Saudi Arabia Air Conditioning Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Saudi Arabia Air Conditioning Market Overview:

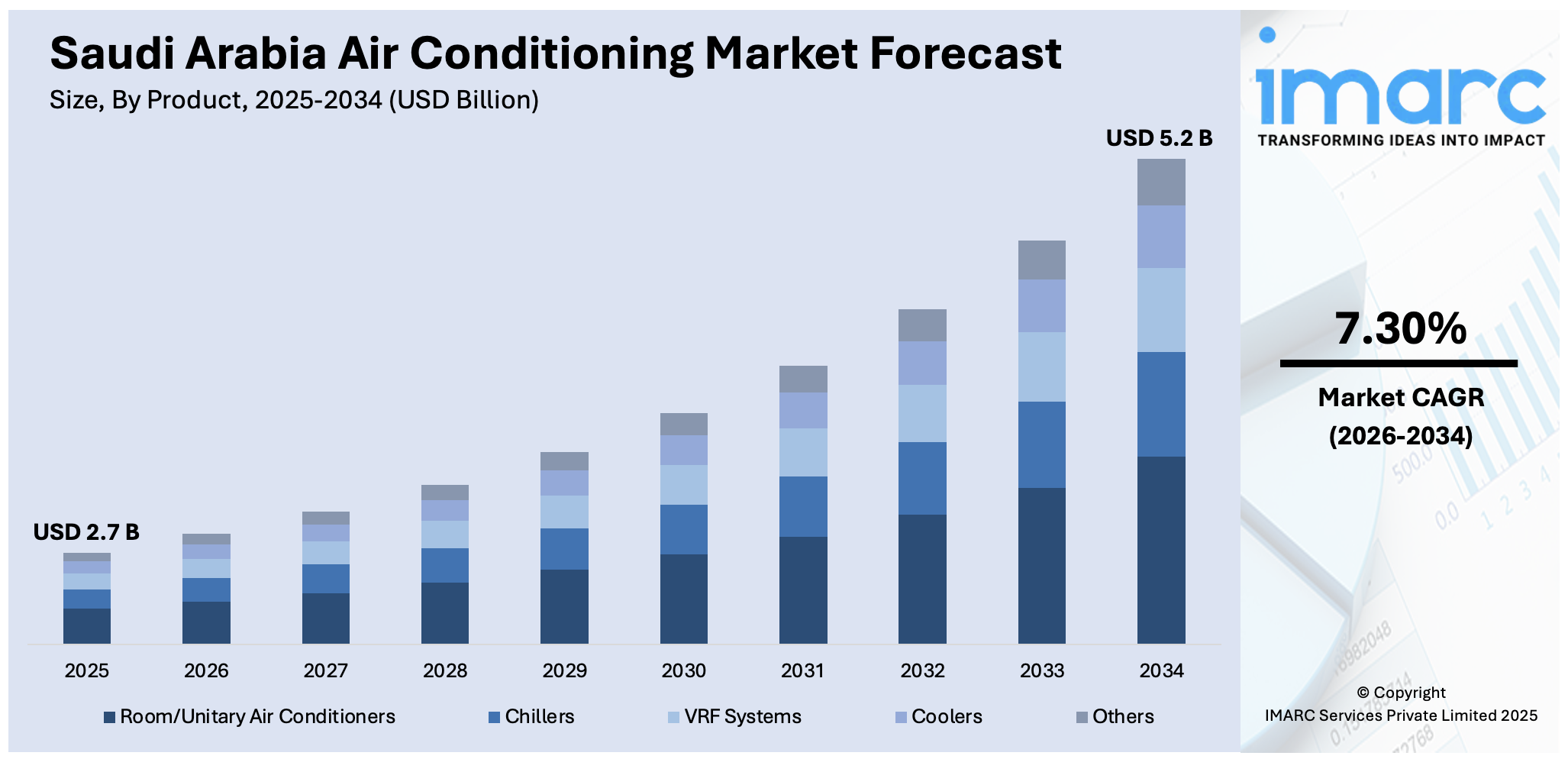

The Saudi Arabia air conditioning market size reached USD 2.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.2 Billion by 2034, exhibiting a growth rate (CAGR) of 7.30% during 2026-2034. The market has grown due to policy-led energy efficiency programs, extreme heat conditions, and rising demand from construction and urban expansion. Local production initiatives and consumer upgrade incentives have further supported sustainable product adoption. This has positively impacted Saudi Arabia air conditioning market share, strengthening domestic competitiveness and long-term market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.7 Billion |

| Market Forecast in 2034 | USD 5.2 Billion |

| Market Growth Rate 2026-2034 | 7.30% |

Saudi Arabia Air Conditioning Market Trends:

Policy Incentives Boost Energy Transition

Saudi Arabia’s air conditioning market is steadily shifting towards energy efficiency, largely driven by targeted government initiatives aimed at reducing power consumption and promoting sustainable living. With the country experiencing prolonged summers and heavy reliance on cooling systems, energy efficiency has become a national priority. Programs supporting household upgrades are helping accelerate the adoption of modern, power-saving air conditioning units across the Kingdom. In September 2024, the Saudi Energy Efficiency Center (SEEC) expanded its “Estbdal” initiative nationwide, offering SR1,000 discounts, along with free delivery and installation, to encourage citizens to replace outdated window air conditioners with energy-efficient models. More than 350 showrooms and over 50 retailers joined the initiative, supported under the National Industrial Development and Logistics Program (NIDLP). This full-scale rollout followed a successful pilot in seven major cities, which concluded in late 2023. By removing financial and logistical barriers, the initiative prompted a faster replacement cycle and directly contributed to reducing household electricity use. These developments are expected to help push the Saudi air conditioning market’s value from SR2.3 Billion in 2024 to SR3.1 Billion by 2029. Such energy-focused incentives are shaping consumer behavior, boosting demand for high-efficiency products and favoring Saudi Arabia air conditioning market growth.

To get more information on this market Request Sample

Manufacturing Localization Drives Market Expansion

The localization of production is emerging as a major driver in Saudi Arabia’s air conditioning market, supporting long-term goals of industrial growth and economic diversification under Vision 2030. As the country aims to reduce its dependence on imports and build competitive domestic industries, there has been a clear push to strengthen local manufacturing capabilities within the HVAC sector. In May 2024, Basic Electronics Company partnered with Chinese appliance giant Gree to establish a smart HVAC factory in Dammam. Spanning 70,000 square meters in its first phase, the Al Asasyah Advanced Industry facility focuses on producing smart air conditioners with Variable Refrigerant Flow (VRF) systems and solar integration. Over 2,000 professionals are expected to be employed across research, testing, and production units. The factory includes labs, AI-driven technologies, and training centers, reflecting Saudi Arabia’s shift toward high-tech, energy-conscious manufacturing. This development is set to reduce import dependence, encourage knowledge transfer, and support the Kingdom’s sustainability and job creation goals. By producing modern HVAC systems locally, Saudi Arabia can better respond to internal demand, control quality, and stabilize supply. Such projects demonstrate how investment in advanced local manufacturing is helping expand the air conditioning market while reinforcing economic resilience and innovation.

Saudi Arabia Air Conditioning Market Growth Drivers:

Increased Need for Cooling Products

The need for air conditioners in Saudi Arabia is always on the rise based on the nation's hot climate, where temperatures are usually very high. Air conditioners are being sought more by the population to offer comfort from the unrelenting heat, particularly in urban centers and housing complexes. Besides residential applications, business and industries are growing, necessitating additional air conditioning systems for business premises, shopping malls, and factories. With the population expanding at such a fast rate and urbanization taking place, more buildings are coming up, and air conditioning is becoming an accepted norm. The government initiatives to diversify the economy and enhance infrastructure further fuel this boom. Manufacturers are continually launching increasingly energy-efficient, eco-friendly systems, meeting the growing demand of the market for sustainable and economical cooling options.

Technological Advancements and Innovation

Saudi Arabian air conditioning systems are reaping the benefits of ongoing technological development. Companies are launching intelligent, energy-saving systems that minimize energy usage without compromising performance. As consumers grow more aware of energy expenditures and environmental considerations, they are increasingly making purchases for air conditioning equipment that uses new technologies, including inverter-driven compressors and AI-based cooling systems. These technologies not only improve the efficiency of energy consumption but also enhance the comfort of the users through features such as automatic temperature control and intelligent remote control functionality. The companies are responding to these changing consumer demands, ensuring that the products they provide are in sync with the most recent market trends. Therefore, the Saudi Arabian air conditioning industry is continually on the move, with companies increasingly looking towards technology improvement and sustainability.

Increase in Construction Activities and Real Estate Development

Saudi Arabia's construction and real estate industry is growing at a rapid pace with massive initiatives like new residential areas, commercial complexes, and industrial estates. With rising demand for residential and office spaces, air conditioning systems also gain necessity, especially in newly constructed buildings. Construction of multi-storey buildings, malls, and business centers demands advanced cooling systems to ensure comfort and comply with contemporary building standards. The growth of smart cities and mixed-use developments is also catalyzing the overall demand, as these developments put a high value on energy efficiency and sustainability and drive the adoption of new air conditioning systems. With the booming real estate market, the air conditioning industry is reaping the benefits of ongoing growth due to the number of buildings requiring efficient cooling systems on the rise. IMARC Group predicts that the Saudi Arabia real estate market is projected to attain USD 132.65 Billion by 2033.

Saudi Arabia Air Conditioning Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on product and application.

Product Insights:

- Room/Unitary Air Conditioners

- Chillers

- VRF Systems

- Coolers

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes room/unitary air conditioners, chillers, VRF systems, coolers, and others.

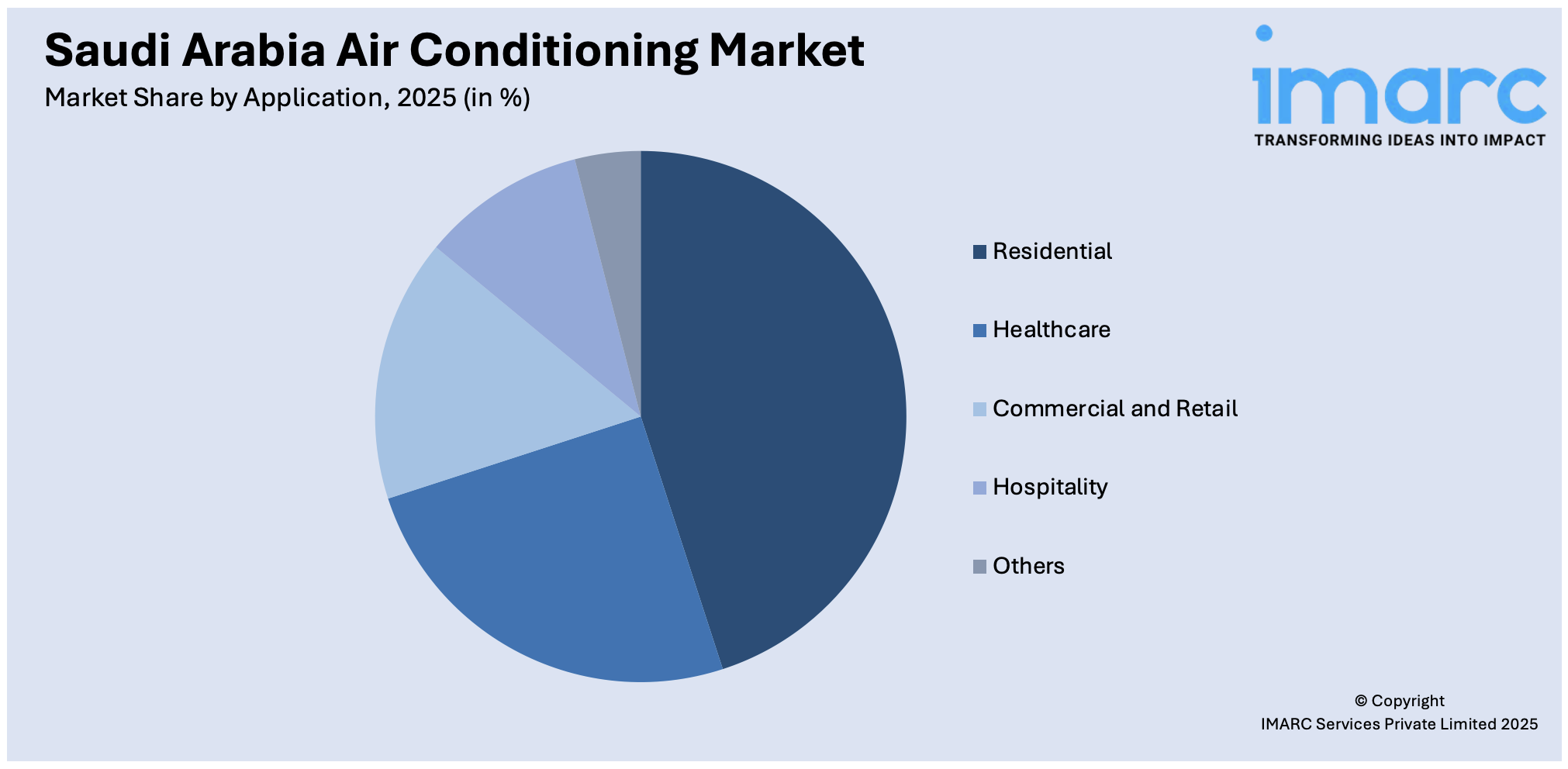

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Healthcare

- Commercial and Retail

- Hospitality

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, healthcare, commercial and retail, hospitality, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Air Conditioning Market News:

- June 2025: The Grand Mosque in Makkah hosts the largest cooling system globally, accommodating over a million Hajj pilgrims in the Saudi city during the summer heat. The yearly pilgrimage is set to start on Wednesday, and Saudi officials have promised that the occasion will be secure despite rising temperatures. Severe penalties have been implemented for unauthorized visitors to Makkah to curb overcrowding.

- May 2025: Johnson Controls Arabia, a worldwide leader in Smart Building Controls and energy efficiency solutions, has launched the inaugural 600-ton air-cooled chiller production line at the YORK Manufacturing Complex in King Abdullah Economic City, Jeddah. This milestone coincides with the introduction of Saudi Arabia’s inaugural AHRI-certified performance testing laboratory specifically for air-cooled chillers up to 600 tons, solidifying the Kingdom’s position as a regional center for HVAC innovation and industrial superiority.

- May 2025: Saudi Arabia’s energy sector is poised for a major enhancement with the initiation of a new joint venture focusing on localizing the manufacturing of high-voltage porcelain insulators, an essential part of the nation’s effort to bolster local production and lessen dependence on imports. The deal, inked with the support of the Ministry of Energy, unites China’s Dalian Insulators Group, Power Union Co., a branch of Al-Ojaimi Industrial Group and the Saudi company Greengrid.

- February 2025: LG Electronics Saudi Arabia and Al-Hassan Ghazi Ibrahim Shaker Co., a company involved in importing, manufacturing, and distributing air conditioning systems and household appliances in the Kingdom, are commemorating their 30-year collaboration, characterized by innovation and quality in the heating, ventilation, and air conditioning sector. This enduring partnership will persist in advancing LG’s cutting-edge HVAC solutions and solidifying LG and Shaker’s status as a top HVAC solution provider in the Kingdom. These sophisticated solutions comprise air conditioning systems and chillers for both residential and commercial use. All are intended to highlight “Made in Saudi,” eco-friendliness, energy effectiveness, and consistency with Saudi Vision 2030’s growth objectives.

- February 2025: Ceer signed a partnership with Zamil Central Air Conditioners Co. Ltd. during the PIF Public Sector Forum. This collaboration supported HVAC component localization for electric vehicles, boosting domestic air conditioning manufacturing and aligning with Saudi Arabia’s broader industrial and energy efficiency goals.

- January 2025: The National Energy Services Company (Tarshid) and Al-Amal Mental Health Hospital (Irada) have initiated an energy-saving project aimed at 19 structures within the hospital’s facilities in Al-Qurayyat. The initiative seeks to improve energy efficiency and lower consumption in accordance with global best practices.

- September 2024: Saudi Arabia expanded its “Replace Old Window Air Conditioners” initiative nationwide, involving 50+ retailers, 350 showrooms, and four local manufacturers. Backed by SEEC and NIDLP, the program promoted energy-efficient upgrades and strengthened domestic production, enhancing long-term growth in the air conditioning market.

Saudi Arabia Air Conditioning Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Room/Unitary Air Conditioners, Chillers, VRF Systems, Coolers, Others |

| Applications Covered | Residential, Healthcare, Commercial and Retail, Hospitality, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia air conditioning market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia air conditioning market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia air conditioning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air conditioning market in Saudi Arabia was valued at USD 2.7 Billion in 2025.

The Saudi Arabia air conditioning market is projected to exhibit a CAGR of 7.30% during 2026-2034, reaching a value of USD 5.2 Billion by 2034.

The Saudi Arabia air conditioning market is driven by extreme climatic conditions, rapid urban developments, and rising disposable incomes. Expanding real estate projects, government initiatives for energy-efficient solutions, and increasing demand for smart air conditioning systems are further boosting market growth, particularly across residential, commercial, and industrial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)