Saudi Arabia Application Security Market Size, Share, Trends and Forecast by Component, Type, Testing Type, Deployment Mode, Organization Size, Industry Vertical, and Region, 2026-2034

Saudi Arabia Application Security Market Summary:

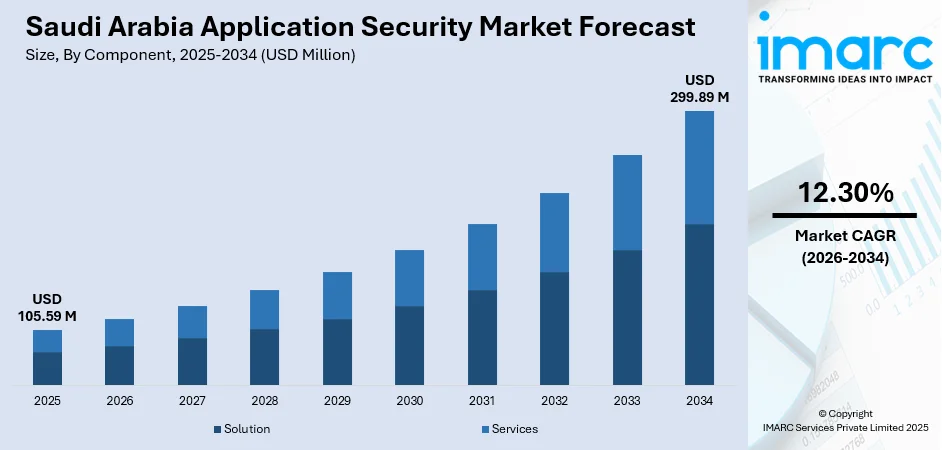

The Saudi Arabia application security market size was valued at USD 105.59 Million in 2025 and is projected to reach USD 299.89 Million by 2034, growing at a compound annual growth rate of 12.30% from 2026-2034.

The market is driven by increasing cyber threats targeting critical digital infrastructure, widespread adoption of cloud-based platforms, and accelerating digital transformation initiatives under national development visions. The expansion of e-governance services and growing emphasis on protecting sensitive data across sectors including finance, healthcare, and government is compelling organizations to invest in robust application security frameworks, thereby contributing to the Saudi Arabia application security market share.

Key Takeaways and Insights:

- By Component: Solution dominates the market with a share of 58% in 2025, driven by the growing need for comprehensive security tools that offer vulnerability detection, threat monitoring, and real-time protection capabilities across enterprise applications.

- By Type: Web application security leads the market with a share of 62% in 2025, owing to the proliferation of web-based services, online banking platforms, and e-commerce portals requiring robust protection against evolving cyber threats.

- By Testing Type: Static application security testing (SAST) represents the largest segment with a market share of 33% in 2025, driven by the emphasis on early vulnerability detection during the software development lifecycle and secure coding practices.

- By Deployment Mode: Cloud-based dominates the market with a share of 53% in 2025, owing to scalability advantages, reduced infrastructure costs, and the widespread adoption of cloud computing platforms across Saudi enterprises.

- By Organization Size: Large enterprises lead the market with a share of 69% in 2025, driven by their substantial IT budgets, complex digital ecosystems, and heightened regulatory compliance requirements.

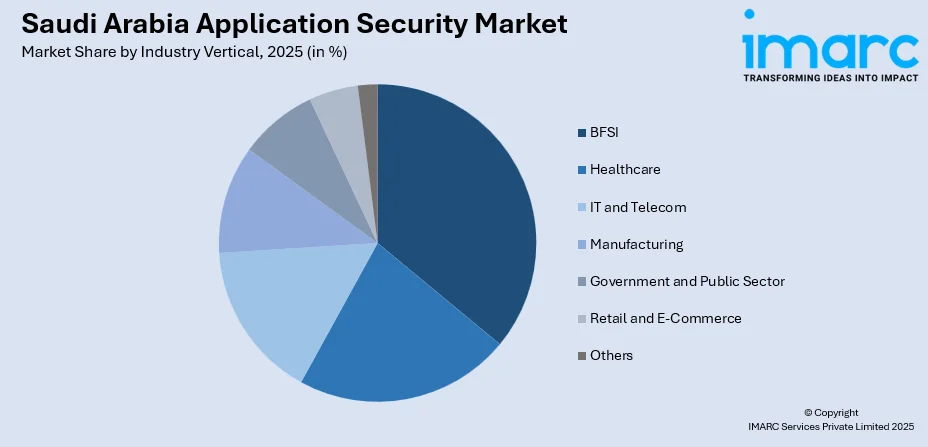

- By Industry Vertical: BFSI represents the largest segment with a market share of 22% in 2025, propelled by stringent data protection regulations, high-value financial transactions, and the critical need to safeguard customer information.

- Key Players: The Saudi Arabia application security market is moderately consolidated, with global and regional players competing through AI-driven threat detection, cloud integration, and comprehensive platforms. Strategic partnerships and continuous innovation drive differentiation across diverse enterprise sectors.

To get more information on this market Request Sample

The Saudi Arabia application security market is experiencing significant growth, fueled by the country’s ongoing digital transformation and increasing awareness of cybersecurity risks among enterprises. The rapid adoption of e-governance platforms, online banking services, and digital commerce channels has expanded the attack surface, making advanced application security solutions essential. Organizations across various sectors are prioritizing the protection of sensitive customer information, ensuring operational continuity, and complying with evolving regulatory requirements. In 2025, the National Cybersecurity Authority (NCA) launched the “Cybersecurity Enablement for Small and Medium Enterprises” initiative, providing vulnerability assessment and continuous monitoring solutions to improve cybersecurity readiness among SMEs. The government’s focus on establishing a secure digital economy under national development initiatives is encouraging both public and private entities to strengthen their cybersecurity measures. Additionally, the integration of proactive security practices into software development workflows is promoting early threat detection and mitigation, driving demand for comprehensive tools that support continuous monitoring, vulnerability assessment, and risk management throughout the application lifecycle.

Saudi Arabia Application Security Market Trends:

Integration of Artificial Intelligence and Machine Learning in Security Solutions

The Saudi Arabia application security market is witnessing significant adoption of artificial intelligence (AI) and machine learning (ML) technologies to enhance threat detection and response capabilities. These advanced technologies enable security solutions to analyze vast amounts of data, identify patterns, and detect anomalies that may indicate potential security breaches. ML algorithms continuously learn from emerging threat landscapes, improving their accuracy in identifying zero-day vulnerabilities and sophisticated attack vectors. This intelligent automation reduces the burden on security teams by prioritizing critical threats and minimizing false positives. Organizations are increasingly leveraging these capabilities to achieve faster incident response times and more effective protection against evolving cyber threats. In February 2025, Resecurity showcased AI-driven cybersecurity and digital identity protection solutions in Riyadh, demonstrating real-time threat detection and proactive security capabilities for organizations across Saudi Arabia.

Growing Emphasis on DevSecOps Adoption

Organizations across Saudi Arabia are increasingly embracing DevSecOps methodologies to integrate security practices throughout the software development lifecycle. This approach shifts security considerations from an afterthought to a foundational element of application development, enabling teams to identify and remediate vulnerabilities early in the process. In 2025, Saudi businesses face rapid digitalization under Vision 2030, with AI-driven threat detection, Zero Trust, DevSecOps, cloud security, and human-focused programs emerging as key cybersecurity trends shaping enterprise protection strategies. Moreover, the adoption of automated security testing tools within continuous integration and continuous deployment pipelines is becoming standard practice. This cultural shift towards shared security responsibility among development, operations, and security teams is enhancing overall application resilience. Companies are investing in training programs and specialized tools that facilitate seamless collaboration and ensure security remains embedded in every development phase.

Rising Demand for Mobile Application Security

The exponential growth of mobile applications in Saudi Arabia is driving heightened demand for mobile application security solutions. With increasing smartphone penetration and the proliferation of mobile banking, e-commerce, and government service applications, securing mobile platforms has become paramount. Organizations are implementing comprehensive mobile security frameworks that address unique vulnerabilities inherent to mobile environments, including insecure data storage, weak authentication mechanisms, and code tampering risks. The emphasis on protecting user privacy and ensuring secure transactions is compelling enterprises to adopt specialized mobile application security tools that provide runtime protection and secure communication protocols. In November 2024, Appknox officially launched in Saudi Arabia, offering AI-driven mobile application security solutions, testing over 1.7 million apps globally and ensuring compliance with SAMA and international standards.

Market Outlook 2026-2034:

The Saudi Arabia application security market is set for significant growth during the forecast period, driven by the Kingdom’s digital transformation initiatives and rising cybersecurity demands. Increasingly sophisticated cyber threats targeting critical infrastructure and enterprise applications are prompting organizations to invest in robust security frameworks. Government cybersecurity regulations and compliance mandates further accelerate adoption. Growing cloud computing, e-governance, and digital financial services are sustaining demand, positioning the market for consistent revenue expansion throughout the forecast period. The market generated a revenue of USD 105.59 Million in 2025 and is projected to reach a revenue of USD 299.89 Million by 2034, growing at a compound annual growth rate of 12.30% from 2026-2034.

Saudi Arabia Application Security Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Solution | 58% |

| Type | Web Application Security | 62% |

| Testing Type | Static Application Security Testing (SAST) | 33% |

| Deployment Mode | Cloud-Based | 53% |

| Organization Size | Large Enterprises | 69% |

| Industry Vertical | BFSI | 22% |

Component Insights:

- Solution

- Services

The solution dominates with a market share of 58% of the total Saudi Arabia application security market in 2025.

The solution segment holds the largest share of the Saudi Arabia application security market, fueled by the extensive protection capabilities these offerings provide to enterprise applications. Organizations increasingly prioritize integrated security solutions that combine vulnerability assessment, code analysis, threat monitoring, and real-time incident response within unified platforms. In July 2025, Black Duck launched Polaris as the first application-security SaaS platform hosted in Saudi Arabia, providing in-Kingdom data residency and integrated AppSec testing. Further, the comprehensive nature of these solutions allows enterprises to address multiple threat vectors simultaneously, ensuring operational continuity while enhancing overall cybersecurity resilience across complex and growing digital environments.

Demand for solution-based offerings is accelerating as enterprises seek holistic security frameworks capable of mitigating diverse cyber risks effectively. These solutions streamline security operations by consolidating disparate point tools into cohesive platforms, reducing operational complexity and administrative overhead. By enabling proactive threat detection, real-time monitoring, and automated remediation, solution-based approaches help organizations maintain a strong security posture, comply with regulatory requirements, and safeguard critical enterprise applications against evolving cyber threats in an increasingly digitized business landscape.

Type Insights:

- Web Application Security

- Mobile Application Security

The web application security leads with a share of 62% of the total Saudi Arabia application security market in 2025.

Web application security dominates the Saudi Arabia application security market as organizations increasingly depend on web-based platforms for critical business operations, customer engagement, and service delivery. The rapid growth of online portals, e-commerce platforms, and web-based enterprise applications has heightened the need to protect digital assets from cyber threats. Ensuring the security of these platforms is essential to maintain operational continuity, safeguard sensitive information, and preserve organizational reputation in a highly digital business environment.

The segment’s leadership reflects the broad attack surface of web applications and the sophisticated nature of threats targeting these platforms. Organizations are investing significantly in web application firewalls, vulnerability scanners, and runtime protection tools to mitigate risks. These investments not only protect sensitive data but also build customer confidence in digital services. Proactive monitoring, threat detection, and advanced security measures are becoming critical as enterprises increasingly rely on web applications for core operations and revenue-generating activities.

Testing Type Insights:

- Static Application Security Testing (SAST)

- Dynamic Application Security Testing (DAST)

- Interactive Application Security Testing (IAST)

- Runtime Application Self-Protection (RASP)

The static application security testing (SAST) exhibits a clear dominance with a 33% share of the total Saudi Arabia application security market in 2025.

Static application security testing (SAST) leads the testing type segment in the Saudi Arabia application security market, as organizations focus on detecting vulnerabilities early in the software development lifecycle. SAST tools analyze source code, binaries, and executables to identify security weaknesses before deployment, allowing enterprises to implement timely, cost-effective remediation. In November 2024, Appknox launched in Saudi Arabia at Black Hat MEA 2024, introducing AI-driven SAST and security tools aligned with SAMA regulations to strengthen mobile application protection. Early vulnerability detection helps prevent security breaches, reduces operational risks, and ensures that applications are more resilient when released into production environments, supporting stronger overall cybersecurity posture.

The segment’s prominence is also attributed to the rising regulatory emphasis on secure software development and the need for enterprises to meet compliance standards. Organizations are increasingly integrating SAST into DevSecOps pipelines to automate security checks, improve developer accountability, and enhance collaboration between development and security teams. This integration accelerates software delivery while maintaining high security standards, positioning SAST as a critical tool for managing risk in increasingly complex and large-scale application environments.

Deployment Mode Insights:

- On-premises

- Cloud-based

The cloud-based dominates with a market share of 53% of the total Saudi Arabia application security market in 2025.

Cloud-based deployment dominates the Saudi Arabia application security market as organizations adopt scalable and flexible solutions aligned with their cloud transformation strategies. These tools reduce infrastructure requirements, provide automatic updates, and allow resources to scale according to demand. In June 2023, Qualys launched its Saudi Cloud Platform, enabling localized cybersecurity, real-time visibility, and compliance with NCA and SAMA regulations through a fully cloud-based security and compliance ecosystem. Additionally, enterprises benefit from centralized management, improved operational efficiency, and seamless integration with existing cloud ecosystems, enabling consistent protection across dynamic environments and supporting business continuity while maintaining a strong overall security posture.

The segment’s leadership is also driven by the growing need for remote accessibility and real-time monitoring of applications. Cloud-based deployment enables organizations to enforce security policies, detect threats, and respond rapidly across multiple locations. Consumption-based pricing models provide cost-effective access to enterprise-grade security solutions, allowing businesses of all sizes to implement advanced protection without significant capital investment while ensuring reliable safeguarding of applications hosted in private, public, and hybrid cloud environments.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The large enterprises lead with a share of 69% of the total Saudi Arabia application security market in 2025.

Large enterprises command the maximum share of the Saudi Arabia application security market, driven by their extensive digital footprints, complex application portfolios, and significant cybersecurity budgets. In November 2025, 51% of Saudi organizations have implemented AI in security operations, with 60% highly aware of AI-driven cyber threats, reflecting growing enterprise focus on advanced application security. These organizations face heightened regulatory scrutiny and reputational risks, requiring comprehensive security frameworks. Their reliance on critical applications and sensitive data necessitates robust, enterprise-grade security measures to safeguard operations, protect customer information, and maintain business continuity in an increasingly threat-prone digital environment.

The segment’s leadership is supported by the early adoption of advanced security technologies and the presence of dedicated security teams capable of managing sophisticated solutions. Large enterprises continually invest in application security to meet stringent compliance requirements, address evolving cyber threats, and secure complex IT infrastructures. Their scale and operational complexity drive ongoing deployment of integrated security frameworks, advanced monitoring tools, and proactive risk management strategies, ensuring resilient protection across all enterprise applications and digital assets.

Industry Vertical Insights:

Access the Comprehensive Market Breakdown Request Sample

- BFSI

- Healthcare

- IT and Telecom

- Manufacturing

- Government and Public Sector

- Retail and E-Commerce

- Others

The BFSI exhibits a clear dominance with a 22% share of the total Saudi Arabia application security market in 2025.

The BFSI sector leads the industry vertical segment in the Saudi Arabia application security market, driven by the critical importance of financial data and stringent regulatory requirements for data protection. According to reports, in February 2025, Saudi Arabia’s SDAIA and Central Bank signed agreements to strengthen personal data protection across financial institutions, enhancing regulatory oversight and compliance with national data governance standards. Moreover, financial institutions prioritize application security to safeguard customer assets, prevent breaches, and maintain trust. Ensuring robust security across digital platforms is essential to support secure financial transactions, protect sensitive information, and comply with evolving regulations while sustaining operational continuity.

The sector’s dominance is also reinforced by the high-value nature of financial transactions and the attractiveness of financial institutions as targets for cybercriminals. Continuous innovation in mobile banking, online payments, and digital financial services increases exposure to sophisticated cyber threats, driving substantial investment in application security solutions. Organizations deploy advanced monitoring, threat detection, and mitigation strategies to secure critical digital assets, ensure compliance, and provide reliable, trustworthy services to customers across all digital channels.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region leads the Saudi Arabia application security market, supported by Riyadh’s concentration of government institutions, financial headquarters, and major corporate enterprises. As the hub for national digital transformation initiatives, the region’s critical infrastructure requires advanced security solutions to safeguard sensitive government and enterprise applications.

The Western Region holds significant market share due to Jeddah’s commercial prominence and expanding digital infrastructure supporting tourism and religious pilgrimage. Diverse economic activities, including trade, hospitality, and retail, drive demand for comprehensive application security solutions, ensuring protection across multiple industry verticals and safeguarding both customer-facing and internal digital platforms.

The Eastern Region drives strong demand in the Saudi Arabia application security market, anchored by energy sector operations in Dammam and nearby industrial zones. Critical oil, gas, and logistics infrastructure require stringent application security measures to protect operational technology systems, prevent cyber threats, and maintain uninterrupted energy production and distribution processes.

The Southern Region represents an emerging opportunity as digital infrastructure extends beyond major commercial centers. Government-led economic diversification initiatives are fostering technology adoption, stimulating the need for application security solutions to support the growth of regional digital ecosystems and ensure protection for new enterprise, public, and industrial digital applications.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Application Security Market Growing?

Accelerating Digital Transformation Across Sectors

The comprehensive digital transformation initiatives are driving unprecedented demand for application security solutions across public and private sector organizations. National development visions emphasizing digital economy growth are compelling enterprises to modernize their technology infrastructure and adopt digital platforms for service delivery. As per sources, in July 2025, Saudi Arabia’s Digital Government Authority integrated and closed 267 government digital platforms, advancing unified service delivery and strengthening national digital-government efficiency. Moreover, this widespread digitization significantly expands the attack surface for cyber threats, necessitating robust application security frameworks. Organizations are recognizing that digital transformation success hinges on maintaining secure digital environments that protect sensitive data and ensure business continuity. The integration of emerging technologies including cloud computing, artificial intelligence, and Internet of Things devices further amplifies security requirements. As enterprises continue their digital evolution, the demand for comprehensive application security solutions that address evolving threat landscapes and protect critical business applications is experiencing sustained growth.

Stringent Regulatory Compliance Requirements

The implementation of comprehensive cybersecurity regulations and data protection frameworks in Saudi Arabia is compelling organizations to strengthen their application security postures. Regulatory bodies are establishing stringent requirements for protecting personal data, financial information, and critical infrastructure from cyber threats. Organizations face significant penalties for non-compliance, including financial sanctions and reputational damage, driving substantial investments in security solutions. In 2024, Saudi Arabia fully enforced its Personal Data Protection Law (PDPL), mandating organisation-wide compliance and empowering SDAIA to issue administrative penalties reaching SAR 5 million for violations. The emphasis on achieving and maintaining compliance with national and international security standards is accelerating the adoption of application security tools that enable continuous monitoring, vulnerability management, and audit trail capabilities. Furthermore, industry-specific regulations governing sectors such as banking, healthcare, and government services impose additional security requirements that necessitate specialized application security implementations. This regulatory landscape is creating sustained demand for comprehensive security solutions that help organizations demonstrate compliance and protect against evolving threats.

Growing Cybersecurity Awareness Among Enterprises

Rising awareness of cyber threats and their potential business impact is driving increased investment in application security across Saudi Arabia. High-profile data breaches and cyberattacks have heightened executive attention to cybersecurity risks and the importance of protecting digital assets. Organizations are recognizing that security investments represent business enablers rather than cost centers, as robust security postures enhance customer trust and competitive positioning. The understanding that application vulnerabilities can lead to operational disruptions, financial losses, and reputational damage is motivating enterprises to adopt proactive security approaches. Board-level engagement in cybersecurity matters is increasing, with security considerations becoming integral to strategic business planning. This elevated awareness is translating into expanded security budgets and dedicated resources for application security initiatives. According to the sources, in May 2024, Cisco reported that 99% of Saudi organisations increased cybersecurity budgets in the past 12–24 months, reflecting heightened enterprise awareness of rising cyber risks. Furthermore, the growing recognition that cybersecurity is fundamental to business success is sustaining strong demand for comprehensive application security solutions.

Market Restraints:

What Challenges the Saudi Arabia Application Security Market is Facing?

Shortage of Skilled Cybersecurity Professionals

The Saudi Arabia application security market faces constraints from the limited availability of qualified cybersecurity professionals capable of implementing and managing sophisticated security solutions. Organizations struggle to recruit and retain specialists with expertise in application security testing, secure coding practices, and threat analysis. This talent gap impedes the effective deployment of security tools and limits organizations' ability to maximize their security investments. The shortage also increases operational costs as organizations compete for limited talent resources.

Complexity of Integration with Legacy Systems

Many organizations in Saudi Arabia operate legacy application environments that present significant integration challenges for modern security solutions. The complexity of implementing application security tools within heterogeneous technology landscapes creates deployment delays and increases implementation costs. Legacy systems often lack compatibility with contemporary security frameworks, requiring extensive customization and creating potential security gaps. This integration complexity can discourage organizations from pursuing comprehensive security implementations.

Budget Constraints Among Smaller Organizations

Small and medium-sized enterprises face financial limitations that restrict their ability to invest in comprehensive application security solutions. The cost of acquiring, implementing, and maintaining sophisticated security tools often exceeds the budgetary capacity of smaller organizations. These entities may lack dedicated security personnel and struggle to justify security investments against competing business priorities. Budget constraints can result in inadequate security coverage and increased vulnerability to cyber threats.

Competitive Landscape:

The Saudi Arabia application security market exhibits a moderately consolidated competitive structure characterized by the presence of established global technology providers alongside specialized regional security firms. Market participants compete on the basis of technological innovation, solution comprehensiveness, and the ability to address evolving threat landscapes. The emphasis on offering integrated security platforms that combine multiple capabilities within unified frameworks is intensifying competitive dynamics. Vendors are differentiating through advanced features including artificial intelligence-powered threat detection, automated remediation capabilities, and seamless cloud integration. Strategic partnerships with local systems integrators and technology resellers are enabling market participants to expand their reach and enhance service delivery capabilities. The competitive environment encourages continuous innovation as vendors seek to address the sophisticated security requirements of enterprise customers across diverse industry verticals.

Recent Developments:

- In January 2025, SEALSQ, in cooperation with WISeKey, announced an expansion of their post-quantum cybersecurity footprint in Saudi Arabia through WISeKey Arabia. The initiative supports Vision 2030 by introducing quantum-resistant PKI, advanced digital identity solutions, and the WISeSat.Space secure satellite ecosystem, strengthening the Kingdom’s digital infrastructure and emerging deep-tech capabilities.

Saudi Arabia Application Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Types Covered | Web Application Security, Mobile Application Security |

| Testing Types Covered | Static Application Security Testing (SAST), Dynamic Application Security Testing (DAST), Interactive Application Security Testing (IAST), Runtime Application Self-Protection (RASP) |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, Healthcare, IT and Telecom, Manufacturing, Government and Public Sector, Retail and E-Commerce, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia application security market size was valued at USD 105.59 Million in 2025.

The Saudi Arabia application security market is expected to grow at a compound annual growth rate of 12.30% from 2026-2034 to reach USD 299.89 Million by 2034.

The solution component held the largest share of the Saudi Arabia application security market, driven by its comprehensive protection capabilities. Integrated security solutions, including vulnerability assessment, code analysis, and threat monitoring, enable organizations to address multiple threat vectors efficiently while streamlining operations and enhancing overall cybersecurity resilience.

Key factors driving the Saudi Arabia application security market include accelerating digital transformation initiatives, rising cyber threats and data breaches, stringent regulatory compliance requirements, expansion of e-governance services, and growing cybersecurity awareness among enterprises.

Major challenges include shortage of skilled cybersecurity professionals, complexity of integration with legacy systems, budget constraints among smaller organizations, evolving sophistication of cyber threats, and the need for continuous solution updates to address emerging vulnerabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)