Saudi Arabia Alcohol Free Perfumes Market Size, Share, Trends and Forecast by Product Type, Gender, Price Range, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Alcohol Free Perfumes Market Overview:

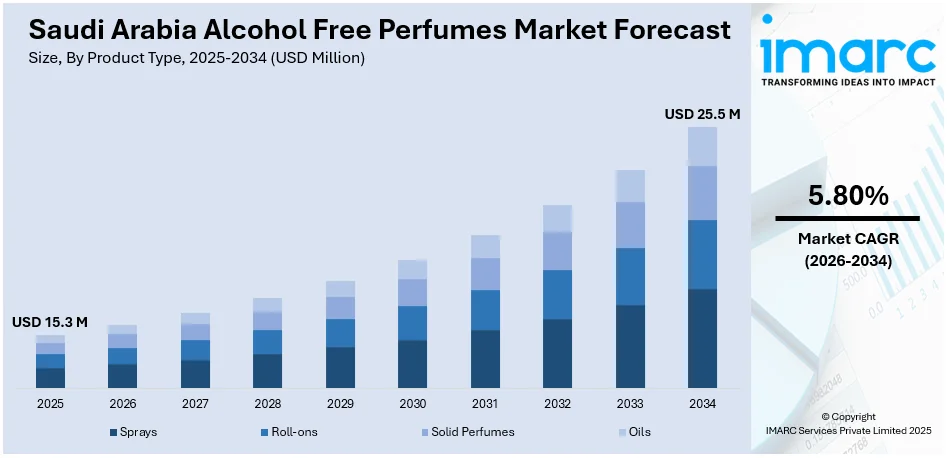

The Saudi Arabia alcohol free perfumes market size reached USD 15.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 25.5 Million by 2034, exhibiting a growth rate (CAGR) of 5.80% during 2026-2034. The market is influenced by the nation's rich cultural tradition for alcohol-free scents like oud, musk, and amber, which are central to social rituals and personal hygiene. Increasing health and wellness consciousness is also encouraging consumers to try natural and alcohol-free variants. Increasing disposable income resulting in augmented expenditure on premium and niche perfumes, and e-commerce platforms enabling consumers having a larger selection of alcohol-free perfumes to browse from, which further increases the Saudi Arabia alcohol-free perfumes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 15.3 Million |

|

Market Forecast in 2034

|

USD 25.5 Million |

| Market Growth Rate 2026-2034 | 5.80% |

Saudi Arabia Alcohol Free Perfumes Market Trends:

Increasing Demand for Alcohol-Free Perfumes Among Local Consumers

The shift toward alcohol-free perfumes in Saudi Arabia is greatly influenced by cultural and religious reasons emphasizing purity and the use of products free from alcohol. With increasing awareness, consumers increasingly opt for alternatives that are more Islamic, and hence alcohol-free formulations are not only a choice but a requirement. The trend is being observed throughout different sectors of the population, ranging from young adults to more conservative groups, who are gravitating toward perfumes that maintain both their individual beliefs and social expectations. The growing range of alcohol-free perfumes available to purchase also contributes to this effect, as buyers are no longer constrained in terms of scent profiles or product quality. These fragrances are now considered compliant and luxurious usually having long-lasting longevity and deep, complex notes. The attraction is supplemented by an increasing awareness about skin-friendly components and the developing trend toward natural and sustainable products.

To get more information on this market Request Sample

Innovation and Local Brand Empowerment

With demand picking up, domestic perfume manufacturers in Saudi Arabia are catching up, by investing into research and innovation to create advanced alcohol-free perfumes that compete with international luxury brands. The move has triggered a renaissance for the country's perfume industry, with homegrown companies thriving by using traditional Arabian ingredients such as oud, amber, musk, and rose, mixed in innovative combinations. These local designers are known for creating high-quality, compliant fragrances that stay abreast of global levels of craftsmanship. Moreover, innovative fragrance profiles and contemporary packaging, the message now is that alcohol-free no longer equates to old-fashioned or boring. Rather, these fragrances are now marked by prestige and personal taste. Several brands are also using social media and online channels to target young consumers, who are interested in patronizing local business owners and appreciate uniqueness in their fragrance selection, which further contributes to the Saudi Arabia alcohol free perfumes market growth.

Global Influence and Retail Expansion

The alcohol-free perfume trend in Saudi Arabia is prominent in mass market retail outlets and high-end outlets as well, apart from niche stores. Large beauty retailers and department stores have further broadened their product base to encompass a large variety of halal-certified and alcohol-free perfumes, reflecting strong commercial interest and consumer appeal. International brands are following suit, with several rolling out dedicated alcohol-free lines specifically targeted toward the Middle Eastern market. This legitimizes the trend globally, while also injecting more competitive forces into the domestic market. The combination of international expertise and Saudi sensibilities is creating a specialized perfume culture that puts Saudi Arabia at the cutting edge of this maturing industry. As the market develops, export opportunities are bound to increase, with Saudi-produced alcohol-free perfumes becoming popular in other nations and among customers looking for ethical and skin-friendly scent products.

Saudi Arabia Alcohol Free Perfumes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, gender, price range, distribution channel, and end user.

Product Type Insights:

- Sprays

- Roll-ons

- Solid Perfumes

- Oils

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sprays, roll-ons, solid perfumes, and oils.

Gender Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on the gender has also been provided in the report. This includes men, women, and unisex.

Price Range Insights:

- Premium

- Mid-Range

- Economy

A detailed breakup and analysis of the market based on the price range has also been provided in the report. This includes premium, mid-range, and economy.

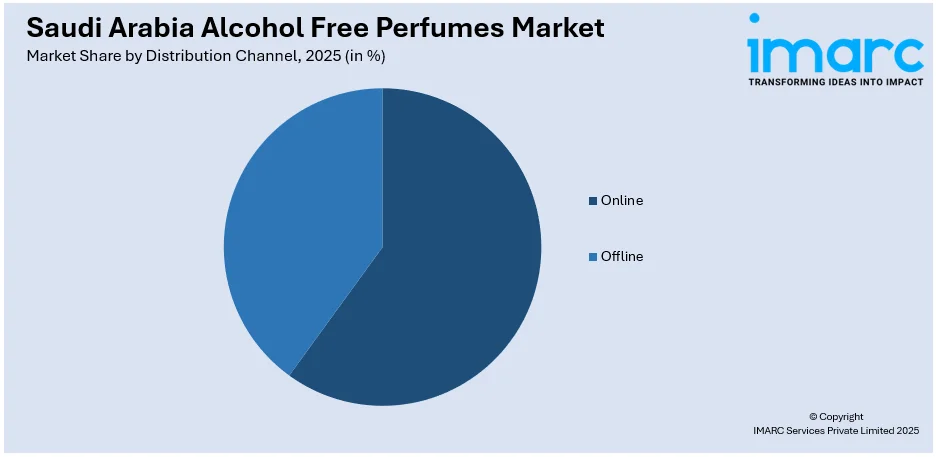

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes online and offline.

End User Insights:

- Personal Use

- Gifting

The report has provided a detailed breakup and analysis of the market based on the end user. This includes personal use and gifting.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Alcohol Free Perfumes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sprays, Roll-ons, Solid Perfumes, Oils |

| Genders Covered | Men, Women, Unisex |

| Price Ranges Covered | Premium, Mid-Range, Economy |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Personal Use, Gifting |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia alcohol free perfumes market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia alcohol free perfumes market on the basis of product type?

- What is the breakup of the Saudi Arabia alcohol free perfumes market on the basis of gender?

- What is the breakup of the Saudi Arabia alcohol free perfumes market on the basis of price range?

- What is the breakup of the Saudi Arabia alcohol free perfumes market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia alcohol free perfumes market on the basis of end user?

- What is the breakup of the Saudi Arabia alcohol free perfumes market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia alcohol free perfumes market?

- What are the key driving factors and challenges in the Saudi Arabia alcohol free perfumes market?

- What is the structure of the Saudi Arabia alcohol free perfumes market and who are the key players?

- What is the degree of competition in the Saudi Arabia alcohol free perfumes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia alcohol free perfumes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia alcohol free perfumes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia alcohol free perfumes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)