Saudi Arabia Application Processor Market Size, Share, Trends and Forecast by Device Type, Core Type, and Region, 2026-2034

Saudi Arabia Application Processor Market Overview:

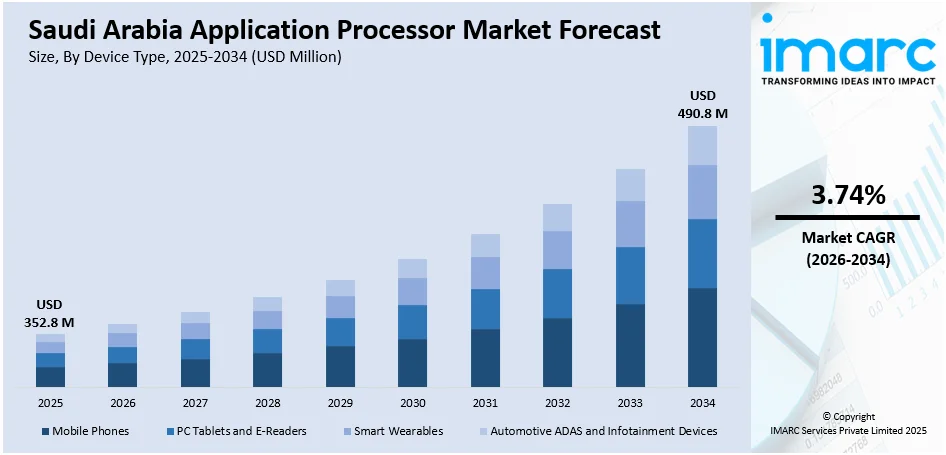

The Saudi Arabia application processor market size reached USD 352.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 490.8 Million by 2034, exhibiting a growth rate (CAGR) of 3.74% during 2026-2034. Rising smartphone penetration, 5G rollout, demand for high-performance mobile gaming, growing IoT ecosystem, and digital transformation initiatives under Vision 2030 are some of the factors contributing to Saudi Arabia application processor market share. These factors are boosting adoption across consumer electronics, automotive, and industrial applications, supporting overall market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 352.8 Million |

| Market Forecast in 2034 | USD 490.8 Million |

| Market Growth Rate 2026-2034 | 3.74% |

Saudi Arabia Application Processor Market Trends:

Rise of 5G-Ready Processing for Industrial Edge Deployment

Saudi Arabia is advancing toward widespread use of processors with built-in 5G support in the 450 MHz band, enabling secure and efficient connectivity across industrial and enterprise environments. This development supports the expansion of edge computing, where devices operate with minimal latency and increased autonomy. The processors are tailored to power smart infrastructure, remote monitoring systems, and high-demand IoT deployments. This shift aligns with the country’s Vision 2030, which prioritizes digital transformation across key sectors such as energy, logistics, and manufacturing. Enhanced processing capability at the edge improves system responsiveness and reduces dependence on central networks, making operations more resilient and scalable. The Saudi market is now positioning itself as a regional leader in next-gen processor integration. These factors are intensifying the Saudi Arabia application processor market growth. For example, in September 2024, Qualcomm and Aramco Digital have introduced the world’s first processors with native 5G support in the 450 MHz band, tailored for industrial and enterprise use in Saudi Arabia. The new QCS8550 and QCS6490 processors aim to boost nationwide connectivity for edge devices, aligning with Saudi Arabia’s Vision 2030. This marks a major advancement in the country’s application processor market, supporting large-scale digital infrastructure and IoT deployment.

To get more information on this market Request Sample

AI-Enhanced Processing Driving Industrial and Automotive Innovation

Saudi Arabia is steadily moving toward the adoption of high-performance processors designed to support AI-driven functions, improved memory access, and multi-domain computing. New-generation processors featuring multi-core architecture, built-in neural processing units, and LPDDR5 support are being deployed across automotive, industrial automation, and IoT sectors. These capabilities enable real-time decision-making, edge intelligence, and efficient system integration in complex environments. With national priorities focused on building smart infrastructure and modernizing manufacturing, processors that support AI inference and advanced data handling are becoming essential. This shift reflects a broader move toward localized processing power, enabling applications like autonomous mobility, predictive maintenance, and smart asset tracking. The market is embracing solutions that combine computing efficiency with scalable performance for diverse real-world applications. For instance, in November 2024, NXP Semiconductors introduced the i.MX 95 application processor family, featuring a 6-core Arm Cortex-A55 CPU, integrated AI acceleration via the eIQ Neutron NPU, and support for LPDDR5 memory. Tailored for automotive, industrial, and IoT applications, the i.MX 95 is poised to meet Saudi Arabia's growing demand for advanced processors amid its digital transformation initiatives.

Saudi Arabia Application Processor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on device type and core type.

Device Type Insights:

- Mobile Phones

- PC Tablets and E-Readers

- Smart Wearables

- Automotive ADAS and Infotainment Devices

The report has provided a detailed breakup and analysis of the market based on the device type. This includes mobile phones, PC tablets and e-readers, smart wearables, and automotive ADAS and infotainment devices.

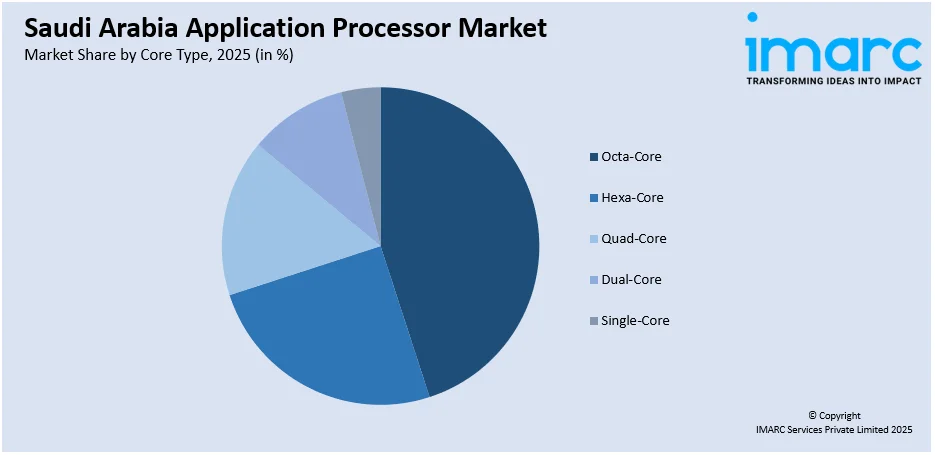

Core Type Insights:

Access the comprehensive market breakdown Request Sample

- Octa-Core

- Hexa-Core

- Quad-Core

- Dual-Core

- Single-Core

A detailed breakup and analysis of the market based on the core type have also been provided in the report. This includes octa-core, hexa-core, quad-core, dual-core, and single-core.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Application Processor Market News:

- In February 2025, at LEAP 2025, Qualcomm unveiled the ALLaM AI PC, powered by the Snapdragon X Elite processor. This device integrates a national Arabic Large Language Model (LLM) and aims to bolster Saudi Arabia's AI ecosystem. Additionally, Qualcomm introduced the ALLaM Developer Playground for developers to explore AI capabilities.

Saudi Arabia Application Processor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Mobile Phones, PC Tablets and E-Readers, Smart Wearables, Automotive ADAS and Infotainment Devices |

| Core Types Covered | Octa-Core, Hexa-Core, Quad-Core, Dual-Code, Single-Core |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia application processor market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia application processor market on the basis of device type?

- What is the breakup of the Saudi Arabia application processor market on the basis of core type?

- What is the breakup of the Saudi Arabia application processor market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia application processor market?

- What are the key driving factors and challenges in the Saudi Arabia application processor?

- What is the structure of the Saudi Arabia application processor market and who are the key players?

- What is the degree of competition in the Saudi Arabia application processor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia application processor market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia application processor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia application processor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)