Saudi Arabia Anti Caking Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Anti Caking Market Summary:

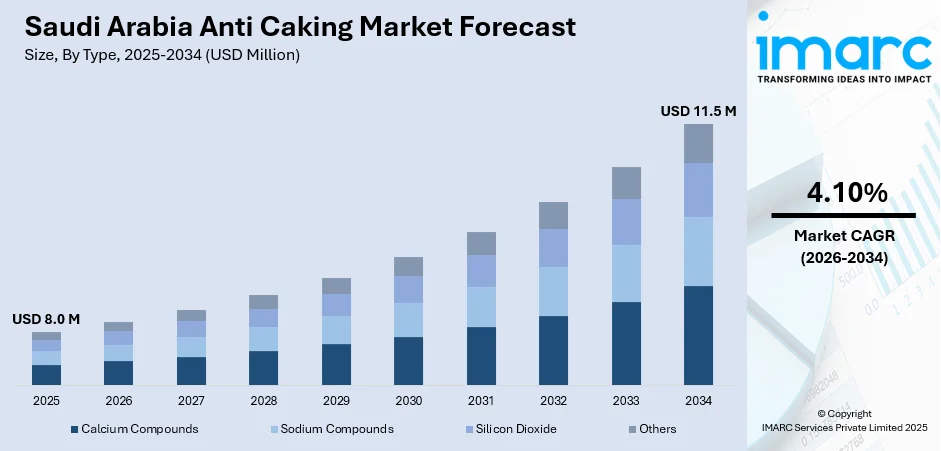

The Saudi Arabia anti caking market size was valued at USD 8.0 Million in 2025 and is projected to reach USD 11.5 Million by 2034, growing at a compound annual growth rate of 4.10% from 2026-2034.

The Saudi Arabia anti caking market is experiencing robust growth driven by the expanding food and beverage manufacturing sector and increasing demand for processed food products across the Kingdom. Rising urbanization, changing consumer lifestyles, and the growth of the dairy, bakery, and convenience food industries are fueling demand for high-quality anti caking agents that ensure product consistency and extended shelf life. Government initiatives under Vision 2030 to enhance food security and localize production are further strengthening the Saudi Arabia anti caking market share.

Key Takeaways and Insights:

-

By Type: Silicon dioxide dominates the market with a share of 42% in 2025, driven by its superior moisture absorption properties, cost-effectiveness, and widespread application in preventing clumping in powdered food products and seasonings.

-

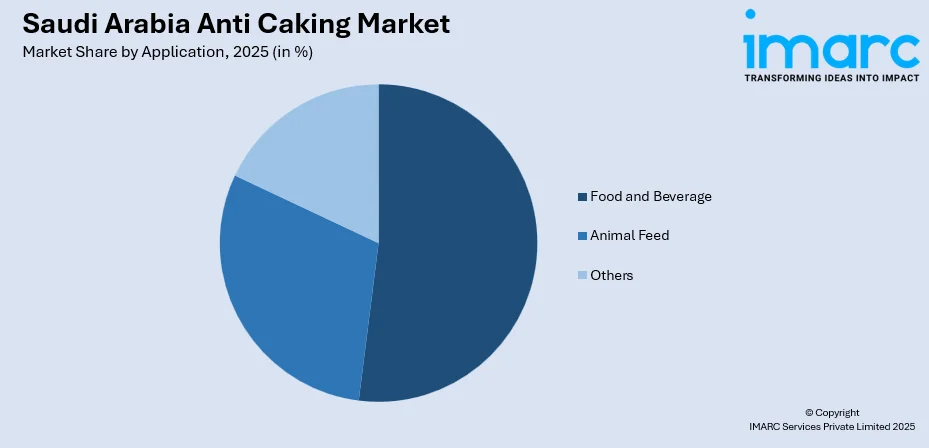

By Application: Food and beverage leads the market with a share of 52% in 2025, owing to the expanding processed food industry, growing consumption of packaged foods, and stringent quality standards enforced by the Saudi Food and Drug Authority.

-

Key Players: The competitive structure of the Saudi Arabian anti caking market is somewhat concentrated, with both local producers and well-known international specialty chemical firms. To support the Kingdom's expanding food manufacturing industry, market players compete on the basis of product purity, supply chain dependability, application knowledge, and regulatory compliance with SFDA norms.

To get more information on this market Request Sample

The Saudi Arabia anti caking market is benefiting from substantial investments in the food manufacturing sector aligned with Vision 2030's food security objectives. The Kingdom's food and beverage market continues to drive demand for quality ingredients including anti caking agents. In April 2025, Saudi Arabia launched a major dairy industrial cluster in Al-Kharj spanning one million square meters as part of its National Industrial Strategy, which is expected to significantly increase demand for food-grade additives including anti caking agents. The cluster is designed to foster synergies across the value chain, including animal feed, food additives, packaging, and machinery manufacturing, which is expected to significantly increase demand for food-grade additives including anti caking agents.

Saudi Arabia Anti Caking Market Trends:

Rising Demand for Natural and Clean-Label Additives

The Saudi anti caking market is witnessing a significant shift toward natural and clean-label products as health-conscious consumers increasingly scrutinize ingredient lists. Food manufacturers are reformulating products with naturally derived anti caking agents such as plant-based silica and cellulose derivatives to meet transparency requirements. This consumer-driven trend is prompting companies to replace synthetic additives with natural alternatives that maintain product functionality while appealing to wellness-focused shoppers seeking recognizable ingredients in their food products.

Expansion of Processed and Convenience Food Manufacturing

Rapid urbanization and changing lifestyles in Saudi Arabia are fueling unprecedented growth in processed and convenience food production, directly boosting anti caking agent consumption. With more dual-income households and busy work routines, consumers increasingly prefer ready-to-eat meals, frozen items, and packaged snacks that require anti caking agents for quality preservation. The proliferation of modern retail formats, expanding e-commerce channels, and growing cloud kitchen establishments further accelerate demand for processed foods requiring specialty additives across the Kingdom.

Integration of Advanced Anti caking Technologies

Technological advancements in anti caking agent formulations are transforming the Saudi market as manufacturers seek enhanced performance and multifunctionality. Innovations include nano-sized anti caking particles offering improved efficiency at lower dosages, and specialty silica products designed for specific food applications. Global players have introduced advanced anti caking solutions aligning with clean-label trends, while sustainable production methods are gaining prominence as manufacturers prioritize environmentally responsible formulations for the expanding Middle Eastern food sector.

How Vision 2030 is Transforming the Saudi Arabia Anti Caking Market:

Saudi Arabia's Vision 2030 is reshaping the anti caking market by prioritizing food security, localizing production, and positioning the Kingdom as a regional leader in food manufacturing. Mega-projects such as NEOM, the Red Sea Global developments, Qiddiya, and Diriyah are driving unprecedented demand for food processing facilities requiring quality anti caking agents. Regulatory reforms, including stringent SFDA food safety standards and quality mandates, have boosted adoption of certified anti caking solutions. Riyadh's rapid urbanization and ambitious homeownership targets are accelerating residential growth and food consumption, while integrated food industrial clusters developed in Jeddah and Al-Kharj are creating substantial demand for specialty food additives. The Kingdom's goal to significantly localize food production is creating promising investment opportunities for anti caking agent suppliers serving food manufacturing activities across the nation.

Market Outlook 2026-2034:

The Saudi Arabia anti caking market outlook remains highly favorable as the Kingdom accelerates food manufacturing investments under Vision 2030. The establishment of large-scale food industrial clusters in Jeddah and Al-Kharj positions the market for sustained growth, with national food exports expected to increase significantly. Growing demand for processed dairy products, bakery items, and convenience foods will continue driving anti caking agent consumption as the Kingdom strengthens its position as a regional food manufacturing hub. The market generated a revenue of USD 8.0 Million in 2025 and is projected to reach a revenue of USD 11.5 Million by 2034, growing at a compound annual growth rate of 4.10% from 2026-2034.

Saudi Arabia Anti Caking Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Silicon Dioxide |

42% |

|

Application |

Food and Beverage |

52% |

Type Insights:

- Calcium Compounds

- Sodium Compounds

- Silicon Dioxide

- Others

The silicon dioxide segment dominates the market with a 42% share of the total Saudi Arabia anti caking market in 2025.

Silicon dioxide has emerged as the leading anti caking agent type in Saudi Arabia due to its exceptional moisture absorption capabilities and versatility across food applications. This compound demonstrates superior fluid absorption capacity, making it highly effective in maintaining free-flowing properties of powdered ingredients. Saudi Arabia represents a significant consumer of silicon dioxide in the MENA region, with domestic production experiencing remarkable growth reflecting strong localization efforts in specialty chemical manufacturing.

The silicon dioxide segment benefits from growing demand across multiple food categories including table salt, spice blends, instant beverages, and powdered milk products. Major food-grade silicon dioxide applications include artificial sweeteners, bake mixes, baking powders, cocoa mixes, instant coffee, non-dairy creamers, grated cheeses, and soup mixes. The material's effectiveness as a glidant ensures products flow smoothly through manufacturing equipment while maintaining stability during storage and distribution across the Kingdom's expanding food retail network.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverage

- Animal Feed

- Others

The food and beverage segment leads with a 52% share of the total Saudi Arabia anti caking market in 2025.

The food and beverage application segment dominates the Saudi Arabia anti caking market driven by the Kingdom's expanding processed food manufacturing sector and rising consumer demand for convenience foods. As per the IMARC Group, the Saudi food additives market size is expected to reach USD 873.12 Million by 2033, exhibiting a growth rate (CAGR) of 4.63% during 2025-2033, with anti caking agents representing a critical ingredient category supporting product quality and shelf-life enhancement.

The food and beverage segment benefits from diverse applications spanning dairy products, bakery items, seasonings, instant beverages, and convenience foods. The bakery and confectionery sector extensively utilize anti caking agents in flour, baking powder, and cake mixes to maintain product consistency. Rising demand for processed snacks and the proliferation of cloud kitchens further strengthen anti caking agent consumption. The SFDA's trans-fat ban has accelerated product reformulations in carbonated drinks, baked goods, and ready-to-eat meals, increasing demand for quality food-grade additives.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region witness high demand with Riyadh serving as the primary commercial hub housing major food processing facilities, dairy manufacturers, and the highest concentration of food manufacturing units driving substantial anti caking agent consumption.

The Western Region represents significant market potential anchored by the Jeddah Food Cluster established in 2024, the largest food industrial cluster regionally, alongside Makkah and Madinah serving as major consumption centers supporting food processing activities.

The Eastern Region demonstrates strong growth driven by industrial diversification in Dammam and Al-Ahsa, proximity to major petrochemical complexes enabling cost-effective chemical sourcing, and expanding food manufacturing infrastructure serving the eastern provinces.

The Southern Region presents emerging opportunities supported by agricultural activities in Asir and Jazan, growing local food production initiatives, and government investments in developing food processing capabilities to serve regional populations.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Anti Caking Market Growing?

Expanding Food Manufacturing Sector Under Vision 2030

Saudi Arabia's ambitious Vision 2030 initiative is driving unprecedented growth in the food manufacturing sector, directly boosting demand for anti caking agents. The establishment of large-scale food industrial clusters in Jeddah and Al-Kharj, spanning significant industrial space, represents cornerstone investments expected to boost national food exports substantially. Major investments from both domestic and international food manufacturers are creating substantial demand for specialty ingredients. Leading dairy producers and global food companies continue expanding their Saudi operations, demonstrating strong corporate commitment to food manufacturing expansion requiring quality anti caking solutions.

Rising Consumption of Processed and Convenience Foods

Rapid urbanization and evolving consumer lifestyles in Saudi Arabia are fueling growing demand for processed and convenience foods that require anti caking agents for quality maintenance. Ready-to-eat meals, frozen goods, and packaged snacks are becoming more popular among customers due to the rise in dual-income homes and hectic work schedules. The Saudi food and beverage market continues demonstrating strong growth trajectory. Cloud kitchens have proliferated significantly, while supermarkets and hypermarkets command substantial market share. The expanding convenience food and snacks segment highlights the growing market driving anti caking agent consumption across the Kingdom.

Stringent Food Safety Regulations and Quality Standards

The Saudi Food and Drug Authority enforces rigorous food safety regulations that drive adoption of high-quality, certified anti caking agents in food manufacturing. SFDA mandates pre-approval for new food products, with detailed scrutiny of all ingredients including anti caking additives. The authority implemented a trans-fat ban driving reformulations across carbonated drinks, baked goods, and ready-to-eat meals. In 2025, the SFDA announced 60% growth in feed product availability during the first half of 2025 compared to the same period in 2024, demonstrating continued regulatory support for quality food additives including anti caking agents across food and animal feed applications.

Market Restraints:

What Challenges the Saudi Arabia Anti Caking Market is Facing?

Import Dependency and Supply Chain Vulnerabilities

Saudi Arabia imports a substantial majority of its food products and a significant portion of specialty chemical ingredients including anti caking agents, creating vulnerability to global supply chain disruptions. Geopolitical tensions and logistical challenges can affect raw material availability and pricing, with logistics expenses potentially rising considerably during disruption periods, impacting manufacturer margins and market stability.

Stringent Regulatory Compliance Requirements

Complex regulatory requirements enforced by the Saudi Food and Drug Authority create market entry barriers for anti caking agent suppliers. Companies may incur substantial compliance costs, and a notable proportion of new product applications experience delays due to labeling or ingredient scrutiny, extending time-to-market and increasing operational costs for manufacturers.

Fluctuating Raw Material Prices

Volatility in raw material prices poses challenges for anti caking agent manufacturers, particularly for key inputs like silica and calcium compounds. Global supply-demand imbalances and commodity price fluctuations impact production costs, while price pressures from both synthetic and natural source materials affect profitability and pricing strategies across the value chain.

Competitive Landscape:

The Saudi Arabia anti caking market exhibits a moderately consolidated competitive structure characterized by the presence of established multinational specialty chemical companies competing alongside regional manufacturers. Market participants differentiate through product quality certifications, SFDA compliance expertise, technical support capabilities, and supply chain reliability. Competition intensifies around food-grade product purity standards, halal certification, application-specific formulations, and competitive pricing. Key strategies include strategic partnerships with local distributors, investment in technical service capabilities, and development of natural and clean-label anti caking alternatives to capture the health-conscious consumer segment. The market rewards suppliers demonstrating consistent quality, regulatory expertise, and ability to support the expanding food manufacturing sector under Vision 2030 initiatives.

Saudi Arabia Anti Caking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Calcium Compounds, Sodium Compounds, Silicon Dioxide, Others |

| Applications Covered | Food and Beverage, Animal Feed, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia anti caking market size was valued at USD 8.0 Million in 2025.

The Saudi Arabia anti caking market is expected to grow at a compound annual growth rate of 4.10% from 2026-2034 to reach USD 11.5 Million by 2034.

Silicon dioxide dominated the type segment with a 42% market share in 2025, driven by its superior moisture absorption properties, cost-effectiveness, and extensive applications in preventing clumping across powdered food products, seasonings, and instant beverage mixes.

Key factors driving the Saudi Arabia anti caking market include expanding food manufacturing investments under Vision 2030, rising consumption of processed and convenience foods, stringent SFDA food safety regulations mandating quality additives, and growth in dairy, bakery, and packaged food sectors.

Major challenges include high import dependency for specialty chemicals creating supply chain vulnerabilities, complex regulatory compliance requirements with lengthy approval processes, fluctuating raw material prices affecting production costs, and competition from alternative anti caking solutions in specific applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)