Saudi Arabia Artisanal Dairy Products Market Size, Share, Trends and Forecast by Product Type, Raw Material, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Artisanal Dairy Products Market Overview:

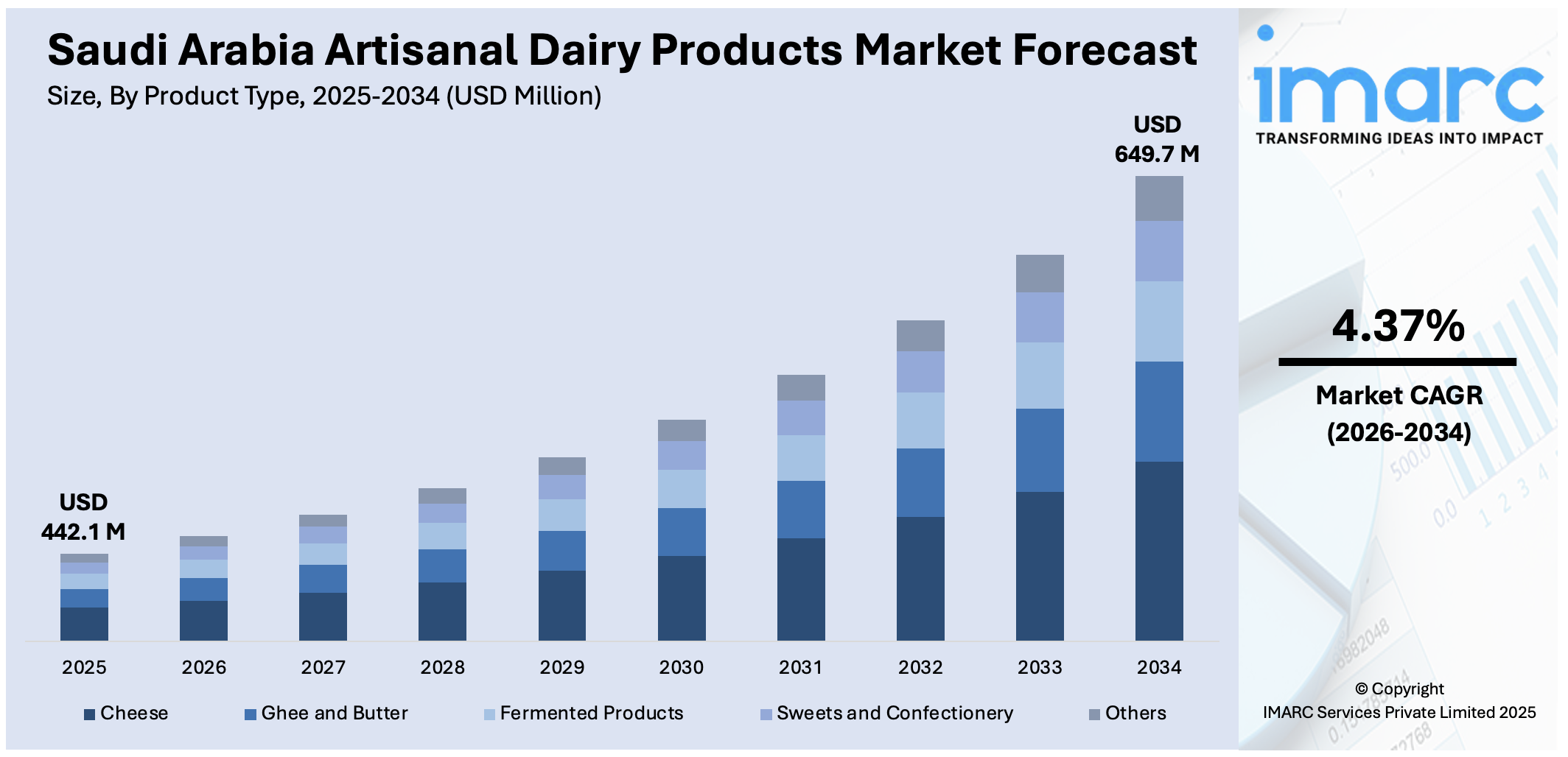

The Saudi Arabia artisanal dairy products market size reached USD 442.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 649.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.37% during 2026-2034. The market is experiencing steady growth, driven by rising demand for premium, locally crafted items that emphasize authenticity and quality. Evolving consumer preferences, growing health consciousness, and increasing interest in traditional flavors also fuel market growth. Producers are focusing on innovation while leveraging gourmet stores, specialty retailers, and online platforms to reach consumers represent another growth-inducing factor enhancing the development of the Saudi Arabia artisanal dairy products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 442.1 Million |

|

Market Forecast in 2034

|

USD 649.7 Million |

| Market Growth Rate 2026-2034 | 4.37% |

Saudi Arabia Artisanal Dairy Products Market Trends:

Increasing Demand for Premium and Authentic Products

Consumers in Saudi Arabia are showing a growing preference for premium, high-quality dairy products that reflect authenticity and traditional craftsmanship. Artisanal dairy products like unique cheeses, yogurts, and butter attract the consumer who is interested in unique taste enjoyment and products as well as natural ingredients and traditional processes. This demand is also driven due to the need to have locally produced goods that support regional business and sustainable consumption patterns. Consumers believe that artisanal dairy is healthier, fresher, and more delicious in comparison to the mass production of dairy. This preference for genuine, hand-made dairy products is greatly augmenting the growth of the artisanal dairy category and spurring producers into diversifying and innovating with product lines in response to evolving consumer requirements.

To get more information on this market Request Sample

Shifting Consumer Preferences Toward Health and Wellness

The increasing health and wellness awareness among Saudi consumers is shaping the demand for artisanal dairy products. Consumers are becoming more concerned about the nutritional content, sourcing, and production practices of dairy products and prefer those that are perceived as natural, organic, and less processed. Artisanal dairy, which is largely unprocessed and free of artificial additives or preservatives, fulfills such values, with supposed health benefits, plus rich taste and quality. In addition, the trend towards functional foods, including probiotic-rich yoghurts and kefir, is also contributing to making the artisanal products more attractive. This shift in consumption patterns is a key driver of growth, as consumers balance indulgence with well-being, fostering demand for healthier and more authentic dairy options. For instance, in February 2025, Saudi dairy company AlSafi unveiled its newest campaign, "TaMoo Tabee3y," a daring and lighthearted effort aimed at interacting with Generation Z via comedy, real-life encounters, and the distinct flavor of its dairy products. With the tagline "TaMoo Tabee3y," the campaign highlights its outstanding taste, natural ingredients, and playful, youthful brand personality.

Government Support for Local Food Production and Entrepreneurship

Saudi Arabia’s government, under its Vision 2030 strategy, is actively promoting local food production and entrepreneurship, creating a favorable environment for artisanal dairy producers. Initiatives supporting small-scale and family-run dairies through grants, training programs, and marketing platforms are helping to boost local production capabilities. Additionally, the government organizes food festivals, trade exhibitions, and culinary events that offer producers opportunities to showcase their artisanal dairy products, connect with consumers, and expand market reach. These initiatives not only support the preservation of traditional food-making techniques but also encourage innovation and quality improvement among local producers, further driving the Saudi Arabia artisanal dairy products market growth.

Saudi Arabia Artisanal Dairy Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, raw material, distribution channel, and end user.

Product Type Insights:

- Cheese

- Ghee and Butter

- Fermented Products

- Sweets and Confectionery

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cheese, ghee and butter, fermented products, sweets and confectionery, and others.

Raw Material Insights:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Mixed-Milk Products

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes cow milk, buffalo milk, goat milk, and mixed-milk products.

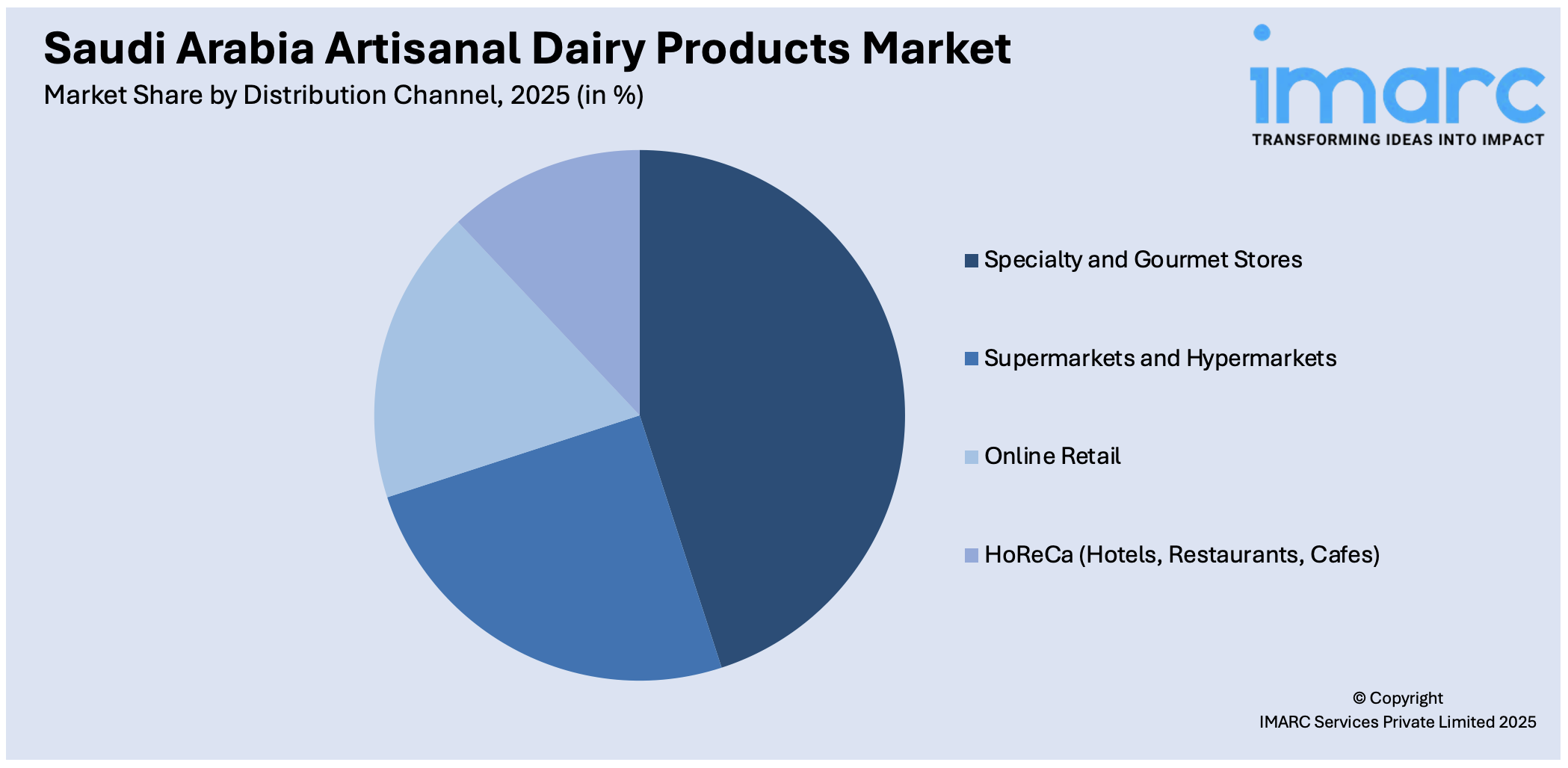

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Specialty and Gourmet Stores

- Supermarkets and Hypermarkets

- Online Retail

- HoReCa (Hotels, Restaurants, Cafes)

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty and gourmet stores, supermarkets and hypermarkets, online retail, and HoReCa (hotels, restaurants, cafes).

End User Insights:

- Household Consumers

- Institutional Buyers

- Food Service Industry

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes household consumers, institutional buyers, and food service industry.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Artisanal Dairy Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cheese, Ghee and Butter, Fermented Products, Sweets and Confectionery, Others |

| Raw Materials Covered | Cow Milk, Buffalo Milk, Goat Milk, Mixed-Milk Products |

| Distribution Channels Covered | Specialty and Gourmet Stores, Supermarkets and Hypermarkets, Online Retail, HoReCa (Hotels, Restaurants, Cafes) |

| End Users Covered | Household Consumers, Institutional Buyers, Food Service Industry |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia artisanal dairy products market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia artisanal dairy products market on the basis of product type?

- What is the breakup of the Saudi Arabia artisanal dairy products market on the basis of raw material?

- What is the breakup of the Saudi Arabia artisanal dairy products market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia artisanal dairy products market on the basis of end user?

- What is the breakup of the Saudi Arabia artisanal dairy products market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia artisanal dairy products market?

- What are the key driving factors and challenges in the Saudi Arabia artisanal dairy products market?

- What is the structure of the Saudi Arabia artisanal dairy products market and who are the key players?

- What is the degree of competition in the Saudi Arabia artisanal dairy products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia artisanal dairy products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia artisanal dairy products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia artisanal dairy products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)