Saudi Arabia Air Cargo Market Size, Share, Trends and Forecast by Type, Service, Destination, End User, and Region, 2026-2034

Saudi Arabia Air Cargo Market Overview:

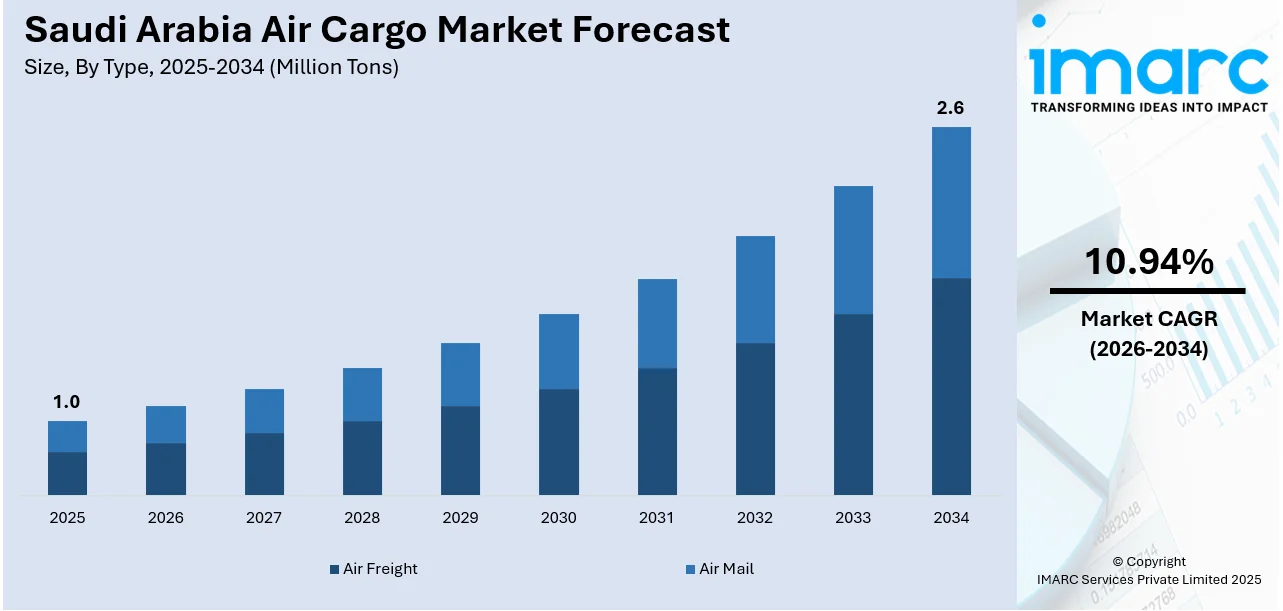

The Saudi Arabia air cargo market size reached 1.0 Million Tons in 2025. Looking forward, IMARC Group expects the market to reach 2.6 Million Tons by 2034, exhibiting a growth rate (CAGR) of 10.94% during 2026-2034. The market is fueled by government efforts under Vision 2030 to make the Kingdom a global logistics hub, encouraging infrastructure development and efficient trade processes. Investments in airport modernization, increasing cargo capacities, and implementing cutting-edge technologies such as AI and blockchain improve operational efficiency and rigorous demand in areas like e-commerce, pharma, and perishables are propelling the Saudi Arabia air cargo market share to become an integral part of Saudi economic diversification and trade aspirations across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 1.0 Million Tons |

| Market Forecast in 2034 | 2.6 Million Tons |

| Market Growth Rate 2026-2034 | 10.94% |

Saudi Arabia Air Cargo Market Trends:

Strategic Infrastructure Investments

Saudi Arabia's air freight industry is witnessing tremendous growth, with major investments in infrastructure to boost the country's logistics capacity. Recently, in May 2025, US President Donald Trump reportedly obtained a substantial $600 billion investment pledge from Saudi Arabia during his initial state visit to the Kingdom after winning a second term. The declaration signifies the most extensive collection of trade agreements ever documented between the United States and Saudi Arabia, including significant investments in energy, cutting-edge technology, infrastructure, healthcare, defense, and international sports. Moreover, Saudi Vision 2030 highlights the significance of making the Kingdom a global logistics hub, and hence the development and augmentation of major airports like King Abdulaziz International Airport at Jeddah and King Khalid International Airport at Riyadh. These upgrades are geared toward expanding cargo handling capacities and enhancing operational efficiencies, thus allowing for smoother and more efficient trade operations. Apart from this, the setting up of modern logistics centers that are supported by cutting-edge technologies, such as automated guided vehicles (AGVs) and real-time tracking systems, also underpins the development of the air cargo market through improved service delivery and customer satisfaction.

To get more information on this market Request Sample

Technological Advancements and Digitalization

The integration of advanced technology is one of the prime motivators for innovation in Saudi Arabia's air cargo market. Saudia Cargo, for example, is investing in digital infrastructure to enhance operational efficiency. The application of artificial intelligence (AI) and machine learning algorithms enables real-time data processing, as well as predictive analytics for demand forecasting and route optimization. Additionally, the use of blockchain technology increases transparency and security in supply chain management, with real-time tracking of shipments and minimizing the potential for fraud. These technologies enhance operational efficiency while also consolidating with world trends toward digitalization in the logistics industry, further propelling the Saudi Arabia air cargo market growth.

Expansion of Global Connectivity

Saudi Arabia's geographical position at the intersection of Asia, Africa, and Europe gives it a special edge to its air cargo industry. With the Kingdom boosting international connectivity through opening direct air cargo services to major world markets, Saudia Cargo, for example, has added new permanent routes to Shenzhen, China, and seasonal routes to Athens and Nice, reinforcing its network to move goods across continents. These initiatives are followed by the formation of international partnerships with international logistics players, reinforcing Saudi Arabia as a pivotal point for global trade. The expansion of air cargo connectivity not only enhances the Kingdom's economic diversification objectives but also increases its competitiveness in the global logistics landscape.

Saudi Arabia Air Cargo Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, service, destination, and end user.

Type Insights:

- Air Freight

- Air Mail

The report has provided a detailed breakup and analysis of the market based on the type. This includes air freight and air mail.

Service Insights:

- Express

- Regular

A detailed breakup and analysis of the market based on the service has also been provided in the report. This includes express and regular.

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination has also been provided in the report. This includes domestic and international.

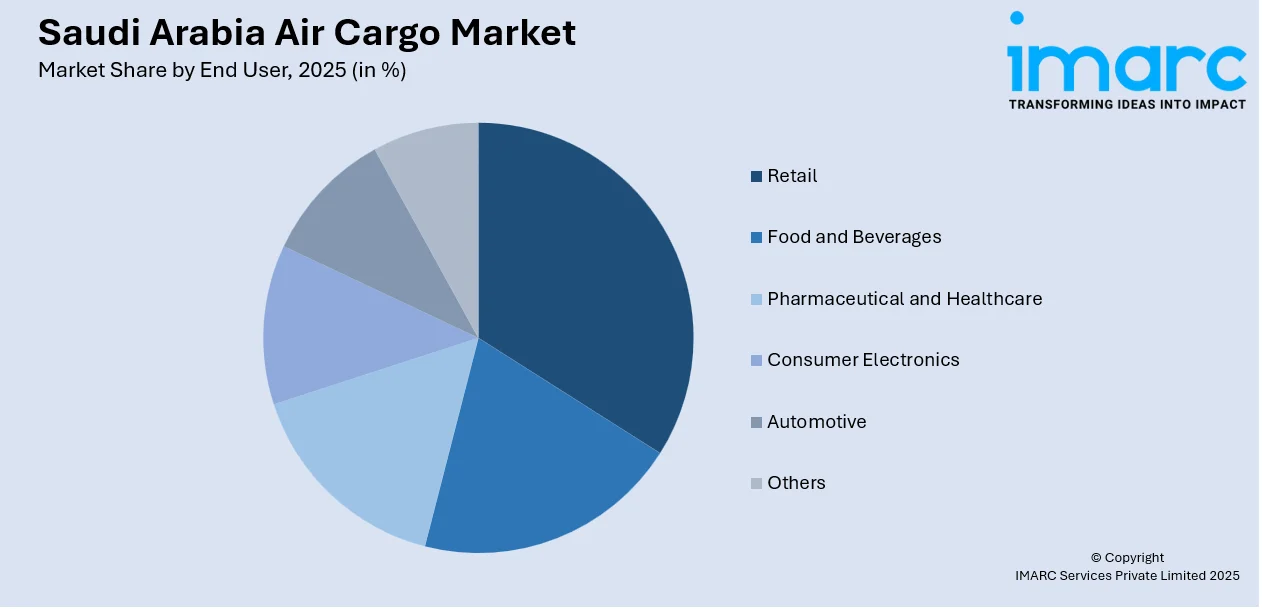

End User Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Food and Beverages

- Pharmaceutical and Healthcare

- Consumer Electronics

- Automotive

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes retail, food and beverages, pharmaceutical and healthcare, consumer electronics, automotive, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Air Cargo Market News:

- In May 2025, SAL, a logistics and supply chain service provider from Saudi Arabia, achieved full membership in the air cargo industry's quality standards organization, Cargo iQ. The new membership enhances Cargo iQ's presence in the EMEA area and aligns with its goal to expand its membership with firms from the entire supply chain.

- In August 2024, the Saudi Arabian Public Investment Fund, possessing assets exceeding $925 billion, revealed that it is in talks with the top two aircraft manufacturers globally, Europe's Airbus and the United States' Boeing, to purchase a fleet of cargo planes, intending to establish a new air cargo company.

Saudi Arabia Air Cargo Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Air Freight, Air Mail |

| Services Covered | Express, Regular |

| Destinations Covered | Domestic, International |

| End Users Covered | Retail, Food and Beverages, Pharmaceutical and Healthcare, Consumer Electronics, Automotive, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia air cargo market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia air cargo market on the basis of type?

- What is the breakup of the Saudi Arabia air cargo market on the basis of service?

- What is the breakup of the Saudi Arabia air cargo market on the basis of destination?

- What is the breakup of the Saudi Arabia air cargo market on the basis of end user?

- What is the breakup of the Saudi Arabia air cargo market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia air cargo market?

- What are the key driving factors and challenges in the Saudi Arabia air cargo market?

- What is the structure of the Saudi Arabia air cargo market and who are the key players?

- What is the degree of competition in the Saudi Arabia air cargo market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia air cargo market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia air cargo market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia air cargo industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)