Saudi Arabia Airport Baggage Handling System Market Size, Share, Trends and Forecast by Identification Technology, Airport Class, Check-In Type, Type, Efficiency, Cost Analysis, and Region, 2026-2034

Saudi Arabia Airport Baggage Handling System Market Overview:

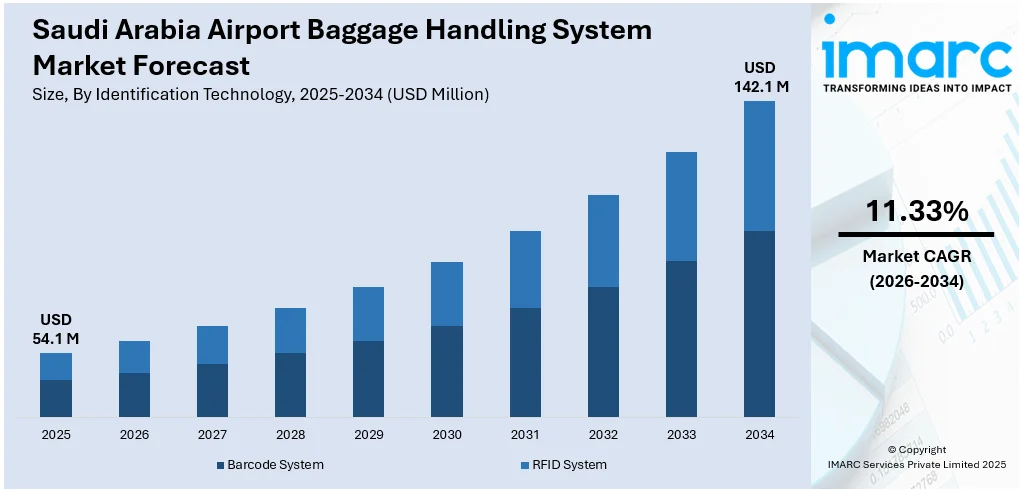

The Saudi Arabia airport baggage handling system market size reached USD 54.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 142.1 Million by 2034, exhibiting a growth rate (CAGR) of 11.33% during 2026-2034. Rising air passenger traffic, increasing airport modernization projects, growing demand for efficient baggage tracking, government investments in smart airport infrastructure, and adoption of advanced technologies like RFID and automation, are expanding the Saudi Arabia airport baggage handling system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 54.1 Million |

| Market Forecast in 2034 | USD 142.1 Million |

| Market Growth Rate 2026-2034 | 11.33% |

Saudi Arabia Airport Baggage Handling System Market Trends:

Automation Driving Modernization of Baggage Handling Systems

Saudi Arabia is undergoing a significant transformation in its aviation infrastructure, and automation is at the forefront of this evolution. The country’s major airports are increasingly integrating smart baggage handling systems that streamline operations, reduce human error, and enhance passenger experience. These systems use technologies such as AI, machine learning, and RFID to track and manage luggage in real-time. As the government continues investing in smart city and smart airport projects under Vision 2030, the focus on seamless, automated baggage operations is intensifying, thereby fostering Saudi Arabia airport baggage handling system market growth. For instance, The Abdul Latif Al Hamad Development Award was given to the Abu Dhabi Fund for Development (ADFD) on April 9, 2025, in recognition of its contribution to the Bahrain International Airport expansion project. This project sought to increase the airport's ability to handle 14 million passengers a year and was funded with USD 919 Million from the UAE's USD 2.5 Billion contribution to Bahrain in 2013. The project has strengthened Bahrain's standing as a regional aviation hub and made a substantial socioeconomic development contribution. Airports are replacing outdated conveyor systems with modular, scalable, and energy-efficient alternatives that align with sustainability goals. On June 16, 2024, SITA stated that despite 5.2 billion passengers worldwide, baggage mishandling rates decreased to 6.9 per 1,000 passengers in 2023 from 7.6 the year before. The use of automated baggage handling technology by the aviation industry, such as computer vision and artificial intelligence, is responsible for this development. Additionally, SITA's research identified rising passenger expectations for smooth travel experiences, including mobile-enabled journey tracking and self-service bag drops. Moreover, the growing number of international travelers and the need to handle large volumes of baggage quickly and securely have made automation a necessity rather than an option. This shift is redefining baggage logistics, making them faster, safer, and more reliable across major Saudi airports.

To get more information on this market Request Sample

Rise of Self-Service Technologies Enhancing Passenger Convenience

The demand for self-service technologies in Saudi airports is rapidly influencing the baggage handling ecosystem. Increasingly tech-savvy passengers prefer independent check-ins, and airports are responding by implementing advanced self-service bag drops and kiosks. Notably, Red Sea International Airport (RSI) in Saudi Arabia and SITA established a strategic cooperation on December 10, 2024, to supply specialized airport systems for the new Main Terminal Building. RSI plans to serve one million passengers a year by 2030, with a peak hourly capacity of 900. As part of this arrangement, SITA will automate check-in and departure procedures using cutting-edge solutions, such as SITA Flex and SITA's Maestro departure control system, improving operational effectiveness and passenger experience. These systems not only speed up the check-in process but also integrate smoothly with automated baggage handling operations, improving overall efficiency, which in turn is positively influencing Saudi Arabia airport baggage handling system market outlook. Self-service options reduce staffing needs, cut wait times, and help airports manage peak travel periods more effectively. This shift is particularly relevant in Class A and Class B airports experiencing rising footfall due to tourism growth and business travel. The introduction of biometric verification and mobile-enabled baggage services further supports the trend of contactless, user-friendly airport experiences. As travelers prioritize speed and convenience, Saudi Arabia’s aviation hubs are aligning their baggage handling infrastructure to meet evolving expectations, positioning themselves as global benchmarks in airport innovation and passenger-centric service delivery.

Saudi Arabia Airport Baggage Handling System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on identification technology, airport class, check-in type, type, efficiency, and cost analysis.

Identification Technology Insights:

- Barcode System

- RFID System

The report has provided a detailed breakup and analysis of the market based on the identification technology. This includes barcode system and RFID system.

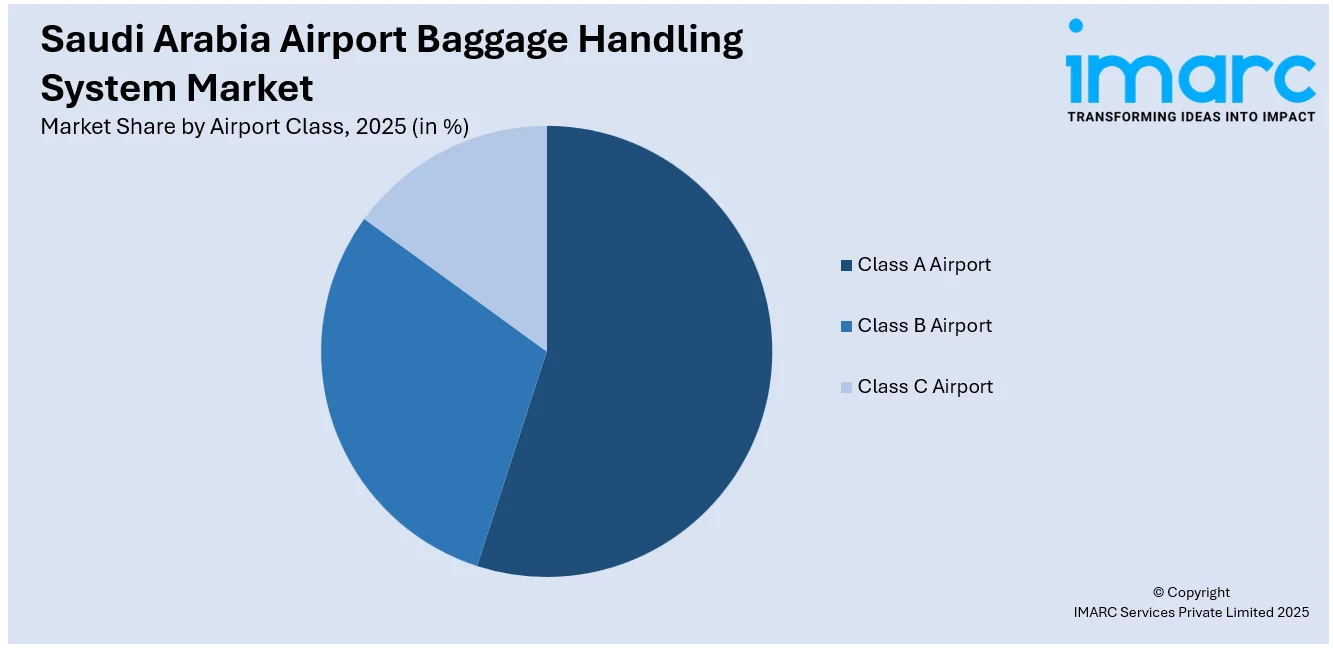

Airport Class Insights:

Access the comprehensive market breakdown Request Sample

- Class A Airport

- Class B Airport

- Class C Airport

A detailed breakup and analysis of the market based on the airport class have also been provided in the report. This includes class A airport, class B airport, and class C airport.

Check-In Type Insights:

- Assisted Service Bag Check-In

- Self-Service Bag Check-In

The report has provided a detailed breakup and analysis of the market based on the check-in type. This includes assisted service bag check-in and self-service bag check-in.

Type Insights:

- Conveyor System

- Destination Coded Vehicle

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes conveyor system and destination coded vehicle.

Efficiency Insights:

- Below 3000

- 3000 to 6000

- Above 6000

The report has provided a detailed breakup and analysis of the market based on the efficiency. This includes below 3000, 3000 to 6000, and above 6000.

Cost Analysis Insights:

- Operational Cost Analysis

- Installation Cost Analysis

A detailed breakup and analysis of the market based on the cost analysis have also been provided in the report. This includes operation cost analysis and installation cost analysis.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Airport Baggage Handling System Market News:

- On 10 Dec, 2024, SITA, a leading air transport technology solutions provider, formed a strategic partnership with Saudi Arabia's Red Sea International Airport (RSI) to provide Specialized Airport Systems (SAS) for the airport's new Main Terminal Building. This collaboration follows SITA's successful work on the airport's Air Taxi Terminal.

Saudi Arabia Airport Baggage Handling System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Identification Technologies Covered | Barcode System, RFID System |

| Airport Classes Covered | Class A Airport, Class B Airport, Class C Airport |

| Check-In Types Covered | Assisted Service Bag Check-In, Self-Service Bag Check-In |

| Types Covered | Conveyor System, Destination Coded Vehicle |

| Efficiencies Covered | Below 3000, 3000 to 6000, Above 6000 |

| Cost Analyses Covered | Operational Cost Analysis, Installation Cost Analysis |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia airport baggage handling system market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia airport baggage handling system market on the basis of identification technology?

- What is the breakup of the Saudi Arabia airport baggage handling system market on the basis of airport class?

- What is the breakup of the Saudi Arabia airport baggage handling system market on the basis of check-in?

- What is the breakup of the Saudi Arabia airport baggage handling system market on the basis of type?

- What is the breakup of the Saudi Arabia airport baggage handling system market on the basis of efficiency?

- What is the breakup of the Saudi Arabia airport baggage handling system market on the basis of cost analysis?

- What is the breakup of the Saudi Arabia airport baggage handling system market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia airport baggage handling system market?

- What are the key driving factors and challenges in the Saudi Arabia airport baggage handling system market?

- What is the structure of the Saudi Arabia airport baggage handling system market and who are the key players?

- What is the degree of competition in the Saudi Arabia airport baggage handling system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia airport baggage handling system market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia airport baggage handling system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia airport baggage handling system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)