Saudi Arabia Architectural Lighting Market Report by Light Source (Fluorescent Lights, High Intensity Discharge (HID) Lights, Light Emitting Diode (LED) Lights, and Others), Lighting Type (Ambient, Task, Accent), Application (Wall Wash, Cove Lighting, Backlighting, and Others), End Use (Commercial, Residential, Industrial, and Others), and Region 2026-2034

Saudi Arabia Architectural Lighting Market Size:

Saudi Arabia architectural lighting market size reached USD 65.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 105.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.45% during 2026-2034. The market is experiencing significant growth mainly driven by urbanization, infrastructure investments and rising focus on energy efficiency. The widespread adoption of LED and smart lighting technologies, various government initiatives, and increasing sustainability goals are also contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 65.4 Million |

| Market Forecast in 2034 | USD 105.4 Million |

| Market Growth Rate (2026-2034) | 5.45% |

Saudi Arabia Architectural Lighting Market Analysis:

- Major Market Drivers: Key market drivers include rapid urbanization and substantial infrastructure investments, which boost the demand for advanced lighting solutions in commercial, residential, and public spaces. Government initiatives and Vision 2030 goals emphasize energy efficiency and sustainability, accelerating the adoption of energy-saving technologies such as LEDs and smart lighting systems. Additionally, the rising focus on aesthetic and functional lighting in modern architectural designs fuels market growth. Technological advancements, including smart and IoT-integrated lighting solutions, further drive innovation and enhance user experience, thus contributing to the market's expansion and increased investment opportunities.

- Key Market Trend: Key market trends include the rapid adoption of energy-efficient LED technology mainly driven by a strong emphasis on sustainability and cost savings. Smart lighting solutions are also gaining traction offering advanced features like remote control, automation and customization through IoT integration. In line with this, the market is also witnessing an increased investment in high-profile commercial and public projects, reflecting a broader trend towards modern, innovative, and environmentally conscious lighting designs.

- Competitive Landscape: Key players in the architectural lighting market are actively investing in advanced technologies and expanding their product offerings. They are focusing on integrating smart lighting solutions with IoT capabilities for enhanced control and energy efficiency. Companies nowadays are also emphasizing on sustainability by promoting LED technologies and eco-friendly materials. In addition to this, key players are also engaging in strategic partnerships and large-scale projects to strengthen their market presence and cater to the growing demand for innovative and customized lighting solutions.

The report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. - Challenges and Opportunities: The market faces various challenges which includes navigating complex regulatory requirements and ensuring compliance with local standards, which can vary across regions. In line with this, the market faces competition from both international and local players, necessitating continuous innovation and differentiation. However, there are significant opportunities driven by substantial investments in infrastructure and urban development which create demand for advanced and energy-efficient lighting solutions. The strong emphasis on sustainability and government initiatives, such as Vision 2030, also provides opportunities for growth by encouraging the adoption of eco-friendly technologies and smart lighting systems.

Saudi Arabia Architectural Lighting Market Trends:

Technological Innovations

Technological innovations in lighting such as tunable white lighting and dynamic color-changing systems are reshaping the Saudi Arabia architectural lighting market. Tunable white lighting allows for the adjustment of color temperatures enabling spaces to shift from warm to cool light to suit different times of day or activities. Dynamic color-changing systems offer the ability to alter lighting colors and intensities creating customizable atmospheres for various events and moods. These technologies enhance the versatility and functionality of lighting in both commercial and residential settings providing architects and designers with advanced tools to craft unique and adaptive environments that meet evolving aesthetic and practical needs. For instance, in July 2024, Versatile International announced its new venture Asheil Versatile Lighting Technologies, in Saudi Arabia. This joint venture with Haneco Lighting aims to manufacture lighting technologies and provide consultancy and planning services for large-scale lighting installations, catering to both destination-scale projects and the local wholesale market. The company's goal is to establish Saudi Arabia as a producer of world-class lighting technologies and to reduce reliance on global supply chains while supporting the Kingdom's development projects.

Smart Lighting Solutions

Smart lighting solutions are increasingly sought after in the Saudi Arabia architectural lighting market due to their integration with IoT technology. These systems enable remote control and automation of lighting through smartphones or voice commands, offering users the convenience to adjust settings from anywhere. Smart lighting enhances energy efficiency by enabling precise control over lighting usage, including scheduling and dimming. As modern buildings prioritize sustainability and user comfort, the adoption of smart lighting solutions is growing, reflecting a shift toward more connected and adaptable lighting systems in both residential and commercial spaces. According to Saudi Arabia architectural lighting market statistics, the adoption of smart lighting solutions is expected to increase significantly, driven by the demand for advanced, energy-efficient systems that offer enhanced control and customization in both residential and commercial applications. For instance, in December 2023, India's Hynetic Electronics entered the Saudi Arabian market by securing an order to deploy a Street Lighting POC. The company aims to bring transformative solutions to the smart lighting space, promoting energy efficiency and future-proof technologies. The company emphasized the importance of efficient lighting solutions in reducing CO2 emissions. Hynetic Electronics plans to utilize LoRaWAN and NEMA Street Light Controllers for their deployment strategy. These innovative smart lighting solutions are creating a positive Saudi Arabia architectural lighting market outlook by improving energy efficiency, enhancing operational control, and supporting the country’s sustainability goals.

Rising Focus on Sustainability

The focus on energy efficiency and sustainability in the Saudi Arabia architectural lighting market is largely driven by government initiatives and Vision 2030 goals. This national strategy emphasizes reducing energy consumption and promoting environmental stewardship. As a result, there is a significant push toward adopting energy-saving lighting solutions, such as LED technology and smart lighting systems. The trend encourages the use of sustainable materials and innovative technologies, contributing to greener, more efficient buildings and infrastructure. This shift aligns with broader efforts to create a sustainable future for the country. According to the Saudi Arabia architectural lighting market analysis report, the adoption of energy-efficient and sustainable lighting solutions is expected to accelerate, driven by the country's commitment to environmental goals and the increasing demand for advanced, cost-effective lighting technologies in both new developments and retrofitting projects. According to an article published by Arab News, Saudi Arabia is set to become the first G20 country to replace all streetlights with energy-efficient LEDs. This announcement was made by technical services director of Tarshid, at the Global Project Management Forum 2024. The initiative aligns with Saudi Vision 2030, aiming to produce 50% renewable electricity by 2030 and achieve net-zero emissions by 2060.

Saudi Arabia Architectural Lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on light source, lighting type, application, and end use.

Breakup by Light Source:

- Fluorescent Lights

- High Intensity Discharge (HID) Lights

- Light Emitting Diode (LED) Lights

- Others

The report has provided a detailed breakup and analysis of the market based on the light source. This includes fluorescent lights, high intensity discharge (HID) lights, light emitting diode (LED) lights, and others.

Fluorescent lights remain a common choice in Saudi Arabia's architectural lighting market due to their energy efficiency and longer lifespan compared to incandescent bulbs. These lights are often utilized in commercial and office settings, providing bright, diffused illumination that reduces glare. However, the adoption of fluorescent lights is gradually declining as LED technology gains traction. With growing government initiatives promoting energy conservation and sustainability, fluorescent lights are increasingly being replaced by LED solutions, especially in newer architectural projects where energy efficiency is prioritized.

High-Intensity Discharge (HID) lights play a significant role in large-scale architectural lighting in Saudi Arabia, particularly in outdoor environments like stadiums, airports, and large commercial complexes. HID lights are favored for their ability to provide high-intensity, bright lighting over wide areas. However, despite their powerful illumination, they are less energy-efficient as compared to modern alternatives like LEDs. The rising focus on energy-efficient solutions, combined with the high operational costs of HID systems, is driving a shift toward LED technology, though HID lights continue to be used in specific large-scale applications.

Light Emitting Diode (LED) lights dominate the Saudi Arabia architectural lighting market, favored for their superior energy efficiency, long lifespan, and versatility. LEDs are increasingly used in various architectural settings, from residential to commercial projects, offering flexible design possibilities with adjustable brightness and color options. Government initiatives aimed at reducing energy consumption, coupled with the national focus on sustainable urban development, have accelerated the transition to LED lighting. As a result, LEDs are rapidly replacing traditional light sources like fluorescent and HID lights in both new constructions and retrofitting projects across the country. LEDs are gaining traction, holding a significant Saudi Arabia architectural lighting market share due to their cost-effectiveness, energy efficiency, and ability to meet the growing demand for smart and sustainable lighting solutions in both urban and rural developments.

Breakup by Lighting Type:

- Ambient

- Task

- Accent

A detailed breakup and analysis of the market based on the lighting type have also been provided in the report. This includes ambient, task, and accent.

Ambient lighting forms the foundation of architectural lighting in Saudi Arabia, providing overall illumination in both residential and commercial spaces. It sets the tone and mood of an environment, ensuring comfortable visibility without glare. As Saudi Arabia continues its focus on sustainable and modern urban development, ambient lighting solutions increasingly favor energy-efficient options like LED lights. In larger projects, such as malls and hotels, ambient lighting plays a crucial role in creating welcoming and functional spaces. The growing demand for smart lighting systems that offer adjustable brightness and energy-saving features further fuels the market's shift towards LED-based ambient lighting.

Task lighting serves specific functions in Saudi Arabia's architectural lighting market, offering concentrated light for activities like reading, cooking, or working. In both residential and commercial applications, task lighting enhances productivity by reducing eye strain and improving focus. This type of lighting is common in office buildings, kitchens, and study areas, where precision lighting is essential. As the market grows, task lighting increasingly incorporates LED technology due to its energy efficiency and versatility. Adjustable and portable designs are also gaining popularity, reflecting the trend toward personalized lighting solutions that cater to individual needs in workspaces and homes.

Accent lighting is pivotal in Saudi Arabia's architectural lighting market, focusing on highlighting specific design features or creating focal points within a space. Often used in museums, art galleries, hotels, and luxury homes, accent lighting enhances the visual appeal of architectural elements, artwork, or landscapes. LED lights dominate this segment due to their ability to offer directional light with minimal energy consumption. The rising demand for customized and aesthetically pleasing lighting designs in high-end projects further boosts the popularity of accent lighting, as architects and designers seek to create visually impactful environments while adhering to energy-efficient standards.

Breakup by Application:

- Wall Wash

- Cove Lighting

- Backlighting

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes wall wash, cove lighting, backlighting, and others.

Wall wash lighting is widely used in the Saudi Arabia architectural lighting market to enhance the aesthetic appeal of interior and exterior surfaces. By evenly distributing light across a wall or surface, this technique highlights architectural features, creating a sense of depth and openness in spaces such as lobbies, galleries, and hotel facades. The increasing demand for modern, sleek designs in commercial and residential projects is driving the adoption of wall wash lighting, especially with energy-efficient LED solutions. Its ability to create visually striking environments while minimizing energy use makes it a popular choice in contemporary architectural design.

Cove lighting, a popular indirect lighting technique, is frequently employed in Saudi Arabia’s high-end residential, hospitality, and commercial spaces to provide soft, ambient light. It is typically installed in recessed ceilings or along ledges to create a subtle glow, enhancing the architectural features of a room. As LED technology advances, cove lighting solutions have become more energy-efficient and customizable, offering color-changing and dimming options that are increasingly sought after in luxury interiors. The growing focus on smart and energy-saving lighting systems further propels the demand for LED-based cove lighting in both new construction and renovation projects.

Backlighting is extensively used in Saudi Arabia's architectural lighting market to add depth and drama to a variety of settings, from commercial spaces to residential interiors. This technique involves placing light sources behind objects like mirrors, signage, or architectural elements to create a halo effect. In modern architectural designs, backlighting is favored for enhancing visual impact and adding sophistication to spaces. LED lights are predominantly used in backlighting applications due to their slim design, energy efficiency, and capacity for color variation. As smart lighting solutions rise in popularity, backlighting continues to evolve, offering dynamic and visually compelling lighting effects.

Breakup by End Use:

- Commercial

- Residential

- Industrial

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial, residential, industrial, and others.

In Saudi Arabia's commercial sector, architectural lighting plays a critical role in shaping modern office buildings, malls, hotels, and retail spaces. With the increasing emphasis on energy efficiency and aesthetics, LED lighting solutions are becoming the preferred choice for commercial projects. These lights offer customizable brightness and color options, enhancing the ambiance while reducing energy costs. The sector’s growth is driven by large-scale construction projects linked to Vision 2030, fostering demand for advanced lighting systems, including smart lighting and sustainable designs, to meet the evolving needs of the commercial landscape.

The residential segment in Saudi Arabia's architectural lighting market is witnessing significant growth, fueled by rising urbanization and a demand for energy-efficient lighting solutions. Modern homes increasingly incorporate LED lighting due to its energy-saving benefits, versatility, and aesthetic appeal. Homeowners prioritize ambient, task, and accent lighting to create functional yet visually pleasing environments. With a growing interest in smart home systems, demand for adjustable lighting solutions that offer remote control and energy management is on the rise, aligning with Saudi Arabia's broader goals for sustainability and energy conservation in residential construction.

Architectural lighting in Saudi Arabia's industrial sector is essential for both functionality and safety. Factories, warehouses, and large-scale industrial complexes require robust, high-performance lighting solutions that offer durability and energy efficiency. The transition toward LED lighting in industrial applications is driven by the need for cost-effective and long-lasting lighting systems that can operate under demanding conditions. Additionally, government policies promoting energy conservation and sustainability are encouraging industrial facilities to adopt more efficient lighting technologies, ensuring compliance with environmental standards while improving operational efficiency across various industrial projects.

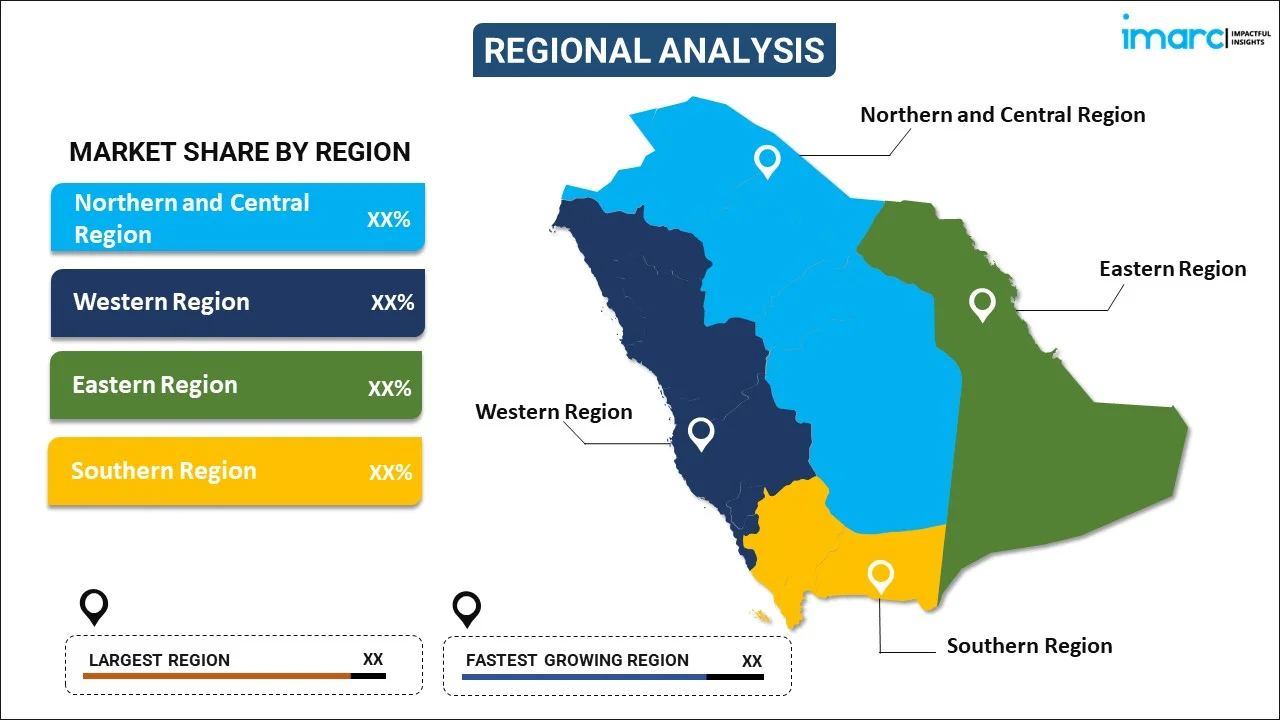

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major markets in the region which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

The Northern and Central Region of Saudi Arabia, including the capital Riyadh, represents a major hub for architectural lighting demand, driven by large-scale infrastructure and urban development projects. Riyadh's growing skyline, influenced by Vision 2030, emphasizes modern architecture and sustainable lighting solutions. LED lighting dominates the market, providing energy-efficient options for commercial and residential spaces. The focus on smart city initiatives and green building standards further enhances the demand for advanced lighting systems. As the region continues to develop, architectural lighting that aligns with energy-saving and aesthetic goals is expected to grow significantly.

The Western Region of Saudi Arabia, home to cities like Jeddah and Makkah, is a key market for architectural lighting, influenced by religious tourism and commercial development. As the gateway for millions of pilgrims annually, Makkah demands high-quality lighting solutions for hotels, religious complexes, and infrastructure. In Jeddah, commercial growth and waterfront developments increase the demand for modern lighting systems, particularly energy-efficient LEDs. Smart lighting and accent lighting are gaining traction in the Western Region, catering to luxury hotels and public spaces. This region’s growth in hospitality and infrastructure continues to drive the architectural lighting market.

The Eastern Region, including cities like Dammam and Al Khobar, is a vital industrial and economic hub, largely driven by the oil and gas sector. Architectural lighting in this region focuses on industrial applications, commercial projects, and high-end residential developments. The region’s push toward modern infrastructure and smart city initiatives creates a growing demand for LED-based, energy-efficient lighting solutions. Industrial facilities require durable lighting systems, while commercial and residential developments emphasize aesthetics and sustainability. The Eastern Region’s strategic importance in Saudi Arabia’s economic development continues to fuel investments in advanced lighting technologies.

The Southern Region of Saudi Arabia, known for its mountainous terrain and smaller urban centers, is experiencing growing demand for architectural lighting as urbanization expands. While not as commercially or industrially developed as other regions, the Southern Region is seeing investments in residential and tourism projects. Energy-efficient lighting, particularly LED solutions, is gaining popularity for residential spaces, with an emphasis on ambient and accent lighting. The government’s focus on regional development, improving infrastructure, and promoting sustainable energy use is gradually driving demand for modern architectural lighting solutions across this emerging region.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- The Saudi Arabia architectural lighting market is highly competitive, characterized by a diverse array of global and regional players. Major companies lead with advanced lighting technologies, including energy-efficient LEDs and smart lighting solutions, capitalizing on their technological expertise and market presence. Regional firms are increasingly prominent, offering customized solutions that align with local preferences and regulatory standards. The market's expansion is driven by substantial investments in infrastructure and urban development, creating ample opportunities for innovation. The strong focus on energy efficiency and sustainability enhances competition, prompting continuous advancements and differentiation among market participants. These advancements and increasing investments in cutting-edge lighting technologies are expected to increase Saudi Arabia architectural lighting market revenue in the coming future.

Saudi Arabia Architectural Lighting Market News:

- In May 2024, Singapore-based Swan & Maclaren Group (SMG) secured a $28 million contract to design illumination systems for the Six Flags Qiddiya theme park in Riyadh, set to be the world's largest. This marks SMG's first illumination engineering project in the Middle East. The firm's portfolio includes the 2018 Winter Olympic Games opening ceremony and renowned architectural designs. With international presence, SMG is excited to contribute to this iconic theme park in Saudi Arabia.

- In March 2024, Ilmex by Ximenez Group expanded to Saudi Arabia with a dazzling lighting project showcased at the Yanbu Flower and Garden Festival. The sustainable lighting project features over 120,000 LED lights and spans 200 meters. With a 25-year history, the company has become a global leader, illuminating more than 50 countries. The project in Saudi Arabia adds to its international portfolio, which includes exclusive lighting designs for events worldwide.

Saudi Arabia Architectural Lighting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Light Sources Covered | Fluorescent Lights, High Intensity Discharge (HID) Lights, Light Emitting Diode (LED) Lights, Others |

| Lighting Types Covered | Ambient, Task, Accent |

| Applications Covered | Wall Wash, Cove Lighting, Backlighting, Others |

| End Uses Covered | Commercial, Residential, Industrial, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia architectural lighting market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Saudi Arabia architectural lighting market?

- What is the breakup of the Saudi Arabia architectural lighting market on the basis of light source?

- What is the breakup of the Saudi Arabia architectural lighting market on the basis of application?

- What are the various stages in the value chain of the Saudi Arabia architectural lighting market?

- What are the key driving factors and challenges in the Saudi Arabia architectural lighting market?

- What is the structure of the Saudi Arabia architectural lighting market, and who are the key players?

- What is the degree of competition in the Saudi Arabia architectural lighting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia architectural lighting market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia architectural lighting market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia architectural lighting industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)