarter of 2026. To tackle these challenges, Nole Agriculture works with tech partners like Priva and Stolze.

- In September 2025, In the presence and support of His Excellency Eng. Abdulrahman Abdulmohsen AlFadley, Minister of Environment, Water and Agriculture, announced today the inauguration of two new facilities in central Saudi Arabia for Tanmiah Food Company (Tanmiah), a top vertically integrated poultry and food producer in the Kingdom: an advanced poultry processing plant in Al Majmaa (Majmaa 2) and a modern feed mill in Dahna. These expansions enhance Tanmiah’s current network of hatcheries, feed mills, and processing facilities, strengthening Tanmiah’s dedication to improving food security, boosting operational efficiency, and aiding local communities through job creation and sustainable development efforts.

- In June 2025, Saudi Arabia and the Netherlands have finalized several agreements and memoranda of understanding (MoU) with investments surpassing SR428 million (USD 114 million) to foster the development and localization of modern technologies in environmental, water, and agricultural sectors.

- In May 2025, Saudi agritech company Arable has secured $2.55 million in seed funding to expand its hydroponic farming systems. The firm develops controlled-environment agriculture systems tailored for dry climates, emphasizing efficient water utilization and modular cultivation units. The funding round featured investors concentrated on regional climate and food initiatives. Arable will utilize the funds to increase production capability, localize production, and improve its unique technology. The organization is currently running pilot locations throughout various regions in the Kingdom.

- In January 2025, Saudi Arabia's hydroponic farming industry is set for growth, as the local agritech startup Arable reveals the successful completion of a $2.55 million seed funding round, spearheaded by unidentified investors. The investment round garnered interest from institutional and individual investors, with 90 percent of the funds sourced from overseas investors. The company announced in a press release that the funds will be distributed within Saudi Arabia to support the development of the nation's agricultural sector.

Saudi Arabia Agriculture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Food Crops/Cereals, Fruits, Vegetables, Oilseeds and Pulses |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia agriculture market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia agriculture market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia agriculture industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agriculture market in Saudi Arabia was valued at USD 136.9 Billion in 2025.

The Saudi Arabia agriculture market is projected to exhibit a CAGR of 5.02% during 2026-2034, reaching a value of USD 212.6 Billion by 2034.

Saudi Arabia is making significant investments in its agricultural sector by utilizing advanced technologies, improving water management, and supporting research initiatives to enhance food security and self-sufficiency. The administration is encouraging precise agriculture, hydroponic systems, and sustainable methods, alongside enhancing irrigation and desalination initiatives. Guided by Vision 2030, Saudi agriculture is poised for rapid growth, drawing substantial investments in agritech to boost productivity and ensure sustainability in an arid environment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)