Saudi Arabia Airborne ISR Market Size, Share, Trends and Forecast by Platform, System, Type, Fuel Type, Application, and Region, 2026-2034

Saudi Arabia Airborne ISR Market Overview:

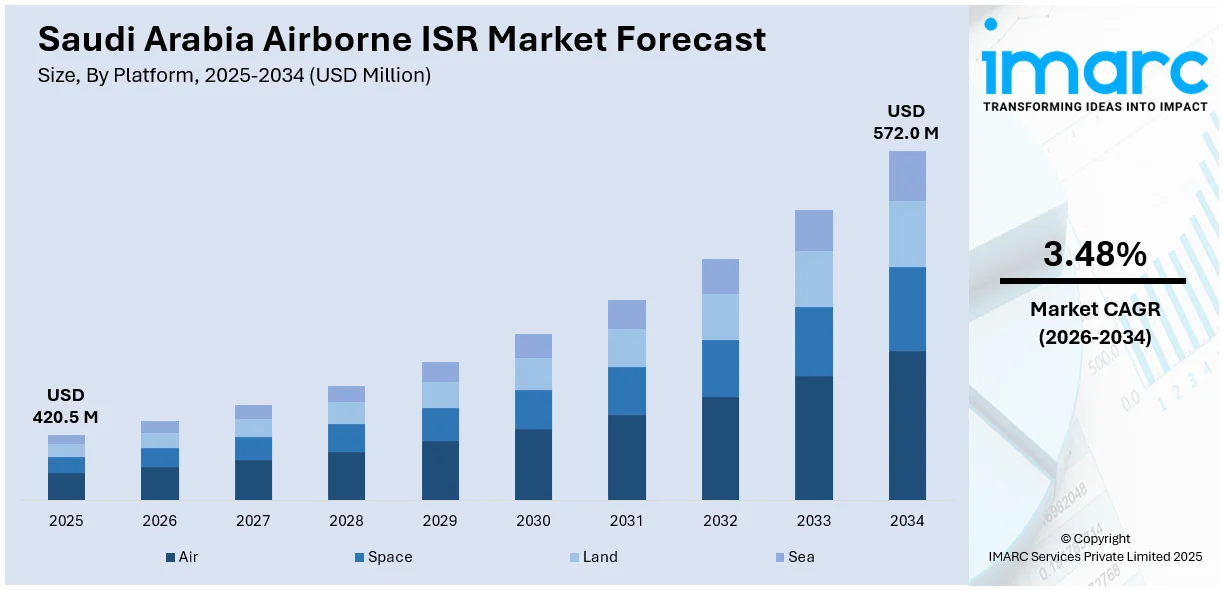

The Saudi Arabia airborne ISR market size reached USD 420.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 572.0 Million by 2034, exhibiting a growth rate (CAGR) of 3.48% during 2026-2034. The market is fueled by increased regional security issues, Vision 2030 defense spending increases, developments in surveillance technologies, and the emphasis of the military on real-time intelligence capabilities. Strategic alliances with international defense companies and local production programs further hasten procurement and system integration processes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 420.5 Million |

| Market Forecast in 2034 | USD 572.0 Million |

| Market Growth Rate 2026-2034 | 3.48% |

Saudi Arabia Airborne ISR Market Trends:

Shift Toward Indigenous ISR Capabilities and Technology Transfer

A significant trend in Saudi Arabia’s airborne ISR market is the emphasis on developing indigenous capabilities through technology transfer and local partnerships. As part of Vision 2030, the government is prioritizing defense self-reliance, pushing foreign defense contractors to establish local manufacturing and R&D units. Companies entering the Saudi market are increasingly required to collaborate with domestic firms and transfer technical knowledge to meet offset obligations. This approach aims to cultivate local talent, foster a sustainable defense ecosystem, and reduce long-term reliance on foreign suppliers. Consequently, ISR systems integration, maintenance, and software development are gradually being localized, positioning Saudi Arabia as a regional hub for ISR innovation and sustainment. These initiatives are also enhancing lifecycle support for deployed airborne surveillance platforms. For instance, as of 2024, Saudi Arabia is considering a reboot of its long-standing Saudi Border Guard Development Program, known as MIKSA, which has been managed by Airbus Group for the past decade. The refresh could reignite competition among defense contractors for the program. MIKSA focuses on border surveillance, and its modernization aligns with Saudi Arabia’s national security priorities. The move suggests renewed investment in ISR and border control technologies amid regional security concerns and reflects the Kingdom’s ongoing defense modernization efforts.

To get more information on this market Request Sample

Growing Investment in Multi-Platform ISR Fleet Modernization

Saudi Arabia is expanding and modernizing its airborne ISR fleet by incorporating a diverse mix of platforms, including manned aircraft, unmanned aerial vehicles (UAVs), and rotary-wing systems. The integration of advanced sensors, synthetic aperture radars, signal intelligence payloads, and communication suites across platforms allows for improved operational flexibility and enhanced situational awareness. This modernization is not limited to procurement but also includes upgrades to legacy ISR platforms to extend their utility and ensure interoperability with newer systems. This multi-platform approach supports a layered surveillance strategy, enabling persistent monitoring of strategic borders, critical infrastructure, and maritime routes. The diversified ISR fleet enhances the Kingdom’s ability to respond swiftly to regional threats and asymmetrical warfare scenarios. For instance, as per industry reports, in 2024, Saudi Arabia plans to merge its air and space forces into a unified command, aiming to build integrated military space capabilities aligned with Vision 2030. Backed by U.S. advisors, the initiative includes launching a military satellite and establishing a national space strategy. The merger supports the development of ISR, SATCOM, and space-based deterrence systems. This organizational shift is designed to enhance joint operations and modernize the Kingdom’s multi-domain ISR framework, linking space, airborne, and ground-based surveillance assets.

Saudi Arabia Airborne ISR Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on platform, system, type, fuel type, and application.

Platform Insights:

- Air

- Space

- Land

- Sea

The report has provided a detailed breakup and analysis of the market based on the platform. This includes air, space, land, and sea.

System Insights:

- Maritime Patrol

- Electronic Warfare

- Airborne Early Warning and Control (AEWC)

- Airborne Ground Surveillance (AGS)

- Signals Intelligence (SIGINT)

A detailed breakup and analysis of the market based on the system have also been provided in the report. This includes maritime patrol, electronic warfare, airborne early warning and control (AEWC), airborne ground surveillance (AGS), and signals intelligence (SIGINT).

Type Insights:

- Surveillance

- Reconnaissance

- Intelligence

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes surveillance, reconnaissance, and intelligence.

Fuel Type Insights:

- Hydrogen Fuel-Cells

- Solar Powered

- Alternate Fuel

- Battery Operated

- Gas-Electric Hybrids

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes hydrogen fuel-cells, solar powered, alternate fuel, battery operated, and gas-electric hybrids.

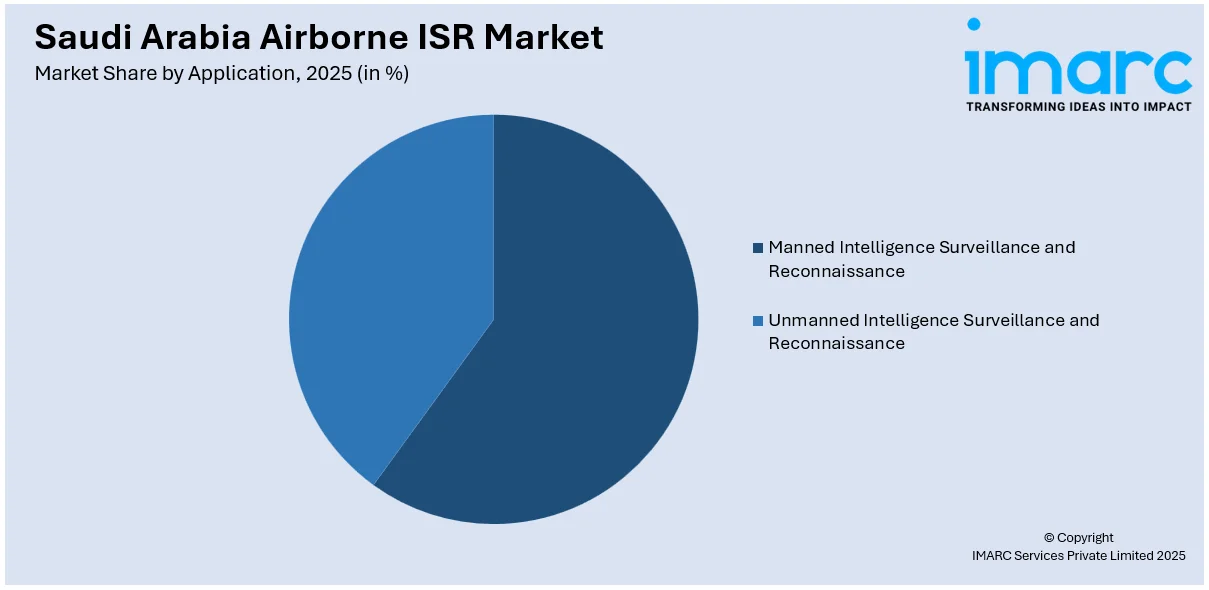

Application Insights:

Access the comprehensive market breakdown Request Sample

- Manned Intelligence Surveillance and Reconnaissance

- Unmanned Intelligence Surveillance and Reconnaissance

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes manned intelligence surveillance and reconnaissance and unmanned intelligence surveillance and reconnaissance.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Airborne ISR Market News:

- In July 2024, Collins Aerospace, a Raytheon company, secured a USD 264.6 Million contract (with a USD 300 Million ceiling) to sustain DB-110 and MS-110 reconnaissance pod systems for the U.S. Air Force's Foreign Military Sales (FMS) program. The contract includes hardware/software support, depot repairs, and field services for countries including Saudi Arabia, among others. The work will continue through June 2027, with initial funding of USD 2.29 Million allocated at the time of award.

Saudi Arabia Airborne ISR Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Air, Space, Land, Sea |

| Systems Covered | Maritime Patrol, Electronic Warfare, Airborne Early Warning and Control (AEWC), Airborne Ground Surveillance (AGS), Signals Intelligence (SIGINT) |

| Types Covered | Surveillance, Reconnaissance, Intelligence |

| Fuel Types Covered | Hydrogen Fuel-Cells, Solar Powered, Alternate Fuel, Battery Operated, Gas-Electric Hybrids |

| Applications Covered | Manned Intelligence Surveillance and Reconnaissance, Unmanned Intelligence Surveillance and Reconnaissance |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia airborne ISR market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia airborne ISR market on the basis of platform?

- What is the breakup of the Saudi Arabia airborne ISR market on the basis of system?

- What is the breakup of the Saudi Arabia airborne ISR market on the basis of type?

- What is the breakup of the Saudi Arabia airborne ISR market on the basis of fuel type?

- What is the breakup of the Saudi Arabia airborne ISR market on the basis of application?

- What are the various stages in the value chain of the Saudi Arabia airborne ISR market?

- What are the key driving factors and challenges in the Saudi Arabia airborne ISR market?

- What is the structure of the Saudi Arabia airborne ISR market and who are the key players?

- What is the degree of competition in the Saudi Arabia airborne ISR market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia airborne ISR market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia airborne ISR market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia airborne ISR industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)