Saudi Arabia Aluminum Cans Market Size, Share, Trends and Forecast by Application, and Region, 2026-2034

Saudi Arabia Aluminum Cans Market Overview:

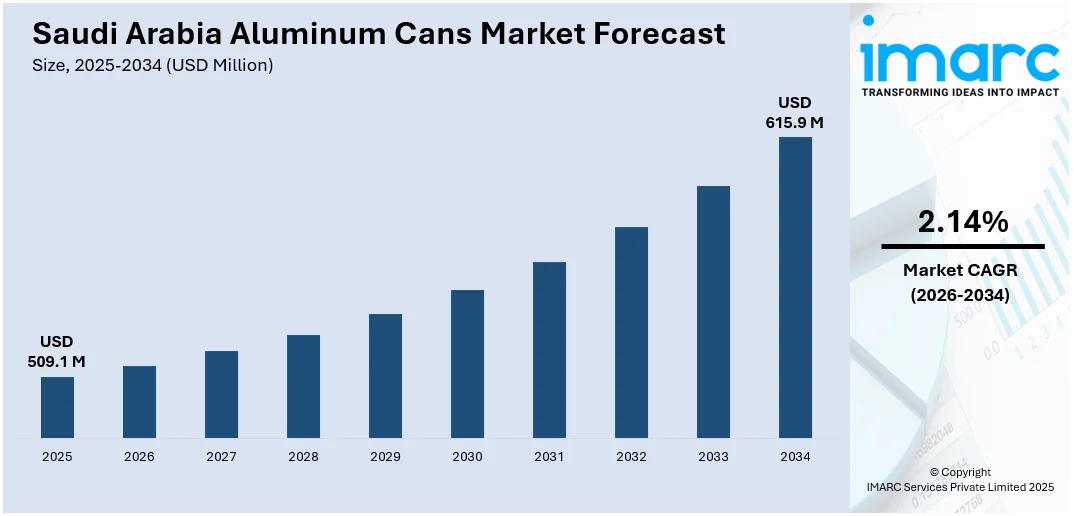

The Saudi Arabia aluminum cans market size reached USD 509.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 615.9 Million by 2034, exhibiting a growth rate (CAGR) of 2.14% during 2026-2034. The growing environmental awareness and evolving user preferences, combined with sustainability goals and expanding demand for packaged food and beverages, are driving the adoption of aluminum cans in Saudi Arabia owing to their recyclability, durability, product protection, and branding flexibility.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 509.1 Million |

| Market Forecast in 2034 | USD 615.9 Million |

| Market Growth Rate 2026-2034 | 2.14% |

Saudi Arabia Aluminum Cans Market Trends:

Growing Demand for Sustainable Packaging

The increasing emphasis on sustainable practices is influencing the aluminum cans market in Saudi Arabia, as the kingdom aligns itself with international environmental goals and reduces reliance on plastic packaging. Aluminum cans, known for their infinite recyclability, lightweight properties, and relatively low carbon footprint, are gaining traction among manufacturers and individuals alike. This momentum is further supported by national priorities under Vision 2030, which promote circular economy principles and encourage the use of eco-friendly materials. As Saudi Arabia intensifies its efforts to diversify its economy and minimize environmental harm, aluminum cans are being adopted in sectors such as food and beverages (F&B). Their appeal lies in both functional advantages and their alignment with consumer demand for green alternatives. The market shift is also reflected in economic indicators, such as the Saudi Arabia metal packaging market reached USD 1,554.6 Million in 2024, and projections from the IMARC Group estimate it will grow to USD 2,002.1 Million by 2033, marking a CAGR of 2.85% during 2025–2033. This growth highlights the rising acceptance of aluminum packaging as both a sustainable and economically viable option. As regulatory pressures and consumer preferences continue to evolve, aluminum cans are poised to play a vital role in packaging strategies, reinforcing their position as a key solution for balancing functionality, consumer convenience, and environmental responsibility.

To get more information on this market Request Sample

Rising Use in F&B Industry

The F&B industry in Saudi Arabia is experiencing consistent growth, fueled by a youthful demographic and changing tastes favoring convenient, ready-to-eat (RTE) and packaged items. This shift in consumption patterns is creating an increasing need for dependable and high-quality packaging options, with Aluminum cans becoming favored for their convenience, product safeguarding, and aesthetic attractiveness. These cans aid in maintaining freshness, prolonging shelf life, and offer convenience in management and storage. These features are crucial for items such as carbonated beverages, juices, energy drinks, and canned goods. Their ability to protect against oxygen and light, combined with resistance to tampering, renders them ideal for preserving sensitive products. Additionally, the aesthetic adaptability of aluminum cans facilitates sophisticated branding and personalized design, improving product visibility in retail environments. The growing participation of international companies in the F&B sector further supports this trend. In 2024, SCG International collaborated with Saudi Arabia’s Tamimi Group to supply Siam Signature’s high-quality food and beverage items via Tamimi Markets. These partnerships emphasized the increasing arrival of premium imported products and strengthened the need for packaging that adheres to international standards. With both domestic producers and international brands seeking efficient and marketable packaging formats, Aluminum cans are seeing strong adoption across the evolving F&B landscape in Saudi Arabia.

Saudi Arabia Aluminum Cans Market Segmentation:

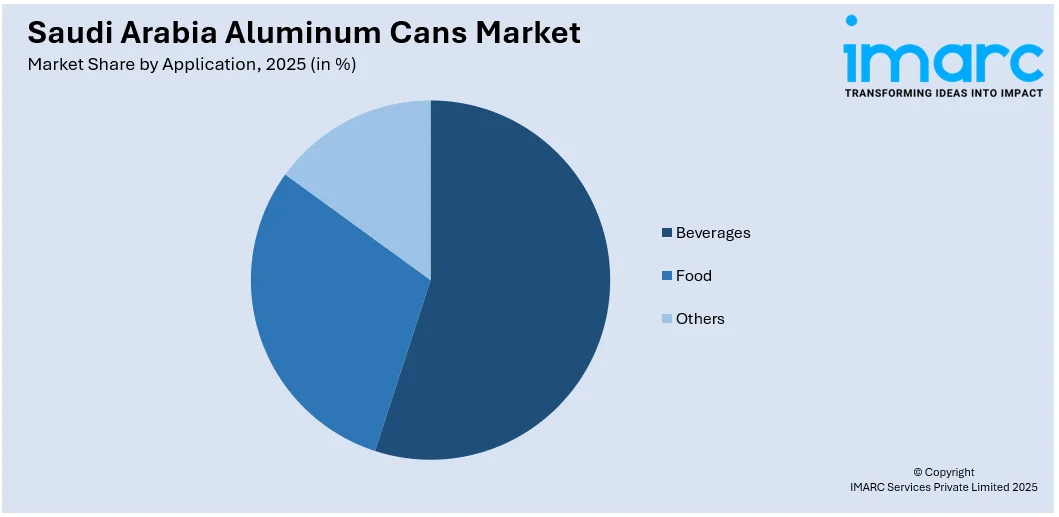

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on application.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Beverages

- Food

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes beverages, food, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Aluminum Cans Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Beverages, Food, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia aluminum cans market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia aluminum cans market on the basis of application?

- What is the breakup of the Saudi Arabia aluminum cans market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia aluminum cans market?

- What are the key driving factors and challenges in the Saudi Arabia aluminum cans?

- What is the structure of the Saudi Arabia aluminum cans market and who are the key players?

- What is the degree of competition in the Saudi Arabia aluminum cans market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia aluminum cans market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia aluminum cans market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia Aluminum cans industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)