Saudi Arabia Air Compressor Market Size, Share, Trends and Forecast by Type, Technology, Lubrication Method, Power Rating, End User, and Region, 2026-2034

Saudi Arabia Air Compressor Market Overview:

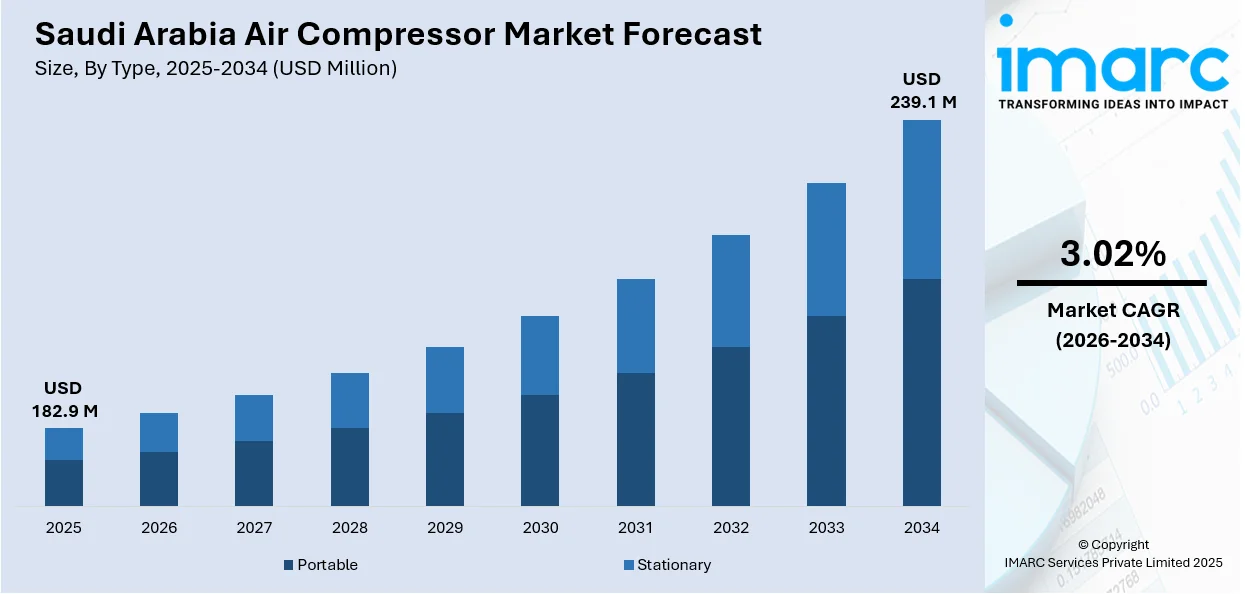

The Saudi Arabia air compressor market size reached USD 182.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 239.1 Million by 2034, exhibiting a growth rate (CAGR) of 3.02% during 2026-2034. The market is driven by industrial expansion, energy efficiency demands, and government initiatives such as Vision 2030. Growth in oil and gas, construction, and manufacturing sectors enhances demand, while stricter regulations and sustainability goals push the adoption of advanced, eco-friendly compressors. Additionally, rising healthcare and food processing needs are further expanding the Saudi Arabia air compressor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 182.9 Million |

| Market Forecast in 2034 | USD 239.1 Million |

| Market Growth Rate 2026-2034 | 3.02% |

Saudi Arabia Air Compressor Market Trends:

Rising Industrial Developments and Infrastructure Growth

Saudi Arabia's air compressor market is being considerably influenced by the industrial innovations and infrastructure growth in the country. As part of the Vision 2030, Saudi Arabia is investing heavily in industries like oil and gas, manufacturing, and construction. This constant expansion is boosting demand for air compressors, which are used for a range of industrial applications, from driving machinery to supplying compressed air for work. As big infrastructure ventures like airports, hospitals, and residential projects expand, industries are increasingly depending on productive and high-performance air compressors. Businesses are always upgrading equipment to keep pace with growing production needs and increase efficiency. With the nation prioritizing economic diversification, it is constantly developing new industrial activities, thus propelling the air compressor industry. Growing demand for energy-efficient and economical compressors is driving advanced compressor technologies, which are becoming a critical element for these industries. Moreover, the government is conducting various exhibitions and seminars to facilitate industrial innovation in the country. For instance, Industrial Transformation Saudi Arabia is an innovative industrial trade show and exhibition venue poised to redefine the future of industry in the Kingdom. As a recent addition to the global Industrial Transformation series, driven by the esteemed Hannover Messe, INDUSTRIAL TRANSFORMATION SAUDI ARABIA distinctly positions Saudi Arabia in the landscape of advanced industrial innovation.

To get more information on this market Request Sample

Growing Demand for Oil and Gas Exploration and Production

The oil and gas sector is also heavily contributing to the increase in air compressors demand in Saudi Arabia. The nation is among the world's major crude oil producers, and its energy sector is still growing with new exploration and development programs. Air compressors find extensive applications in many phases of oil drilling and refinery operations, ranging from driving pneumatic equipment, air-powered pumps, and control systems. With the government encouraging the growth of more onshore and offshore fields, the demand for compressors is ever-increasing to cater to these projects' operational requirements. The industry's ongoing efforts to increase productivity and safety levels are also creating the demand for more sophisticated and reliable compressors. With growing exploration in remote and harsh environments, the deployed air compressors are also developing the capability to withstand extreme conditions, contributing to the market further. IMARC Group predicts that the Saudi Arabia oil and gas midstream market is projected to attain USD 125 Billion by 2033.

Growing Manufacturing Base

Saudi Arabia is experiencing a boom in the manufacturing base, especially in chemicals, petrochemicals, and food processing. This growth is heavily influencing the demand for air compressors since they play a significant part in automating and increasing production processes. Compressed air is being employed to drive equipment, for cooling purposes, and in other automation processes within the manufacturing lines. Manufacturing plants, as they attempt to make their operations as efficient as possible and improve productivity, are upgrading their air compression systems continuously to provide more efficiency and less downtime. Furthermore, the government's interest in developing indigenous manufacturing capabilities, curbing import dependence, and increasing industrial output is helping to lead to a steady rise in compressor needs. As manufacturing units and industries continue to grow, air compressors are becoming a necessity to sustain high levels of quality and accuracy in production. In 2024, Kawasaki Heavy Industries, Ltd. declared that it sent four gas compressors from Kobe Works to Saudi Arabia. The compressors were requested by Samsung E&A Co., Ltd.

Saudi Arabia Air Compressor Market Growth Drivers:

Advancements in Technology and Energy Efficiency

The Saudi Arabian air compressor market is being spurred on by technological innovation in compressors, particularly energy efficiency. The move toward more energy-efficient technologies is driven by concerns over the environment as well as increased energy costs. Firms are going for the upgrade of their air compressor units to include the latest technology that delivers high performance coupled with low energy use. Variable-speed drive (VSD) compressors and oil-free compressors, with their higher energy efficiency and lower maintenance costs, are increasingly being used across different industries. Also, with increasing environmental regulations, industries are progressively implementing eco-friendly solutions, such as energy-efficient air compressors that reduce carbon footprints. Advances in smart compressors, with the ability to provide real-time monitoring and predictive maintenance, are also fueling the growth of the market. The growing emphasis on reducing operating expenses and enhancing energy efficiency is stimulating companies to invest in more sophisticated, eco-friendly compressor systems.

Government Policies and Investments in Support

The government of Saudi Arabia is playing an active role in the growth of the air compressor market through policies stimulating industrial development. With its Vision 2030 strategy, the government is making huge investments in energy, infrastructure, and manufacturing industries, all of which are greatly dependent on air compressors. The drive by the government to diversify the economy, decrease the reliance on oil, and increase new sources of employment is also contributing to the establishment of new manufacturing and industrial plants, further increasing the demand for air compressors. Apart from infrastructure investment, the government is also providing incentives and tax exemptions to international investors, which is drawing more international players to invest in the Saudi market. These friendly policies and investments are making Saudi Arabia's air compressor market environment-friendly to boost its market size for international as well as local players to respond to the increasing industrial requirements.

Growing Use in the Automotive Sector

The Saudi Arabian automotive sector is expanding at a fast rate, and air compressors are becoming unavoidable for numerous applications within this sector. The automobile manufacturers and workshops incorporate air compressors to use them in a variety of ways, including powering pneumatic tools, spray painting, filling tires, and other assembly operations. With the capacity of local automobile manufacturing improving and more multinational automobile manufacturers setting up plants in the country, the demand for good-quality and performing air compressors is on the rise. Also, with the emphasis by the country to be a regional automotive hub, the demand for productive air compressors is improving in order to achieve production targets. In addition, the surging number of automobile maintenance and repair services is also driving the demand because air compressors play a critical role in maintaining the effectiveness of different tools and equipment used in these processes.

Saudi Arabia Air Compressor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, technology, lubrication method, power rating, and end user.

Type Insights:

- Portable

- Stationary

The report has provided a detailed breakup and analysis of the market based on the type. This includes portable and stationary.

Technology Insights:

- Reciprocating/Piston

- Rotary/Screw

- Centrifugal

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes reciprocating/piston, rotary/screw, and centrifugal.

Lubrication Method Insights:

- Oil-filled

- Oil-free

The report has provided a detailed breakup and analysis of the market based on the lubrication method. This includes oil-filled and oil-free.

Power Rating Insights:

- 0-100 kW

- 101-300 kW

- 301-500 kW

- 501 kW and Above

A detailed breakup and analysis of the market based on the power rating have also been provided in the report. This includes 0-100 kW, 101-300 kW, 301-500 kW, and 501 kW and above.

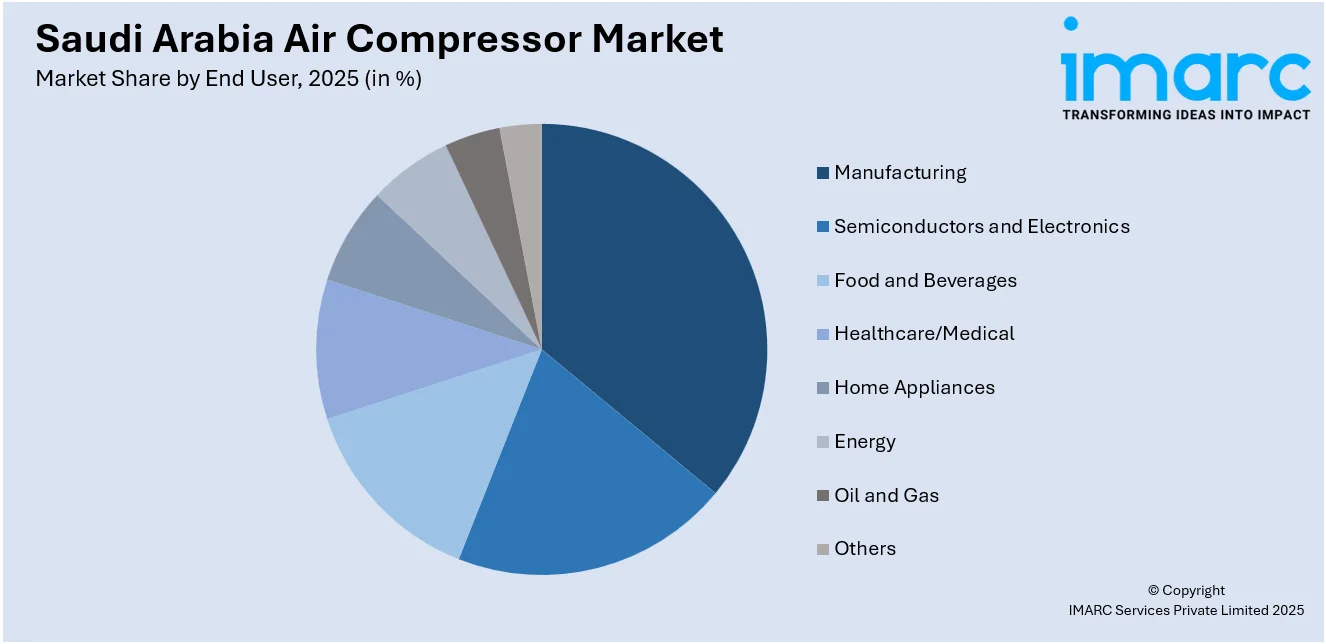

End User Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Semiconductors and Electronics

- Food and Beverages

- Healthcare/Medical

- Home Appliances

- Energy

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes manufacturing, semiconductors and electronics, food and beverages, healthcare/medical, home appliances, energy, oil and gas, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Air Compressor Market News:

- March 2025: Siemens Energy has secured a USD 1.6 billion contract, with Harbin Electric International as the EPC contractor, to deliver essential technologies for the Rumah 2 and Nairyah 2 gas-fired power plants in Saudi Arabia. Situated in the central and western areas, the facilities will contribute 3.6 gigawatts of energy to the national grid, sufficient to power approximately 1.5 million households. The project encompasses extended maintenance contracts to ensure the plants’ operational dependability for the upcoming 25 years.

Saudi Arabia Air Compressor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Portable, Stationary |

| Technologies Covered | Reciprocating/Piston, Rotary/Screw, Centrifugal |

| Lubrication Methods Covered | Oil-filled, Oil-free |

| Power Ratings Covered | 0-100 kW, 101-300 kW, 301-500 kW, 501 kW and Above |

| End Users Covered | Manufacturing, Semiconductors and Electronics, Food and Beverages, Healthcare/Medical, Home Appliances, Energy, Oil and Gas, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia air compressor market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia air compressor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia air compressor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air compressor market in Saudi Arabia was valued at USD 182.9 Million in 2025.

The Saudi Arabia air compressor market is projected to exhibit a CAGR of 3.02% during 2026-2034, reaching a value of USD 239.1 Million by 2034.

Key factors driving the Saudi Arabia air compressor market include ongoing industrialization and infrastructure development, growing demand in the oil and gas sector, expansion of the manufacturing industry, advancements in energy-efficient technologies, government investments and supportive policies, and increased adoption within the automotive industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)