Saudi Arabia Amino Acids Market Size, Share, Trends and Forecast by Type, Raw Material, Application, and Region, 2026-2034

Saudi Arabia Amino Acids Market Overview:

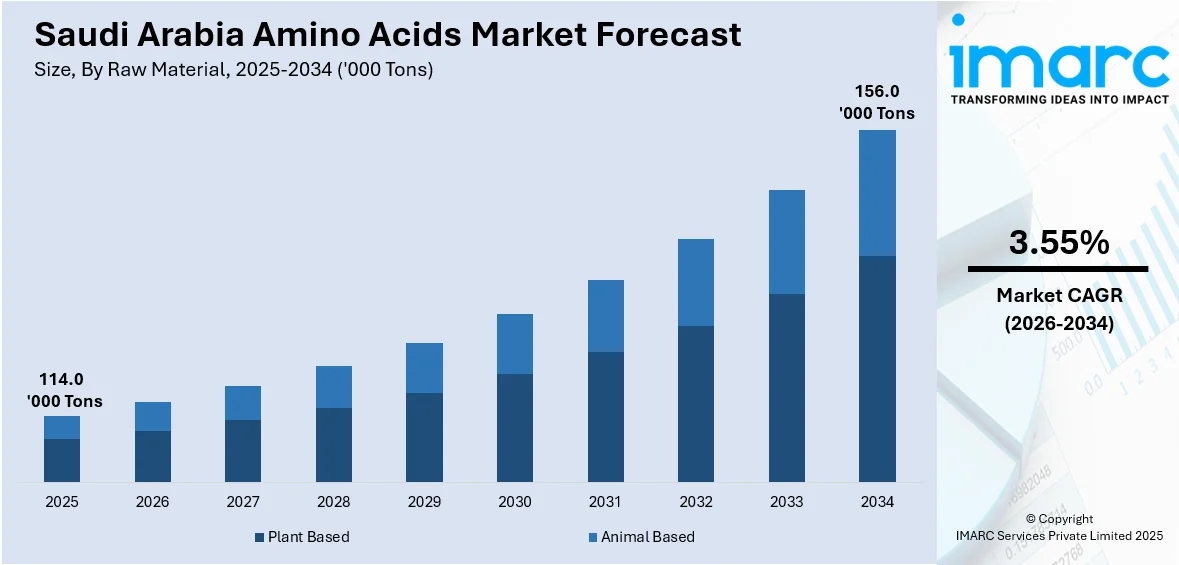

The Saudi Arabia amino acids market size reached 114.0 Thousand Tons in 2025. Looking forward, IMARC Group expects the market to reach 156.0 Thousand Tons by 2034, exhibiting a growth rate (CAGR) of 3.55% during 2026-2034. The market is driven by the rise in innovations in the Saudi Arabian livestock and poultry sector, increased health and wellness awareness among consumers, and heightened localization of drug manufacturing under the Vision 2030 diversification targets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 114.0 Thousand Tons |

| Market Forecast in 2034 | 156.0 Thousand Tons |

| Market Growth Rate 2026-2034 | 3.55% |

Saudi Arabia Amino Acids Market Trends:

Innovations in Livestock and Poultry Industry

A rise in innovations in the Saudi Arabian livestock and poultry sector is impelling the growth of the market. Amino acids like lysine, methionine, and threonine are critical ingredients in animal nutrition, especially in enhancing feed efficiency, supporting faster growth, and boosting immunity in livestock. With the growing governmental support for home-based agricultural independence and decreased dependency on foreign meat products, the nation is experiencing a lot of investment in indigenous animal husbandry. Consequently, the demand for premium feed additives, such as amino acids, is increasing drastically. Additionally, the shift toward intensive livestock production systems, with great dependence on maximized feed formulation, even further drives amino acid consumption. The Saudi Vision 2030 plan also focuses on economic diversification and enhanced food security, which has caused further improvements in the food and beverage (F&B) industry. For this reason, the gradual increase in poultry and livestock production has a direct relation to the higher consumption of amino acids throughout the kingdom. In 2025, Balady Poultry Trading Co. presented a 5-year plan for growth with an investment of 1.14 billion riyals. The company aims to construct a new slaughterhouse and processing unit and set up its own hatcheries.

To get more information on this market Request Sample

Rising Demand for Nutraceuticals and Dietary Supplements

Increased health and wellness awareness among consumers is driving the demand for dietary supplements and nutraceuticals in Saudi Arabia, leading to a substantial increase in the amino acids market. Leucine, isoleucine, glutamine, and arginine are critical ingredients of most health supplements since they play a function in muscle repair, immune support, and general metabolism. Higher occurrences of lifestyle disorders such as obesity, diabetes, and cardiovascular disease are also diverting the attention of consumers towards preventive medicine, where supplements based on amino acids are playing a significant role. Also, the increasing fitness and bodybuilding culture among youth is fueling demand for branched-chain amino acids (BCAAs) due to their performance and muscle-building properties. The government-led initiatives to promote healthier lifestyles, are increasing the health and wellness applications for amino acids. The IMARC Group predicts that the Saudi Arabia health and wellness market size will reach USD 81,109.5 Million by 2033.

Improvements in Pharmaceutical Manufacturing Sector

Amino acids are used as precursors in the manufacturing of different drugs, such as parenteral nutrition solutions, agents for wound healing, and therapeutic agents for metabolic and neurological disorders. As the Kingdom seeks to localize drug manufacturing under its Vision 2030 diversification targets, investments in local drug factory facilities are rising. These involve both multination partnership-building and local capability-building. With the growth of the pharmaceutical industry, there is a growing need for high-purity amino acids, both as direct therapeutic products and as intermediate products for complicated synthesis processes. Furthermore, the increasing incidence of chronic illnesses is driving the demand for formulations containing amino acids in clinical nutrition and therapeutic formulations. Regulatory encouragement and tax incentives towards pharma investments are driving the need for amino acids. In 2024, the CPHI Middle East was opened at the Riyadh Exhibition and Convention Centre Malham. This event included an exhibition and conference to assist both local and global pharmaceutical firms in collaborating within one of the world's rapidly evolving and expanding pharmaceutical centers.

Saudi Arabia Amino Acids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type, raw material, and application.

Type Insights:

- Glutamic Acids

- Lysine

- Methionine

- Threonine

- Phenylalanine

- Tryptophan

- Citrulline

- Glycine

- Glutamine

- Creatine

- Arginine

- Valine

- Leucine

- Iso-Leucine

- Proline

- Serine

- Tyrosine

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes glutamic acids, lysine, methionine, threonine, phenylalanine, tryptophan, citrulline, glycine, glutamine, creatine, arginine, valine, leucine, iso-leucine, proline, serine, tyrosine, and others.

Raw Material Insights:

- Plant Based

- Animal Based

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes plant based and animal based.

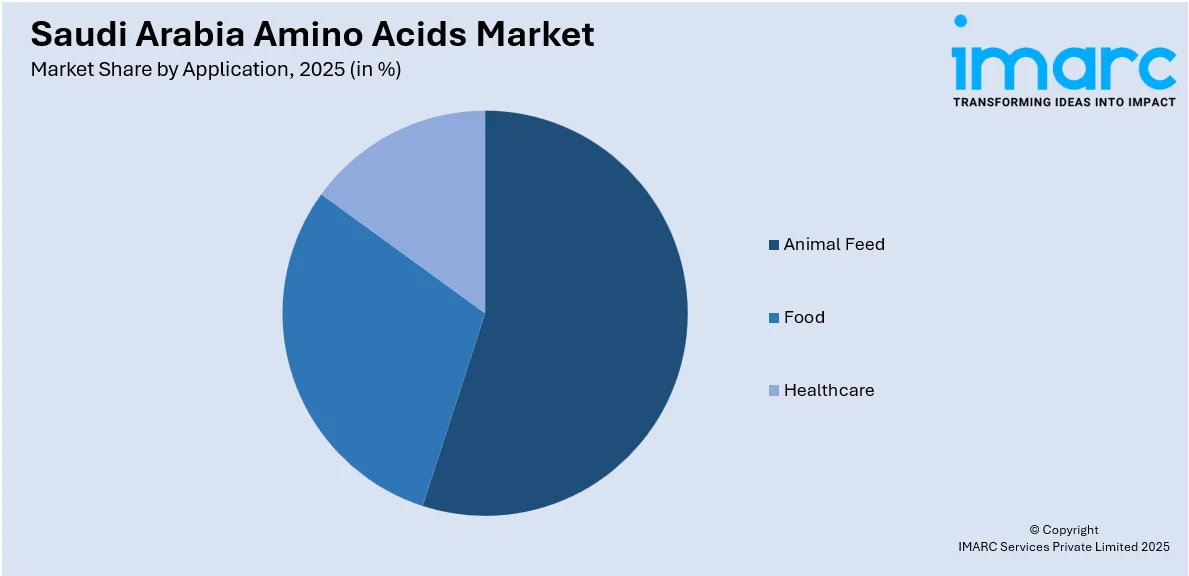

Application Insights:

Access the comprehensive market breakdown Request Sample

- Animal Feed

- Food

- Healthcare

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes animal feed, food, and healthcare.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include northern and central region, western region, eastern region, and southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Amino Acids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Glutamic Acids, Lysine, Methionine, Threonine, Phenylalanine, Tryptophan, Citrulline, Glycine, Glutamine, Creatine, Arginine, Valine, Leucine, Iso-Leucine, Proline, Serine, Tyrosine, Others |

| Raw Materials Covered | Plant Based, Animal Based |

| Applications Covered | Animal Feed, Food, Healthcare |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia amino acids market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia amino acids market on the basis of type?

- What is the breakup of the Saudi Arabia amino acids market on the basis of raw material?

- What is the breakup of the Saudi Arabia amino acids market on the basis of application?

- What is the breakup of the Saudi Arabia amino acids market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia amino acids market?

- What are the key driving factors and challenges in the Saudi Arabia amino acids?

- What is the structure of the Saudi Arabia amino acids market and who are the key players?

- What is the degree of competition in the Saudi Arabia amino acids market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia amino acids market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia amino acids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia amino acids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)