Saudi Arabia Aircraft Line Maintenance Market Size, Share, Trends and Forecast by Service, Type, Aircraft Type, Technology, and Region, 2026-2034

Saudi Arabia Aircraft Line Maintenance Market Overview:

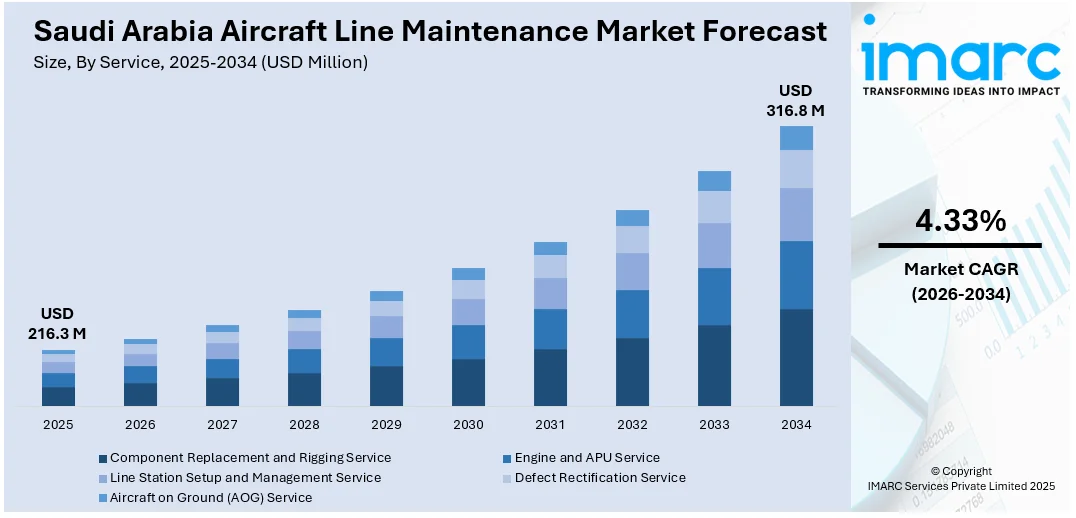

The Saudi Arabia aircraft line maintenance market size reached USD 216.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 316.8 Million by 2034, exhibiting a growth rate (CAGR) of 4.33% during 2026-2034. The aircraft line maintenance market is growing because of efforts to localize aviation services, develop a skilled domestic workforce, and enhance operational standards through strategic international airline partnerships that demand high-quality, internationally aligned maintenance capabilities and technical readiness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 216.3 Million |

| Market Forecast in 2034 | USD 316.8 Million |

| Market Growth Rate 2026-2034 | 4.33% |

Saudi Arabia Aircraft Line Maintenance Market Trends:

Localization of Maintenance Capabilities and Workforce Development

In accordance with Saudi Arabia's Vision 2030, there is a unified effort to localize aviation services, such as aircraft maintenance, to lessen reliance on foreign skills and generate local employment opportunities. This approach directly influences the line maintenance sector by promoting the development of local technical skills and the creation of regional service centers. Funding for aviation training centers, technical schools, and collaborations with international maintenance companies is contributing to the development of a proficient workforce ready to manage daily maintenance tasks. This localization initiative also motivates local firms to join the maintenance sector, promoting innovation, rivalry, and enhancing service access. 2025, Saudi Arabia issued its first industrial licenses for aircraft maintenance and overhaul to Middle East Propulsion Co. and Saudia Technic at the Aerospace Connect Forum in Jeddah. This move supports Vision 2030 by boosting local aviation capabilities and reducing reliance on foreign services. The licenses cover a broad range of military and commercial aviation maintenance activities. Such initiatives not only emphasize the advancing self-reliance of Saudi Arabia in aircraft upkeep but also indicate the development of a strong, competitive, and export-ready industry. As local expertise develops, the aircraft line maintenance market grows more scalable, integrated, and in harmony with the wider objectives of economic diversification and workforce development in Saudi Arabia.

To get more information on this market Request Sample

Strategic Airline Alliances and Global Partnerships

Airlines in Saudi Arabia are progressively establishing strategic partnerships and codeshare agreements with leading international airlines, combining their operations and service quality worldwide. These collaborations necessitate a significant degree of operational coordination, especially in sectors like line maintenance, where compliance with global safety and performance benchmarks is essential. As a result, local providers are focusing on enhancing the quality, consistency, and efficiency of their maintenance practices to satisfy the demands of international partners. In 2024, Riyadh Air and Delta Air Lines announced a strategic partnership aimed at expanding their global networks and enhancing the customer experience. The agreement included interline and codeshare services, integration of their loyalty programs, and plans for a future joint venture. Delta became Riyadh Air’s exclusive North American partner, with the potential for nonstop flights to Riyadh. Such partnerships not only elevate air traffic levels but also bring in more intricate regulatory and operational demands, particularly for long-distance, international services. These advancements fuel the need for exceptionally skilled maintenance staff and improved processes that can accommodate various fleets and demanding timelines. Moreover, collaborations of this magnitude frequently provide access to innovative technologies, training opportunities, and international best practices, thereby enhancing the local maintenance ecosystem. As Saudi Arabia's aviation industry expands globally, these partnerships act as triggers for the modernization and internationalization of its line maintenance, ensuring it stays competitive, compliant, and able to support top-tier aviation operations.

Saudi Arabia Aircraft Line Maintenance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on service, type, aircraft type, and technology.

Service Insights:

- Component Replacement and Rigging Service

- Engine and APU Service

- Line Station Setup and Management Service

- Defect Rectification Service

- Aircraft on Ground (AOG) Service

The report has provided a detailed breakup and analysis of the market based on the service. This includes component replacement and rigging service, engine and APPU service, line station setup and management service, defect rectification service, and aircraft on ground (AOG) service.

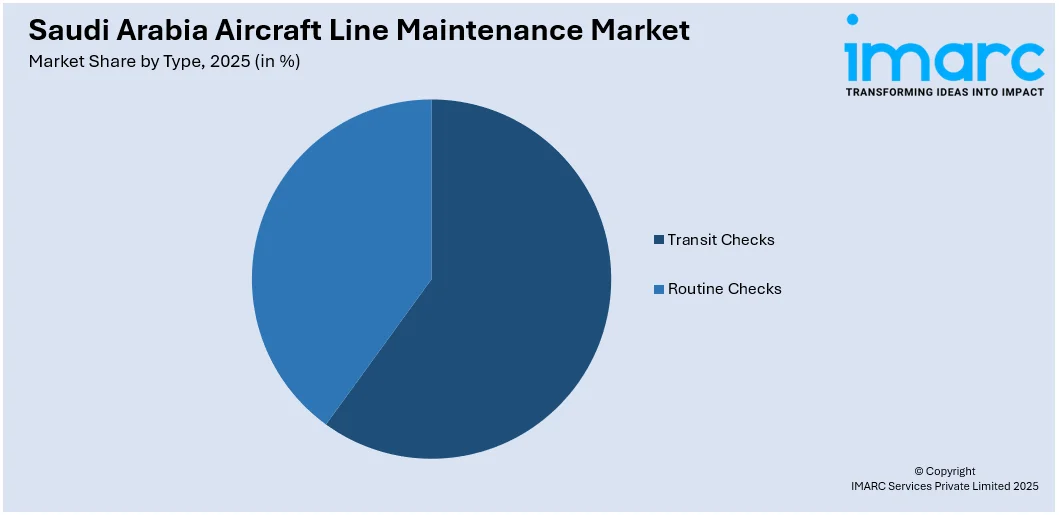

Type Insights:

Access the comprehensive market breakdown Request Sample

- Transit Checks

- Routine Checks

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes transit checks and routine checks.

Aircraft Type Insights:

- Narrow Body Aircraft

- Wide-Body Aircraft

- Very Large Body Aircraft

- Others

The report has provided a detailed breakup and analysis of the market based on the aircraft type. This includes narrow body aircraft, wide-body aircraft, very large body aircraft, and others.

Technology Insights:

- Traditional Line Maintenance

- Digital Line Maintenance

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes traditional maintenance and digital line maintenance.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Aircraft Line Maintenance Market News:

- In February 2025, Panasonic Technical Services announced a new inflight entertainment (IFE) MRO station in Riyadh as part of a 10-year deal with Riyadh Air to support its Boeing 787 fleet. The initiative includes local hiring, training, and proactive maintenance through Panasonic’s Total Care Package. Astrova’s modular IFE system allows easier upgrades, reducing downtime and enhancing passenger experience.

- In February 2025, Saudi Arabia launched its first aircraft manufacturing and maintenance industrial zone in Jeddah. Licenses were granted to Middle East Aircraft Engines Co. and Saudia Aerospace Engineering Industries. An MoU was also signed to establish maintenance centers within airports.

Saudi Arabia Aircraft Line Maintenance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Component Replacement and Rigging Service, Engine and APU Service, Line Station Setup and Management Service, Defect Rectification Service, Aircraft on Ground (AOG) Service |

| Types Covered | Transit Checks, Routine Checks |

| Aircraft Types Covered | Narrow Body Aircraft, Wide-Body Aircraft, Very Large Body Aircraft, Others |

| Technologies Covered | Traditional Line Maintenance, Digital Line Maintenance |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia aircraft line maintenance market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia aircraft line maintenance market on the basis of service?

- What is the breakup of the Saudi Arabia aircraft line maintenance market on the basis of type?

- What is the breakup of the Saudi Arabia aircraft line maintenance market on the basis of aircraft type?

- What is the breakup of the Saudi Arabia aircraft line maintenance market on the basis of technology?

- What is the breakup of the Saudi Arabia aircraft line maintenance market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia aircraft line maintenance market?

- What are the key driving factors and challenges in the Saudi Arabia aircraft line maintenance market?

- What is the structure of the Saudi Arabia aircraft line maintenance market and who are the key players?

- What is the degree of competition in the Saudi Arabia aircraft line maintenance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia aircraft line maintenance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia aircraft line maintenance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia aircraft line maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)