Saudi Arabia Aluminum Extrusion Market Size, Share, Trends and Forecast by Product Type, Alloy Type, End-Use Industry, and Region, 2026-2034

Saudi Arabia Aluminum Extrusion Market Overview:

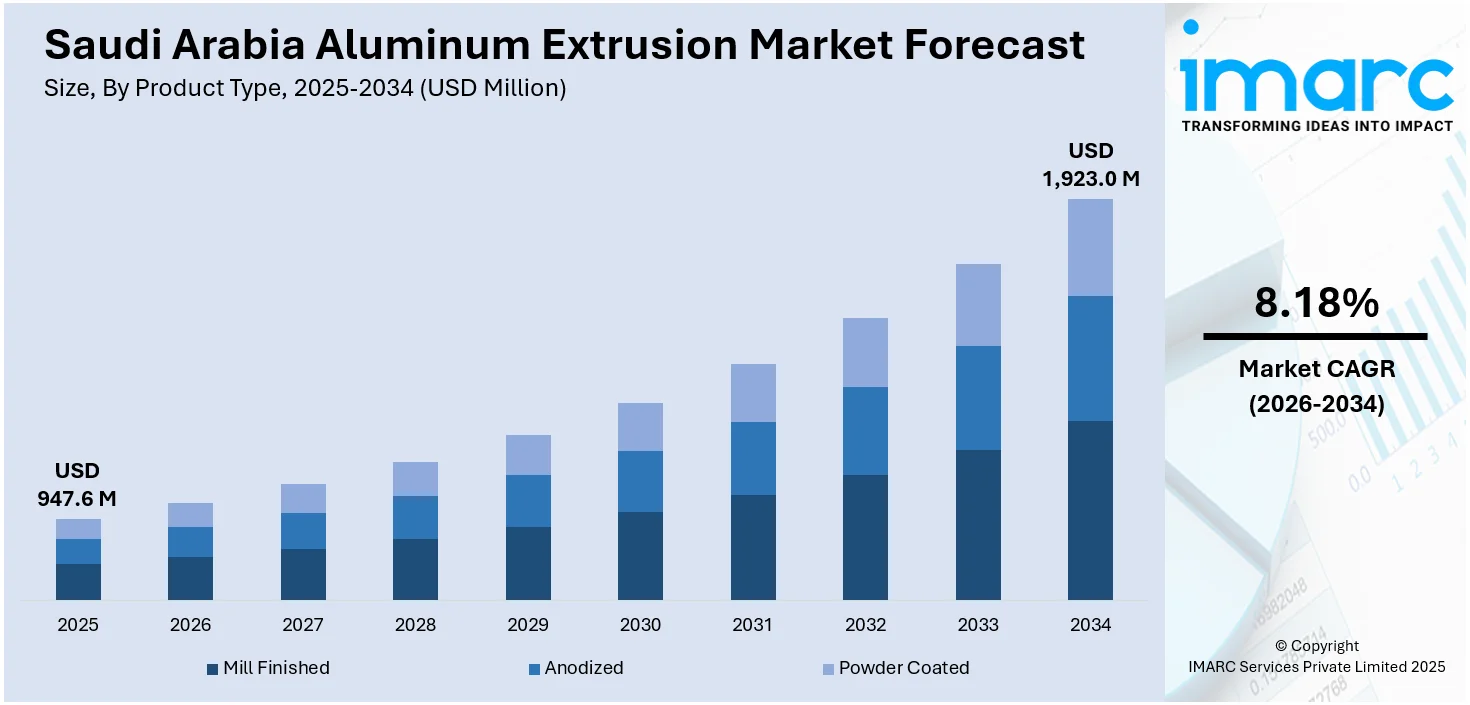

The Saudi Arabia aluminum extrusion market size reached USD 947.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,923.0 Million by 2034, exhibiting a growth rate (CAGR) of 8.18% during 2026-2034. Growing construction activities, infrastructure investments, expanding automotive and transportation sectors, demand for lightweight materials, increasing industrial applications, and rising adoption in solar energy projects, supported by government initiatives and technological advancements in extrusion processes, are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 947.6 Million |

| Market Forecast in 2034 | USD 1,923.0 Million |

| Market Growth Rate 2026-2034 | 8.18% |

Saudi Arabia Aluminum Extrusion Market Trends:

Expansion of Aluminum Extrusion Usage

In Saudi Arabia, the use of aluminum extrusion is expanding steadily across various sectors, driven by ongoing development in construction, transportation, and manufacturing. Its appeal lies in properties like durability, flexibility in design, and lightweight performance, making it suitable for a wide range of structural and decorative purposes. The material is gaining preference in projects emphasizing energy efficiency and modern architectural standards. As the country continues to invest in infrastructure and industrial growth, extrusion applications are becoming more widespread. Local producers are enhancing capabilities to meet rising demand, while interest in sustainable and recyclable materials is further encouraging its adoption. With increasing integration into both traditional and emerging sectors, aluminum extrusion continues to grow in relevance within the national industrial landscape. For example, the global aluminum extrusion market size was valued at USD 97.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 185.2 Billion by 2033, exhibiting a CAGR of 7.4% during 2025-2033.

To get more information on this market Request Sample

Boost in Aluminum Extrusion for Renewable Applications

Saudi Arabia is seeing increased integration of aluminum extrusion in solar energy projects, reflecting a broader focus on localized manufacturing and sustainable development. The growing use of extruded aluminum components in solar tracking systems supports national efforts to expand renewable energy infrastructure. This shift is driving enhancements in domestic production capacity, particularly in the extrusion segment, to meet the technical and volume requirements of solar installations. The emphasis on strengthening local supply chains is also promoting investment in advanced extrusion technologies and fostering collaboration across the industrial ecosystem. As solar adoption accelerates, aluminum extrusion is becoming a critical element in the country’s strategy to develop self-reliant, energy-efficient solutions for long-term infrastructure needs. For instance, in February 2024, Array Technologies partnered with Alupco to strengthen regional manufacturing of aluminum components in Saudi Arabia. The collaboration enables the localized production of solar tracking systems using extruded aluminum, supporting the country’s renewable energy targets. By expanding Alupco’s extrusion capabilities for solar projects, the agreement enhances domestic supply chains and aligns with national goals to boost sustainable infrastructure and aluminum-based manufacturing.

Saudi Arabia Aluminum Extrusion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, alloy type, and end-use industry.

Product Type Insights:

- Mill Finished

- Anodized

- Powder Coated

The report has provided a detailed breakup and analysis of the market based on the product type. This includes mill finished, anodized, and powder coated.

Alloy Type Insights:

- 1000 Series Aluminum Alloy

- 2000 Series Aluminum Alloy

- 3000 Series Aluminum Alloy

- 5000 Series Aluminum Alloy

- 6000 Series Aluminum Alloy

- 7000 Series Aluminum Alloy

A detailed breakup and analysis of the market based on the alloy type have also been provided in the report. This includes 1000 series aluminum alloy, 2000 series aluminum alloy, 3000 series aluminum alloy, 5000 series aluminum alloy, 6000 series aluminum alloy, and 7000 series aluminum alloy.

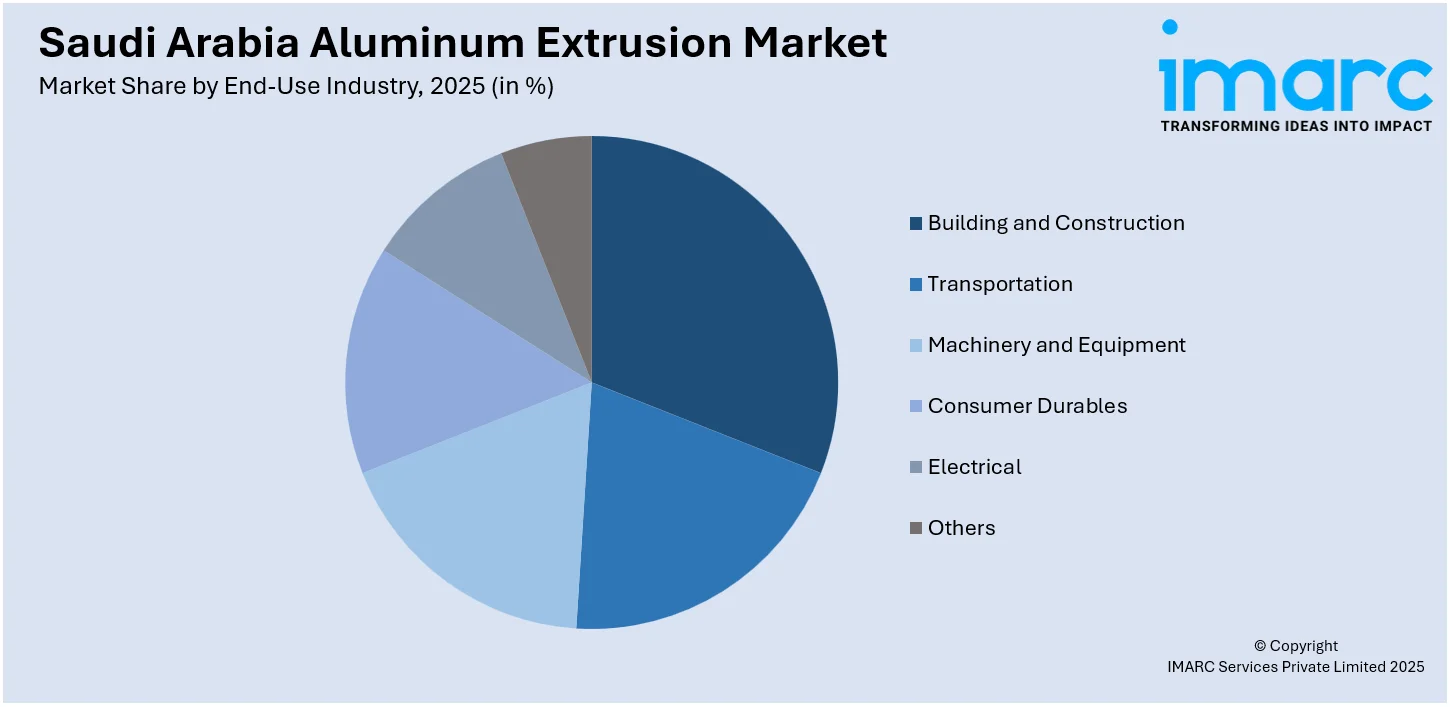

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Transportation

- Machinery and Equipment

- Consumer Durables

- Electrical

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes building and construction, transportation, machinery and equipment, consumer durables, electrical, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Aluminum Extrusion Market News:

- In October 2024, Sparklo reported collecting over 50 million bottles and cans across the MENA region, with Saudi Arabia among the key contributors. The initiative promotes circular economy goals by recovering aluminum packaging for reuse. This aligns with Saudi Arabia’s sustainability efforts and could support raw material recovery for industries including aluminum extrusion, encouraging localized recycling and material flow within the country’s growing manufacturing ecosystem.

- In October 2024, Saudi Arabia's Aluminium Products Company (ALUPCO) partnered with United Arab Aluminum Company (UAAC) to supply aluminum for the Jeddah Tower, set to become the world's tallest building at 1,000 meters. This collaboration underscores ALUPCO's significant role in the nation's aluminum extrusion sector, contributing to landmark projects like the Jeddah Tower and reinforcing its position in Saudi Arabia's construction industry.

Saudi Arabia Aluminum Extrusion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mill Finished, Anodized, Powder Coated |

| Alloy Types Covered | 1000 Series Aluminum Alloy, 2000 Series Aluminum Alloy, 3000 Series Aluminum Alloy, 5000 Series Aluminum Alloy, 6000 Series Aluminum Alloy, 7000 Series Aluminum Alloy |

| End-Use Industries Covered | Building and Construction, Transportation, Machinery and Equipment, Consumer Durables, Electrical, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia aluminum extrusion market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia aluminum extrusion market on the basis of product type?

- What is the breakup of the Saudi Arabia aluminum extrusion market on the basis of alloy type?

- What is the breakup of the Saudi Arabia aluminum extrusion market on the basis of end-use industry?

- What is the breakup of the Saudi Arabia aluminum extrusion market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia aluminum extrusion market?

- What are the key driving factors and challenges in the Saudi Arabia aluminum extrusion?

- What is the structure of the Saudi Arabia aluminum extrusion market and who are the key players?

- What is the degree of competition in the Saudi Arabia aluminum extrusion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia aluminum extrusion market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia aluminum extrusion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia aluminum extrusion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)