Saudi Arabia Ammunition Market Size, Share, Trends and Forecast by Product, Caliber, Guidance, Lethality, Application, and Region, 2026-2034

Saudi Arabia Ammunition Market Overview:

The Saudi Arabia ammunition market size reached USD 247.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 333.3 Million by 2034, exhibiting a growth rate (CAGR) of 3.34% during 2026-2034. The significant investments in local production and technological innovation to reduce reliance on foreign suppliers, along with increasing demand for advanced weaponry and missile systems to strengthen national defense and regional security under its Vision 2030 are expanding the Saudi Arabia ammunition market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 247.9 Million |

| Market Forecast in 2034 | USD 333.3 Million |

| Market Growth Rate 2026-2034 | 3.34% |

Saudi Arabia Ammunition Market Trends:

Investments in Domestic Ammunition Production and Technological Innovation

Saudi Arabia has been significantly investing in enhancing its local ammunition production capacity to diminish dependence on overseas suppliers and improve its self-reliance in defense manufacturing. This initiative is in line with the objectives of the Vision 2030 plan, which aims to diversify the Kingdom’s economy by reducing reliance on oil and broadening its industrial sector. A crucial aspect of this initiative is enhancing technological advancements in ammunition manufacturing, with the governing body promoting collaborations with global defense companies and funding local research and development (R&D). Such partnership seeks to improve Saudi Arabia’s manufacturing capabilities and implement cutting-edge ammunition technologies. For example, in 2024, WAHAJ and Nexter Munitions established a joint venture, "WAHAJ NEXTER Industries," to localize the production of 155mm artillery ammunition for the Saudi Armed Forces. This initiative supported Saudi Arabia's Vision 2030, focusing on enhancing the Kingdom’s defense industrial base. The JV aimed to manufacture modular charges and shell bodies for large-caliber ammunition in Saudi Arabia. These initiatives are speeding up the expansion of the market, allowing Saudi Arabia to fulfill its rising defense requirements while also enhancing its industrial strengths and generating economic chances within the Kingdom.

.jpeg)

To get more information on this market Request Sample

Expansion of Advanced Weaponry and Missile Systems

The increasing demand for advanced weaponry and missile systems is a crucial factor bolstering the Saudi Arabia ammunition market growth. As part of its strategy to strengthen national defense and regional security, Saudi Arabia is focusing on acquiring cutting-edge technologies to enhance its military capabilities. This includes the procurement of high-performance ammunition, such as precision-guided missiles, advanced air-to-air combat missiles, and modern tank ammunition, all of which are critical components for the Kingdom’s evolving defense needs. These acquisitions are not only essential for maintaining operational readiness but also enable Saudi Arabia to stay competitive in a rapidly changing military landscape. The focus on advanced ammunition systems reflects Saudi Arabia’s growing emphasis on integrating modern technologies into its defense strategy, ensuring that its armed forces are equipped with the latest tools for combat and defense. With continuous investment in missile and ammunition technologies, Saudi Arabia aims to enhance its deterrence capabilities and safeguard its interests in a region marked by shifting geopolitical dynamics. This trend is supporting the growth of the market, as the demand for specialized and advanced munitions continues to rise alongside Saudi Arabia's efforts to modernize its military forces. In 2024, the US State Department approved a $1.45 billion Foreign Military Sale to Saudi Arabia. The deal included AIM-9X Block II Sidewinder missiles for air-to-air combat, Hellfire II missiles, and 105mm tank ammunition. The sale aimed to enhance Saudi Arabia's defense capabilities with advanced missile and ammunition systems.

Saudi Arabia Ammunition Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, caliber, guidance, lethality, and application.

Product Insights:

- Bullets

- Aerial Bombs

- Grenades

- Mortars

- Artillery Shells

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes bullets, aerial bombs, grenades, mortars, artillery shells, and others.

Caliber Insights:

- Small

- Medium

- Large

A detailed breakup and analysis of the market based on the caliber have also been provided in the report. This includes small, medium, and large.

Guidance Insights:

- Guided

- Non-Guided

The report has provided a detailed breakup and analysis of the market based on the guidance. This includes guided and non-guided.

Lethality Insights:

- Less-Lethal

- Lethal

A detailed breakup and analysis of the market based on the lethality have also been provided in the report. This includes less-lethal and lethal.

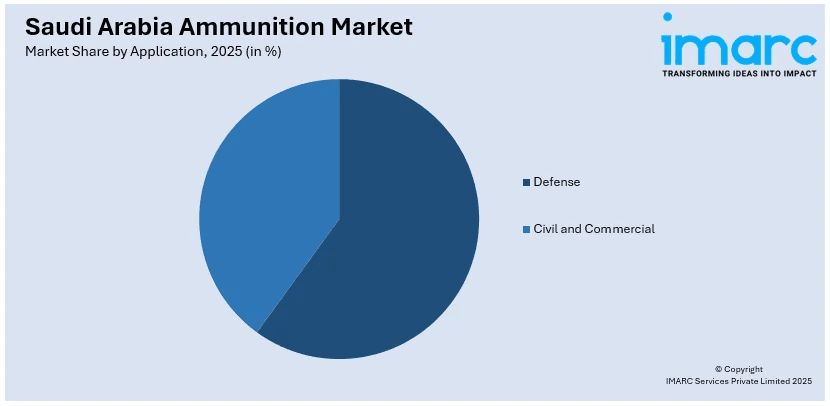

Application Insights:

Access the comprehensive market breakdown Request Sample

- Defense

- Military

- Homeland Security

- Civil and Commercial

- Sporting

- Hunting

- Self-Defense

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes defense (military and homeland security) and civil and commercial (sporting, hunting, self-defense, and others).

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Ammunition Market News:

- In October 2024, the Saudi Falcons Club expanded its hunting weapons and ammunition section at the International Saudi Falcons and Hunting Exhibition. The event, held from October 3 to 12, featured weapons from 55 international brands and offered delivery services across eight regions of Saudi Arabia, with strict transportation protocols for arms and ammunition. The exhibition also included workshops on falcon care and training.

- In February 2024, KNDS France launched the Sabir project to develop a guided 155mm artillery round for Saudi Arabia. The project, part of Saudi Vision 2030, aimed to locally produce ammunition and enhance defense autonomy, starting with artillery modular charges. The round featured a GPS/INS guidance system and semi-active laser for precision targeting, with a range of up to 45 km.

Saudi Arabia Ammunition Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bullets, Aerial Bombs, Grenades, Mortars, Artillery Shells, Others |

| Calibers Covered | Small, Medium, Large |

| Guidances Covered | Guided, Non-Guided |

| Lethalities Covered | Less-Lethal, Lethal |

| Applications Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia ammunition market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia ammunition market on the basis of product?

- What is the breakup of the Saudi Arabia ammunition market on the basis of caliber?

- What is the breakup of the Saudi Arabia ammunition market on the basis of guidance?

- What is the breakup of the Saudi Arabia ammunition market on the basis of lethality?

- What is the breakup of the Saudi Arabia ammunition market on the basis of application?

- What is the breakup of the Saudi Arabia ammunition market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia ammunition market?

- What are the key driving factors and challenges in the Saudi Arabia ammunition market?

- What is the structure of the Saudi Arabia ammunition market and who are the key players?

- What is the degree of competition in the Saudi Arabia ammunition market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia ammunition market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia ammunition market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia ammunition industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)